LVMH 2025 $MC (-0.19%) :

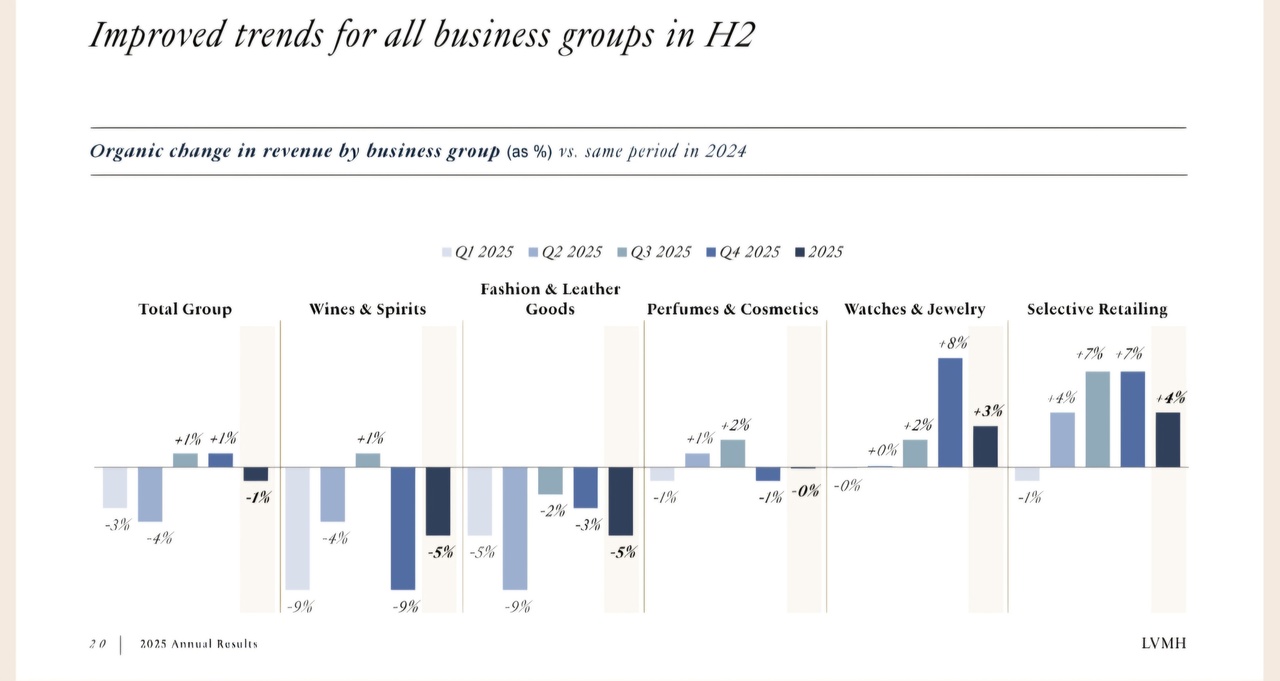

* Sales: € 80.8 billion (down slightly by -1%).

* Profit: € 10.9 billion.

* Dividend: € 13.00 per share (unchanged from the previous year). Of which still to be paid: € 7.50 on April 30, 2026.

What you need to know:

● Sephora is the winner: while other areas are weakening, the beauty business is doing extremely well.

●Luxury fashion remains stable: brands such as Louis Vuitton and Dior maintain their high margins of 35%.

●Challenge Asia & USA: Political tensions and less tourism slow down growth in wine, spirits and leather goods.

●Focus 2026: The Group relies on cost discipline and new collaborations (such as with Formula 1) to remain the market leader.

Despite headwinds, LVMH remains a cash flow machine (€11.3 billion) and keeps the dividend stable for investors.