🐺 CD Projekt: Of sorcerers and cyberpunks - the masters of digital worlds 🏙️

CD Projekt, a company based in Poland, specializes in the development and publication of video games. Founded in 1988, the company began as an IT service provider and has since developed into one of the most renowned names in the global gaming industry.

Historical development

$CDR (-0.02%) The company's origins lie in Optimus S.A., which began as an IT service provider. A decisive milestone in the company's history was the acquisition of game developer CD Projekt RED Sp. z o.o. in 2009, which marked the company's entry into game development and laid the foundation for its current success. In 2012, the company was finally renamed CD Projekt S.A., underlining the transition to a pure game developer.

Business model and core competencies

CD Projekt specializes in the development of story-driven role-playing games and has thus achieved an outstanding position in the industry. The company is particularly known for its ability to create deep, immersive game worlds that are popular with players worldwide. Its best-known productions include the award-winning "The Witcher" series, which has established itself internationally as one of the most successful role-playing games.

In addition to game development, CD Projekt also operates the digital distribution platform GOG.com, which provides an additional source of income and further diversifies the business model.

Future prospects and strategic initiatives

The future of CD Projekt rests on two central pillars: the further development of existing franchises and the creation of new intellectual property rights (IPs). The company is investing heavily in its technology and development processes to make future releases smoother and to further increase the quality of its games.

Another important strategic focus is the expansion of the business into other media. An outstanding example of this is the successful Netflix adaptation of "The Witcher", which has not only significantly increased brand awareness but also opened up new sources of revenue.

Market position and competition

CD Projekt is in direct competition with major game developers such as $TTWO (+0.4%) , $UBI (+0.51%)

$EA (+0.32%) . Nevertheless, the company manages to stand out from the competition thanks to its special focus on high-quality, story-based single-player experiences. This specialization has earned the company a loyal fan base and contributes significantly to its strong market position.

Total Addressable Market (TAM)

The global market for video games is growing continuously and offers CD Projekt enormous potential. With the increasing proliferation of gaming platforms and the growing demand for high-quality and immersive gaming experiences, CD Projekt has excellent opportunities to capitalize on this growing market.

Share performance

TR 14k % since IPO and -2.3% over the last three years.

Development

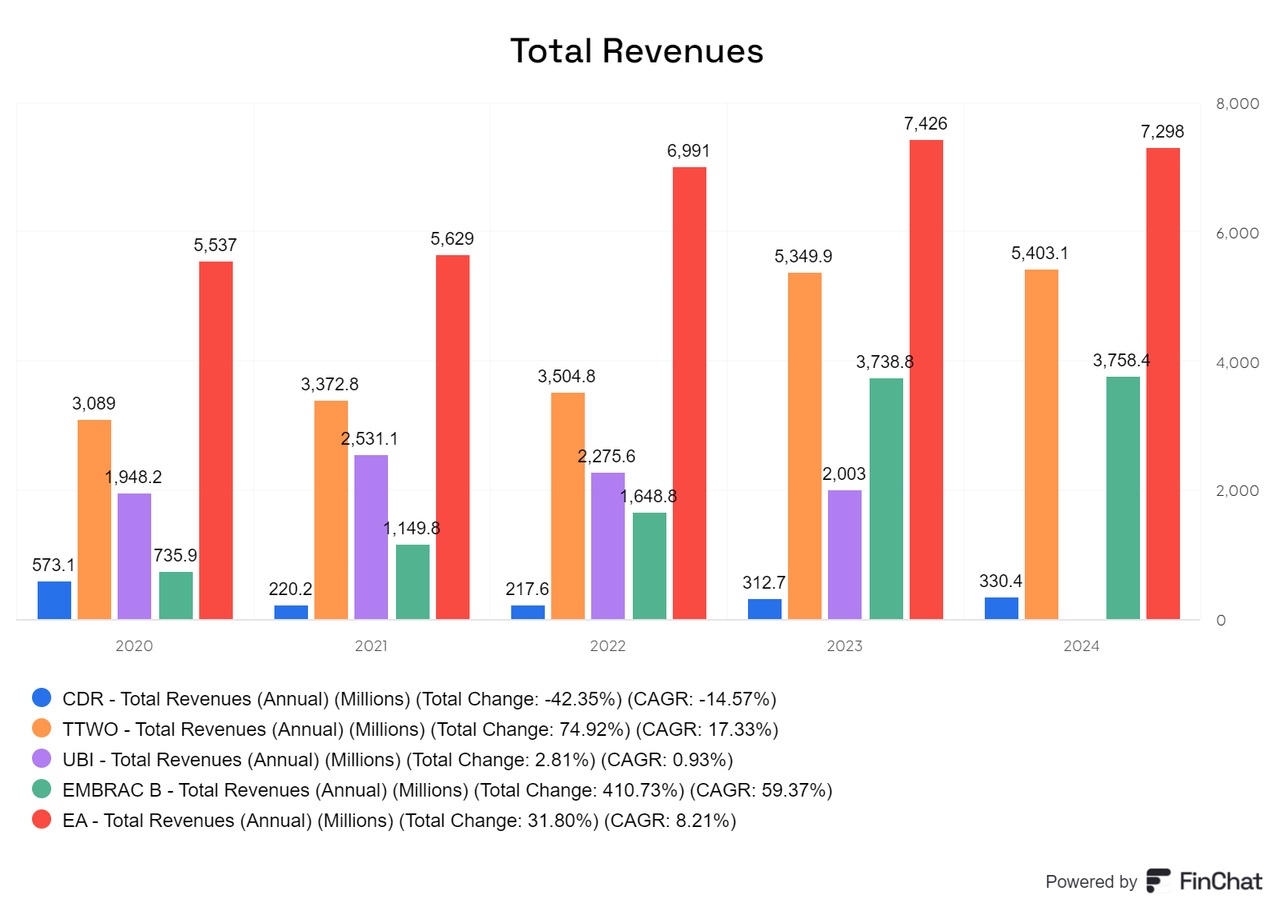

CD Projekt is currently one of the smaller game publishers in terms of sales. However, this does not mean that it has to stay that way - the potential for future growth is certainly there.

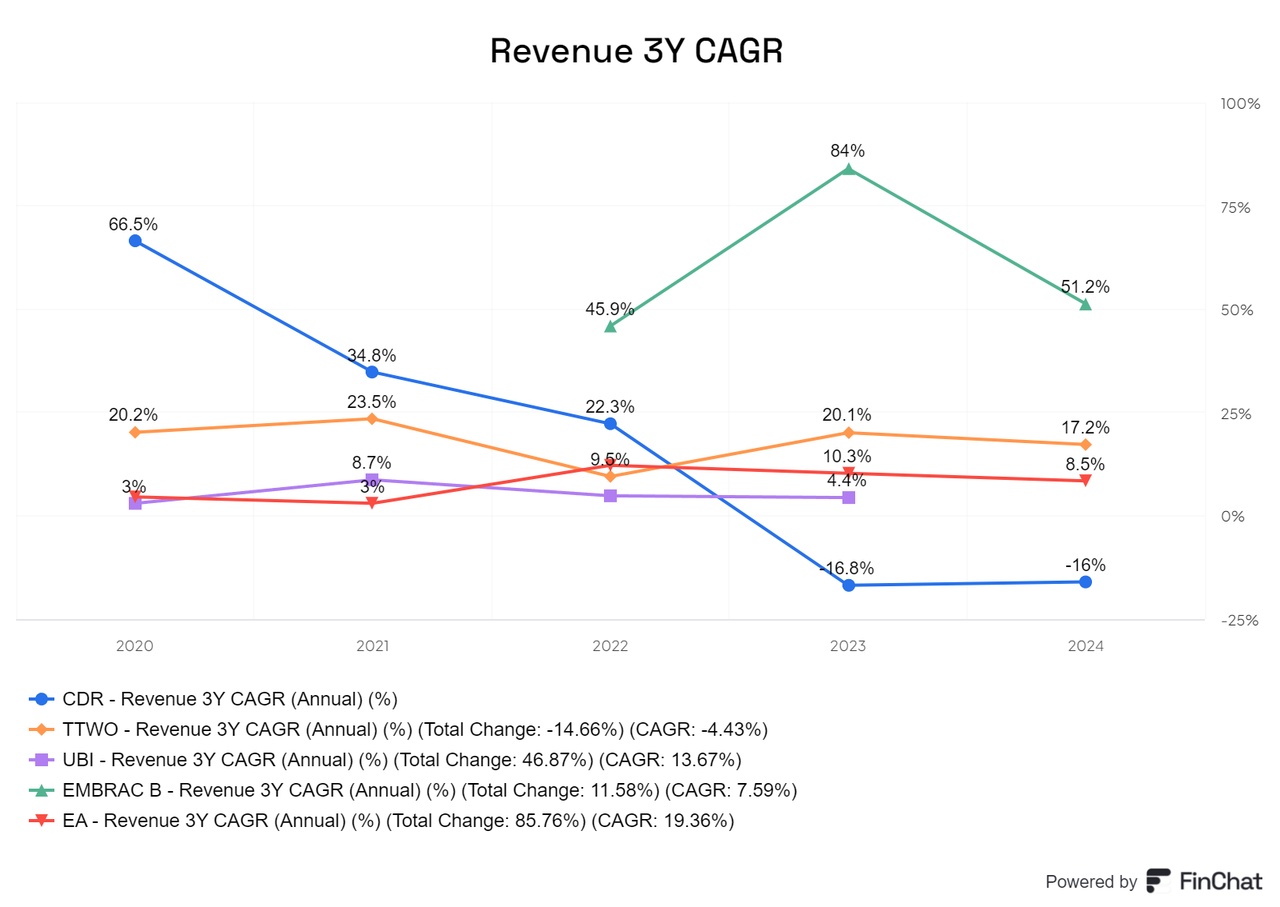

CD Projekt is also currently at the lower end of the growth scale, which is mainly due to the fact that the last major game release was some time ago. However, new titles are already in development. Compared to other game publishers, CD Projekt also has a significantly smaller number of IPs, which has given them less flexibility to date.

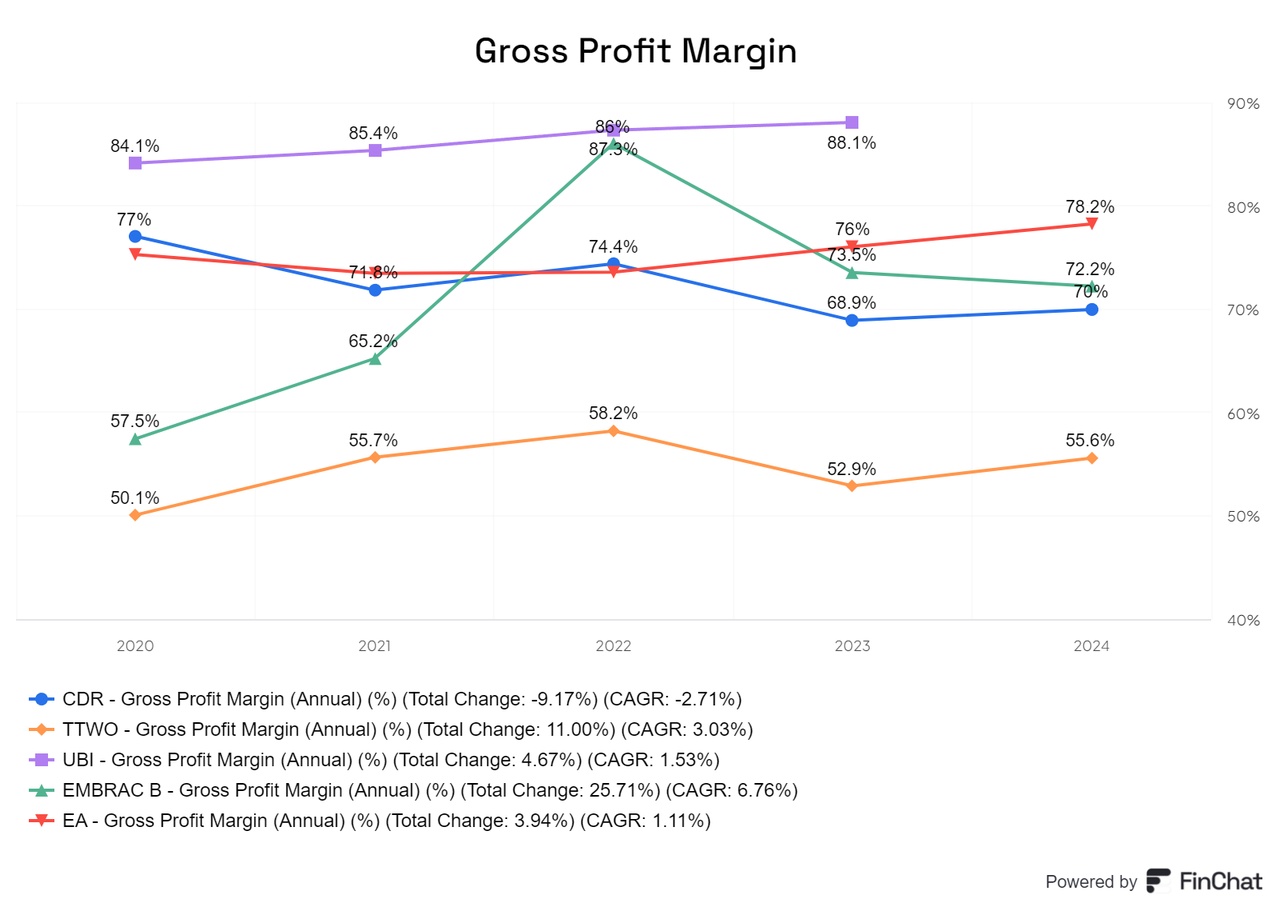

In terms of gross margin, CD Projekt is neither at the top nor at the bottom of the rankings. However, the margin, which has fallen recently, should rise again slightly following the release of the new projects. This puts the company in line with the industry average.

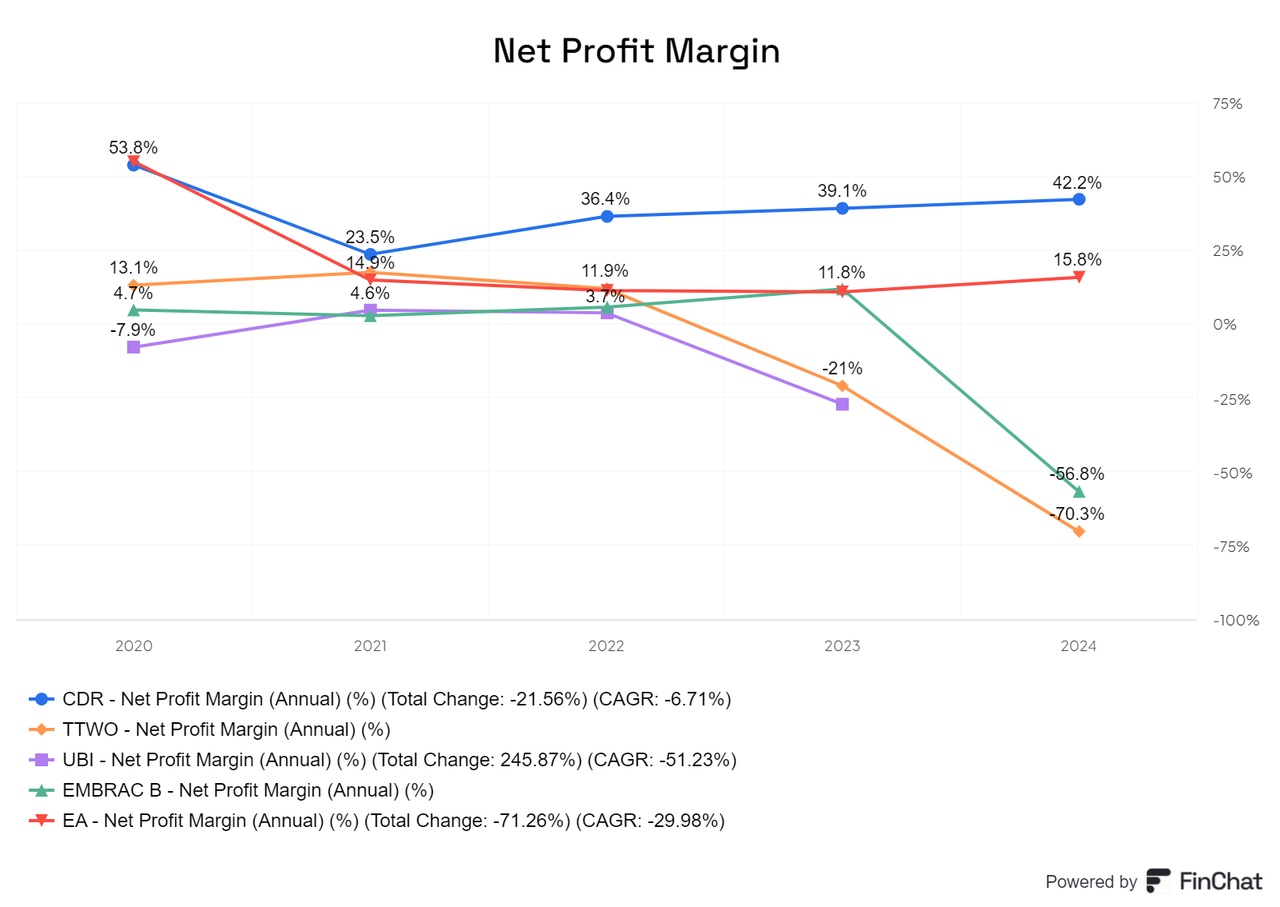

In contrast, CD Projekt clearly stands out in terms of its net profit margin. Even after a decline, the company is still twice as good as many of its competitors and thus clearly holds its own at the top.

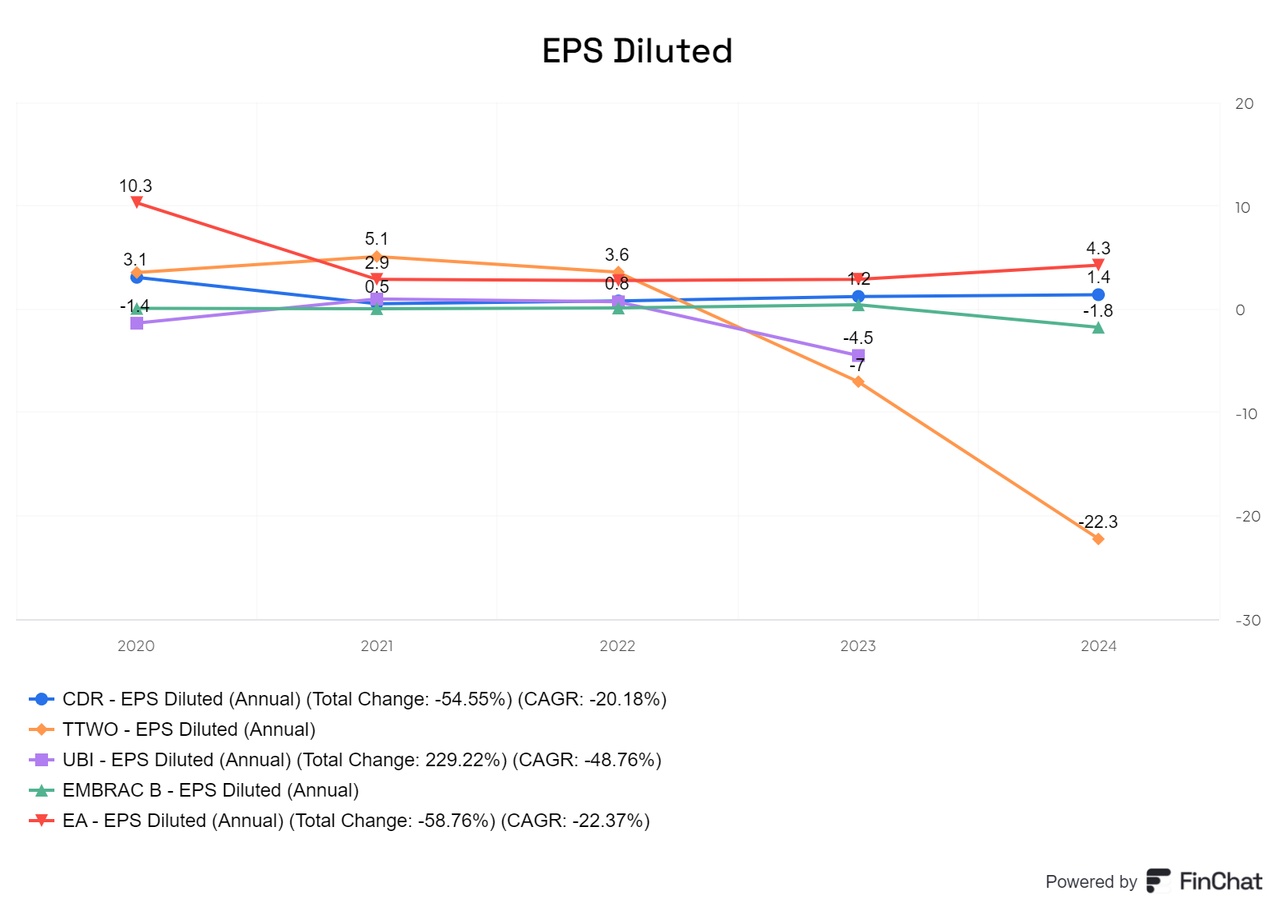

In terms of earnings per share (EPS), CD Projekt is remarkably consistent in positive territory, while many other manufacturers often slip into negative territory in this respect.

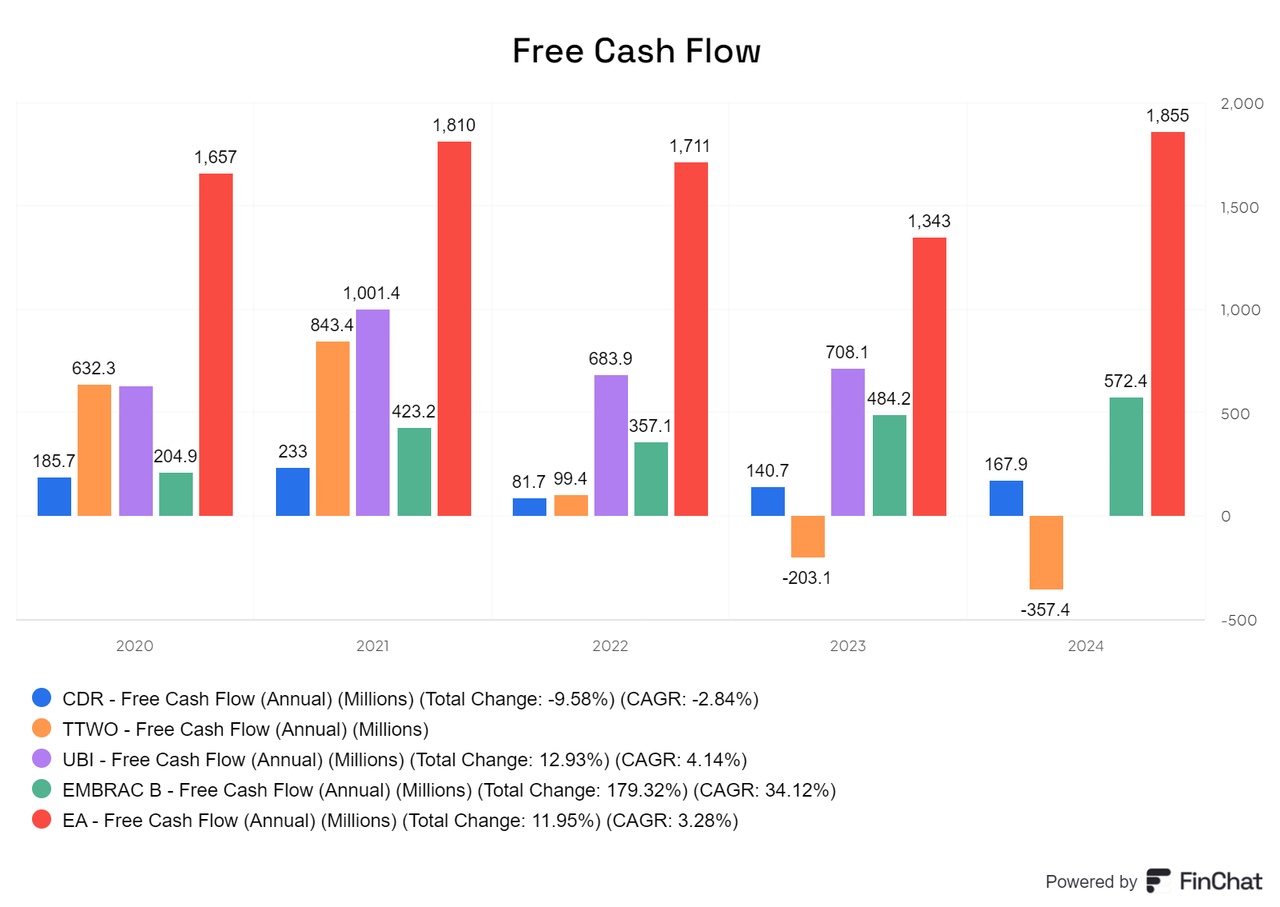

CD Projekt's free cash flow (FCF) has also been positive for some time now, which illustrates the company's forward-looking planning and intelligent management. Despite the continuous investment in the development of new projects, the cash flow remains stable, which speaks for the financial health of the studio.

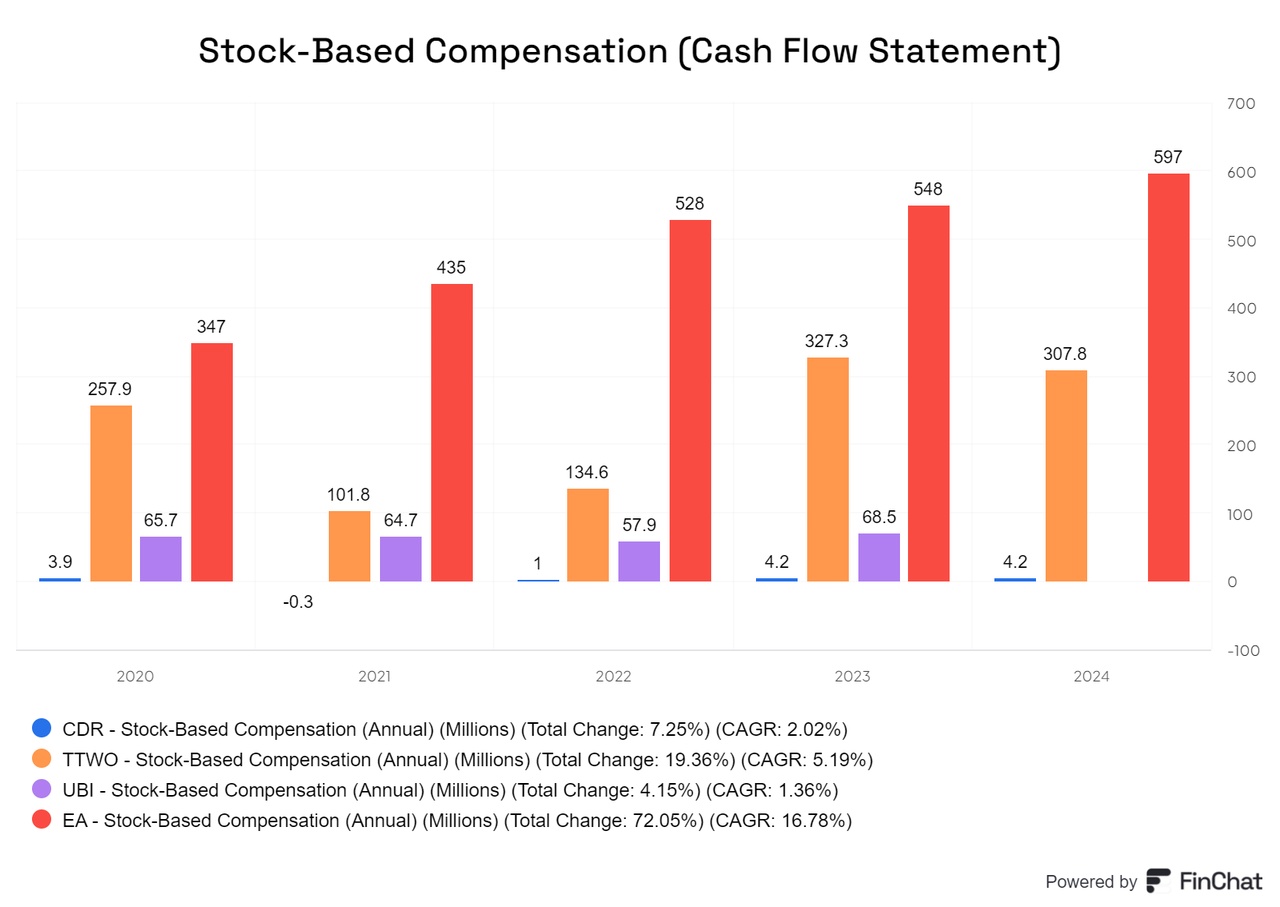

Another advantage for CD Projekt's shareholders is the almost non-existent stock-based compensation (SBC)

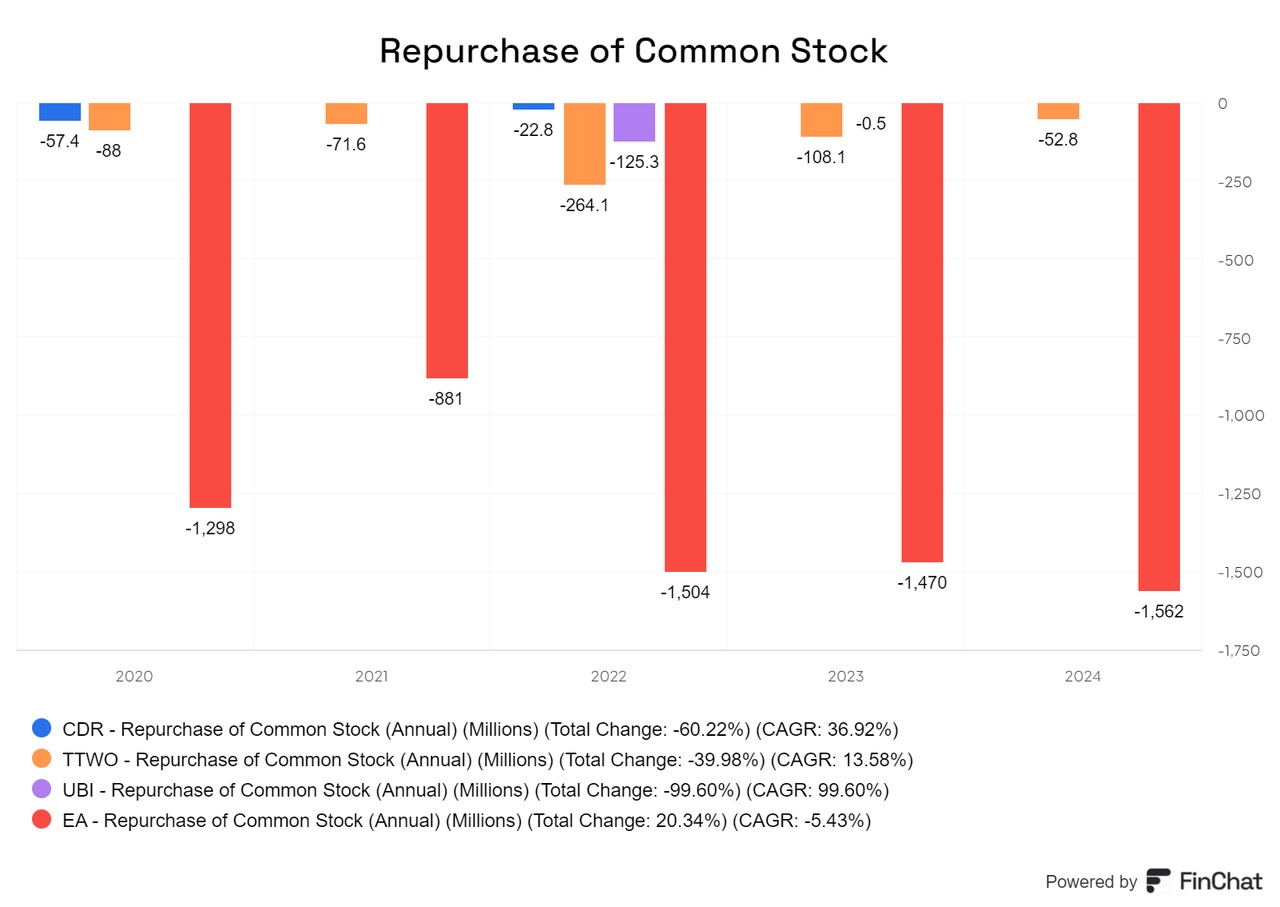

In contrast to many other companies that use buybacks to compensate for dilution effects and bring money to shareholders, CD Projekt can largely do without such measures

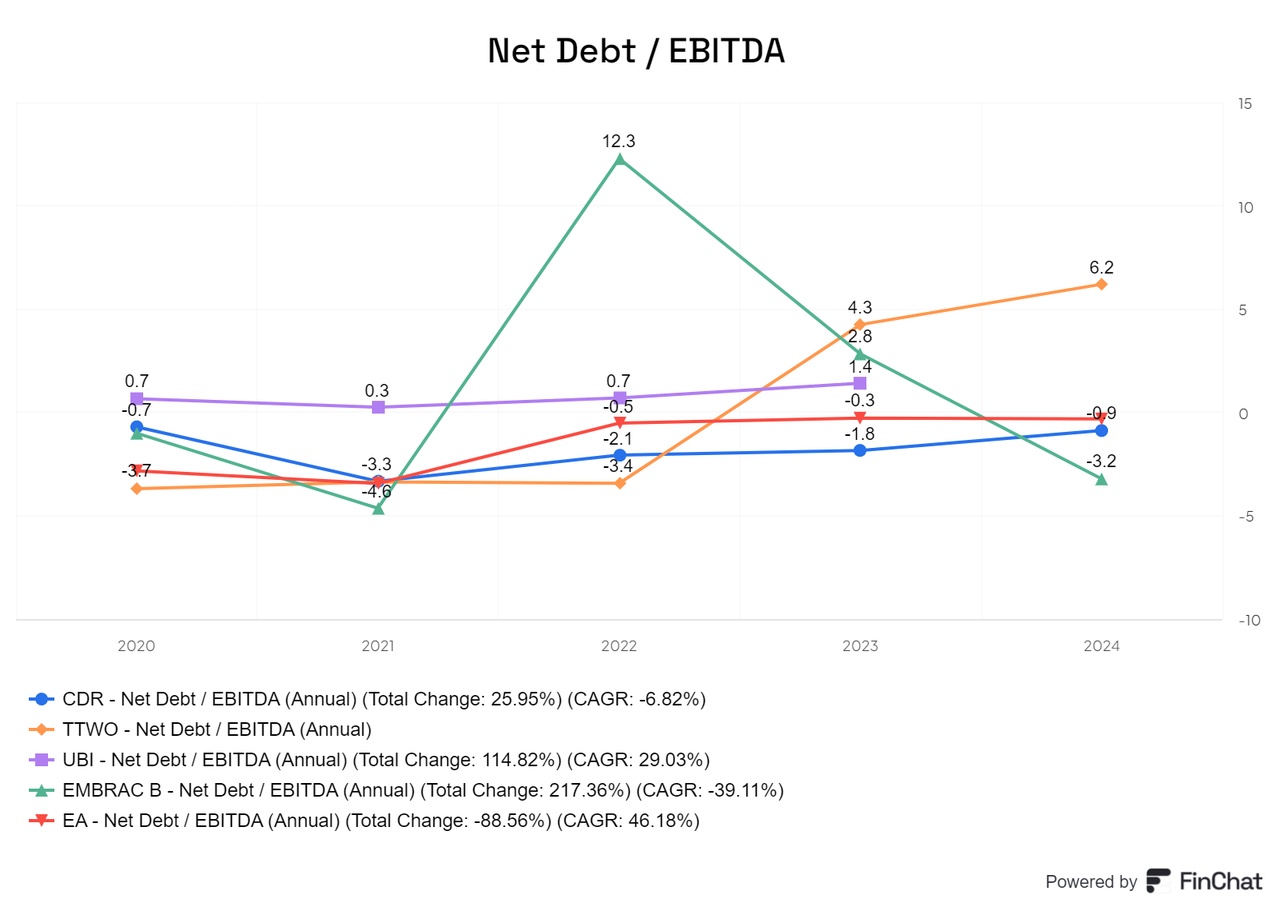

The ratio of net debt to EBITDA is also slightly negative at CD Projekt

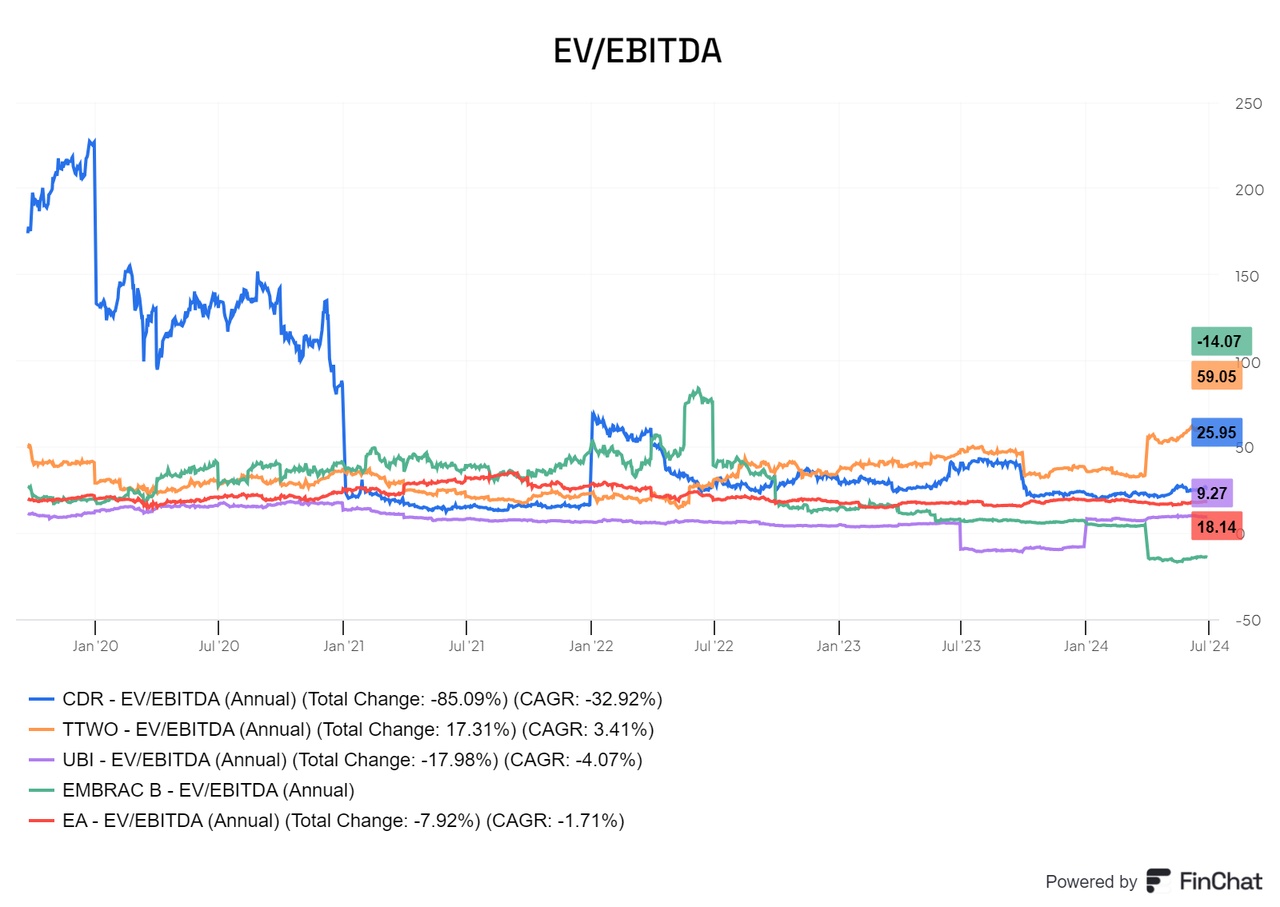

However, CD Projekt is the most expensive gaming company in terms of EV/EBITDA ratio, reflecting investors' high expectations for future growth and the success of new projects.

Part 2: https://getqu.in/UAF5xR/