Further information, as I have read some skepticism here regarding the weakness of the share price:

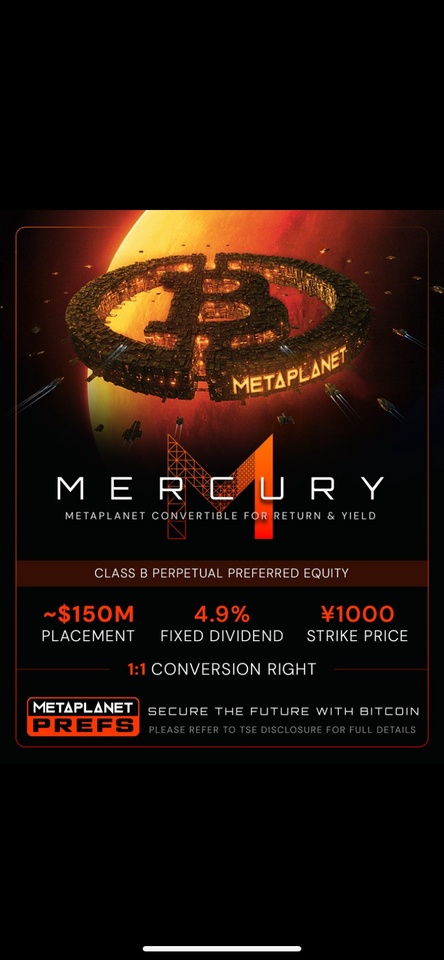

Announcement from MERCURY: New Class B Perpetual Preferred Equity.

Details:

- Volume: 23.61 million shares at ¥900 per share = ¥21.25 billion gross (~$135-150 million USD)

- Dividend: 4.9% fixed (annual, cumulative; capped at 25% BTC NAV)

- Conversion: ¥1,000 strike price (convertible 1:1 into common shares)

- Placement: Private Third-Party Allotment to institutions (e.g. Nautical 40%, Smallcap World Fund 25%, Anson Funds 28%, Ghisallo 6.67%)

- Payment: December 29, 2025; TSE listing applied for

- Purpose100% proceeds (~¥20.4bn net) for BTC purchases (target: 100k BTC by end 2026, 210k by 2027)

https://x.com/metaplanet/status/1991456331908469153?s=46

So we have capital inflow that is not dilutive. Buyback program at MNAV below 1. Prospective inclusion in the Japanese index. Good market conditions in Japan. And crucially:

BTC yield > MNAV.

As long as this is the case, the investment thesis remains intact.

Of course, the price shows weakness when $BTC (-2.13%) shows weakness. In the long term, I am bullish on BTC. This is of course a basic prerequisite for an investment in a BTC treasury company.

I am also in the red, but the thesis is stronger than ever. Wait and see.