I have been invested in $MVST (+4.53%) for some time now. I have just been surprised to see that there are still no posts about the company. So it's about time!

Brief description

Microvast Holdings, Inc. is an American battery technology company specializing in the development, production and integration of lithium-ion battery cells, modules and energy storage systems (ESS). Its products are used in commercial vehicles, buses, specialty vehicles and stationary energy storage systems, among others.

The company offers a fully integrated portfolio - from cell chemistry and module design to battery packs and battery management systems. Microvast operates sites in the USA, Germany and China and supplies global partners in the automotive and energy sectors.

Well-known cooperations exist with manufacturers of commercial vehicles and industrial partners for the development of sustainable e-mobility solutions, among others. Microvast is also involved in projects such as the USABC funding program for the further development of energy storage technologies.

📚 Key figures about the company

Company data

- Founded: 2006.

- Headquarters: Stafford, Texas (USA).

- Industry: Battery manufacturer / energy storage (lithium-ion).

- Number of employees (approximate): ~1,900 (figures vary depending on source / time).

- Product range: cells, modules, battery packs, BMS, ESS (stationary), engineering & testing.

Finances & enterprise value

- Revenue FY 2024: $379.8m (year 2024; significant growth compared to 2023).

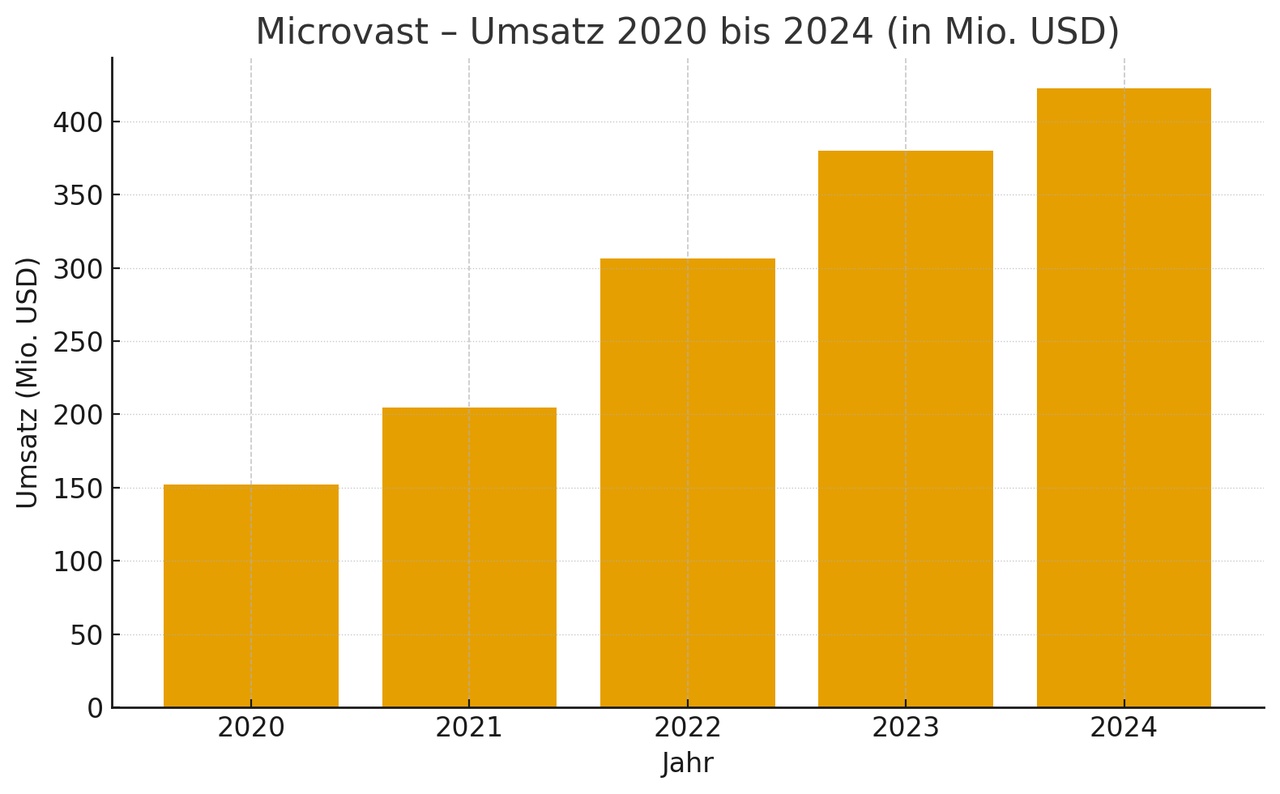

- Sales trend (strong growth 2020→2024): see chart below (table & bar chart).

- Adj. EBITDA FY 2024 (non-GAAP): negative adjusted EBITDA for the full year 2024 (source reports approx. -$44.8m for 2024), whereby the company reported positive adjusted EBITDA figures in individual quarters during 2024/2025 (e.g. Q3/2024, Q4/2024, Q1/2025/Q2/2025). → means: operational turnaround in 2024/2025, but annual key figure for 2024 still negative.

- Cash / liquidity (as at 31.12.2024): Cash, cash equivalents and short-term investments approx. $109.6m.

Key figures for the share

- Ticker / Stock exchange: NASDAQ: MVST.

- Market capitalization (current, market ratio varies): approximately USD 1.4 billion

- Last years (short):

- Revenue 2023 → 2024: increase from approx. $306.6M → $379.8M (growth ~24% YoY).

- Quarterly: several quarters 2024/2025 with improved profitability (positive adjusted EBITDA quarters), nevertheless positive/negative GAAP result per quarter; management reports stable progress towards profitability.

⚙️ Opportunities and risks

Opportunities:

- Growing demand for batteries for commercial vehicles and energy storage systems

- Expansion of production capacities (USA, Germany, China)

- Several quarters of 2024/2025 with positive adjusted EBITDA → Trend towards profitability

Risks:

- Fierce competition with large manufacturers such as $3750 (-2.56%) , $1211 (+1.54%) , $066570 , $6752 (-2.64%) (CATL, BYD, LG, Panasonic)

- High capital requirements for new factories

- Previous cuts to government subsidy programs (e.g. in the USA)

- Volatile share with high price sensitivity

🔗 Sources & references

Microvast Investor Relations & Annual Reports

Microvast Holdings Inc (NASDAQ: MVST) - Yahoo Finance

SEC Filings & Q4 / FY 2024 Results Presentation

Company website: https://microvast.com

Nasdaq Market Data: https://www.nasdaq.com/market-activity/stocks/mvst

Yahoo Finance Company Profile: https://finance.yahoo.com/quote/MVST