Hello everyone,

this is my first post on this site and I would like to share my analysis of today's $PG (+3.31%) with you today. I hope I was able to help you with this.

Technical analysis:

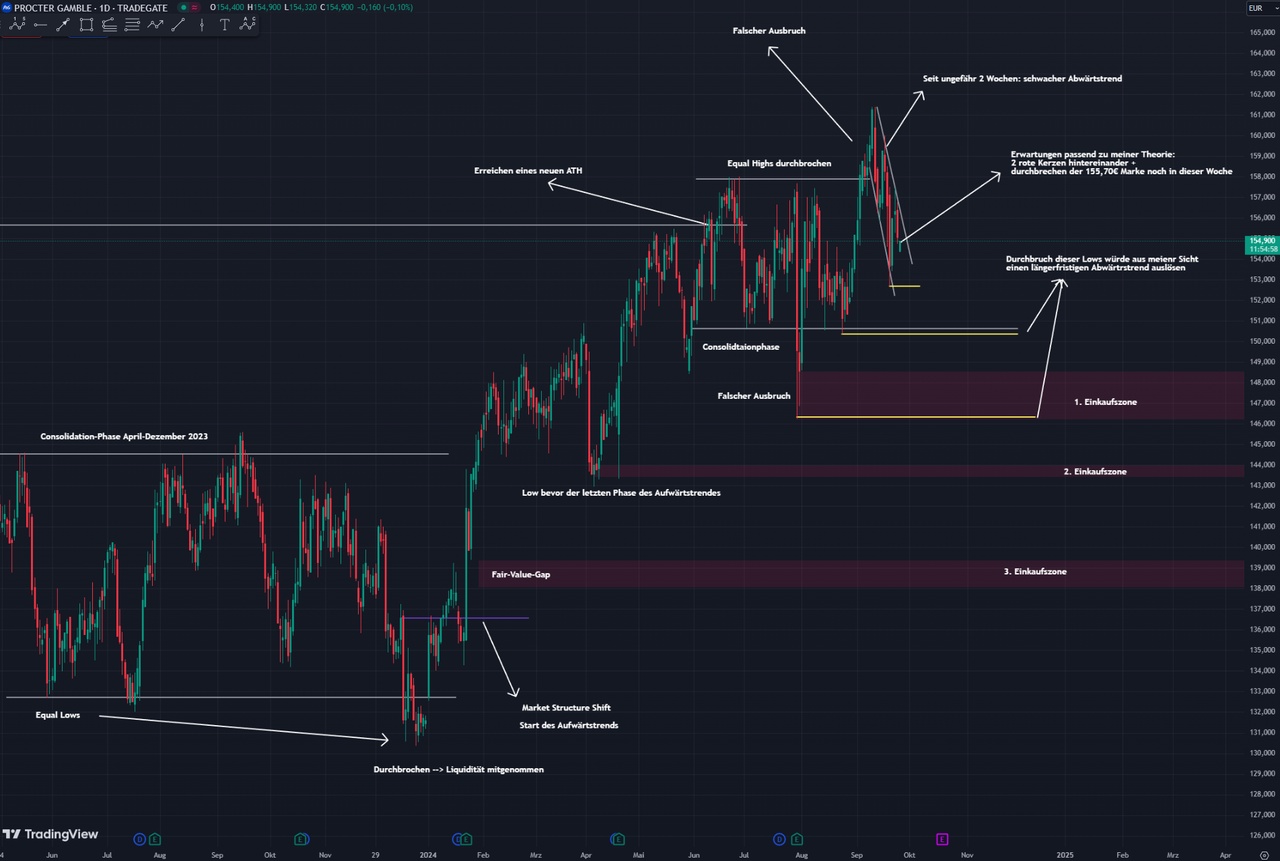

Procter & Gamble has been in a longer-term uptrend since December 2023. This began after a false breakout to the downside during the consolidation phase (April-December 2023) and was confirmed by the break through the last high. In September 2024, we saw another breakout from a consolidation phase, this time to the upside. I also regard this as a false breakout, as the move was quickly corrected by two strong red candles. We are currently in a short-term downtrend that is increasingly approaching the lower limit of the consolidation phase.

The 9-day moving average crossed the 21-day moving average yesterday, giving a bearish signal - but not yet meaningful on its own. However, these lines will soon cross on the weekly chart as well, which is of greater importance to me. The exponential moving averages of the last 20, 50, 100 and 200 days are also beginning to flatten out and point downwards.

The first minor confirmation of my theory should come this week if the €152.7 level is broken to the downside. A stronger and more important confirmation would come if the level of € 150.60 - the lower limit of the consolidation phase - is broken. Based on the last important lows and a fair value gap, I see three potential buy zones.

All in all, the technical analysis gives me a bearish signal.

Multiples:

EV/EBITDA values of the last 15 years:

Current EV/EBITDA value of Procter & Gamble: 19.16

Industry median for consumer goods companies: 10.7

It can be seen that P&G achieves an above-average valuation compared to its competitors and the industry median.

We also recognize that the current value is above average when compared to the highest values of the last few years and the median values of the highest years.

In summary, we recognize a possible overvaluation, but this alone is not sufficient to expect prices to fall. Nevertheless, my personal weighting of the above values leads me to the following conclusion:

WORST CASE: ~13.5

BUY: ~14.00

SELL: ~18.60

(These values are based on a long-only strategy. If you also sell short, SELL is indicated as follows: >18.60)

Price/sales values of the last 15 years:

Current P/S value of Procter & Gamble: 4.89

Industry median for consumer goods companies: 3.04

Here, too, it can be seen that P&G is rated above average compared to its competitors and the industry median.

Compared to the mean values of the last three years (also the highest three years), we are even above average here.

In summary, we recognize a possible overvaluation, but this alone is not sufficient to expect prices to fall. Nevertheless, my personal weighting of the above values leads me to the following conclusion:

WORST CASE: ~3.25

BUY: ~3.70

SELL: ~4.80

(These values are based on a long-only strategy. If you also sell short, SELL is indicated as follows: >4.80)

Financial analysis:

Sales growth:

- On an annual basis, P&G showed consistent sales growth of around 4-5%, mainly due to price increases and strong demand in key markets.

- On a quarterly basis, sales figures were also stable, but fluctuated slightly due to seasonality and currency effects. In the last quarter, a slight decline in organic sales was observed in certain international markets, but this was offset by price adjustments.

Earnings (profits):

- Earnings on an annualized basis have steadily increased in recent years. P&G has seen an improvement in gross margin due to efficiency measures and cost controls.

- On a quarterly basis, there are some fluctuations, particularly due to raw material costs and currency effects, which have impacted profit margins. Nevertheless, net profits remain at a healthy level due to the company's ability to manage costs effectively and pass on price increases.

Conclusion:

Based on the combination of the results of the fundamental and technical analysis, I come to the following conclusion:

Procter & Gamble could see a small correction in the near future, possibly reaching the final zone of 138-139.5€. This correction is unlikely to be long-lasting or have a lasting effect. In the short term, my assessment of this share therefore remains negative for the time being. The best chance of a good return is to make several partial entries into the share, the zones of which are marked in the chart.

Personal entry strategy:

1/3 of the planned investment amount* at € 146.30

1/3 of the planned investment amount at € 143.45

1/3 of the planned investment amount at € 138

*(= total amount that you would like to invest in the share)

#proctergamble

#konsumgüter

#usa