It currently seems as if many rock-solid companies are being sold off heavily, especially by small investors 😉. The background to this seems to be concern about the AI narrative, according to which artificial intelligence could make numerous business models and entire industries obsolete. 😂

This will not happen. On the contrary, it is precisely these companies that will benefit greatly and more efficiently from AI.

It may well be that one or two will fall by the wayside, but I currently see very attractive opportunities and am taking advantage of some of them.

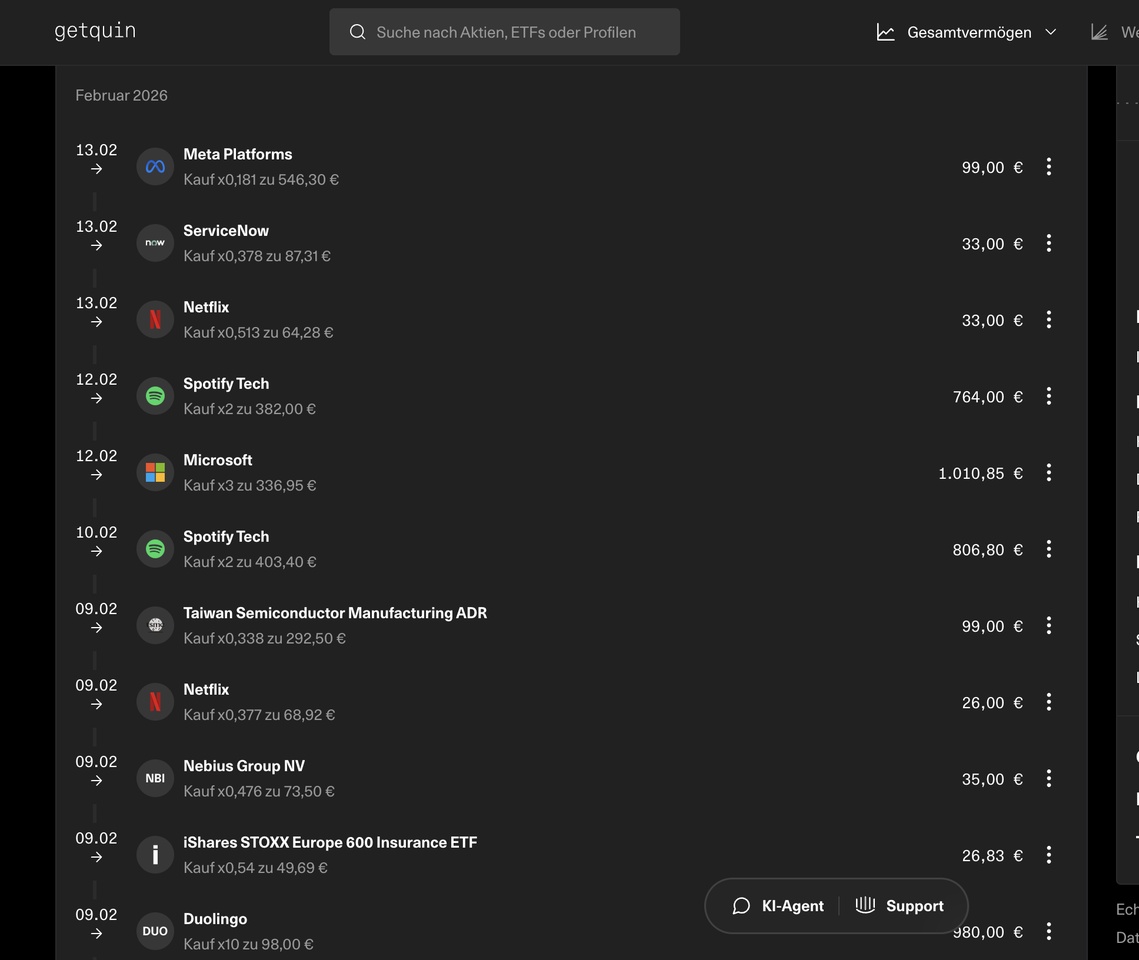

I bought the following this week👇 😎

(two-digit savings plan, three-digit purchase 🤑)