$AII (+0.56%) Almonty Industries is a Canadian mining company specializing in the extraction and processing of tungsten - a strategically important industrial metal. The company owns active and planned mines in Spain, Portugal and South Korea, including the important Sangdong project, which is scheduled to be put back into operation in 2025. Almonty plans to move to the USA at the end of this year and be listed on the NASDAQ $CSNDX (-0.48%) stock exchange.

I myself have been invested for a short time and am currently increasing my stake as I see great potential here.

📌 Overview & history

- Founded: 2011 in Toronto, Canada (spin-off from predecessor Primary Metals/PMI)

- Name: "Al" from Alfonse (D'Amato), "Monty" from Monty Black (fathers of the founders)

- CEO: Lewis Black - already in the tungsten business since 2005 and the driving force behind Almonty $AII (+0.56%)

______________________________

🌍 What does the company do?

- Field of activity: International mining with a focus on tungsten - with tin, molybdenum and copper as additional by-products

- Locations & projects:

- Los Santos (Spain): Production mine with approx. 500,000 tons of production capacity/year

- Panasqueira (Portugal): Tungsten, tin & copper processing, under Almonty since 2005

- Valtreixal (Spain): Development project with ~2.8 million tons of resources

- Sangdong (South Korea): Former world-class mine, reopening planned for 2025, target capacity approx. 4,000 tons of tungsten concentrate/year

______________________________

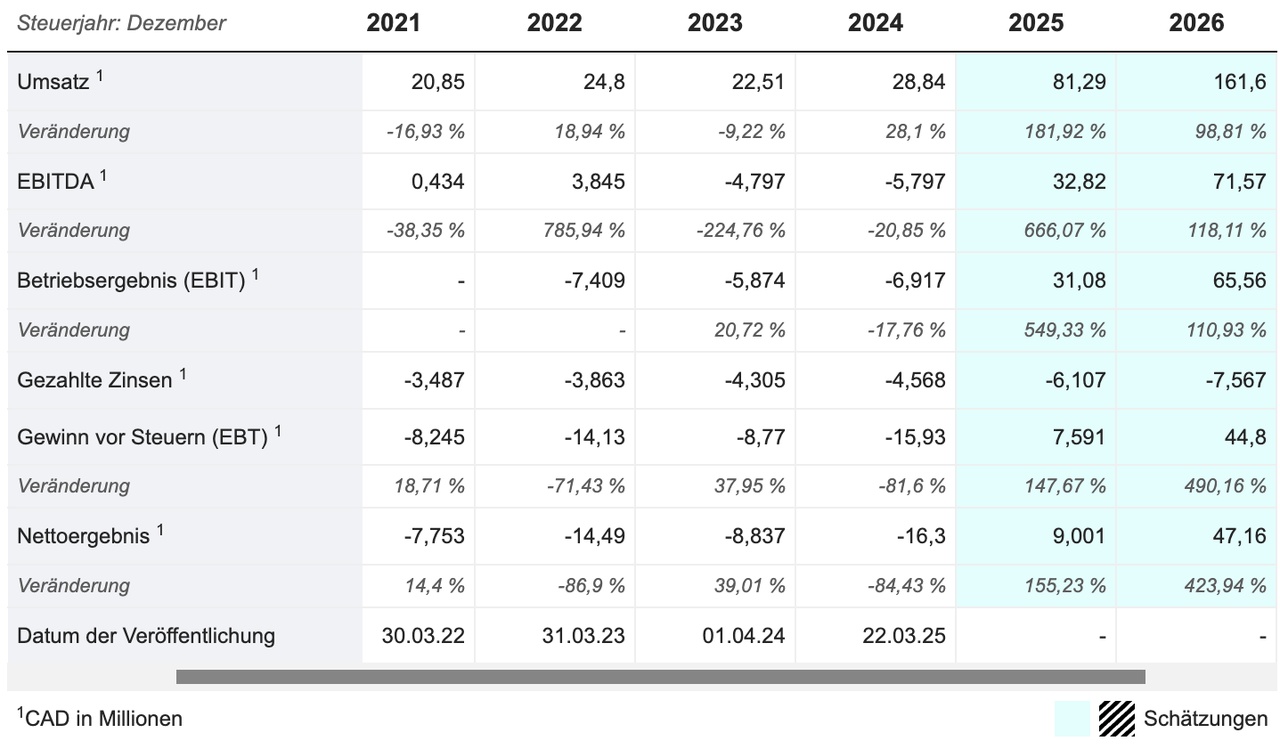

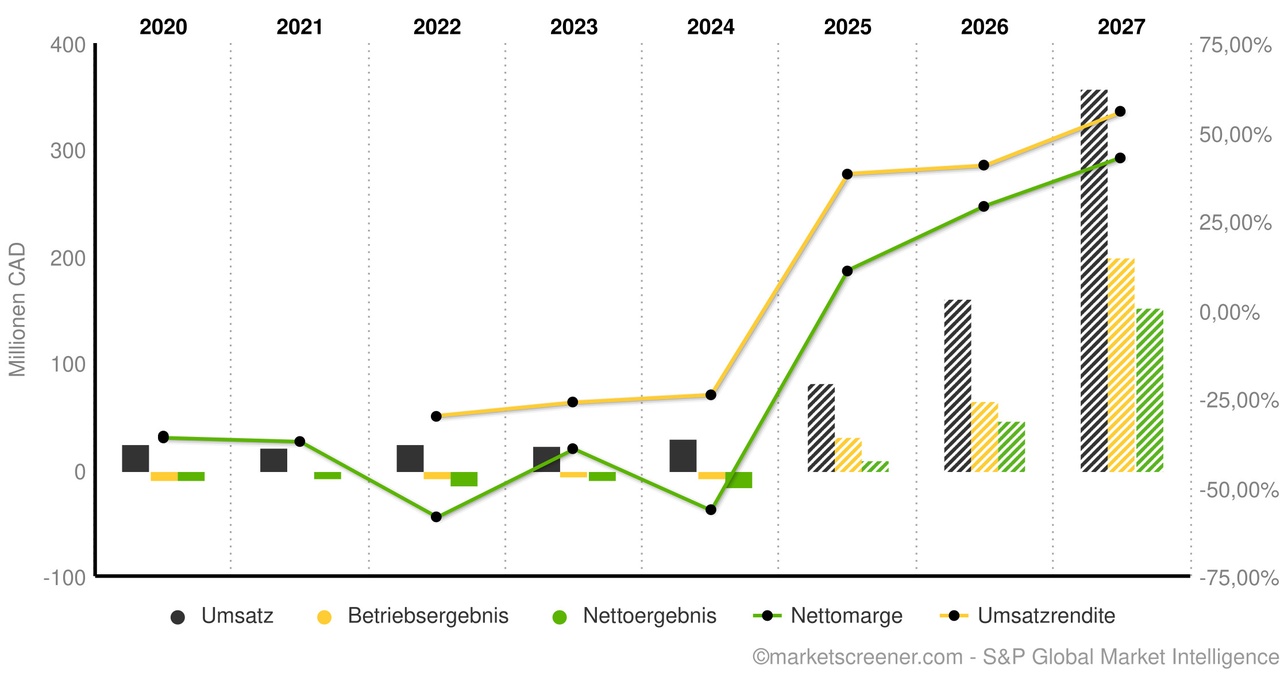

💰 Figures

______________________________

📊 Analyst assessment & price targets

- Consensus: 4 "Buy" recommendations, 0 Hold/Sell → Overall: Strong Buy

- B. Riley (Apr 2025): Rating raised to Strong Buy with expected EPS of: Q1 2025 C$0.01 to FY 2027 C$0.60

- 12-month price target:

- Average target: approx. C$4.87-C$7.31 depending on source

- Upside according to analyst consensus: +5-28%

______________________________

🔍 Latest news & developments

- April 2025: Participation in the Planet MicroCap Showcase; B. Riley upgrade

- June/July 2025:

- Inclusion in the S&P/TSX Global Mining Index

- Application for NASDAQ listing & simultaneous 1:1.5 share split/consolidation

- Submission of current NI-43-101 Technical Report for Sangdong

______________________________

⚠️ Opportunities & Risks

✅ Opportunities:

- Global market share: China dominates, but geopolitical trends (West) favor tungsten suppliers outside of China

- Sangdong is a high-grade world-class mine - recommissioning from 2025

- Offtake contracts (Plansee: 45%) & funding commitments (KfW Bank) strengthen revenue positions

⚠️ Risks:

- Loss radar - no profits yet, high debt service required

- China could push prices down again, political uncertainty (e.g. South Korea, North Korea)

- Production start delayed - capex risks on completion of Sangdong project

Sources:

📈 Analyst ratings & market data

- B. Riley upgrades Almonty to "Strong Buy" (MarketBeat, April 2025):

- https://www.marketbeat.com/instant-alerts/almonty-industries-tseaii-upgraded-by-b-riley-to-strong-buy-rating-2025-04-16

- More info on the upgrade (ETF Daily News):

- https://www.etfdailynews.com/2025/04/17/b-riley-upgrades-almonty-industries-tseaii-to-strong-buy

- Analyst Consensus (Wall Street Journal, July 2025):

- https://www.wsj.com/market-data/quotes/CA/XTSE/AII/research-ratings

🎤 Events & Presentations

- Participation in the Planet MicroCap Showcase (Nasdaq.com):

- https://www.nasdaq.com/press-release/almonty-industries-participate-planet-microcap-showcase-april-23-24-2025-2025-04-17

- Company announcement on Almonty website:

- https://almonty.com/planet-microcap-showcase-2025

🏦 NASDAQ listing & financing activities

- Application for NASDAQ listing + stock split (Mining.com, July 2025):

- https://www.mining.com/almonty-industries-applies-for-nasdaq-listing

🏭 Company background & projects

- Overview of company history, mines & CEO (Wikipedia):

- https://en.wikipedia.org/wiki/Almonty_Industries

Images:

https://de.marketscreener.com/kurs/aktie/ALMONTY-INDUSTRIES-INC-105958333/finanzen/