Let's talk about leveraged ETFs! On the occasion of the recent Finanzfluss video on leveraged ETFs and because questions keep coming up here in the forum, I'm writing down my thoughts on this for all of you who want more from the stock market than the 7%pa capital market return (like me!).

This much in advance: leveraged ETFs make it possible - but not that easy!

Ready? Then make yourself comfortable and enjoy the wild ride into the realm of leveraged ETFs!

1. introduction

What are leveraged ETFs?

In short: leveraged ETFs work with borrowed capital. The proportion of borrowed capital results in a leverage on the capital invested. In simple terms, an ETF with borrowed capital in the amount of your equity would be a 2-fold leveraged ETF. This doubles the (daily) performance, i.e. if the underlying index rises by 1%, the 2xETF gains 2%, if the index falls by 1%, the 2xETF loses 2%.

Advantages and disadvantages of leveraged ETFs

Leveraged ETFs can generate significant excess returns. Since 1977, a 2x leveraged ETF on the S&P500 has achieved around 18%pa. Anyone can work out for themselves what this return amounts to over 30 years. Even Bitcoin is sweating and Buffett can pack his bags! So the holy grail of investing? Not at all!

Of course, the dream return of leveraged ETFs has its downsides.

First of all, there is the high maximum drawdown of -80% for the 2xS&P500 vs. 50% for the S&P500. If only €20,000 of €100,000 is left, it's not just the wife who is breathing down your neck!

Secondly, there is the path dependency, which ensures a longer drawdown phase. A simple example: 100 - 20% + 20% = 96 vs. 100 - 2x20% +2x20% = 84. If the whole world is cheering about new ATHs and you are still in the red, it's almost as if you were the idiot who wasn't invited to the party.

Thirdly, there are the borrowing costs. In the case of leveraged ETFs, these are roughly equal to the issuer's capital refinancing costs, which is an advantage over bank loans. However, these can also amount to up to 5%pa, which is then deducted from the performance on a daily basis.

In mathematical terms, these disadvantages are manageable in the long term, but the psychological risk of selling at an unfavorable moment with high losses is higher than you might initially think, especially if you are not familiar with long and deep drawdowns. Long-term Bitcoin investors are likely to have a psychological advantage here. But wouldn't it be nice if you could contain this risk as much as possible without having to forego the opportunities or take the detour via Bitcoin?

What else needs to be considered?

There are various 2x leveraged ETFs on large indices (including MSCI World : edit: not true, it is only available as 3x). These still count as special assets and the partial tax exemption applies. At mylife invest you can even save tax-free in the pension insurance wrapper. The TERs for leveraged ETFs are usually somewhat higher, around 0.5%.

There are also some ETFs with higher leverage (3x-5x). These are then regarded as derivatives that are not held as special assets, for which the partial exemption does not apply and losses are offset differently. They are not suitable for a long-term investment. That is why I am only discussing the 2x leverage variant here.

Question: What strategies are there for leveraged ETFs? What is possible?

Let's test that now!

2nd benchmark: S&P500

First of all, it is important to choose a proper benchmark in order to be able to assess the quality of a strategy. I use the S&P500, as it is based on historical data www.Portfoliovisualizer.com historical data back to 1977. The similarity to the MSCI World is relatively high.

I calculate with 10,000$ starting capital and 1,000$/month savings plan. That should be about right for many people here. As a result, I list the final capital, the CAGR, TWRR and mDD.

To explain: CAGR: Compound Annual Growth Rate; average annual return on invested capital (own performance); TWRR: Time-Weighted Return; average annual return of the portfolio (strategy performance); mDD: Maximum Drawdown; largest difference between a high and a low point (risk).

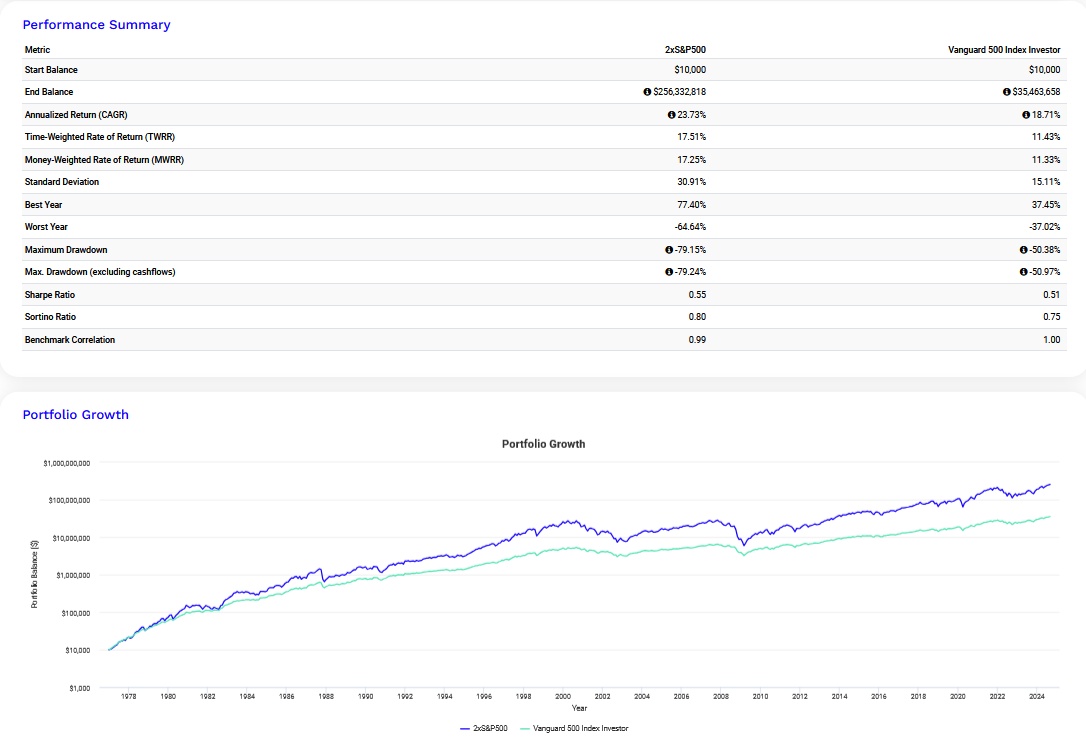

This became 10,000$ with 1000$ savings rate in S&P500:

1977-24: $35M/ CAGR 18.7%/ TWRR 11.4%/ mDD -50.4%

2000-24: 1.8m$/ CAGR 22.3%/ TWRR 7.5%/ mDD -43.7%

3. single-asset B&H strategy

Idea: A regular savings plan allows you to benefit from lower purchase prices. The disadvantage of the high drawdown could also be an advantage.

Backtest: 2xS&P500, 10,000$ + 1000$/M., no taxes/transaction costs, 3%pa average cost of capital (must be entered separately in the tool).

1977-2024: 256mio$/ CAGR 23.7%/ TWRR 17.5%/ mDD -79.2%

2000-2024: $3.9m/ CAGR 27.4%/ TWRR 9.5%/ mDD -75.0%

Analysis: With a savings plan on a leveraged ETF, a significant excess return of +6.1%pa could be achieved in the past. However, the drawdown is much higher at 80%. Only a few can withstand that!

4. multi-asset B&H strategy

Idea: Perhaps a clever combination of uncorrelated asset classes can reduce the drawdown without having to sacrifice significant returns?

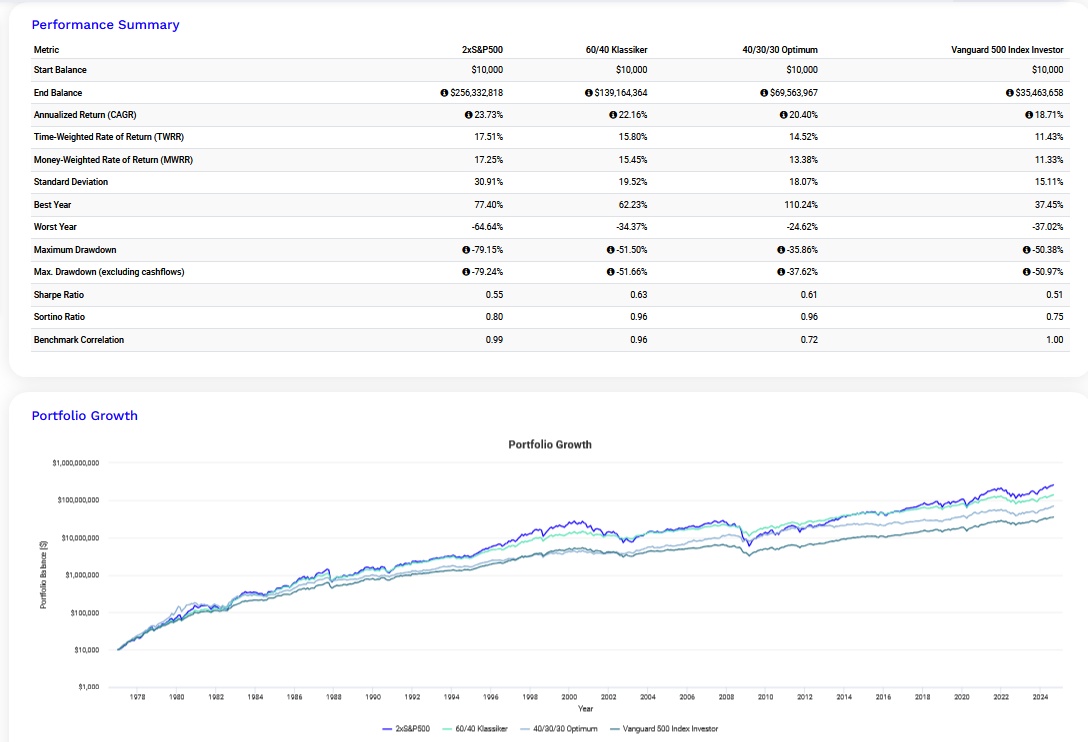

Backtest 1: 60/40 classic: 60% 2xS&P500, 40% 2xT-Notes (10-year US government bonds)

1977-24: $139m; CAGR 22.2%; TWRR 15.8%; mDD -51.5%

2000-24: $2.2m; CAGR 24.4%; TWRR 9.7%mDD -44.7%

Analysis: The addition of leveraged bonds reduces the excess return over the S&P500 to 2-4%pa. But the drawdown is now at the level of the S&P500. More return with the same risk!

Backtest 2: Optimized portfolio: 40% 2xS&P500, 30% 2xT-Notes, 30% 2xGold

1977-24: $69m; CAGR 20.4%; TWRR 14.5%; mDD -35.9%

2000-24: $2.3m; CAGR 24.7%; TWRR 11.5%mDD -33.0%

Analysis: The excess return compared to the S&P500 remains at around 3-4% due to the addition of bonds and gold. However, the drawdown is now significantly reduced, compared to the 2xS&P500 by about half. More return with less risk!

General explanation: Diversified portfolio concepts usually serve to spread or reduce risk. This necessarily comes at the expense of returns. This disadvantage can be compensated for with leverage. The key is to find an allocation in which the risk does not increase more than the return as a result of the leverage. Incidentally, Wisdomtree offers the EfficientCore ETF, a 1.5x leveraged ETF on the 60-40 portfolio - perhaps it is worth considering as a savings plan ETF?

5. single-asset trend-following strategy

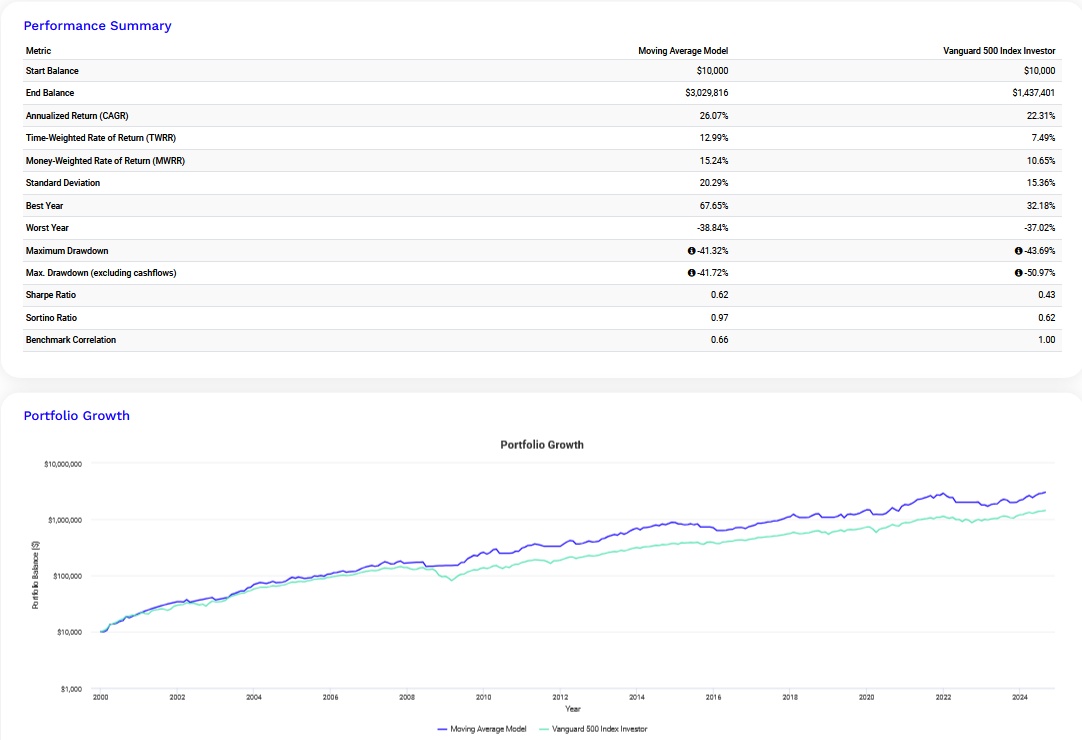

Idea: Since the large drawdowns occur mainly in bear markets, they can perhaps be avoided with a trend-following strategy without having to forego the excess returns of bull markets.

Backtest: Rule: Save and hold the 2xS&P500 ETF if the price of the S&P500 is above the SMA150 at the turn of the month, otherwise save and hold cash (I use the 150-day simple moving average because it is the average of the popular SMA100 and SMA200). Unfortunately, PV only allows you to backtest this strategy back to 2000, but since there have been various crises, a decade of a saw market and a decade of a bull market since then, the results should still be reasonably meaningful

Result:

2000-24: $3.1m; CAGR 26.1%; TWRR 12.7%; mDD -41.3%

The excess return over the B&H S&P500 rises to approx. 5%pa. The risk is slightly lower than the S&P500. Higher return with the same risk!

General explanation: Trend-following strategies for ETFs usually reduce the drawdown, but do not increase returns. Leveraged ETFs take advantage of this downside of the strategies.

6. multi-asset trend-following strategy

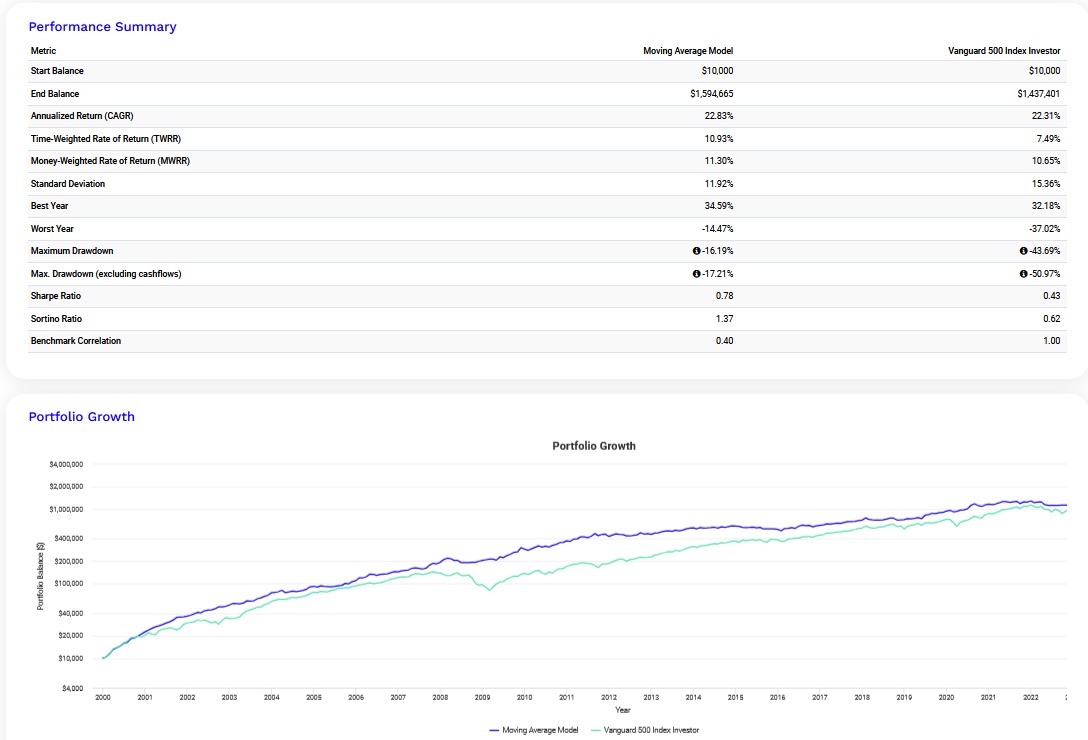

Idea: A combination of a trend-following strategy and a multi-asset strategy can potentially further reduce risk without jeopardizing returns.

Backtest: Rule: Save and hold 40% 2xS&P500, 30% 2xT-Notes, 30% 2xGold, if the respective price is above the SMA150 at the turn of the month, otherwise save and hold cash.

2000-24: $1.6m; CAGR 22.8%; TWRR 10.9%; mDD -16.2%

Analysis: The excess return compared to the S&P500 falls to 4%pa. However, this is accompanied by a drastic reduction in risk, especially compared to the 80% drawdown in the 2xS&P500 savings plan.

7. summary

Leveraged index ETFs offer significantly higher opportunities than normal index ETFs. But they are also riskier: they can incur higher losses, underperform for a very long time and cause greater psychological stress.

To keep these risks under control, leveraged ETFs should only be bought with clear strategies that limit the risk. These could be passive multi-asset strategies, active trend-following strategies or a combination of these. With these strategies, the return can be increased with the same risk or the risk can be reduced with the same return or even better: the return can be increased AND the risk reduced (Kommer doesn't like that!).

In short: Leveraged ETFs are a great thing - if you use them correctly!

8 Possible leverage ETFs

Xtrackers S&P 500 2x Leveraged Daily Swap UCITS ETF 1C LU0411078552

WisdomTree Gold 2x Daily Leveraged JE00B2NFTL95

WisdomTree US Treasuries 10Y 3x Daily Leveraged IE00BKT09032

WisdomTree US Efficient Core UCITS ETF IE000KF370H3 (1.5x leveraged 60/40 portfolio)

9. links for further information

Financial flow video: "Is it worth leveraging the market in the long term?

leverage?" https://youtu.be/gjECYPOZP9g?si=WuqNPYatGAWz5ZNy

Research paper: Leverage for the Long Run - A Systematic

Approach to Managing Risk and Magnifying Returns in Stocks https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2741701

Your Epi