$TGT (-0.48%) | Target Q2'24 Earnings Highlights:

🔹 EPS: $2.57 (Est. $2.19) 🟢; UP +42.8% YoY

🔹 Revenue: $25.45B (Est. $25.2B) 🟢; UP +2.7% YoY

🔹 Comp Sales: +2.0% (Est. +1.07%) 🟢

Raised FY'25 Guidance:

🔸 EPS: $9.00-$9.70 (Est. $9.28; Prior: $8.6 - $9.6) 🟢

🔸 Comparable Sales: Expected in the lower half of 0% to +2% growth

Q3 Outlook:

🔸 EPS: $2.10-$2.40 (Est. $2.24) 🟡

🔸 Comparable Sales: 0% to +2% (Est. +1.91%) 🟡

Other Q2 Metrics:

🔹 Net Income: $1.19B, UP +43% YoY

🔹 Operating Income: $1.64B (Est. $1.38B) 🟢; UP +37% YoY

🔹 Operating Income Margin Rate: 6.4% (Est. 5.46%) 🟢; UP from 4.8% YoY

🔹 Gross Margin: 28.9% (Est. 28%) 🟢; UP from 27.0% YoY

🔹 SG&A Expenses: $5.39B (Est. $5.35B) 🟡; UP +4% YoY

🔹 EBITDA: $2.40B (Est. $2.06B) 🟢; UP +26% YoY

🔹 Interest Expense: $110M, DOWN from $141M YoY

Sales and Customer Metrics:

🔹 Comparable Sales: +2.0% (Est. +1.07%) 🟢

🔹 Store Comparable Sales: +0.7% (Est. +0.67%) 🟢

🔹 Digital Comparable Sales: +8.7% (Est. +3.2%) 🟢

🔹 Customer Transactions: +3% YoY

🔹 Average Transaction Amount: -0.9% YoY (Est. -1.29%) 🟡

Discretionary Categories:

🔹 Apparel Comparable Sales: +3% YoY

🔸 Improving trends noted, supported by price adjustments and new product offerings.

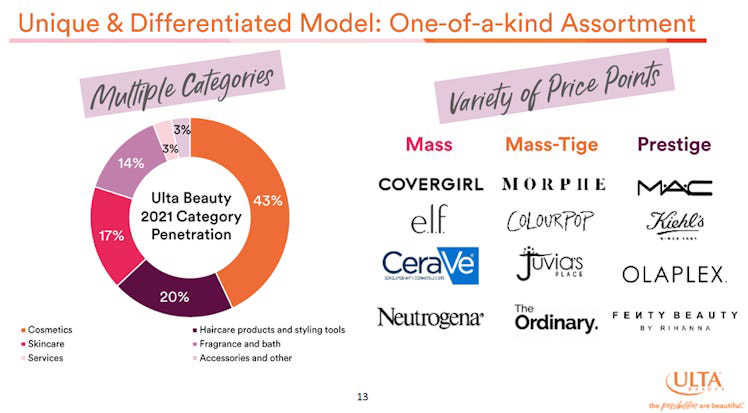

🔸 Continued strength observed in Beauty and other nonfood items.

Digital and Same-Day Services:

🔹 Digital Sales as Share of Total Sales: 17.9%, UP from 16.9% YoY

🔹 Same-Day Services: Saw double-digit growth, led by low teens growth in Drive Up and Target Circle 360™ same-day delivery.

Capital Deployment:

🔹 Dividends Paid: $509M, UP from $499M YoY

🔹 Shares Repurchased: $155M, retiring 1.1M shares at an average price of $145.94

🔹 Return on Invested Capital (ROIC): 16.6%, UP from 13.7% YoY