Dear Community,

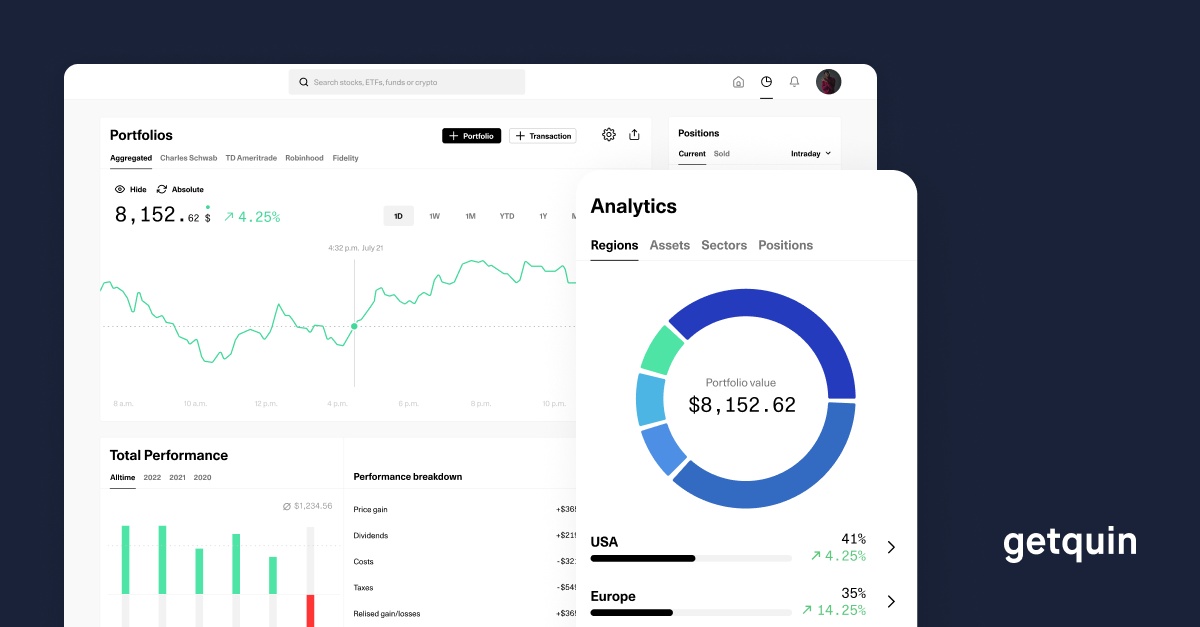

I contacted you at the weekend because I will soon be taking over my father's portfolio. I already have a few years of experience with ETFs, but so far I only have a small equity position of my own.

I also have two other beneficiaries to pay out. I expect to be able to keep a maximum of 40 percent of the value.

I have the impression that the portfolio is very tech-heavy. Some losses were incurred because my father was no longer able to look after it after a sudden illness. Since his death last summer, we have had no access.

Unfortunately, I therefore don't know the exact purchase dates, but I have been able to determine the purchase price for most of the titles. I have entered all items with the same purchase date and the purchase price, as far as known. There are still a few leverage certificates that I could not enter here, but they are all in the red.

As there is a 25-27.5 percent tax on price gains in Austria and this can be offset against losses, it is tax-efficient to sell all loss positions. I will also sell the Allianz leverage certificate. I would like to keep up to 40 percent of the portfolio value of the shares.

I have agreed with the other beneficiaries that it should be possible to settle positions by number of shares. This means that I could, for example, sell 2/3 of the large positions, pay out the proceeds and keep 1/3 of the shares - this would cut the tax burden in thirds. There are also some positions that I would find attractive as a whole - $BRK.B, $MSFT (-2.05%) and $LISP (+1.52%) - Here, however, I would probably have to pay the tax as a whole. But that would be fine with me.

I'm in my early 40s and would like to keep my part of the portfolio as a retirement investment. I could also imagine shifting part of it into ETFs. But I'm still thinking about which allocation makes sense. I have 80k in my own ETF portfolio. My ideas that I have considered so far:

- Keep up to about 40 percent and use up to 20k to cash out from other funds. Further expand the ETF position over the next few years

- Reduce the interesting positions so that they make up no more than 1/3 of the total portfolio, shift the rest into ETFs

Unfortunately, there are not many people in my environment who are interested in the stock market. That's why I'm looking for people here with whom I can exchange ideas.

I think the large positions are generally attractive, but they need to be properly reduced in line with the situation. Depending on the position, I'm thinking of a clean third or a further reduction to 8-10k. What is your opinion on the weighting? Apple/Microsoft roughly equal? Leave Freenet in or take it out?

Looking forward to reading your thoughts.