I often read FOMO in both directions here at $HIMS (+1.86%)

Many are now starting to invest or are partially liquidating their positions, and there are more and more traders who are trying to trade the range of $30 - $70 USD, as this has been successful four times this year.

Why did Hims fall?

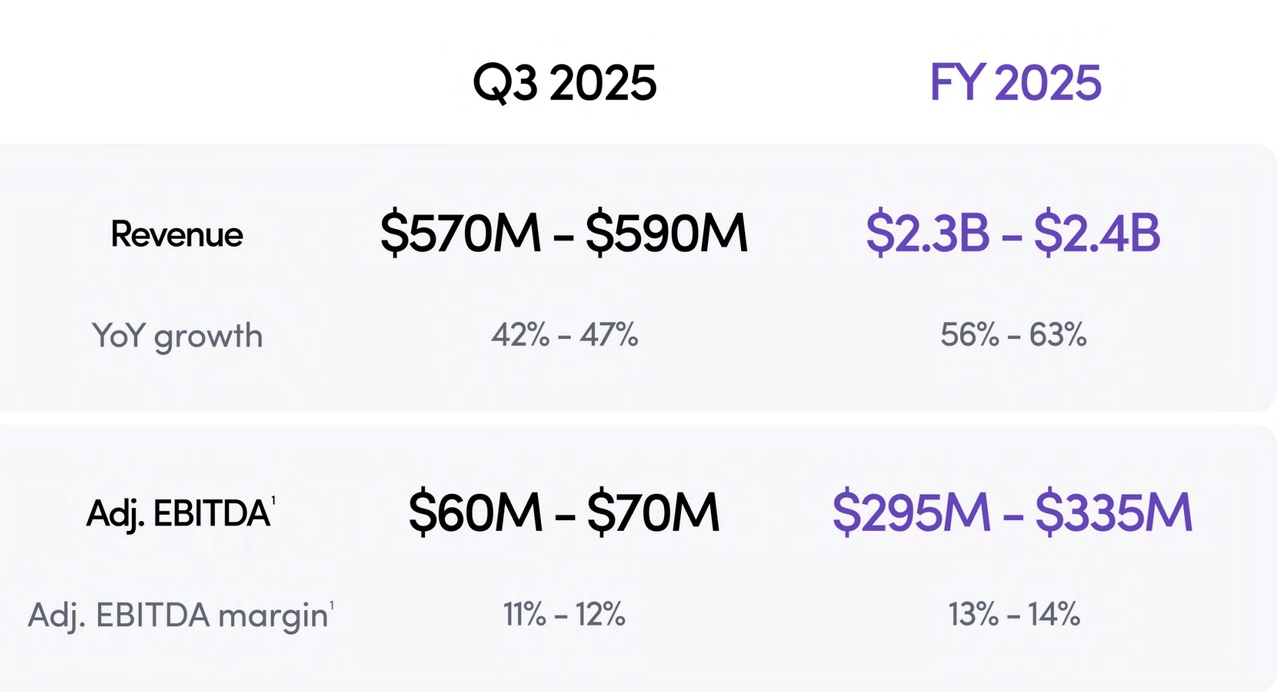

Roughly: The elimination of GLP-1 as a direct deal with $NOVO B (+0.58%) has led to them selling again in a gray area and a lawsuit is always on the table. In addition, compounders have lowered their prices, which has minimized the gap to H&H somewhat. This has meant that Hims has less growth in the GLP-1 area and therefore growth of ~40% is expected for Q3

In addition, ARPU has declined somewhat and Hims has lost momentum in subscriber growth. However, I only see this as a short-term problem as I have adjusted the GLP-1 business and see it as a cash position. In addition, the management is sticking to the 2030 targets which would lead to a FWD P/S of 1.4!!!

The sell-off was also initiated by the sale of shares by the CEO / by the management restructuring and by current market momentum. These factors have led to the current share price decline.

My position has halved since February due to the current price drop, but I am currently considering small purchases (I am an unliquid student) to increase my position a little.

This as a small suggestion, we currently have a P/S of ~3.3!!! I'm off to university now. More to follow