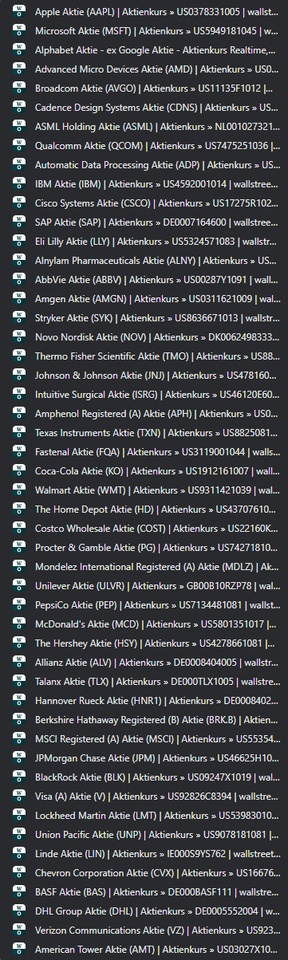

50s savings plan of selected shares

Hello everyone,

After a lot of back and forth, I have picked out a few stocks, some of which are aimed purely at growth, higher dividends and dividend growth:

The aim would be to invest in the respective shares at €10/share to start with, and then later e.g. €20/share....or is it absolutely non-sense and a waste of time? In my opinion, many of these shares are moats and long-term established companies that everyone knows. I would like to generate reliably rising dividends and also have nice growth in my portfolio. A $ISPA (-0.69%) for example, also generates nice growth, but it feels like it's only going sideways...

Of course, it's stupid that each share has only invested €1,200 or a little more in 10 years at the savings rate, for example.... sounds ridiculously low at first.

What do you think? (Click image to enlarge)