Diageo in the #Dividendencheck

The world's largest spirits producer (by sales) and dividend aristocrat has now been paying an annually increasing dividend for 35 years and has a portfolio of over 150 brands that are virtually unmissable for drinking pleasure

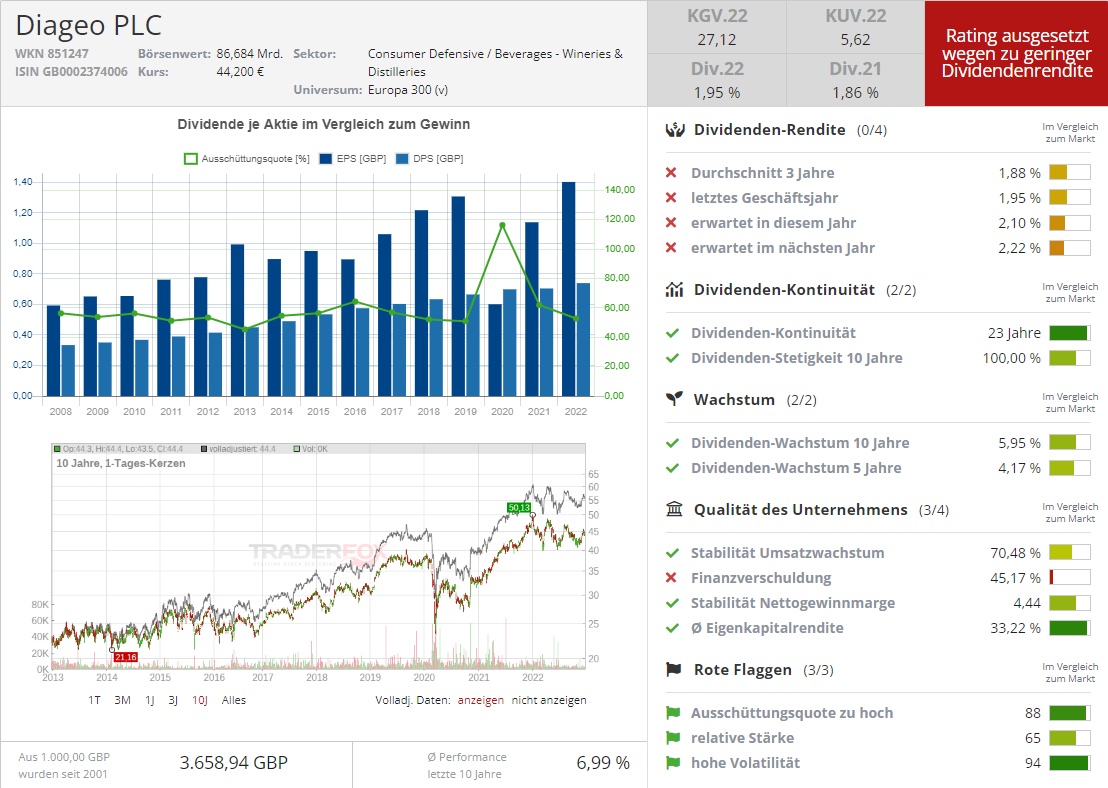

How secure is the dividend?

The payout ratio of profit and FCF is 54% and 62%. Nothing is certain on the stock market, but these values in combination with 35 years of continuity strongly suggest that a (rising) dividend can be expected in the future.

Diageo in my portfolio:

Diageo is already since 2018 in my portfolio and free according to the motto booze is always one of my forever investments:

-Savings Plan 60€/Month

- Buy In: 40,73€

- Net dividends received: 84,67€

without any withholding tax as there is no such thing in U.K. :D