When parents die, you are usually no longer very young yourself. It's better not to make your own pension provision dependent on your inheritance and - because of your advanced age - to be reasonably secure (yes, I wouldn't take out an insurance policy today, that's just the way it was done). You might also have a property, in my case an owner-occupied condominium and two smaller units to rent out.

And then, somewhat unplanned and unexpectedly, an inheritance comes along, which in my case increased my assets by two thirds. Whew.

That sounds great at first, but you're actually quite sad.

I feel it is my duty to handle the money responsibly and sensibly, to make the achievements of my ancestors "permanently usable" and to honor them.

But how?

Perhaps others have similar situations and questions to mine in this case, which is why I am sharing my thoughts and decisions in broad outline.

My "background" and experience with investments:

As you can see, I only joined the forum in April 2025 and I don't have much more experience with investing and the like. For the last 5 years, I only had a €300 savings plan on the S&P 500, yes, but it was all very passive.

Since April, I've bought a few individual stocks with "free capital" (<€25k) in addition to the ETF and had fun with them, e.g. with $IREN (-7.48%) which I picked up at €13 or €14, and I also enjoyed following analyses and thought processes here. It was all experimental and there were plenty of failures.

In the middle of the learning process, the inheritance came quite suddenly and I had to deal with it.

A planning approach

The money can't just "lie around".

What do I actually want to achieve?

- Bring retirement forward by x years (I would still have to work regularly for 9 years) -> how much non-working time can I buy myself? 5 years would be great. So in 4 years I would start paying myself €40-50,000 a year, which I could then significantly reduce again when I officially retire.

- A mobile home (<60k) would be nice.

- But I don't want to spend the money. It would be nice if some of it could be inherited with a high probability (we have two children).

Investment strategy

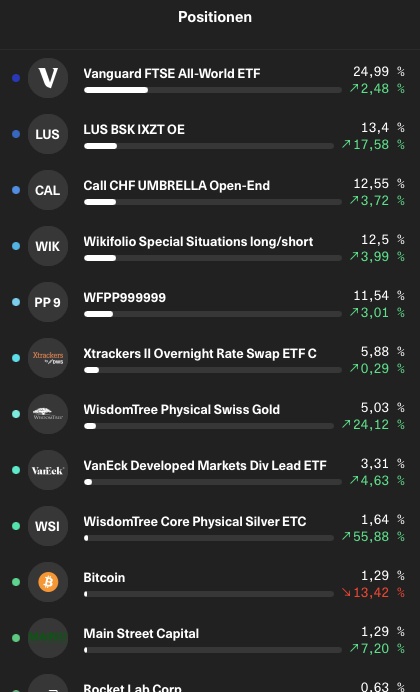

If I have already saved for my retirement myself, then I can also invest for a few more years with moderate risk. growth to make all my wishes come true. I've been thinking about this for a while and explain the result in the screenshot that shows the current portfolio:

My current allocation:

Explanations

The FTSE All-World as the bread and butter core investment covers 25%.

wikifolios (because hopefully people there have a clue) provide growth with 50% of the invested capital.

@Epi s 3xGTAA for momentum (S&P 500 and Nasdaq are covered)

Umbrella and PPInvest low Vola (WFPP999999) for growth with a very good risk/reward ratio (approx. 2!)

Special Situations long/short as an opportunity if Trump goes completely crazy (there is currently 50% cash in there for good reason)

A few percent cash as a reserve in the $XEON (+0.03%)

A few percent gold, silver and bitcoin (teaching money) as diversification

Investment income: $TDIV (-0.25%) and $MAIN (-3.15%) . These are my test field to see whether this is a suitable retirement strategy for a regular dividend income. Most of my savings currently go into these two. Profit-taking should also end up there.

Opportunities/risk assessment

The share-weighted Sharpe ratio across all these investments (excluding equities) should be pretty much exactly 1.

It should be clear that the previous internal rate of return of 24% since 10.11.2025 to date can certainly not be maintained. However, it is certainly my hope that I could - without having to put in a lot of effort - end up with 15-20% p.a.

And I'm keeping the 5-7% in individual shares for fun and learning, because I simply find the topic exciting. Perhaps this will lead to a reorientation in the distribution, but for the time being I'll start like this.

If I do something stupid with my plan, just say so!

Links to the wikifolios:

- 3xGTAA: https://www.wikifolio.com/de/de/w/3XGTAA

- Umbrella: https://www.wikifolio.com/de/de/w/wfumbrella

- PPInvest low Vola: https://www.wikifolio.com/de/de/w/wfpp999999

- Special Situations long/short: https://www.wikifolio.com/de/de/w/wfspecial2