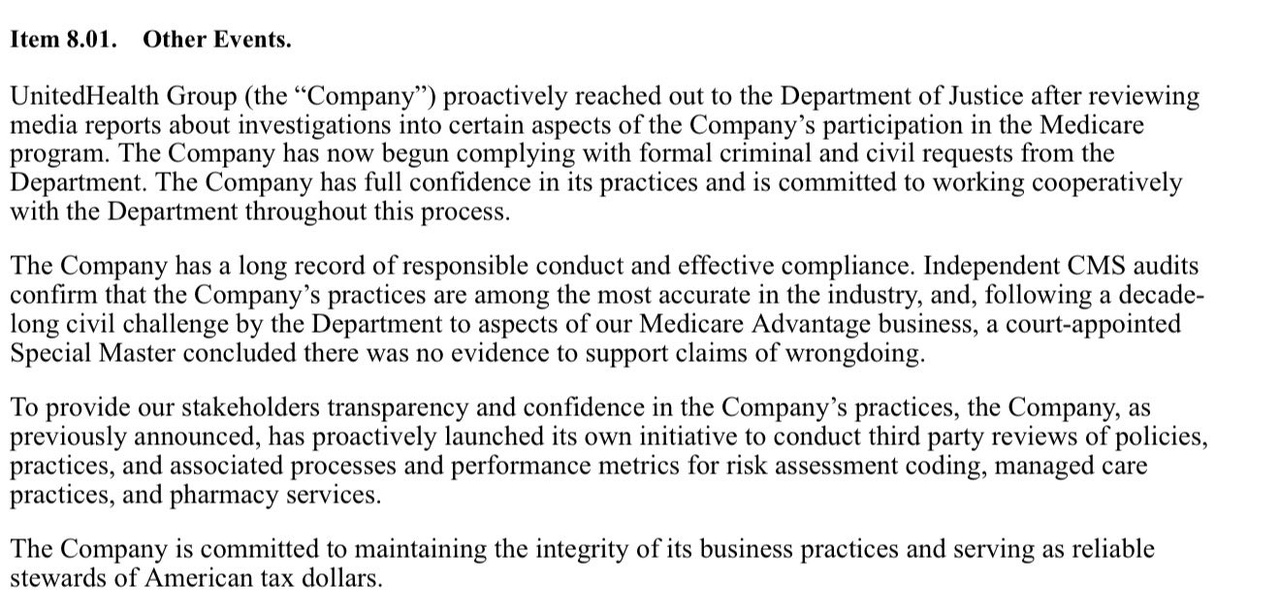

If the Justice Department, FTC and other government agencies were to break up United Healthcare, shareholders would get Optum Health, the nation's largest physician group.

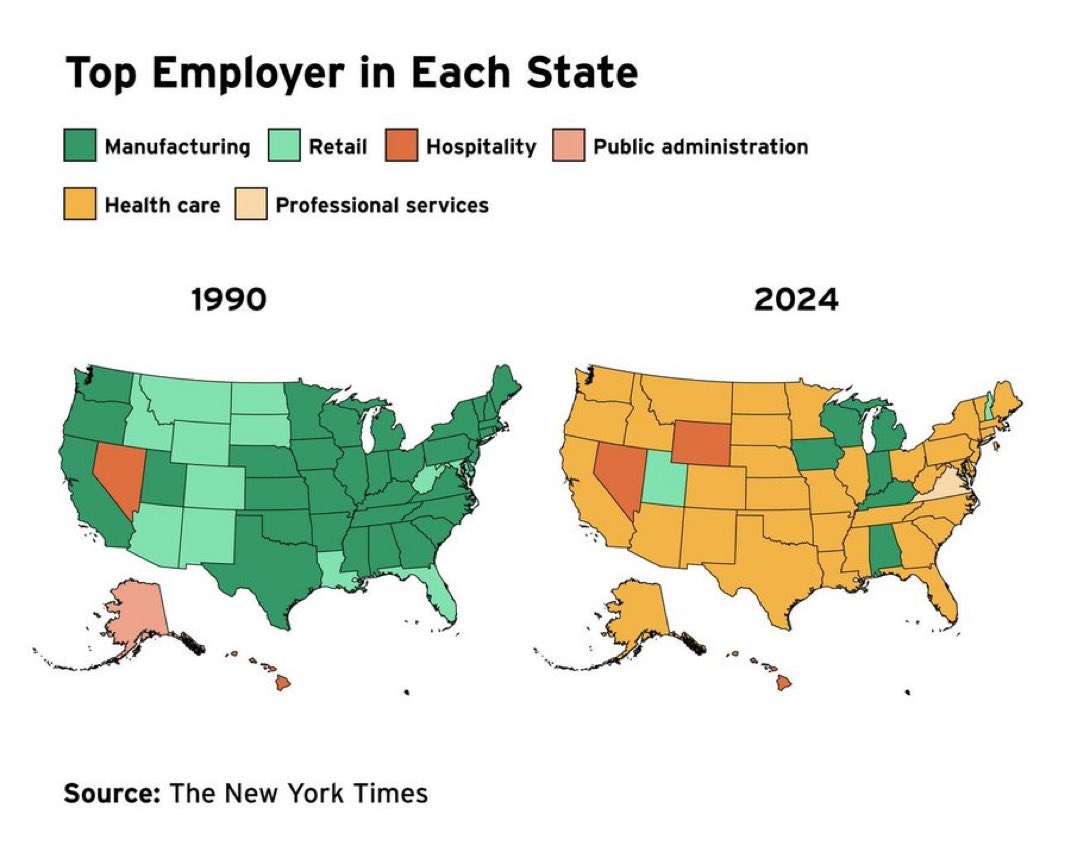

Healthcare is the largest employer in the U.S, $UNH (+2.15%) itself one of the largest employers with over 400,000 employees.

So I would have relatively little to worry about here, you may just need a little patience ✌️

Too big to fail ? 🤔