Since I've already mentioned the "Fear and Greed Index". but have not yet found an explanation, I would like to share a brief summary of the results of my research with you.

The "Fear and Greed Index" is a concept that is often used to measure sentiment on the financial markets, particularly in relation to equities. The index attempts to quantify the prevailing emotions of investors - fear and greed - as these emotions often play a significant role in investment decisions.

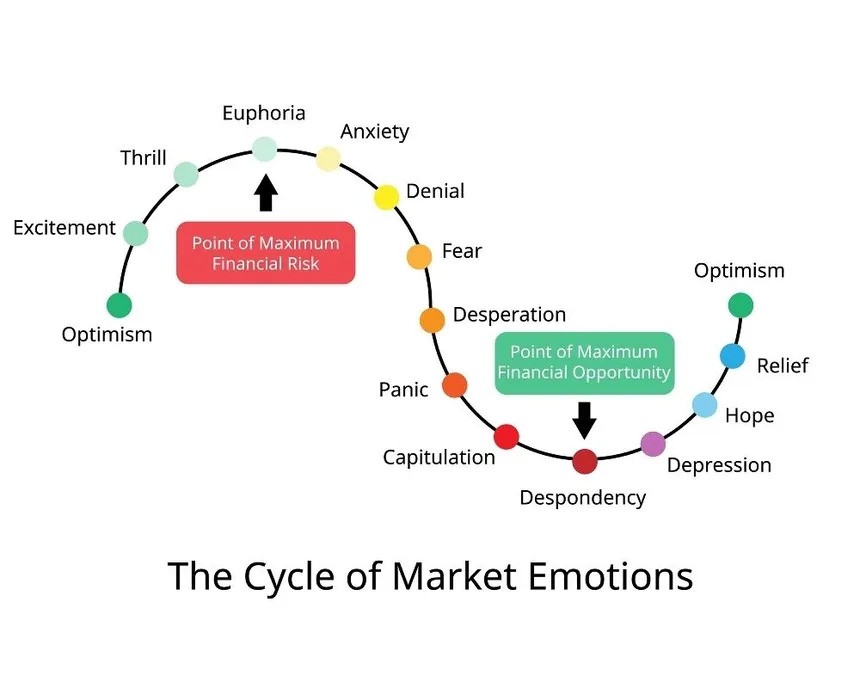

- Concept and purpose: The index is based on the idea that excessive greed can lead to inflated market prices, while extreme fear leads to disproportionate selling and therefore low prices. By quantifying these emotional states, the index aims to give investors an idea of whether the market is currently driven by fear or greed.

- Measurement and indicatorsThe Fear and Greed Index is made up of various market indicators, each measuring different aspects of fear and greed in the markets. These indicators include:

- Market volatilityMeasured using the VIX (Volatility Index)

- Market momentumCompares the current closing prices with the average values of the last few months.

- Share price strength: Observes how many stocks reach 52-week highs and lows.

- Put and call options: Ratio of put options (bets on falling prices) to call options (bets on rising prices).

- Junk bond demand: Measures the demand for riskier bonds.

- Market breadth: Takes into account how broad participation in the market is.

- Safe investments: Assesses the demand for safe asset classes such as government bonds.

- Scale and interpretation: The index is typically presented on a scale of 0 to 100, with lower values indicating fear and higher values indicating greed. Values around 50 are considered neutral.

- Application: The index is often used by investors to determine whether the market is potentially overbought (greed) or oversold (fear). In theory, a very high value on the index could be a signal to be cautious as the market may be overheated, while a very low value could represent a potential buying opportunity.

- Criticism and limitations: The index is highly simplified and does not take into account all factors that may influence the market. Very strongly oriented to the past.

https://edition.cnn.com/markets/fear-and-greed

Extensions are welcome! Let us know in the comments.

Image source: https://assets.bitdegree.org/assets/fear-and-greed-index/crypto-market-emotional-cycle.jpg