"Welt" has analyzed global capital flows together with the data provider Bloomberg. Findings (unsurprisingly): Investors continue to rely on "American exceptionalism". The USA remains the most important market for investors.

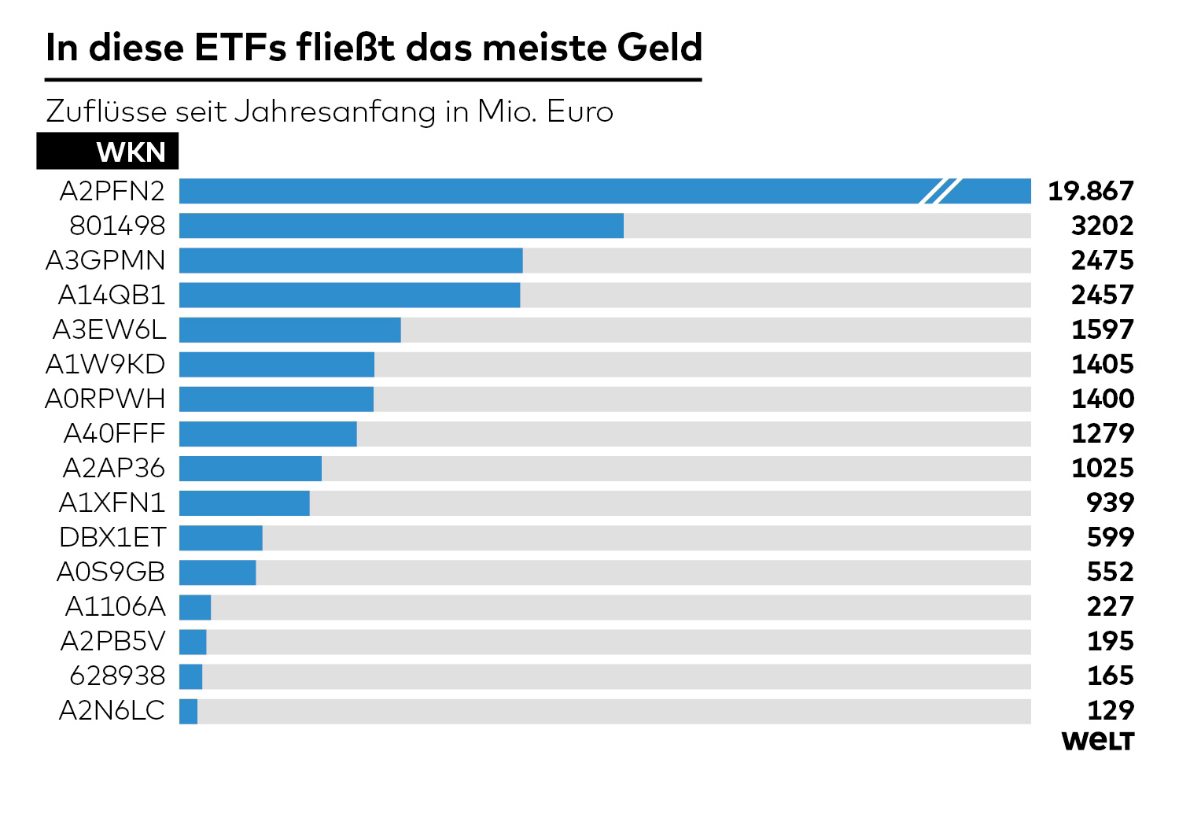

The largest capital inflows were received (Top2):

- $VUAG (-1.25%) Vanguard S&P 500 - approx. EUR +20 bn

- $EQQQ (-2.36%) Invesco QQQ - over EUR +3 billion

Investors are not only focusing on tech, but also on financial stocks. Obviously with the expectation that Trump will further deregulate and loosen merger control will boost the M&A business.

The analysis clearly shows that fund investors will continue to focus on US equities, tech and financials in 2025. European ETFs play only a minor role, as do ETFs with stocks from the Middle Kingdom.

(Source: Welt, 30.01.)