The cryptocurrency market is navigating a period of pronounced uncertainty and consolidation. In such environments, passive holding often forgoes significant yield opportunities on idle liquidity.

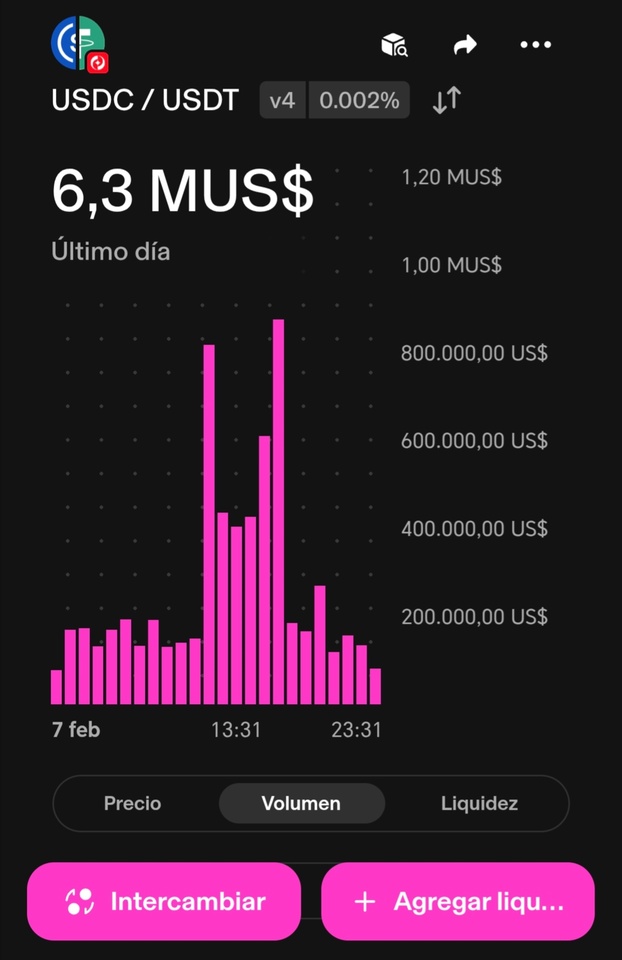

My strategy focuses on generating consistent returns irrespective of directional price action: allocating capital to carefully selected decentralized finance (DeFi) liquidity pools. As illustrated, protocols exist offering up to 30% APR on stablecoin pairs.

This approach transforms liquidity into a productive asset. The yield is sourced from trading fees and protocol incentives, providing a return stream that is decoupled from the volatility of underlying assets like $BTC (-0.06%) or $ETH (-0.91%)

Key considerations are paramount: understanding impermanent loss, rigorously auditing smart contract security, and selecting established protocols with sustainable tokenomics. This is not passive income; it is active risk management.

#DeFi #Cryptocurrency #Stablecoins #YieldFarming #LiquidityPools #CryptoInvesting #Finance