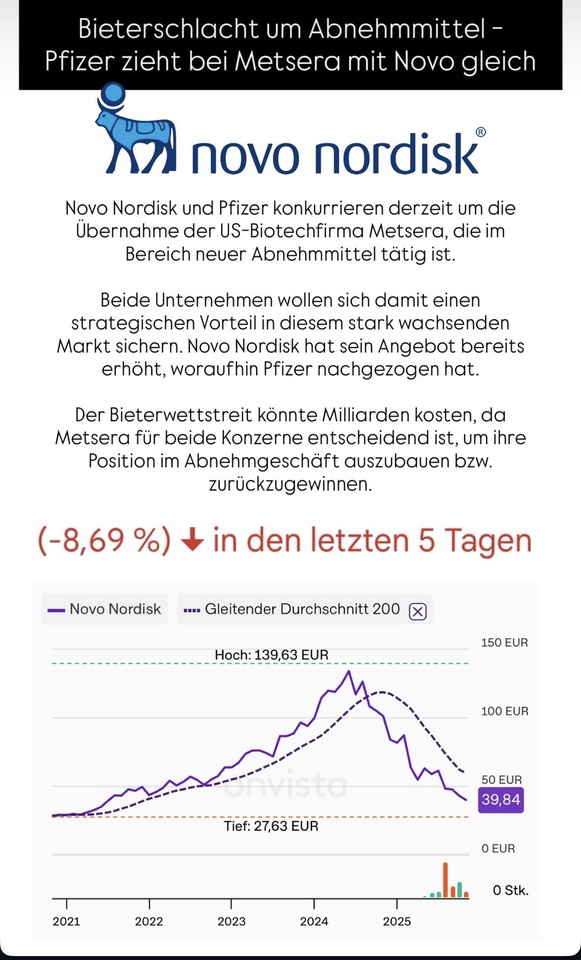

$NOVO B (-2.32%) . for the US biotech company Metsera.

In the billion-euro bidding war for the obesity specialist Metsera, the US pharmaceutical company $PFIZER against its Danish rival $NOVO B (-2.32%) Danish rival. In the expectation of a further booming market, Pfizer is taking over the previously loss-making US developer of weight loss drugs for around ten billion dollars, as both companies announced.

Novo Nordisk admitted defeat on Saturday and declared that it would not increase its now outbid offer any further.

Analysts criticized the price paid by $PFIZER the price paid as very high.