$VZ (+0.51%) | Verizon Q3'24 Earnings Highlights

🔹 Adj EPS: $1.19 (Est. $1.18) 🟢; DOWN -2.5% YoY

🔹 Revenue: $33.3B (Est. $33.44B) 🔴; Flat YoY

🔹 Adjusted EBITDA: $12.5B; UP +2.5% YoY

🔹 Free Cash Flow (YTD): $14.5B

FY24 Guidance:

🔹 Ad EPS Guidance: $4.50–$4.70 (Est. $4.57) 🟡

🔹 Wireless Service Revenue Growth: 2.0%–3.5%

🔹 FY2024 Adjusted EBITDA Growth: 1.0%–3.0%

🔹 Capital Expenditures: $17.0B–$17.5B

Q3 Segment Performance:

Verizon Consumer:

🔹 Revenue: $25.4B; UP +0.4% YoY

🔹 Wireless Service Revenue: $16.4B; UP +2.6% YoY

🔹 Retail Postpaid Phone Net Additions: 81,000 (vs. -51,000 in Q3 2023)

🔹 Retail Postpaid Phone Churn: 0.84%

🔹 Fixed Wireless Net Additions: 209,000

🔹 Fios Internet Net Additions: 39,000

🔹 Segment EBITDA: $11.0B; UP +1.8% YoY

🔹 Segment EBITDA Margin: 43.4% (vs. 42.8%)

Verizon Business:

🔹 Revenue: $7.4B; DOWN -2.3% YoY

🔹 Wireless Service Revenue: $3.5B; UP +2.9% YoY

🔹 Retail Postpaid Net Additions: 281,000

🔹 Postpaid Phone Net Additions: 158,000

🔹 Retail Postpaid Phone Churn: 1.12%

🔹 Fixed Wireless Net Additions: 154,000

🔹 Segment EBITDA: $1.6B; DOWN -3.7% YoY

🔹 Segment EBITDA Margin: 21.8% (vs. 22.1%)

Operational Highlights:

🔹 Total Wireless Service Revenue: $19.8B; UP +2.7% YoY

🔹 Retail Postpaid Net Additions: 349,000

🔹 Retail Postpaid Phone Churn: 0.89%

🔹 Broadband Net Additions: 389,000 (ninth consecutive quarter over 375,000)

🔹 Fixed Wireless Net Additions: 363,000

🔹 Total Broadband Connections: 11.9M; UP +16% YoY

🔹 Fixed Wireless Revenue: $562M; UP $215M YoY

CEO Commentary:

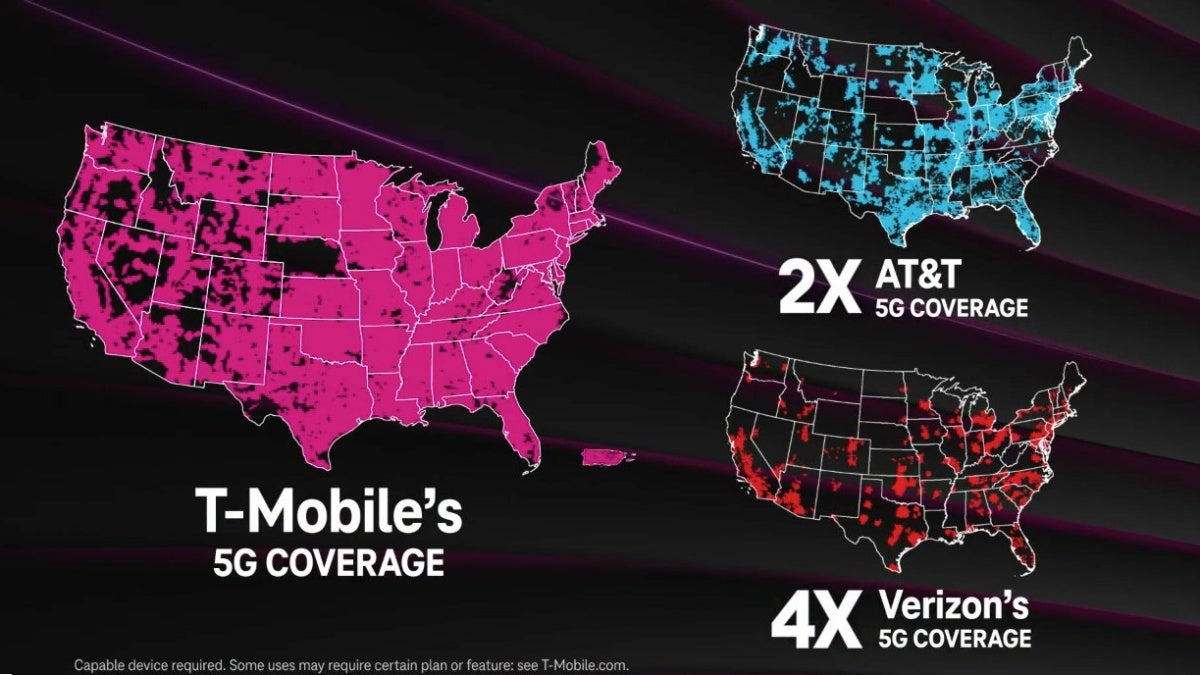

🔸 "This quarter marked transformative strategic moves with continued operational excellence. We delivered strong mobility and broadband results, and are on track to meet full-year 2024 guidance. Our new offerings, such as myPlan, myHome, and Verizon Business Complete, are resonating well with customers. The pending acquisition of Frontier Communications and our Vertical Bridge tower agreement set us up for disciplined growth into the future."