$LLY (+1.28%)

$NOVO B (+4.53%) Eli Lilly shares fall 1.5% after HSBC downgrades the pharmaceutical company's shares twice from "buy" to "reduce".

Rival Novo Nordisk launches weight-loss drug Wegovy in Thailand, ahead of Lilly's Zepbound. Source: https://de.tradingview.com/news/reuters.com,2025:newsml_L8N3R61LI:0/

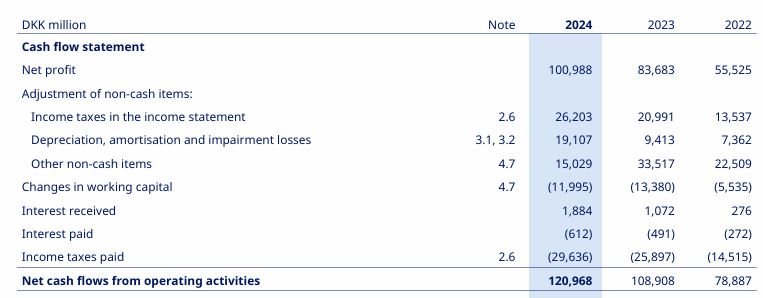

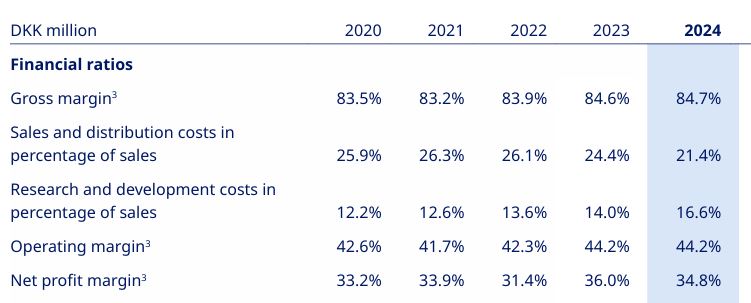

It remains exciting, next week there will be new figures from Novo. Novo has already recovered +10% from the low on April 17. Let's see if and how often the support around €51 will be tested🙄