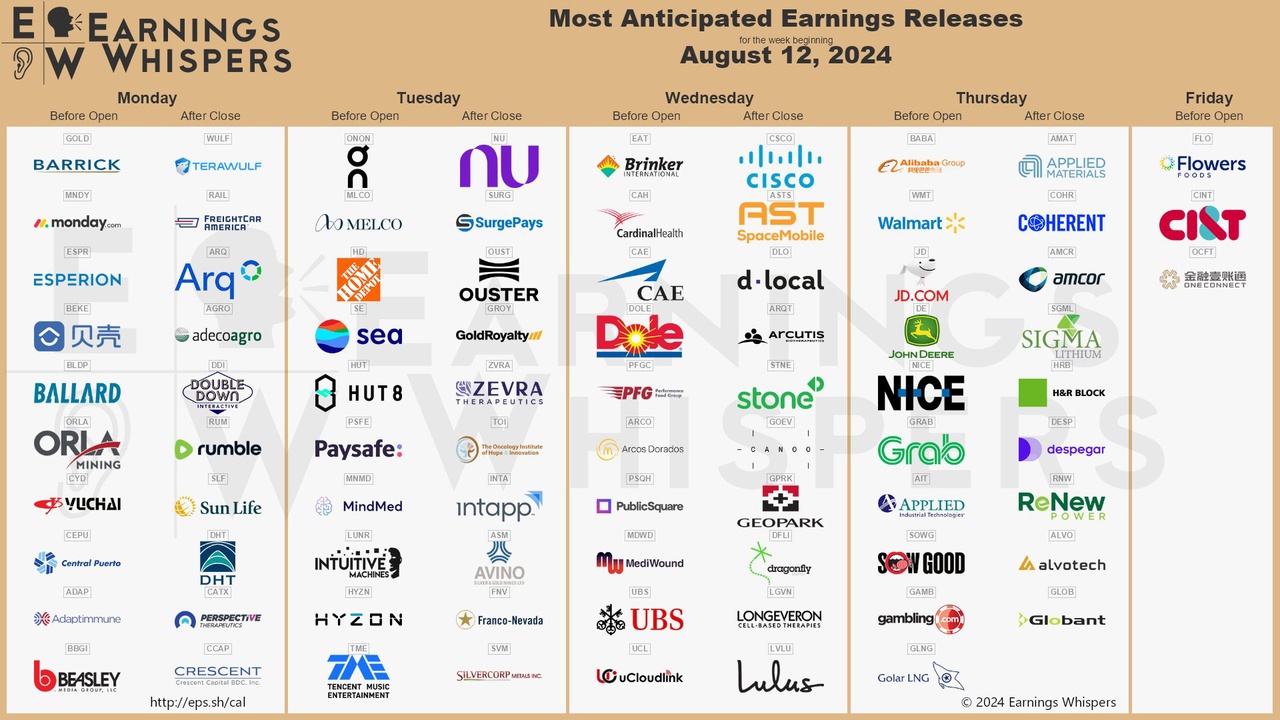

🗓️ Earnings next week 🗓️

- Markets

- Stocks

- Ballard Pwr Sys

- Forum Discussion

Ballard Pwr Sys

Price

Discussion about BLDP

Posts

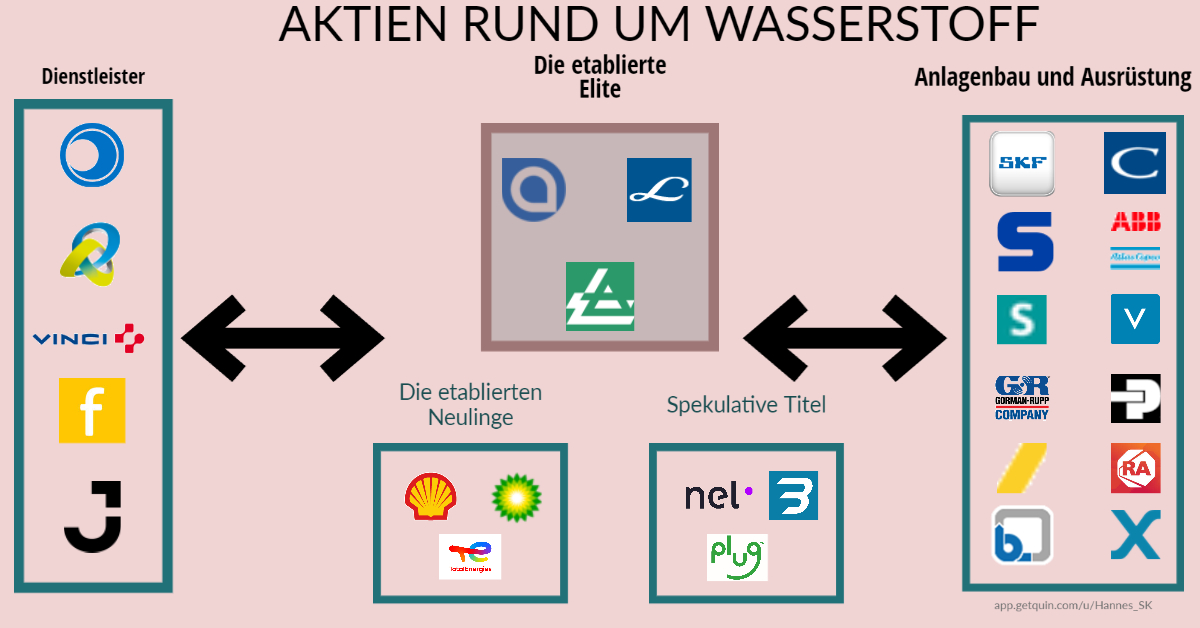

9The 1x1 of the hydrogen industry on the stock exchange.

Hello dear community,

Considering the fact that there are a lot of newcomers on the platform, I have created a, for social media typical, dumb graphic to give you an overview of stocks, which may not be on everyone's radar. After all, it goes without saying that you can't know your way around every industry. But we have come together here in the community for a solid exchange.

But since we're here on Getquin and not on Instagram, here's some input for the inquisitive.

What do the companies do anyway?

Service provider:

On the service provider side, you'll find rather atypical companies for the sector.

Here I have Friedrich Vorwerk $VH2 (+0.45%) , Vinci $DG (-0.4%) , Ferrovial $FER , Bilfinger $GBF (-1%) and Jacobs Solutions $J (+2.71%) listed.

Their main focus is background work on the objects themselves. They support the companies in planning, realization, construction and maintenance. They work decentralized in regional working groups to cover the breadth of the industry. They provide almost any service for an industrial company.

The established elite

If you want to invest in the hydrogen sector, all roads lead to the giants Linde $LIN (+0.37%) , Air Products $APD (+0.81%) and Air Liquide $AI (+0.11%) . Their market power in the field of industrial gases and in today's market environment of commercial hydrogen production seems indisputable. Their know-how in the gaseous materials production segment has been proven over decades and their processes are almost perfectly optimized. Each company also has its own engineering divisions that position them perfectly for the future in electrolyzer development.

The established newcomers

With plenty of money in their satchels, the oil companies Shell $SHEL (+0.5%) , Total $TTE (-0.32%) and BP $BP. (+0.4%) are entering the segment. Oil is finite, but the business should not be. These companies are also experienced in dealing with hydrogen. In the refinery process, hydrogen is an indispensable component. In order to become less dependent on the big 3, they are also entering new market fields. Will they be able to prove themselves there?

Speculative titles

Nothing but expenses. Years of hype and yet a harsh reality hit the small fish in the shark tank around the segment. Nel $NEL (+1.47%) , Plug Power $PLUG (-0.24%) and Ballard $BLDP (+1.89%) are long-suffering. They have never managed to deliver even remotely profitable figures. On the contrary, quarter after quarter, things seem to be getting worse. Only sales are increasing. Can this ever work?

Plant engineering and equipment

Of course, in a globalized world, one no longer takes care of the entire value chain from A-Z. Each company is specialized in its own segment. Permanent beneficiaries of the industry are therefore the equipment suppliers, because they have to technically develop the cornerstones for every innovation in order to survive in the vastness of globalization.

The equipment suppliers

They manufacture the physical parts for the process plants.

Examples of this are Voestalpine $VOE (+0.08%) , Atlas Copco $ATCO B or Sulzer $SUNE .

The equipment suppliers

In addition, the transport of substances is also part of the process. Mass transfer in industry, but also at home, for example in water pipes, is ensured by pumps (for liquids) or by compressors (for gases). Established brands here are KSB $KSB (-2.77%) , Xylem $XYL (+1.21%) , Gorrman-Rupp $GRC (+1.25%) but also as total supplier Chart Industries $GTLS (+1.25%) or SKF $SKF B (+1.87%) or for specialized tools Stanley B&D $SWK (+1.24%) .

Furthermore, process control is indispensable. Here, brands such as Siemens $SIE (-0.54%) , ABB $ABBN (+1.09%) or also Rockwell $ROK (+1.28%) and Parker $PH (+0.67%) have established themselves. They not only supply the electronic equipment for the process plants. They also offer their software services as safety services, so that safety in process control can always be guaranteed.

I hope to have given you a little insight into the industry and would be very happy to receive constructive feedback.

Good Bye, Plug Power. 📉 $PLUG (-0.24%)

In the meantime, the questions about the producer for fuel cells accumulated again. I had already clarified most of the contra-arguments in my anti-H2 series.

Nevertheless, I would now like to explicitly debunk the bubble around Plug and why this company does not deserve its rating.

I hope to present some comprehensible arguments. Therefore, please keep in mind that this is just an opinion.

1. the company

Plug was founded in the late 1990s as a joint venture between DTE and Mechanical Technology. $DTE (+1.7%) and Mechanical Technology. Listed on the stock exchange since 1999, it stirs up visions of the future. The company's image is modern, fully on trend. The technology is presented as groundbreaking and pioneering. The company has been able to attract some large and well-known investors such as SK $034730 have been attracted. The ETF hype for renewable energies reinforced this bias. Everyone wants to be in on it. No one wants to miss out, but no one wants to bet on the wrong horse either.

2. company structure and growth drivers

Plug is subdivided into various specialized subject areas. The overview and insight for interested parties are exemplary. On a higher level, Plug Power can be assigned to the areas of chemistry and energy.

The aim is to produce hydrogen sustainably with the aid of proton exchangers. For this purpose, the company offers entire electrolysers and fuel cells, as well as a wide range of equipment from the field of hydrogen applications.

The growth is considerable, but not in the core products of fuel cells and infrastructure.

According to the annual reports, refrigeration and engineering technology are achieving the greatest growth and therefore now account for half of fuel cell sales. The largest revenue is generated in the domestic US. After all, sales growth of a good 20% could be achieved here in 2022. The regions of Europe and Asia could be developed as a market.

3. hard facts.

So what's the problem? It all sounds very hip and is fully in line with the trend. You even grow.

Plug Power has always burned the money. There is no sustainable cost structure in sight here. The business is unprofitable. Capital increases are the result. Plug itself holds only 3% of its own shares. Just under 86% are in free circulation. By the way, each share has voting rights. This is therefore completely useless for a sustainable business model, since the company's own management can have virtually no influence on the business. Here, one is dependent on investors to constantly obtain fresh capital in order to be able to finance the company itself.

And the finances? - A horror story for any serious investor. No profits generated. More than a halving of the company's value from 2021 to 2022. No free capital.

And the future estimates? These are generally to be taken with a grain of salt with any stock, as analysts, some of them completely unfamiliar with the subject, refer to the strangest studies.

But even so, Plug will only be economically profitable in the distant future. Until then, the company will continue to happily destroy its own balance sheet and will not be able to eliminate the debt factor for what feels like an eternity. Where will the investors' capital come from then?

4 Destructive competitive pressure.

I wrote it in my 1st post, which was to debunk the hype about hydrogen. The industry is a superlative shark tank. Of course, people have recognized the market for hydrogen as an industry of the future. However, why should one focus on these small fish, such as Nel $NEL (+1.47%) , Plug or Ballard $BLDP (+1.89%) speculate?

The market for hydrogen is already there and divided among the top dogs. Hydrogen is not a new innovation! The difference is only in the sustainable production. However, almost all hydrogen producers invoke proton exchangers. The efficiency screw is technically limited. Therefore, one can only look in vain for breakthrough innovations between the individual companies in the producer list. The decisive factor will be market power and the associated pricing power through availability and supply agreements.

Please bear in mind:

The industrial gas producers, especially Linde $LIN , Air Products $APD (+0.81%) , Air Liquide $AI (+0.11%) and also Nippon $4091 (+0.53%) have decades of experience in their field. All of them have sustainable and solid business models. Although their stock market valuations are debatable, the facts and their dominance of the markets outweigh them.

In addition, there are other well-known companies in the energy sector with huge amounts of capital up their sleeves. Among them the Europeans Total $TTE (-0.32%) , Shell $SHEL (+0.5%) and BP $BP. (+0.4%) . Even today, hydrogen is an indispensable part of the refinery process. A hydrogen strategy is therefore inevitably conducive to the independence of oil companies from existing hydrogen producers.

5. a possible outlook.

Is plug sustainable? Certainly not. For that, the company is already in an advanced internal downward spiral. One should rather hope for damage limitation here. In its current state, Plug Power is not competitive as a company. The innovations that the company is striving for require additional capital that it does not have. In this respect, it is almost logical that the company will lose out in the further course of development. People have thrown themselves over within the value chain because they wanted to be more independent. A spin-off of certain areas would have been overdue in order to be able to concentrate on the core competencies.

I'm sure some people will want to argue, "But the inflation reduction act ..."

Keep in mind that this is a subsidy package designed to stimulate investment. Plug no longer has this money.

Therefore, in a continuing speculation, one can only hope that investors can be found to turn Plug around or even hope for a takeover by major competitors. However, it is simply exaggerated to believe that a company with sales of just under $700 million and sheer combustion euphoria can live up to a valuation of just under $6 billion.

Hello dear community,

Without further ado I decided to collect a few reasons why I think regenerative hydrogen is too overproportional on the stock market.

In the future I will write more articles behind technical aspects and processes, because it should be better for an investment to understand the business model, if the interest would be there of course ...

5 selected reasons why the potential of "green" hydrogen is overestimated on the stock market.

1. occurrence:

Hydrogen does not occur on earth in pure form. I hope critics will forgive the assumed 0.03% in the atmosphere. It is always bound. Currently, hydrogen is produced primarily from the process of "steam reforming". A relatively simple and portable process developed in the early 1920's and nearly perfected since then. The efficiency here is about 60-70%. Advantage and disadvantage at the same time: The price of hydrogen is directly linked to the price of natural gas.

2. political will:

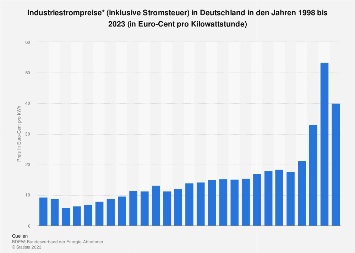

"Germany has the energy for the turnaround!": is the advertising slogan of a good dividend payer. Realistically, this is not the case! Why? Quite simply: the price of electricity. According to official data, the industrial electricity price in Germany is about 40ct gross. That is far too much to make "sustainable" technologies attractive in the future, because it is well known that these are extremely energy-intensive. Just think of the electrolysis of water to hydrogen.

Other European countries are much more favorable in this respect. Just think of Norway, which is why they will be lucky enough to become a net-zero state within Europe. Of course, one can also remain naive and think that the future import from Norway will not be carried off with maximum profits.

3.price:

Ultimately, the end user will always consume according to the lowest price. This applies equally to commercial and private customers.

The following price ranges result per kg:

"Green" hydrogen: 4-6€/kg

"Grey" hydrogen: 1-3€/kg

These are net prices. So don't be surprised at the next H2 filling station when prices between 9€ and 12,50€ are called.

4. industry battle of the future:

Accordingly, the hype around hydrogen arises precisely because of the newcomers around Nel $NEL (+1.47%) , Plug $PLUG (-0.24%) , Ballard $BLDP (+1.89%) and Co.

But it is astonishing how it is assumed that the big players are inactive. In the field of industrial gases, the dominant players are Linde $LIN , Air Liquide $AI (+0.11%) , Air Products $APD (+0.81%) and many more.

But here, too, major new players are entering the field. Total $TTE (-0.32%) , Shell $SHEL (+0.5%) BP $BP. (+0.4%) and other oil companies also have the knowledge. Why? Hydrogen already plays an enormously important role in the refinery process. Naturally, they want to become independent of the gas giants and also move into new segments. So what do such small fish want in this shark tank? They will not be able to assert themselves. Their activities will be watched, of course, but at the right moment a giant will dare to make a takeover bid.

5. every investor overestimates himself here, because FOMO "kicks in." Major stock magazines have been advertising the industry for years, but reality always catches up with the dreamers. Many underestimate the amount of material, planning, cost and price pressure in the industry, because after all, it serves a vision that is politically promoted and serves to save humanity.

To the investors: Are you that naive? Hydrogen has its irreplaceable justification and will continue to gain in importance in the future, but not the importance that corresponds to the stock market values.

Here Nel is valued at about €2.5 billion, although they are burning money. Plug already has a valuation of about €8 billion, but is still unprofitable. Eventually, someone will pay for it. But one thing is for sure: big investors are pulling out the money and taking profits or minimizing losses. You don't have these opportunities for inside information!

Do you want a sequel?

What is your personal interest in hydrogen? Would you also like to know more about the technologies of the individual applicants?

I just read an interesting article that I would like to share with you:

"Ballard Power, as the clear leader in PEM fuel cells, is quietly working to position the company in various fuel cell markets. There is stack capacity being built and expanded, there is massive investment in research and development, there are joint ventures taking place and many prototype developments together with strategic partners. In addition, work is being done on new fields of application such as electrolysis and associated technologies - with the aim of delivering products that are efficient and competitive, more cost-effective, have long operating times and a compact design. All of this is the basis for future orders and, of course, the transition into sustained and rapidly increasing profits. The stock market anticipates all this in share prices long before the facts are on the table. Remember Ballard's share prices at $1, $2, $3? That was only two years ago.

China, meanwhile, has big plans. There, they are not concerned with the discussion about the colors of hydrogen, which is nonsensical and not very effective here in Germany, because they will also be concerned with blue and yellow hydrogen until they reach their goal, green hydrogen. There, over 100,000 commercial vehicles are to run on hydrogen in the next three years, a total of 1 million vehicles (including passenger cars) by 2030. Sinopec alone (state oil company) is planning 1,000 H2 filling stations by 2025, and the megacity of Beijing itself wants to launch 1,500 H2 stations, so that I dare to forecast that there could be a total of 5,000 H2 filling stations in China in 2030 and several times that number by 2040.

Individual provinces are forging ahead and are in talks with Ballard and its joint venture partner Weichai, because the central government has not yet given any figures on how it intends to support the ramp-up of the hydrogen economy with subsidies. Meanwhile, the joint venture says it is in the process of optimizing the stacks and modules produced there and improving the sourcing of the many components. That's all going very well in 2022, CEO Randy MacEwen said on the conference call."

Source: https://www.hzwei.info/blog/2022/01/08/ballard-power-hohes-umsatz-und-gewinnwachstum-erwartet/

I personally think and believe that the topic of "hydrogen" is currently still in its infancy. However, it will hold great opportunities for us in the future and have a lot of potential for a sustainable and clean future.

Today a discussion topic about hydrogen. Here the opinions go quite far apart - for some it is a hype & for others the future.

General information about hydrogen:

As a fuel source, hydrogen's energy conversion is two to three times more efficient than conventional engines.

So it can be driven a further distance with less fuel. The only waste product during production is water.

Hydrogen-powered vehicles do not emit any CO2 or other harmful gases such as volatile organic compounds, carbon monoxide and nitrogen oxides.

Negative aspects:

The production of hydrogen is currently still very expensive and energy-intensive. Also, the cost of fuel cells and building the refueling infrastructure is too expensive.

Furthermore, only with regeneratively generated electricity - from the sun, wind or water power - can fuel cell technology be considered truly environmentally friendly.

What is your opinion on hydrogen? Does hydrogen have a future?

$LIN

$AIL (+0.11%)

$D7G (+1.47%)

$PLUN (-0.24%)

$FEY2

$PO0 (+1.89%)

$IJ8 (+1.54%)

Hello zusammen..........habe Ballard Power for half a year in the depot and already made a whopping 40% (about 1,000, - €) loss.

At that time probably bought into the flag pole.

What do you mean durchhalten....oder away with it?

Trending Securities

Top creators this week