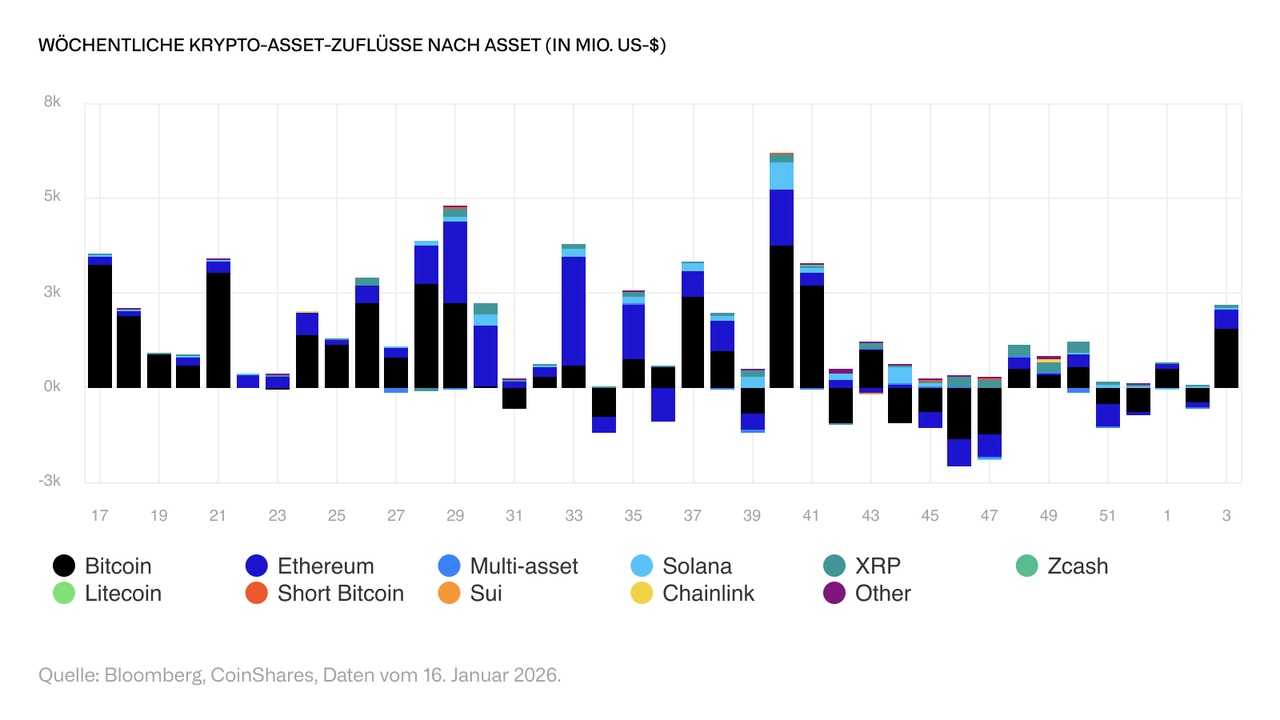

Digital investment products recorded inflows of USD 2.17 billion last week - the highest weekly figure since October 10, 2025, just before the market collapse. Inflows were stronger at the start of the week, but sentiment turned negative on Friday: diplomatic tensions over Greenland and renewed threats of additional tariffs led to outflows of USD 378 million. In addition, speculation that Kevin Hassett - a leading candidate for the chairmanship of the US Federal Reserve and well-known monetary policy dove - is likely to remain in his current post weighed on the market.

#bitcoin led the inflows with 1.55 billion US dollars. Despite a push by the US Senate Banking Committee under the CLARITY Act, which could restrict stablecoins from paying interest, Ethereum and #solana saw inflows of USD 496 million and USD 45.5 million respectively.

A wide range of altcoins saw inflows, most notably #xrp (USD 69.5 million), Sui (USD 5.7 million), LIDO (USD 3.7 million) and Hedera (USD 2.6 million).

$BITC (-1.98%)

$CETH (-2.68%)

$SLNC (-2.48%)

$XRRL (-2.2%)

$GB00BMY36D37 (-1.4%)