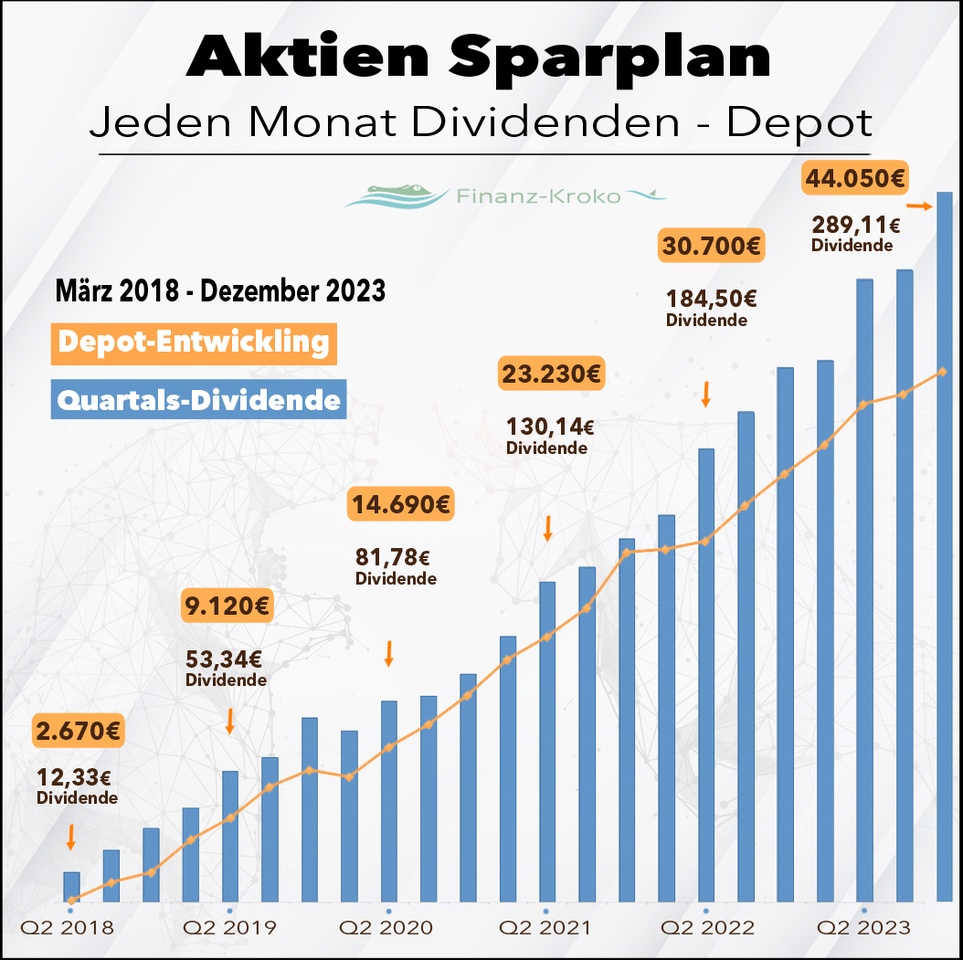

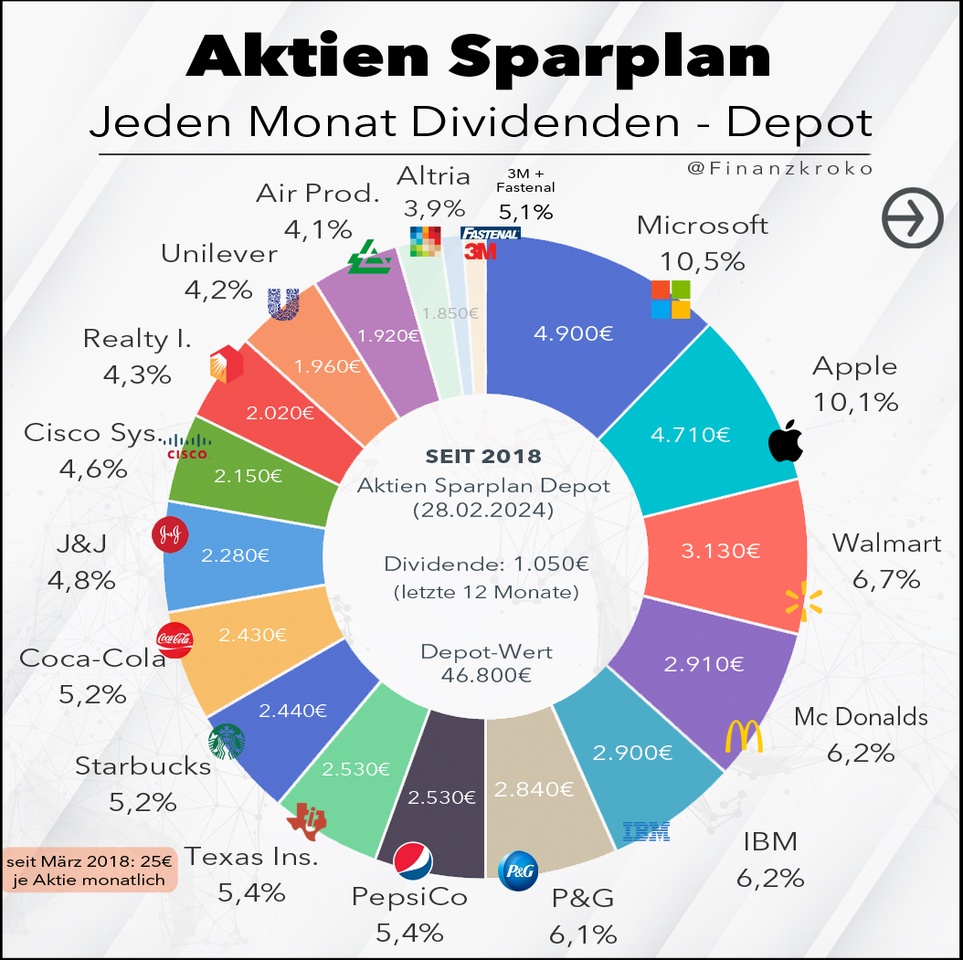

The portfolio stands at around €46,800. The total return (share price + dividend) is almost 39%. With the savings plan, the average annual return over the last 6 years is therefore currently around 11.1% - not bad at all for a savings plan 😅

$MSFT (-0.3%)

$AAPL (+1.51%)

#dividende

#aktien

#sparplan

#depotupdate