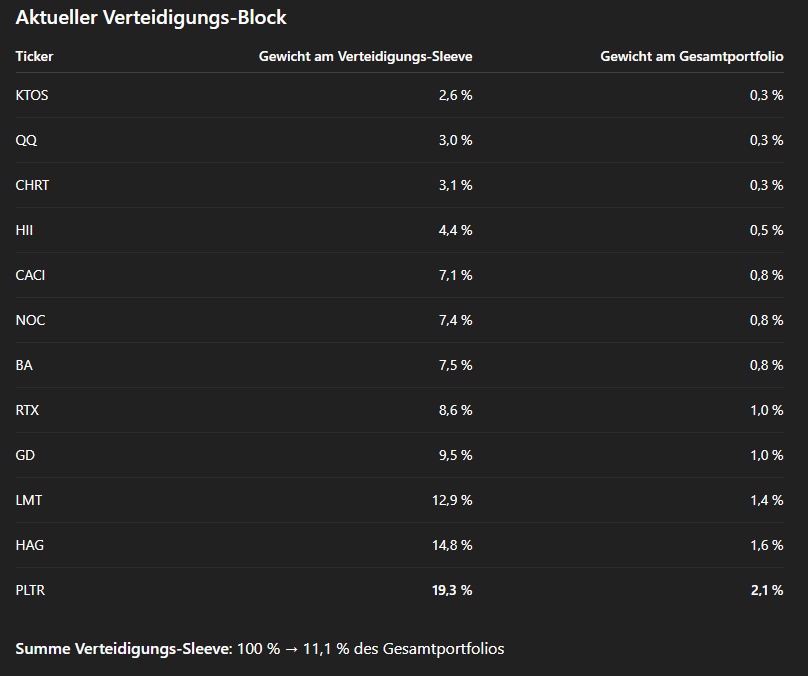

I wanted to give you a little update on my current defense portfolio and the planned changes.

📍Status Quo:

📍Capability areas and benefits for the portfolio:

Air & missile defense

Patriot, PAC-3, THAAD - core systems for the protection of cities, bases and fleets

Combat aircraft & air dominance

F-35 program (LMT), Eurofighter Typhoon, future Tempest/FCAS

Maritime strike capability

$HII (-1.12%) , $GD (-0.72%) , $BA. (-1.37%)

Nuclear submarines (Virginia, Astute), Type-26 frigates, combat systems

Sensors & electronic reconnaissance

$HAG (-2.59%) , $QQ. (-1.18%) , $CHRT (+1.09%) , $BA. (-1.37%)

AESA radars, ESM/ECM, BAE Raven ES-05 radar

Autonomous systems & drones

Almost all companies play me here. $KTOS (-1.91%) as the only drone pure play.

Unmanned jets (XQ-58) and tactical UAS - rapidly growing budget item

Cyber / AI & data fusion

$PLTR (-1.82%) ,$CACI (-0.59%)

AI-supported command and control systems (PLTR Gotham/Apollo) and US government IT services

Ground-based large-scale systems

$GD (-0.72%) ,$NOC (-0.07%) , $BA. (-1.37%)

Abrams modernizations, artillery rockets and ground-based sensors, CV90-IFV, M109 howitzers

Multidomain space flight

US nuclear deterrence - from delivery systems to warning and command and control networks

💰Realized partial sales at $HAG and $PLTR

I had already reduced $HAG and $PLTR by 50% each this year with large gains (+651% and +346%):

The valuations of both companies are currently extremely sporty.

PLTR

Trailing P/E ratio (TTM): 580 - 590x

Forward P/E ratio: ~240x

Price-to-sales: >100x

HAG

Trailing P/E ratio (TTM): 120 - 130x

Forward P/E ratio: ~80x

Price-to-sales: >5x

I will nevertheless remain invested in both positions for the time being. Mainly because I currently see no significant change in the underlying investment story.

Position sizes are relativized by new planned purchases and the concentration risk falls from 34% → 25% of the sleeve.

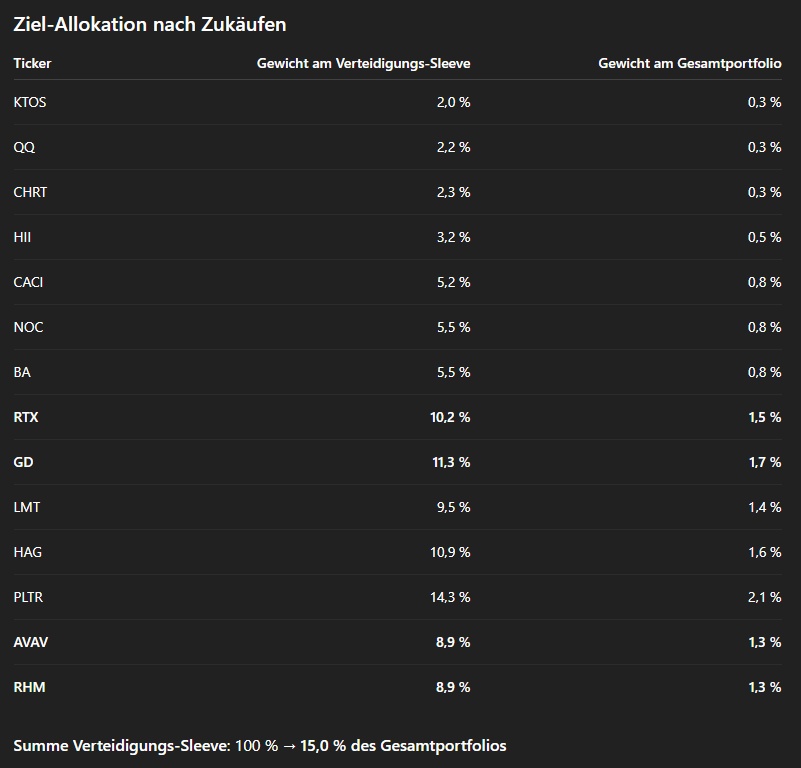

📊Planned adjustments:

❓Why these changes?

New position$AVAV (-2.89%)

(drones/loitering ammunition):

Covers the fastest growing budget line (attritable UAS), which was previously barely represented.

New position $RHM (-1.83%)

(Ammunition & Platforms)

Adds the "155 mm grenades" bottleneck and European land systems to the portfolio; beneficiary of EU armament.

Increase $RTX (-0.39%)

Most favorable US prime (forward P/E ≈ 25), high visibility in air/missile defense systems.

Top-up $GD (-0.72%)

Diversified towards submarines, ground vehicles and ammunition; reliable free cash flow.

📉Planned, staggered entries:

$AVAV: $220 - $185

$RHM: €1550 - €1450

$RTX: $125 - $120

$GD: $285 - $270

🤔 What does your portfolio look like?

Which defense stocks do you hold and why?