TLDR: Very strong figures from $PM (-0.43%) IQOS and ZYN continue to perform excellently and the global cigarette volume (USA excluded) is stabilizing.

I will add any further information as it comes in.

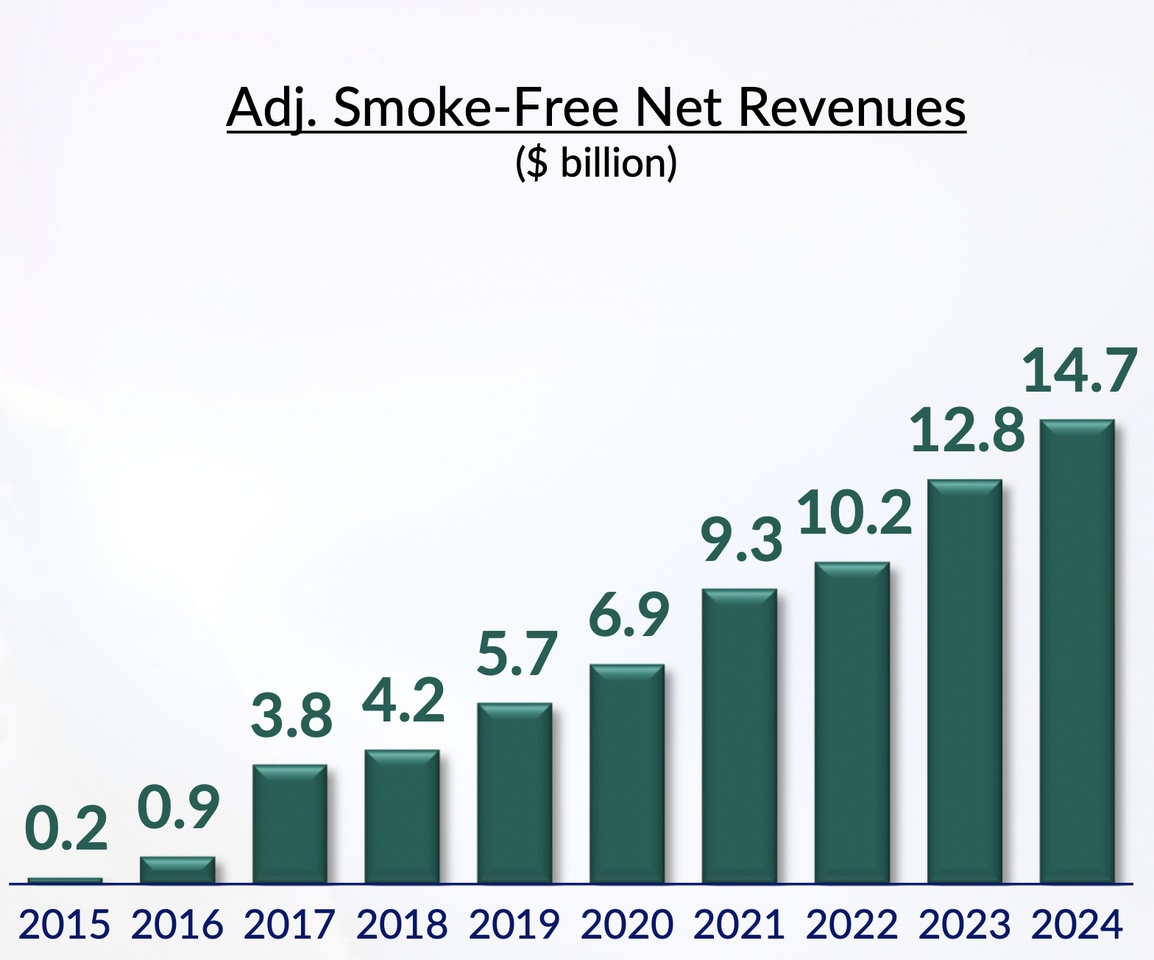

Smoke-free business (SFB):

- Quarterly shipments of smokeless products (HTU and oral products) exceeded 40 billion units for the first time.

- Full-year sales increased by 14.2 % (organically 16.7 %), gross profit by 18.7 % (organically 22.7 %).

- Smokeless products accounted for 40% of total sales and 42% of gross profit.

- The number of adult users rose to 38.6 million (+5.3 million compared to December 2023)

Smoke-free inhalable products (SFP):

- IQOS consolidated its position as the second largest nicotine brand and drove the growth of the heat-not-burn segment (over 75% of global market volume).

- In Japan, the market share of IQOS HTU increased by 3.1 percentage points to 30.6 %; the HTU segment exceeded 50 % market share in several regions.

- In Europe, IQOS HTU's market share increased to 10.6 %, with strong growth in countries such as Spain, Romania and Germany.

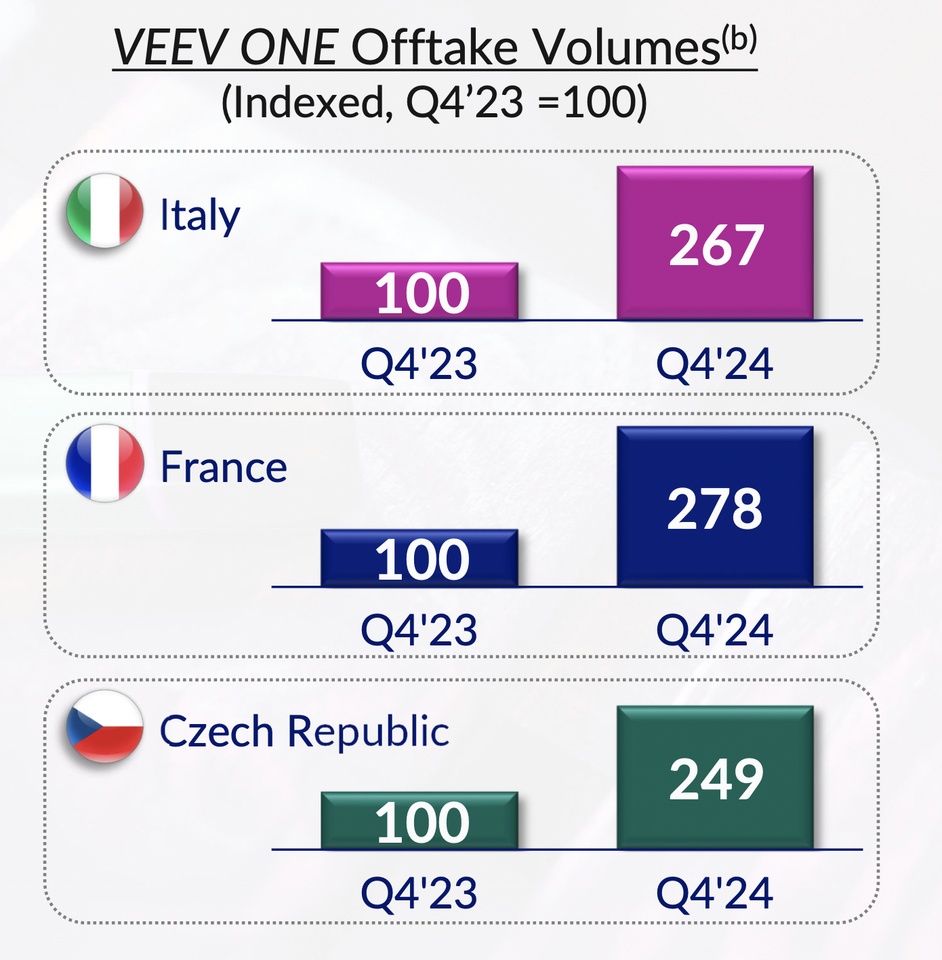

Vaping:

- VEEV is increasingly favored by legal poly users and is among the top 3 brands in 13 European markets (#1 in five markets, including Italy and the Czech Republic).

Oral

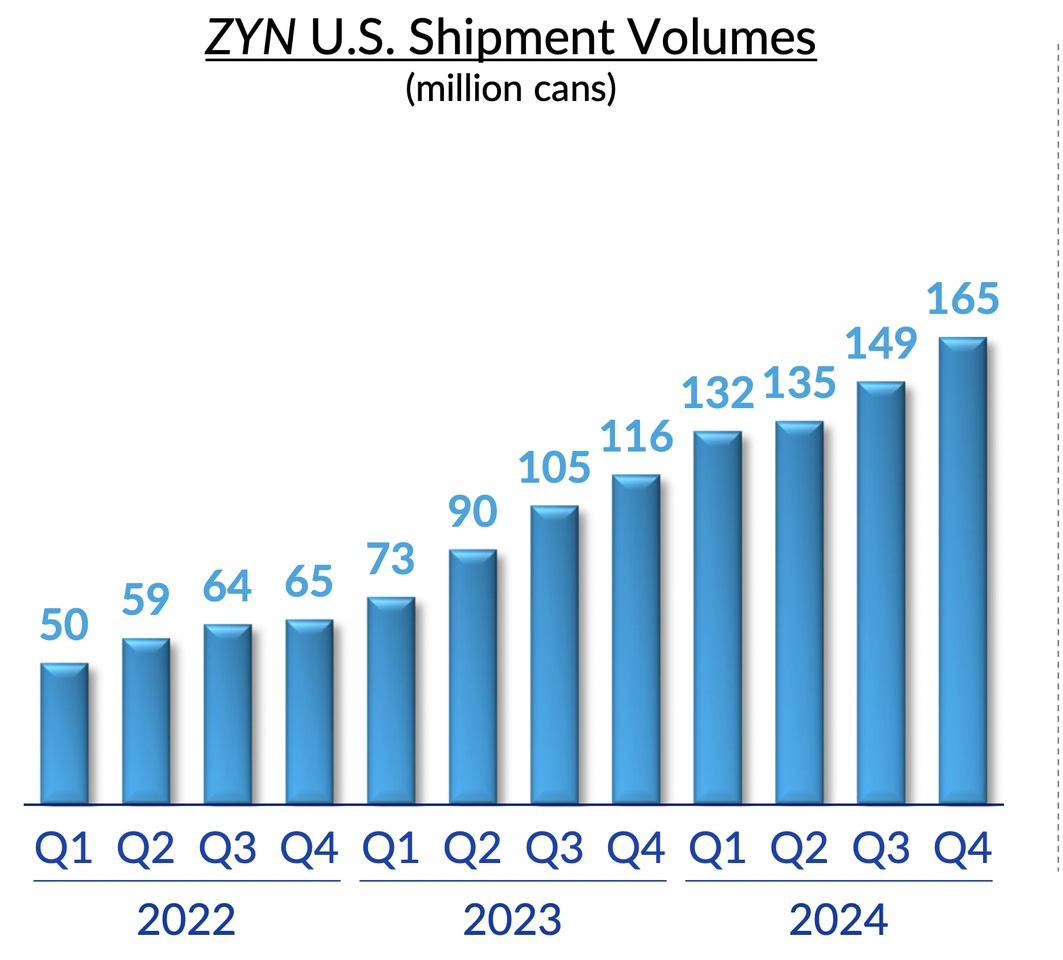

- annual shipments increased by 28 % (doses) and 25 % (pouches).

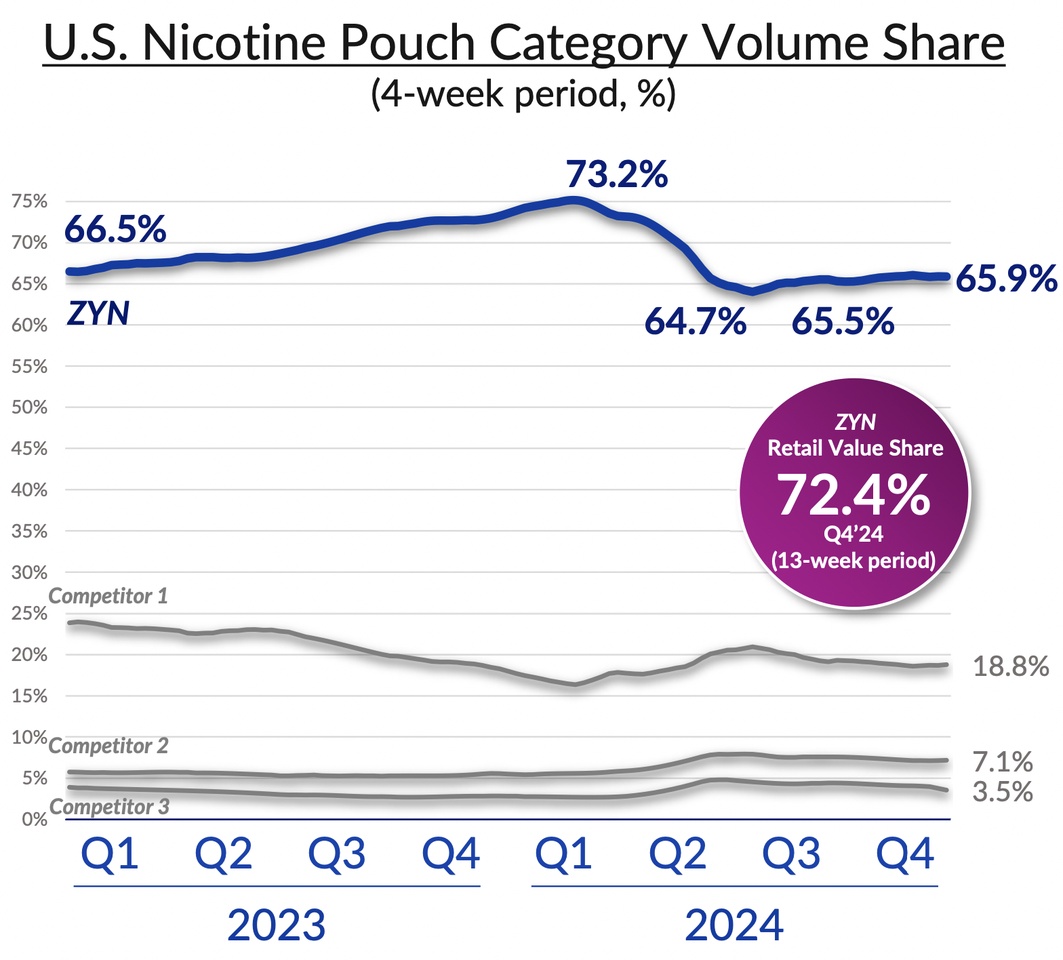

- Growth was driven by ZYN in the USA (+42 %) and international markets such as Pakistan and South Africa.

Combustibles:

- Annual sales increased by 4% (organically 5.9%), in the fourth quarter by 6% (organically 6.2%).

- Strong price adjustments led to gross profit growth of 10.7 %.

- Brands such as Marlboro achieved market share gains.

Although there is no detailed information on IQOS USA, here is an excerpt from the press release and transcript:

"the U.S. Food and Drug Administration has authorized the marketing of Swedish Match's General snus and ZYN nicotine pouches and versions of PMI's IQOS devices and consumables - the first-ever such authorizations in their respective categories. Versions of IQOS devices and consumables and General snus also obtained the first-ever Modified Risk Tobacco Product authorizations from the FDA."

"Turning now to the U.S., where our IQOS 3 'Be The First' campaign in Austin is

progressing well and we expect to commence direct sales of devices and HTUs in

Austin around the end of Q1. We are seeing high interest from consumers, with over

4,000 adult smokers on our waitlist."

Volume in bn units Q4

Total 193.1

Cigarettes 152.8 +1.1%

HTU 35.7 +5.1%

Oral 4.6 +22%

Revenue ($Bn) Q4

Total 9.7 +7.3% BEAT

Combustibles 5.8 +6%

SFB 3.9 +9.2%

SFB share of Rev = 40%

Gross profit ($Bn) Q4

Total 6.3 +12.5%

Combustibles 3.7 +10.7%

SFB 2.6 +15%

SFB share of Gross Profit= 42%

Operating Income ($Bn) Q4

Total 3.3 +12.8%

EPS Q4

Reported Diluted -0.38$

Adjusting Items $(1.93)

Adjusted Diluted 1.55$ +14% BEAT

Currency Impact $0.06

Adjusted Diluted ex fx 1.49$ +9.6%

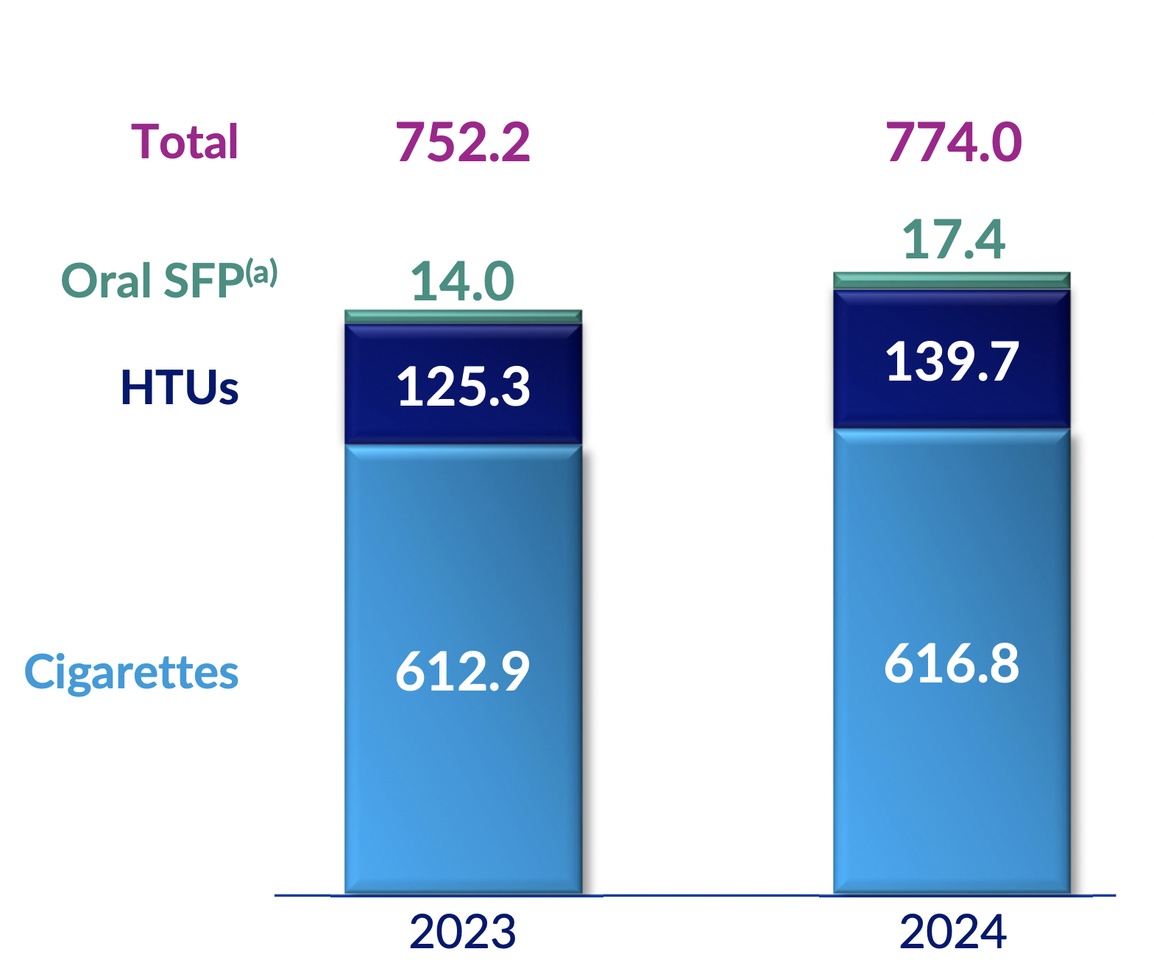

Volume in bn units FY2024

Total 774 +2.9%

Cigarettes 616.8 +0.6%

HTU 139.7 +11.6%

Oral 17.4 +24.6%

Rev ($Bn) FY2024

Total 37.9 +7.7%

Combustibles 23.2 +4%

SFB 14.7 +14.2%

SFB share of Rev = 39%

Gross Profit ($Bn) FY2024

Total 24.5 +10.2%

Combustibles 14.8 +5.2%

SFB 2.6 9.7 +18%

SFB share of Gross Profit= 40%

Operating Income ($Bn) FY2024

Total 13.4 +16%

EPS FY2024

Reported Diluted $4.52 -10%

Adjusting Items $(2.05)

Adjusted Diluted $6.67 +9.3%

Currency Impact $(0.38)

Adjusted Diluted ex fx $6.95 +15.6%

Europe

Volume in bn units Q4 I FY 2024

Combustibles 38 -2.4% I 162 -1.8%

HTU 15 +6.2% I 53 +8.9%

Market Share % Q4 I FY2024

Combustibles 29.9 -30bps I 30 -30bps

HTU 10.8 +80bps I 10 +90bps

Volume in mln cans Q4 I FY2024

Nicotine pouches 13.6 +58% I 48.8 +40.2%

Snus 57.5 -5.9% I 236.4 +0.1%

Other 0.6 -20.1% I 3.4 -18.6%

Total 71.7 +1.7% I 288.9 +4.9%

Q4 in bn$

Revenue 4.05 +7.7%

Operating income 1.8 +11.4%

Adj. operating income margin 45.4% +50bps

FY2024 in bn$

Revenue 15.3 +7.9%

Operating income 6.9 +12.4%

Adj. operating income margin 46.2% +60bps

SSEA, CIS & MEA

Volume in bn units Q4 I FY2024

Combustibles 85.8 +3.4% I 344.8 +3.4%

HTU 8.4 +12.3% I 28.5 +14.8%

Q4 in bn$

Revenue 2.8 +5.9%

Operating income 0.8 +15.3%

Adj. operating income margin 28.2% +220bps

FY2024 in bn$

Revenue 11.2 +5.9%

Operating income 3.4 +9.3%

Adj. operating income margin 31% +10bps

EA, AU & DF

Volume in bn units Q4 I FY2024

Combustibles 11.4 +1.2% I 47.6 -6%

HTU 11.9 -0.1% I 56.8 +12.6%

Q4 in bn$

Revenue 1.4 +0.3%

Operating income 0.57 -0.3%

Adj. operating income margin 40.1% -20bps

FY2024 in bn$

Revenue 6.4 +3%

Operating income 2.8 +13.4%

Adj. operating income margin 45.1% +10bps

Americas

Volume in bn units Q4 I FY2024 excl. USA

Combustibles 17.1 -1.7% I 61.6 -2.6%

HTU 0.15 -25.7% I 622 +6.3%

Volume in mln cans Q4 I FY2024 incl. USA

Nicotine pouches 165.1 +42% I 581.4 +51%

Moist Snuff 32 +2.4% I 134.6 +0.6%

Snus 0.7 -9% I 2.9 -25.8%

Q4 in bn$

Revenue 1.26 +17.3%

Operating income 0.13 +100%

Adj. operating income margin 26.9% +149bps

FY2024 in bn$ (Loss)

Revenue 3.33 +8.8%

Operating income (391) +55%

Adj. operating income (120) +63.2%

Adj. operating income margin (36)% +710bps

Canada Lawsuit

Philip Morris International (PMI) has recognized an impairment charge of USD 2.3 billion on its subsidiary Rothmans, Benson & Hedges (RBH) due to legal developments in Canada. RBH has objected to a proposed settlement plan to resolve tobacco disputes worth CAD 32.5 billion. Since 2019, RBH-related results such as EPS and net debt have been excluded from PMI's financial reports. If the plan is approved and implemented, RBH is expected to remain deconsolidated, however, under certain conditions, future dividend payments could be made to PMI and increase its cash flow and adjusted EPS.