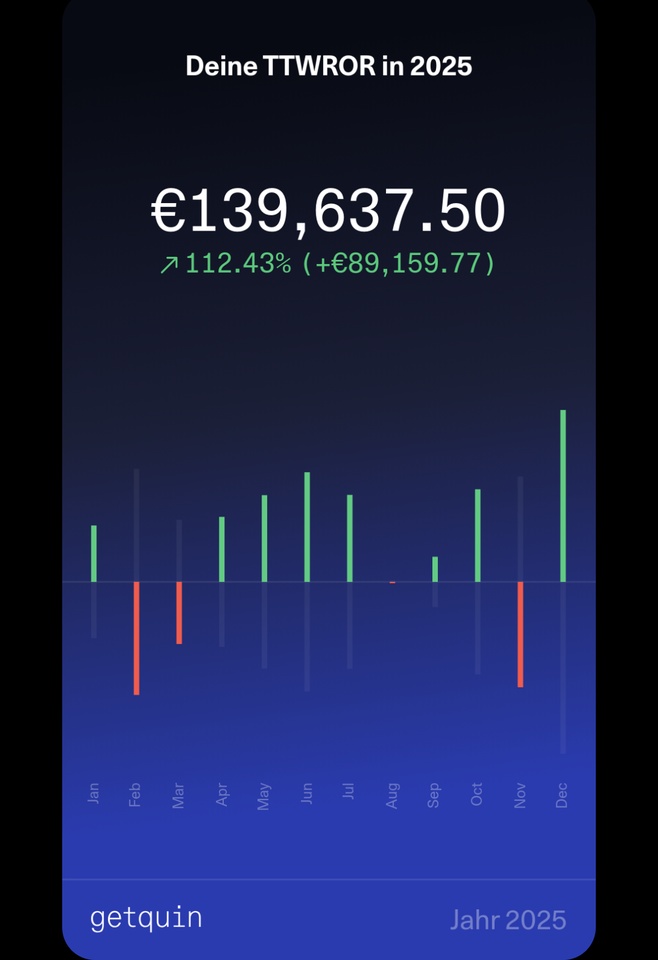

Today is the last trading day of 2025 in Germany.

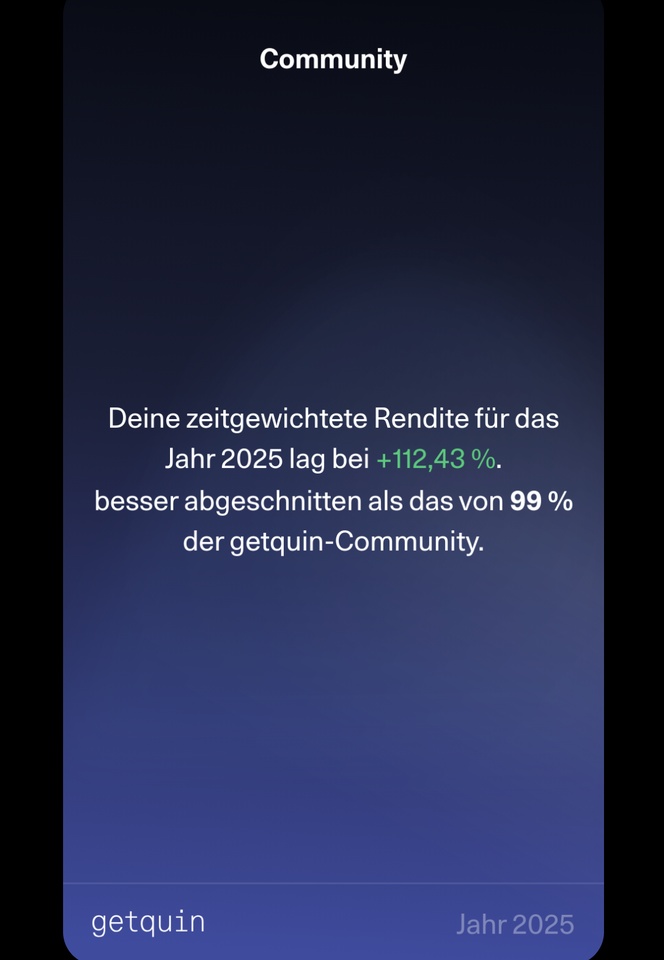

Two weeks ago you could already have the Rewind created in Getquin, but who would have thought that things would happen so fast again in December. So I have to post the rewind again to save it for my history.

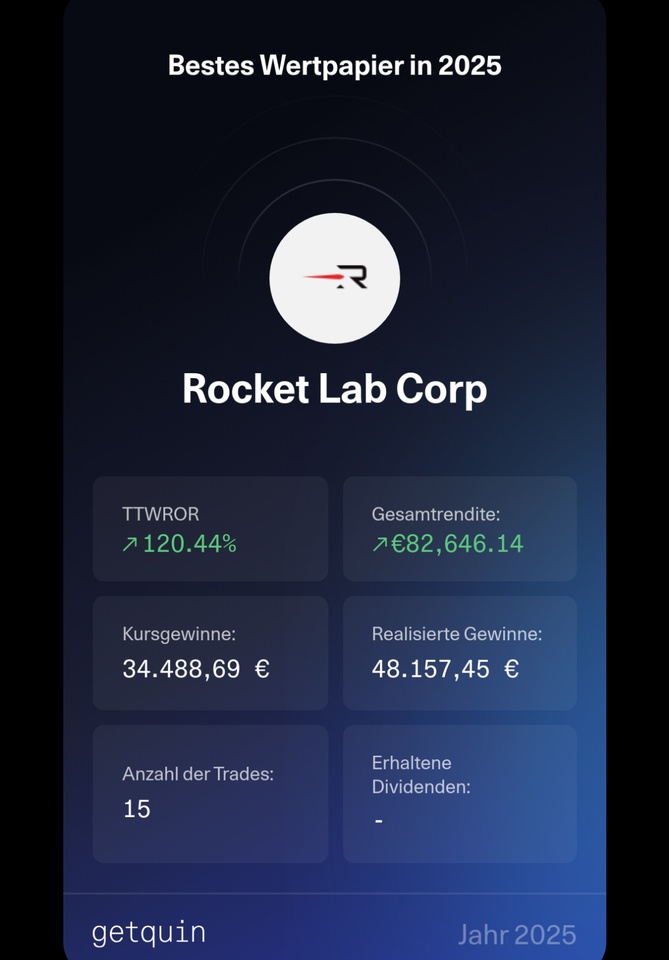

I end the year with only two positions: $RKLB (+2.93%) and $NBIS (+0.68%)

Nevertheless, I've been thinking for days about reducing my $RKLB (+2.93%) position and splitting the money into three or four candidates.

I wish you all a happy new year and happy celebrations. ☺️