Brief presentation of the company

- ISIN / Ticker: BE0003604155 $LOTB (+0.71%)

- Sector / Industry: Consumer Staples - Food & Snacks

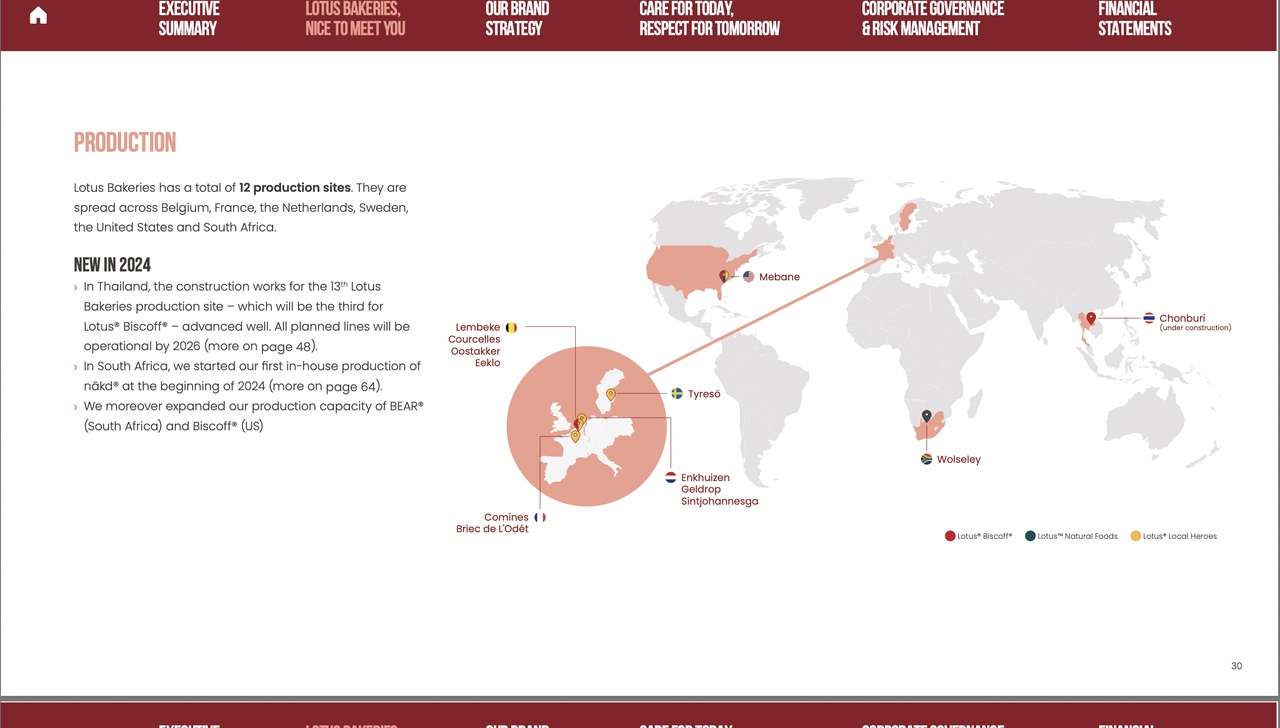

- Geographical positioning: Lotus sells its products in over 70 countries worldwide, with a growing presence in North America, Europe and Asia.

Brief profile & business model

Lotus Bakeries is a Belgian family business headquartered in Lembeke. The company is particularly well known for its iconic caramel cookie "Biscoff", which has been established worldwide as a coffee biscuit. In addition to the core brand, Lotus is continuously expanding into healthy snacking with brands such as BEAR, Nakd, TREK and Kiddylicious.

The company pursues a growth-oriented brand strategy combined with a strong international distribution network. The aim is to gain market share through innovation, premium branding and organic and inorganic growth.

Fundamental key figures

- Market capitalization: € 6.7 billion

- P/E ratio / forward P/E ratio: 43 / 49

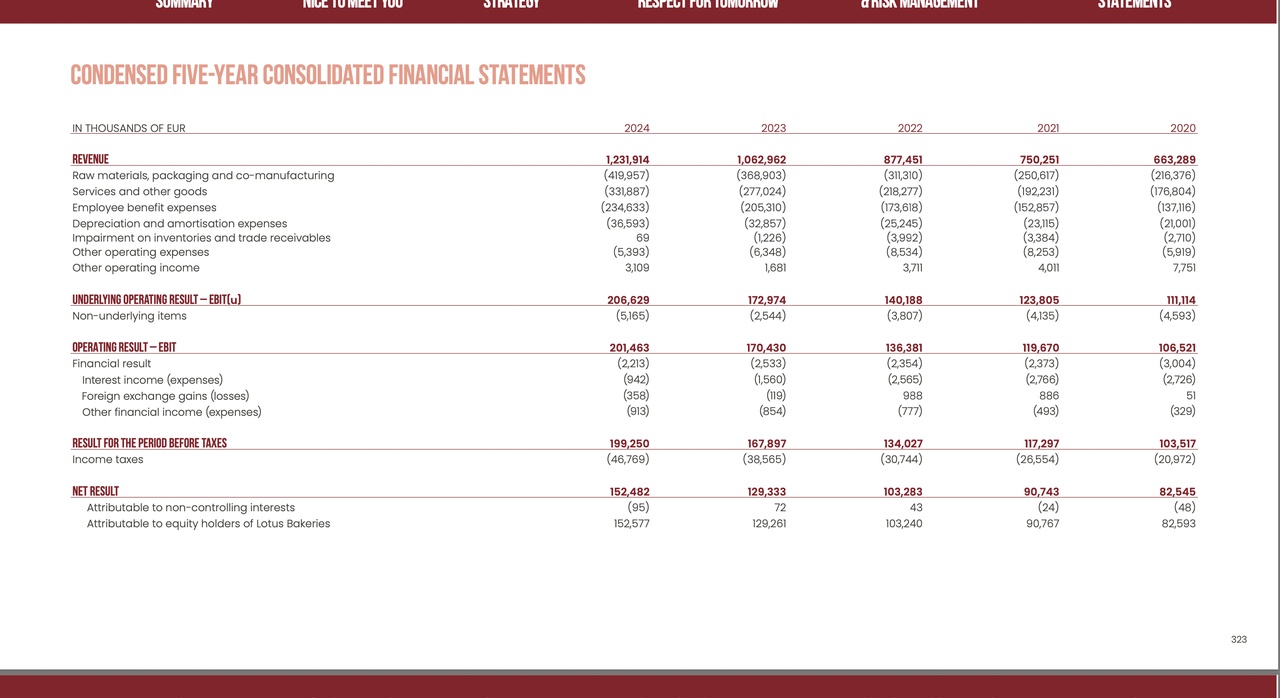

- Sales growth: 14

- Profit growth: 13

- Net profit margin: 12

- Dividend yield: 0.7

Valuation

Lotus is currently valued at a high multiple. Compared to other snack and confectionery manufacturers (e.g. Kellanova, Hershey, Nestle), Lotus shows above-average growth combined with high profitability.

Opportunities & risks

Opportunities:

- Strong brand: Biscoff is globally established and has high pricing potential.

- Growth market "healthy snacking": acquisition and development of innovative brands.

- Internationalization: North America and Asia in particular offer further potential.

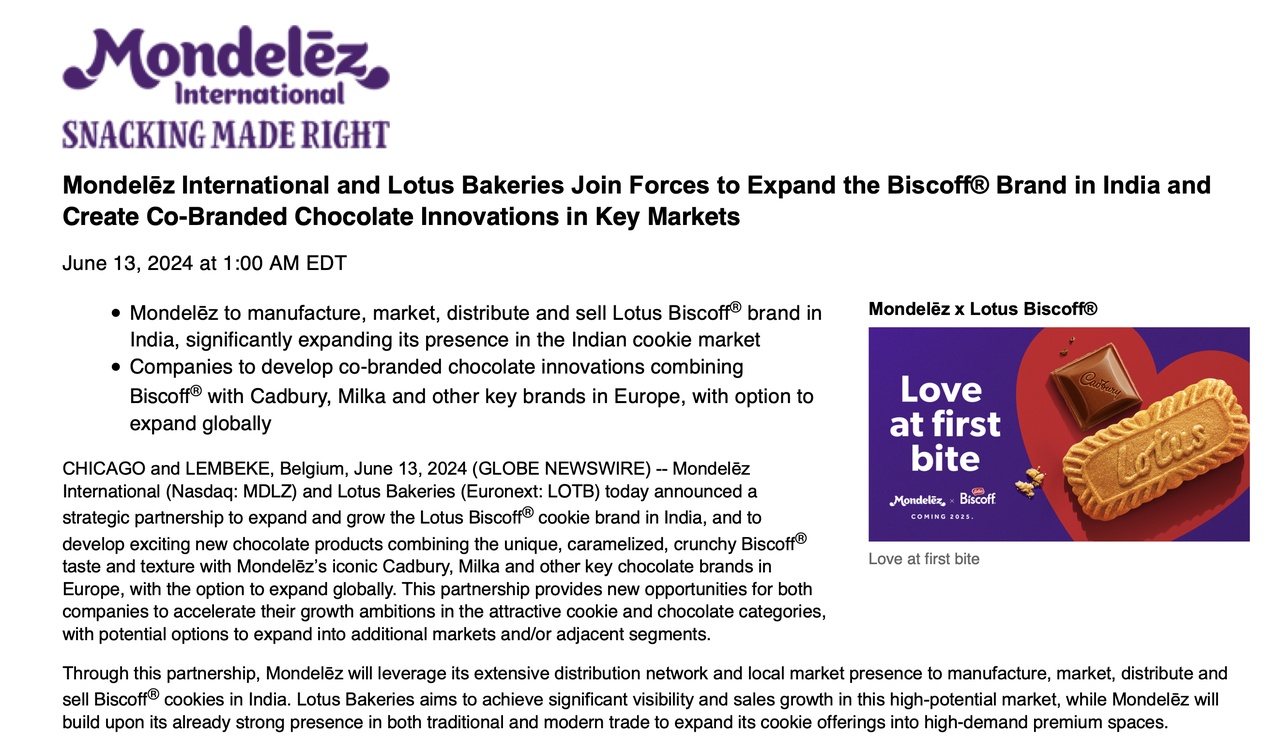

Partnership with Mondelez for marketing in India

- Solid balance sheet: Hardly any debt, high return on equity, strong management.

Risks:

- High valuation: With a forward P/E ratio of 38, Lotus is ambitiously valued.

- Rising labor and material costs

- Concentration on a few brands: Biscoff accounts for a large proportion of sales.

Chart technique

The Lotus share is currently in an impulsive downward trend and has lost approx. 34% since the ATH without resistance.

From a technical point of view, things remain exciting. Although the share has bounced off the resistance marked in yellow for the time being and is even showing the first signs of consolidation in the short term, the volume is weak and the relevant resistance levels are significantly lower.

Conclusion on the chart:

Patience is required, wait for a bottom to form.

I am still going in with a savings plan as I am extremely impatient 🫣

Possible entry range: EUR 5,500-6,000

Personal assessment

Lotus Bakeries remains a quality stock with a strong market position, international expansion and high profitability. The valuation is quite high, but reflects the high pace of growth. For long-term investors with a focus on quality and brand management, this may be an attractive entry opportunity.

Sources:

https://www.lotusbakeries.com/investors

https://ir.mondelezinternational.com/node/28841/pdf

finchat.io