Today I would like to introduce you to a Japanese company that is a leader in its field and can be considered indispensable for the global economy. There has been little or no coverage of this company on Getquin so far. I am talking about Shin-Etsu Chemical $4063 (-1.33%) !!

First a few words on my part:

Media coverage often suggests that the world consists only of the USA and China. The only thing that counts is who is the biggest and loudest. Who builds the most electric cars? Who builds the biggest AI model? This "duel of the giants" is currently being exploited to an exhausting extent. But if you look behind the facade, a more restrained picture often emerges. Mass production is not everything, the decisive factor is the technological basis, the so-called "bottlenecks". These bottlenecks cannot simply be copied with vast amounts of American money or Chinese workers. And it turns out that the country that controls a large number of these bottlenecks is Japan. While the West, in its arrogance, is busy explaining to its population why Japan's demographics and debts are threatening its demise, the Japanese continue to expand their technological position in a state-industry merger. However, we won't really notice any of this until TSMC's competitor Rapidus launches its innovative 2nm chip production in 2027. But let's get back to the company that I also have in my portfolio. ^_-☆

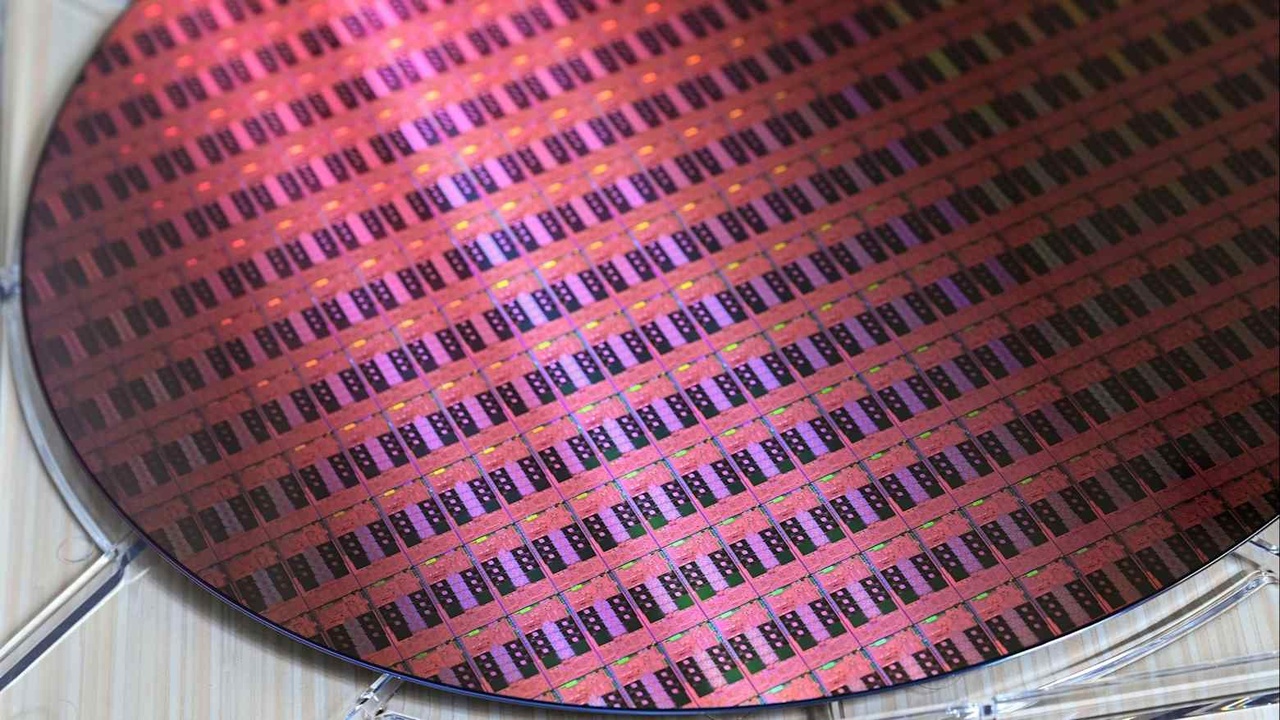

Shin-Etsu Chemical $4063 (-1.33%) is the world's leading manufacturer of silicon wafers. Their wafers reach a purity of 99.99999999999%, the result of years of research that expresses the Japanese penchant for perfection. They control around 33% of the market, but this share increases as the complexity of the chips increases. Another special feature is that they attach great importance to vertical integration. They also produce the required preliminary products themselves (unlike their competitors) and are therefore largely independent of supply chain problems. In addition, they deliver on time almost 100% of the time, which is a form of reliability that can only be made possible by this structure. Furthermore, they have a market share of 25-30% for photoresists (essential for EUV in particular), 50% for photomask blanks (stencil for wafer exposure -> demand increases for smaller structures) and they are also leaders in advanced packaging. For advanced packaging, their high-end thermal interface materials stand out in particular, which are crucial for thermal management (they control around 50% of the market). Also interesting are their resins specially developed for HBM, which fill the gaps between the stacked chips (about 25% in memory stacking). They continue to expand their position in both areas of the AP. Due to the enormous complexity and purity of their chemicals, they also have a very strong moat, one that has been strengthened by decades of research and specialization. Independently of chip production, they are also an important producer of plastics, especially in the USA, where they dominate the market for PVC.

Market capitalization (current): approx. € 60 billion

P/E ratio (current): approx. 22

Sales (2026e): approx. € 14 bn

Profit (2026e): approx. € 3 bn

One relevant future project is the introduction of gallium nitride (GaN), which is particularly suitable for power semiconductors as it is more energy-efficient than conventional silicon. It is expected to play an increasingly important role in the coming years. Shin-Etsu Chemical was the first company to produce GaN as a 300mm wafer. If this goes into mass production, it will be an important growth area for the company. Another company to watch out for is Rapidus, mentioned earlier, because when it starts mass production, Shin-Etsu will be the supplier of choice and will have a large new customer to serve.

Finally, it should also be mentioned that the company's finances are more than robust. They have virtually no debt and are sitting on a mountain of cash, which allows them to easily finance projects such as the new factory in Gunma Prefecture and remain agile even in cyclical downturns.

Overall, it can be said that Shin-Etsu Chemical is the world's leading materials supplier to the semiconductor industry, with the purest chemicals, the strongest research, the soundest finances and geopolitical momentum. The government stands by them in all their initiatives to secure their supremacy. The semiconductor industry still has big growth years ahead and Shin-Etsu Chemical is the (moderately valued) shovel seller of choice. Without this company, the industry would not be able to survive at this level. One could say that the success of players like TSMC $2330 Samsung $005930 Intel $INTC (-5.24%) and others is directly linked to that of Shin-Etsu Chemical.

Since several major banks have just expressed their optimism about Japanese stocks, I am considering making more contributions on other Japanese hidden champions. I also have a few lesser-known ones in my portfolio. If you would be interested, please let me know. :)