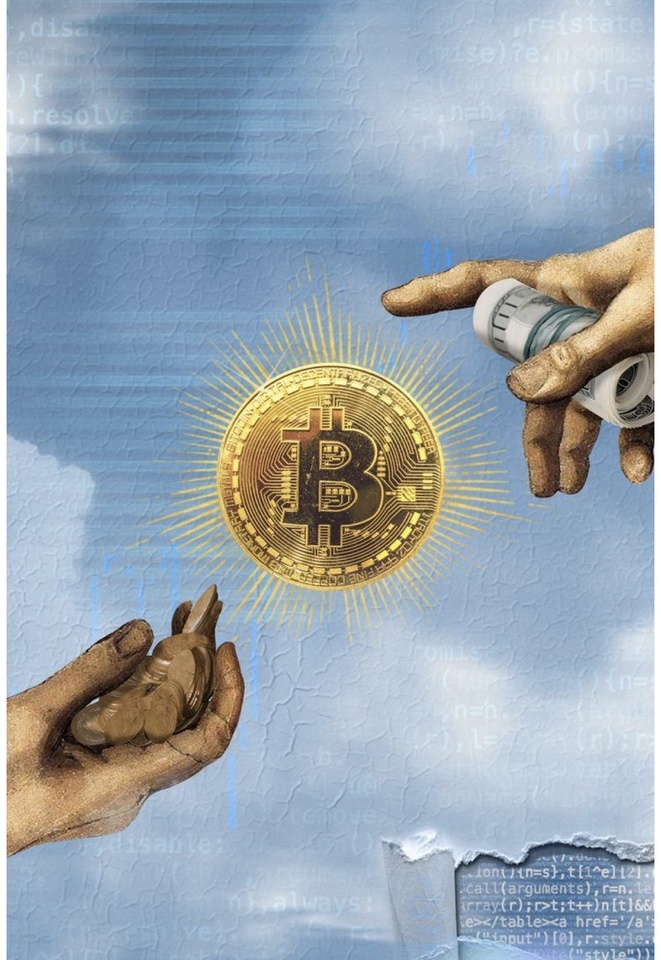

Sometimes there are trends - and sometimes there are things that just won't go away. For me, Bitcoin clearly belongs to the second category. And the deeper you look into it, the more you come to a point where you think:

Maybe Bitcoin isn't just any asset... but THE asset.

Why is that? Quite simply.

Bitcoin is the first form of money that no one can control.

No government. No central bank. No one to secretly tweak the money supply or print bailouts.

21 million. That's it. Over. Out.

While fiat money loses purchasing power year after year, Bitcoin remains mathematically limited - it's almost unfair. It's as if someone has rewritten the rules of the financial system, but this time in a transparent and unchangeable way.

Decentralized money in an increasingly unstable world

We live in a time when countries are more indebted than ever before, currencies are shaky and trust is constantly crumbling. And it is precisely in this phase that a digital form of money exists:

- works 24/7 without permission

- is borderless

- belongs to no one

- and remains unforgeable thanks to the blockchain

The longer you think about it, the more logical it seems that something like Bitcoin will sooner or later play an increasingly important role.

Why many say: "Bitcoin will prevail - no matter what"

Bitcoin is not "new" or "experimental". It has been on the market for over 15 years, has been declared dead countless times - and yet it is in a tougher position than ever before.

Institutional investors are getting in, governments are buying, companies are holding it on their balance sheets.

If a system is repeatedly attacked but never breaks, then that is no coincidence.

That is resilience.

Perhaps Bitcoin is not the alternative... but the foundation

Many still see Bitcoin as speculation.

Others already see it as a hedge.

And some have long since understood that Bitcoin is not trying to improve the old system -

but offers a new one.

A system in which the rules are not dependent on people.

A system that is not tied to trust, but to mathematics.

A system that works even when everything else fails.

My honest conclusion

The more chaos the world produces, the clearer Bitcoin becomes.

Maybe Bitcoin won't become the world's money tomorrow - but to me it feels like we're already on that path.

And honestly:

If in the end there is only one form of money left that works globally, is forgery-proof and belongs to everyone...

then Bitcoin would be my tip.

$BTC (+1.37%)

#bitcoin

$MSTR (-2.54%)

$3350 (-2.69%)

#crypto

$ETH (+0.97%)

#langfristig

#fiatgeldsystem

#tothemoon