Disclaimer: I have no facts, analysis or similar in this post. I'm just presenting my finances in a flow chart, writing something about it and writing very briefly about Bitcoin.

Hello dear pack,

after I decided to reorient myself professionally in 2023, I started a second apprenticeship in the public service. I was also able to shorten it thanks to my good performance.

In order not to lose the standard of living I had acquired up to that point, I lived off my deposit during this time and started a mini-job. This was also possible thanks to investments in the crypto sector. I don't want to say that I invested wisely, but rather emphasize my luck in this regard.

Now I'm fully qualified and can reap my "rewards". I work six days a week. From Monday to Friday in the public service and then from Friday to Saturday on the night shift at a petrol station.

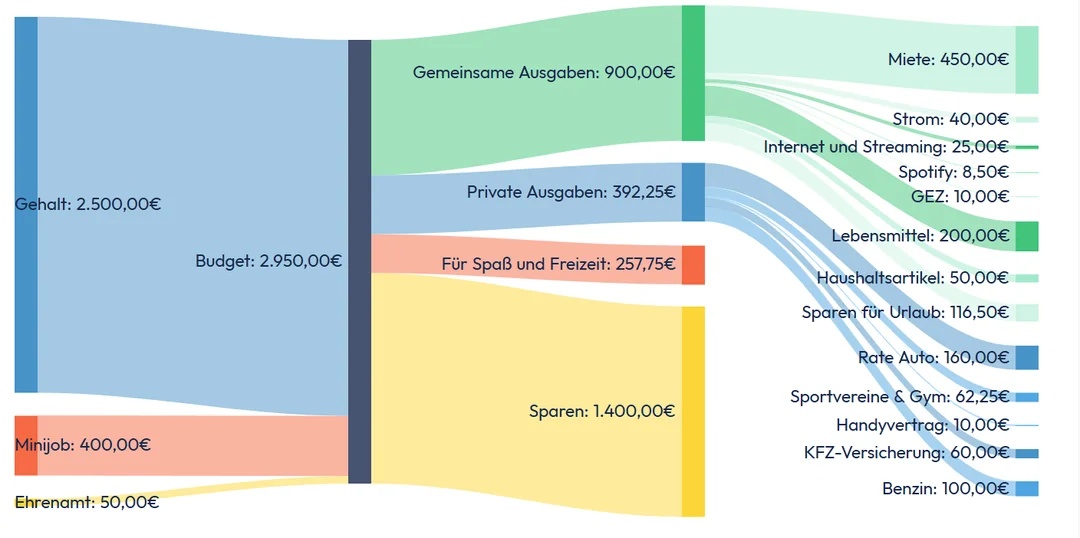

My mini-job would actually be €603. However, I would like to cut back a bit in order to get a bit more free time in return.

The first block is the transfer to the joint account for rent, electricity, etc. I have divided all joint costs by two as I live with my partner.

The apartment is in a big city. We share a 44 square meter new build and first occupancy for 900€ warm. As my partner is often not at home for work reasons, the size of the apartment suits us.

A new apartment would also be far too expensive. I personally don't see the point in paying so much rent lol.

I have very few expenses myself and don't really treat myself to anything. My partner more or less told me to spend the €257 on fun and leisure so that I could do something with the money.

I work and go to the gym. I always buy second-hand clothes. The only private expenses are hairdressing and dates with my partner.

I changed my health insurance after a premium increase and now have almost 2% less premium. I can't really recommend it to anyone, it saves me over €500 a year.

We got a very good offer from Telekom for internet + streaming services. So I think we're saving quite well there.

Next I want to change my electricity tariff and then my car insurance as both are a bit expensive for my taste. The latter in particular is a bit of a joke, I just got a big increase in premiums even though I didn't have an accident or anything like that. I actually expected to pay less.

I also changed my account. The account management fees at the Sparkasse without interest are just a scam in the system. I switched to Check24 and am very satisfied so far.

I forgot to add €40 a year in taxes for the car and €35 a year for liability insurance. But that shouldn't make any difference. :-)

My investment plan for 2026 is not yet fully solidified. However, I am leaning towards a high savings rate in $BTC (-0.48%) (1000€ per month).

I am a big proponent of Bitcoin and have a lot of faith in this asset. I am convinced that we will scratch the 200,000 mark after the next halving. However, I am also of the opinion that we will no longer see a major price reduction, as compared to the last bear markets, significantly more money has flowed into BTC from institutions.

The rest will be invested in silver and an All World ETF. The only individual stocks currently $IRE (+0.83%) are currently in question for me.

What have been your game changers so far to really save something and how do you see Bitcoin developing over the next few years?