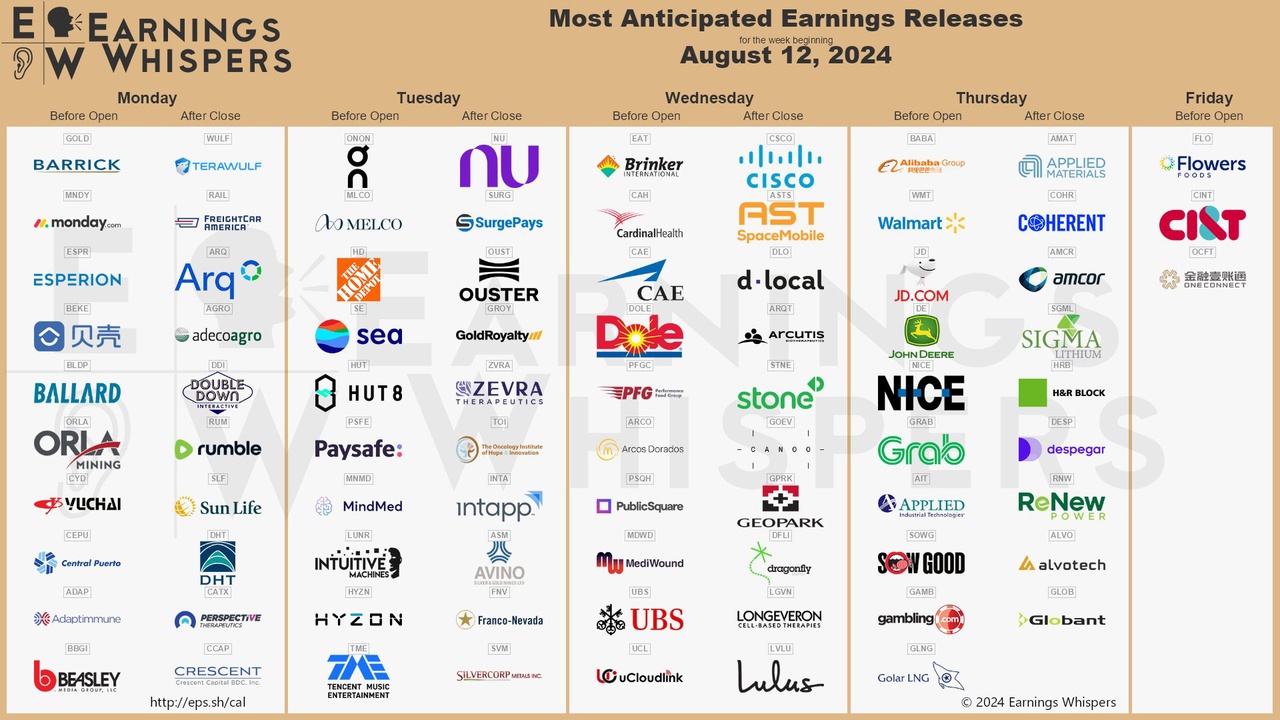

Earnings next week (11.11 - 15.11)

- Markets

- Stocks

- Cisco Systems

- Forum Discussion

Cisco Systems Stock Forum

StockStockDiscussion about CSCO

Posts

115Hardware of data: Arista, Cisco, Juniper and HPE in the infrastructure race

For development (company figures), a better view and more, check out the free blog. https://topicswithhead.beehiiv.com/p/hardware-der-daten-arista-cisco-juniper-und-hpe-im-infrastruktur-wettrennen

Company portraits

Arista Networks, founded in 2004, specializes in cloud networking solutions for large data centers and is a leading provider of high-performance switching.

Cisco Systems, on the market since 1984, is the long-standing industry leader in the networking sector and offers a comprehensive portfolio of network solutions.

Juniper Networks, founded in 1996, focuses primarily on network infrastructure for service providers and large companies.

Hewlett Packard Enterprise (HPE) was created in 2015 through the split-up of HP and offers a broad spectrum of IT solutions ranging from network technologies to cloud and data center infrastructures.

Historical development

Since its foundation, Arista Networks has experienced an impressive rise and established itself in the field of high-performance Ethernet switches, resulting in steadily growing market shares.

Cisco has dominated the networking market for decades, but has faced increasing competition from more agile rivals such as Arista.

Juniper Networks has been particularly successful in the telecommunications infrastructure sector and in large corporate environments.

HPE has significantly expanded its portfolio in the networking sector, particularly in the area of wireless networks and edge computing, through strategic acquisitions such as that of Aruba Networks.

Business models and core competencies

Arista Networks specializes in high-performance Ethernet switches and the EOS operating system. Arista's strength lies in providing solutions that are optimized for cloud environments and data centers with high latency and scalability requirements.

Cisco Systems offers a wide range of networking hardware, software and services, ranging from small and medium-sized enterprises to global corporations. Cisco's strength lies in the diversity of its portfolio and its extensive distribution network, which gives it a dominant position in the market.

Juniper Networks is particularly known for its high-performance routers and security solutions. The company specializes in providing robust network infrastructures for large enterprises and telecommunications providers, with a focus on highly scalable, secure networks.

HPE offers a comprehensive range of IT solutions, from servers and storage systems to network technology. The acquisition of Aruba Networks has strengthened HPE's position in wireless LAN and edge computing, positioning the company as a leader in these areas.

Future prospects and strategic initiatives

All four companies are increasingly focusing on artificial intelligence (AI) and cloud solutions in their strategic initiatives to meet the growing demands of modern networks:

- Arista Networks is positioning itself as a leading provider of network infrastructures that are specifically geared towards AI applications and cloud environments.

- Cisco is investing more heavily in AI-supported network management tools and is expanding its range of cloud solutions.

- Juniper Networks is relying on its Mist AI platform, which enables automated network management and AIOps, to consolidate its position in network automation.

- HPE plans to significantly expand its AI and cloud expertise through the acquisition of Juniper Networks and to challenge Cisco's market leadership.

Market position and competition

Cisco remains the undisputed market leader, but is continuously losing market share to competitors such as Arista, particularly in the high-end segment. HPE hopes that the acquisition of Juniper Networks will significantly strengthen its position in the network market.

Total Addressable Market (TAM)

The global market for networking equipment is estimated to exceed USD 200 billion by 2027, driven by the increasing expansion of cloud infrastructures, 5G technologies and the Internet of Things (IoT). This growing market offers great opportunities for companies, particularly in the areas of cloud networking, automation and edge computing.

Share performance

- Arista Networks: TR over 5 years 534%

- Cisco Systems:TR over 5 years 26%

- Juniper Networks:TR on 5 years 83%

- HPE:TR on 5 years 59%

For the development (company figures), better view and more check out the free blog. https://topicswithhead.beehiiv.com/p/hardware-der-daten-arista-cisco-juniper-und-hpe-im-infrastruktur-wettrennen

Conclusion

It remains to be seen how HPE and Juniper will develop. But given the current situation, it seems to take a lot to remain internationally competitive or attractive as an investor. It is becoming increasingly difficult between Cisco and Arista. Although Cisco is losing market share, it is also increasingly losing revenue streams, for example through acquisitions such as Splunk. Although these are costly and the company manages them only halfway well, capital efficiency and profitability are high enough to remain attractive. So overall the situation is not that bad, but the cloud infrastructure market seems to be weakening more and more for them.

Arista, the newcomer with a German founder, is proving to be extremely innovative, both in terms of the company itself and in terms of its management style and further development. The key figures speak for themselves, and especially now Arista clearly stands out from the market. For me, Arista is a clear buy candidate, but one should wait for a more favorable valuation, ideally when the share returns to the mean.

With Cisco, it depends on how the data business is driven forward. Depending on this, Cisco could also be an interesting investment. Just because the name no longer stands for innovation does not mean that the company is not doing well internally. Wait and see.

HPE is a difficult topic. Margins are poor, as is growth. Maybe things will change after the takeover, but it doesn't seem to be a sensible investment in itself.

$HPE (+4.52%)

$CSCO (+0.48%)

$ANET (+0.19%)

$SPLK

$JNPR (+0.47%)

Cisco

$CSCO (+0.48%) has announced an investment in CoreWeave a leading cloud computing provider and one of the most promising startups in the field of artificial intelligence.

The transaction values CoreWeave at 23 billion dollars. - Bloomberg

Datadog- The pitbull of data analysis or just 3rd class after all

Company presentation

Datadog and Dynatrace are two of the leading companies in the field of cloud monitoring and observability solutions.

$DDOG (-2.68%) Datadog, founded in 2010 and based in New York City, offers a SaaS-based data analytics platform that monitors a wide range of IT infrastructure components - from servers and databases to tools and services - across a cloud environment.

$DT is also an American company that specializes in software intelligence platforms. It provides comprehensive solutions for monitoring application performance, infrastructure and user experience.

Historical development

Datadog has experienced impressive growth since its foundation:

- 2015: Completion of a Series C financing round that supported expansion into new markets and further development of the product range.

- Continuous expansion of the platform, especially log management and application performance monitoring

- 2020: Acquisition of Undefined Labs to strengthen testing and observability capabilities.

Dynatrace has also undergone a remarkable development, although concrete milestones are not specified in the available information.

Business model and core competencies

Datadog:

- Offers a cloud-based platform for comprehensive monitoring.

- Core competencies: Infrastructure monitoring, application performance monitoring, log management, user experience monitoring and security monitoring.

- Focuses on continuous innovation and customization.

Dynatrace:

- Provides a comprehensive end-to-end observability solution.

- Core competencies: Unified platform for observability, security and business data.

- Focuses on automated provisioning and AI-supported analyses.

Future prospects and strategic initiatives

Both companies focus on continuous innovation and the expansion of their product portfolios in order to meet rapidly changing technologies and customer requirements.

Datadog has accelerated the development of new products and doubled the number of its paid solutions within the last year.

Dynatrace is focused on further developing its AI-powered analytics tools and optimizing the automated deployment of its solutions.

Market position and competition

In a dynamic and highly competitive market in which companies such as $SPLK (in the $CSCO (+0.48%) acquisition), New Relic, Elastic and Hyperscaler are also active, both companies are competing for the leading position.

Datadog is recognized as the market leader for its integrated full-stack monitoring solutions.

Dynatrace is positioned as a leader in end-to-end observability with a particular focus on AI-powered solutions.

Market potential (Total Addressable Market, TAM)

Although exact TAM figures are not provided, it is clear that both companies are operating in a rapidly growing market for cloud monitoring and observability solutions, which is being driven by the increasing digital transformation in various industries.

Share performance

Datadog:

- 1-year performance: 5.7%

- TR since the IPO on 19.09.2019:186.83%

- Currently 19.90% below the 52-week high and 45.61% above the 52-week low.

- 84% of analysts recommend the share as a buy (60% "Strong Buy", 24% "Buy").

Dynatrace:

- 1-year performance: 5, %

- TR since the IPO on 01.08.2019 : 113.42%

- Currently 16.99% below the 52-week high and 28.76% above the 52-week low.

- 77 % of analysts recommend the share as a buy (57 % "Strong Buy", 20 % "Buy").

Despite short-term fluctuations, both companies are performing positively overall.

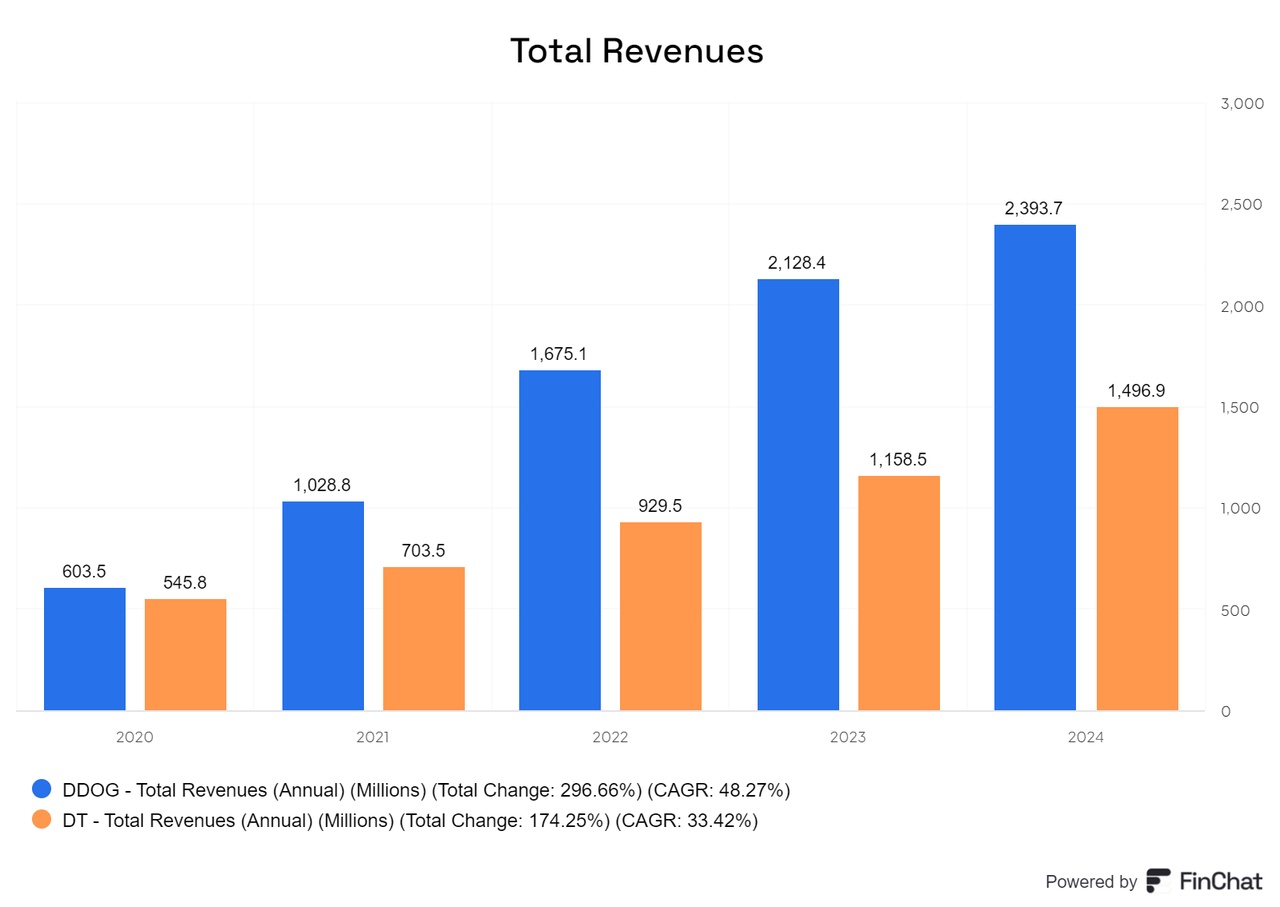

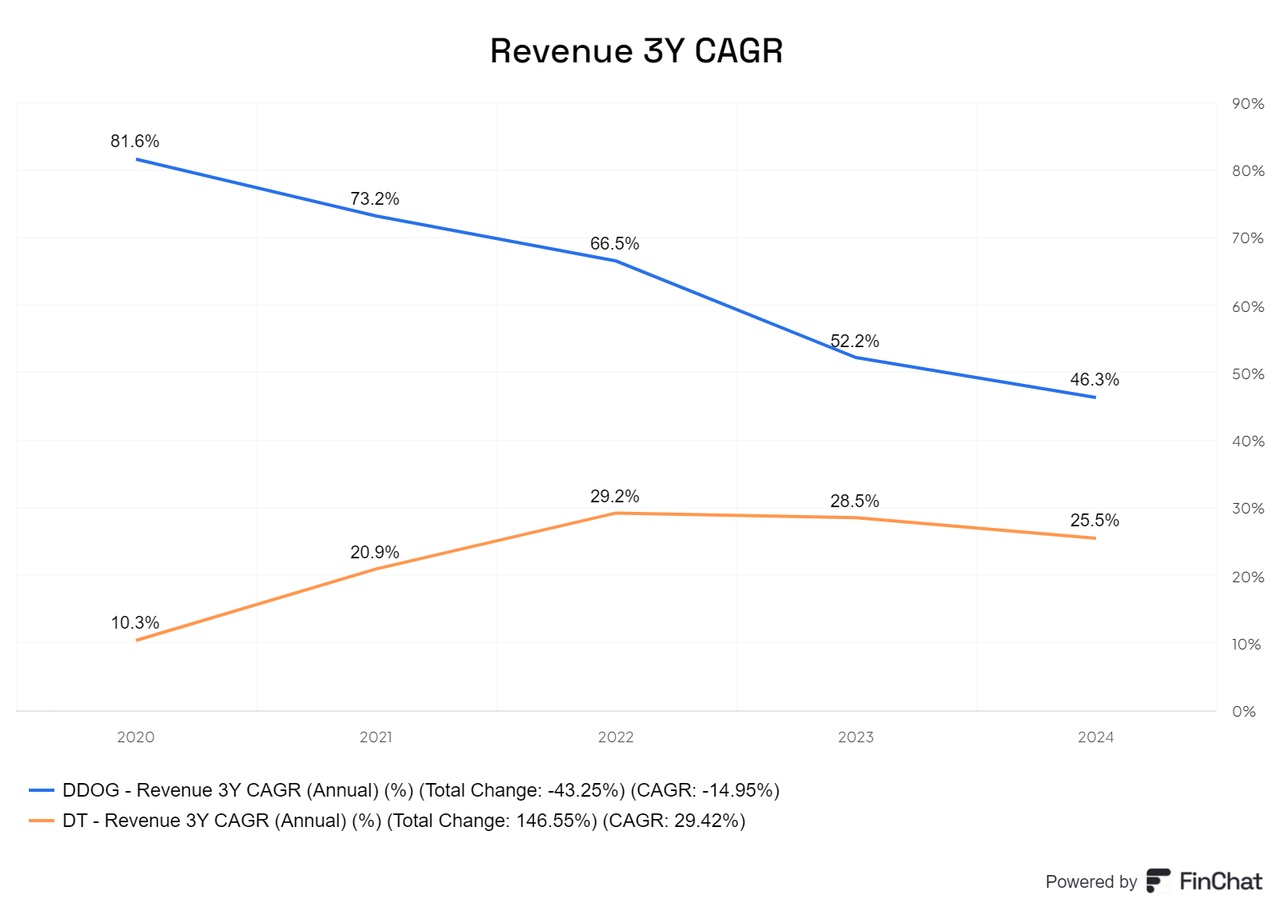

Development

Both companies are recording continuous sales growth, with Datadog showing significantly stronger growth momentum than Dynatrace. As a result, Datadog's turnover is currently around one billion US dollars higher than that of Dynatrace. Nevertheless, the growth rates of both companies are still impressive and are expected to remain at a high level in the coming years.

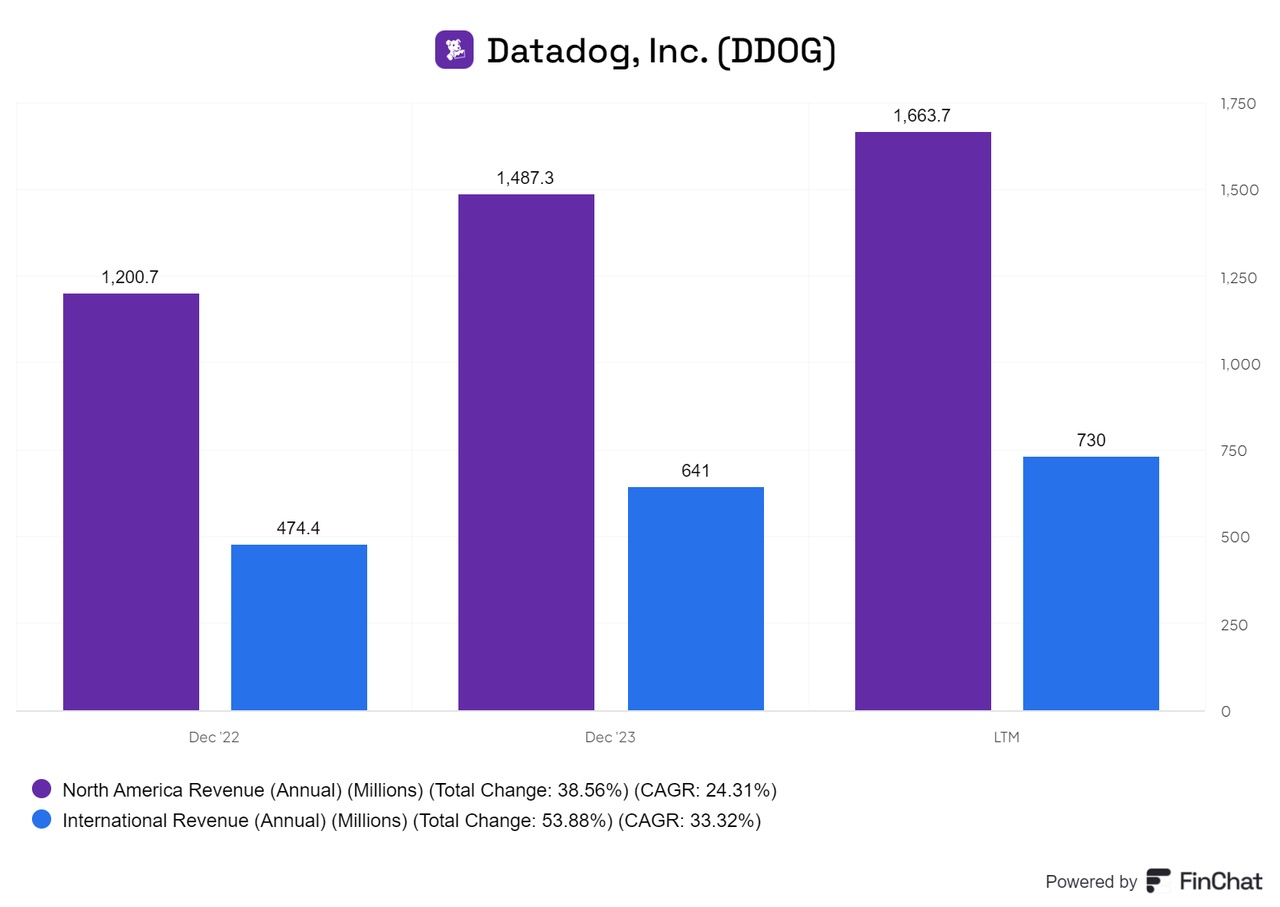

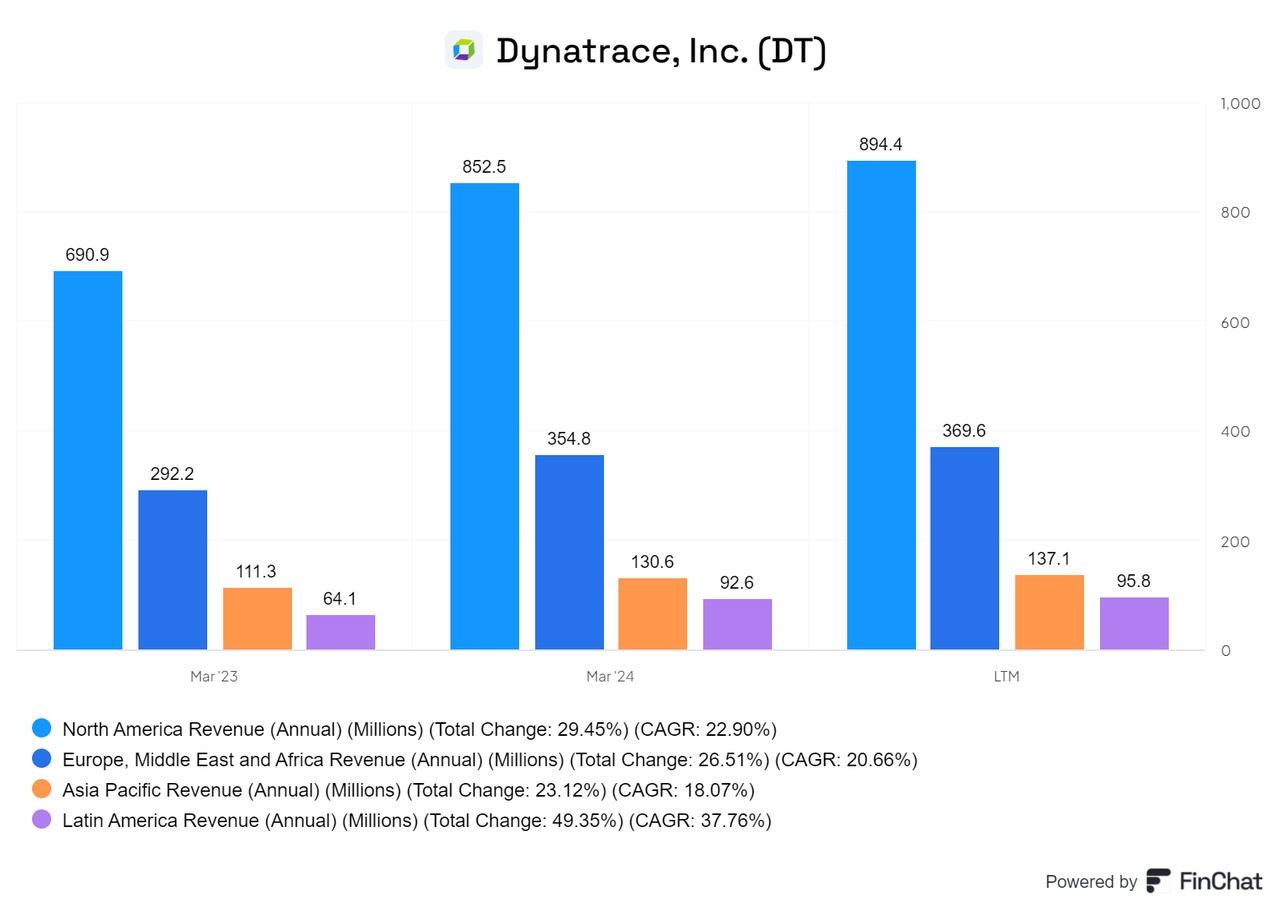

Looking at the distribution of sales by country, it is clear that Datadog concentrates its sales heavily on North America, while Dynatrace is much better diversified internationally.

Despite this difference in geographic focus, Datadog's focus on North America could be seen as a strategic advantage, as the data business in the US is generally more valuable than in many international markets. The strong foothold in North America provides Datadog with a solid foundation to capitalize on the high demand and lucrative business opportunities in the region.

Internationalization should not be difficult for Datadog due to its existing successful model. With its proven product range and high level of innovation, the company is well positioned to gain a foothold on a global level and grow in other markets.

As with sales, Datadog's gross profit is also higher than that of Dynatrace. The gross margins of both companies are almost the same, although Dynatrace had a higher margin at the beginning.

The Annual Recurring Revenue (ARR) of Datadog is currently twice as high as that of Dynatrace, which underlines Datadog's strong growth momentum and market position.

A higher ARR means that Datadog is able to grow recurring revenue faster and effectively leverage long-term customer relationships. This growth may have been driven by successful expansion into new markets and the introduction of additional products and services. A high ARR is also a sign of strong demand and high customer satisfaction, which could be due to the broad offering and versatility of the Datadog platform.

Dynatrace, although also with solid growth rates and a stable ARR, remains smaller compared to Datadog. Nevertheless, it shows that both companies have strongly focused their business models on recurring revenues, which is an important indicator of sustainable growth and financial stability in a competitive market.

Despite the smaller revenues, it shows that Dynatrace has a better EPS than Datadog.

FCF is positive for both

Part 2: https://getqu.in/wuxnDJ/

+ 6

As every Sunday, the most important news from the past week, as well as the dates for the coming weeks.

Also as a video:

https://youtube.com/shorts/f0axgV1KRVs?si=6MLwRC5IQHK7FPqt

Monday:

$FRAS (-1.14%) Frasers seizes the opportunity and increases its stake in $BOSS (-3.01%) HUGO BOSS. The share had recently fallen by more than 50% compared to its highs in 2023. Frasers Group now directly holds more than 15% of the voting rights.

Tuesday:

$HFG (+1.98%) Hellofresh can grow the bottom line and the ready-to-eat segment grows by almost 45%, sales in the cooking box business shrink by 10%. Overall, sales increased by 0.9%. This means that Hellofresh is already able to compensate for the falling sales in the cooking box business and return to growth. In addition

Hellofresh was able to refinance itself favorably. Hellofresh therefore continues to have a solid capital structure.

Producer prices in the USA 🇺🇸 are better than expected. Instead of +0.2 % compared to the previous month, it was +0.1 %. This increasingly points to a first interest rate cut at the beginning of September.

https://finanzmarktwelt.de/inflation-usa-erzeugerpreise-niedriger-was-nun-318977/?amp

Wednesday:

With the exception of Japan, there is growing evidence of a global turnaround in interest rates. Even the economically relatively insignificant (GDP: around USD 250 billion) island state of New Zealand 🇳🇿 has now lowered interest rates. The key interest rate has been lowered from 5.5% to 5.25%.

At +2.9%, the inflation data from the USA 🇺🇸 was below expectations of +3.0%. The markets continue to rise accordingly, and an interest rate cut by the Fed is becoming more likely.

Big deal in the food industry. The non-listed food giant Mars takes over the Pringles manufacturer $K (+1.27%) Kellanova. It is likely to be one of the biggest takeovers in the food industry ever. The confectionery giant Mars already has a turnover of USD 50 billion. With Kellanova, turnover will increase by a further USD 13 billion. The takeover is likely to cost USD 36 billion.

Thursday:

The trade union-affiliated IMK puts the probability of a recession in Germany at 49.2%. The main problems are domestic consumer demand and general demand from abroad.

$CSCO (+0.48%) Cisco has exceeded expectations with its sales forecast for the current quarter. In the previous quarter, sales fell by 10% and profits plummeted by 45%.

https://www.finanzen.net/amp/optimismus-cisco-aktie-steigt-prognose-uebertrifft-erwartungen-13767655

Domestic consumption is driving the economy in Japan 🇯🇵. In the 2nd quarter, GDP grew by an annualized 3.1%. Experts had only expected growth of 2.1%.

$BAYN (-1.69%) Bayer can dismiss a lawsuit in an appeals court. As there are contradictory rulings from appeal courts, Bayer continues to demand that the glyphosate case be brought before the Supreme Court.

Key dates in the coming week:

Tuesday: 14:30 Inflation data (Canada)

Wednesday: 20:00 FOMC Minutes (USA)

Thursday: 10:00 Purchasing Managers' Index (EU)

$CSCO (+0.48%) | Cisco Q4'24 Earnings Highlights

🔹 Non-GAAP EPS: $0.87 (Est. $0.85) 🟢

🔹 Revenue: $13.6B (Est. $13.53B) 🟡; DOWN -10% YoY

Q1'25 Guidance

🔹 Revenue: $13.65 billion - $13.85 billion (Est. $13.71 billion) 🟡

🔹 Non-GAAP EPS: $0.86 - $0.88 (Est. $0.85) 🟢

FY'25 Guidance

🔹 Revenue: $55.0 billion - $56.2 billion (Est. $55.68 billion) 😑

🔹 Non-GAAP EPS: $3.52 - $3.58 (Est. $3.56) 🟡

Segment Revenue:

🔹 Product Revenue: DOWN -15% YoY

🔹 Services Revenue: UP +6% YoY

🔹 Security Revenue: UP +81% YoY

🔹 Observability Revenue: UP +41% YoY

🔹 Networking Revenue: DOWN -28% YoY

Geographic Revenue:

🔹 Americas: DOWN -11% YoY

🔹 EMEA: DOWN -11% YoY

🔹 APJC: DOWN -6% YoY

Margins:

🔹 GAAP Gross Margin: 64.4% (Prev. 64.1%)

🔹 Non-GAAP Gross Margin: 67.9% (Prev. 65.9%)

🔹 GAAP Operating Margin: 19.2% (DOWN from 25.8% YoY)

🔹 Non-GAAP Operating Margin: 32.5% (DOWN from 38.5% YoY)

Operational Metrics:

🔹 Total Annualized Recurring Revenue (ARR): $29.6 billion; UP +22% YoY

🔹 Total Software Revenue: $18.4 billion; UP +9% YoY

🔹 Software Subscription Revenue: $16.4 billion; UP +15% YoY

🔹 Cash Flow from Operations: $3.7 billion; DOWN -37% YoY

Other Metrics:

🔹 Total Subscription Revenue: $27.4 billion

🔹 Cash Flow from Operations: $10.9 billion; DOWN -45% YoY

CEO Chuck Robbins' Commentary:

🔸 "We delivered a strong close to fiscal 2024, seeing steady customer demand with order growth across the business as customers rely on Cisco to connect and protect all aspects of their organizations in the era of AI."

CFO Scott Herren's Insight:

🔸 "Revenue, gross margin, and EPS in Q4 were at the high end or above our guidance range, demonstrating our operating discipline. We remain focused on growth and consistent execution as we invest in AI, cloud, and cybersecurity, while maintaining capital returns."

Dividend Update:

🔹 Quarterly Dividend: $0.40 per share, payable on October 23, 2024.

Which cybersecurity companies do you think will dominate in 5 years?

$CRWD (+0.55%)

$FTNT (+17.41%)

$PANW (+1.75%)

$S (+0.39%)

$ZS (-0.19%)

$MSFT (+0.15%)

$GOOGL (-0.6%)

$CSCO (+0.48%) .....

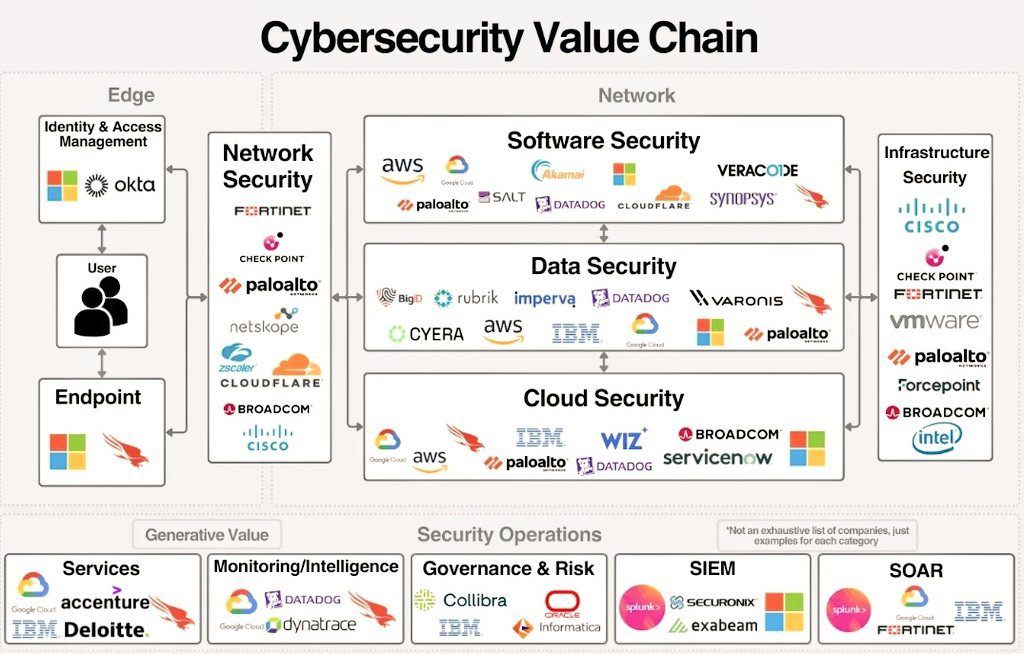

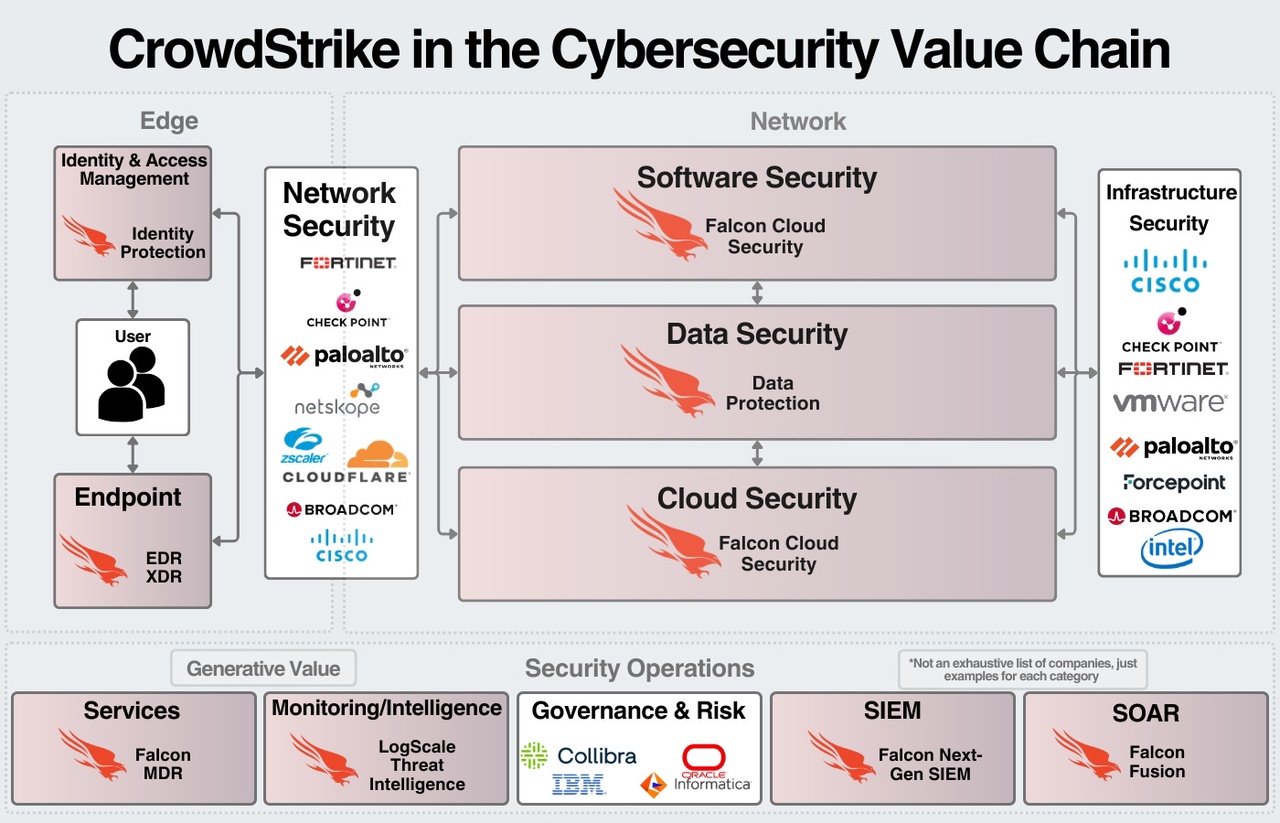

How large companies fit into the ecosystem:

How some of the largest security companies in the world fit into the ecosystem. All of these companies offer products across the security ecosystem and strive to provide security platforms on which customers can consolidate.

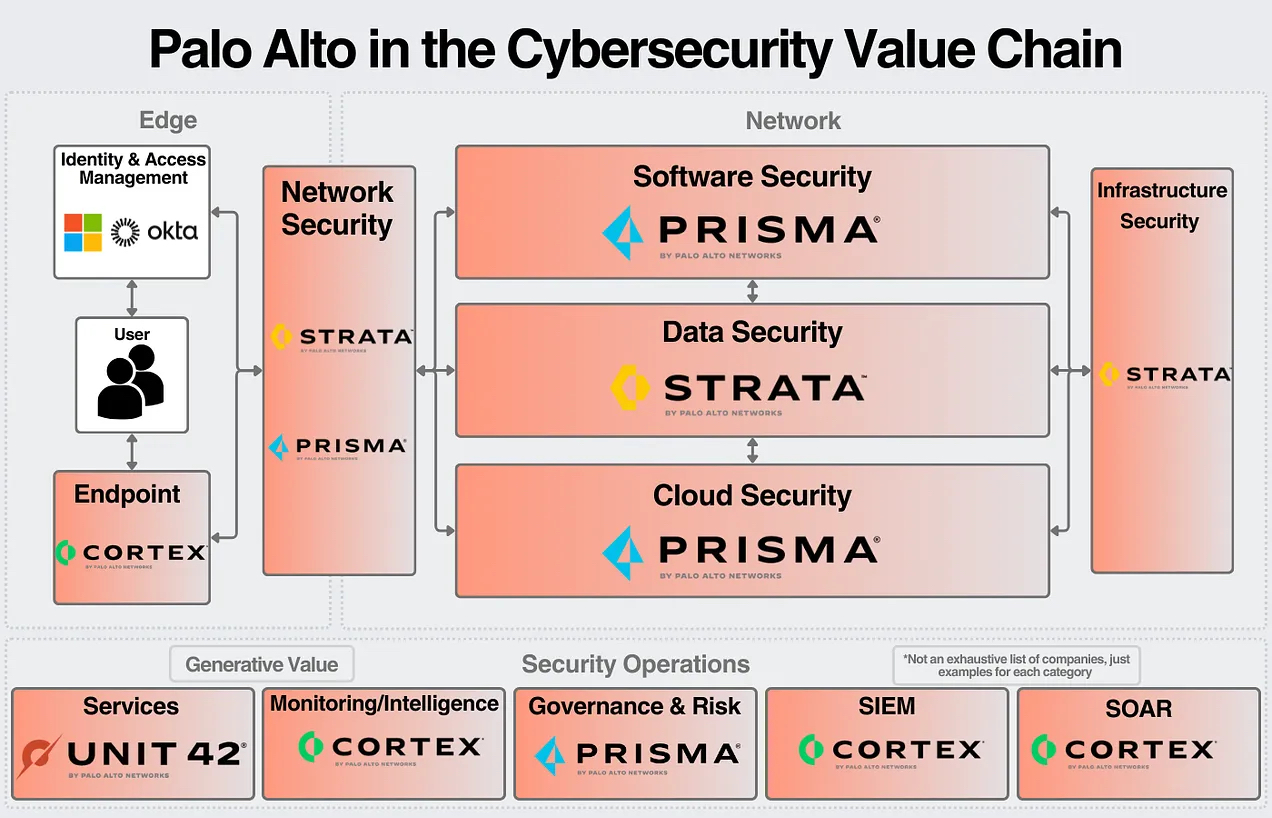

$PANW (+1.75%) - Palo Alto Networks

Palo Alto is the largest pure-play cybersecurity company in the world, both by market capitalization and revenue. Their core product is network firewalls (hardware and software); they have significantly expanded their portfolio through an aggressive acquisition strategy. Their goal is to be the consolidator for cybersecurity, and they continue to show progress towards that goal.

Palo Alto has four main solution areas: Strata (Network), Prisma (Cloud, Access), Cortex (Endpoint, SecOps) and Unit 42 (Managed Services). The only area in which they do not compete is Identity. They have achieved a turnover of 7.5 billion dollars in the last 12 months.

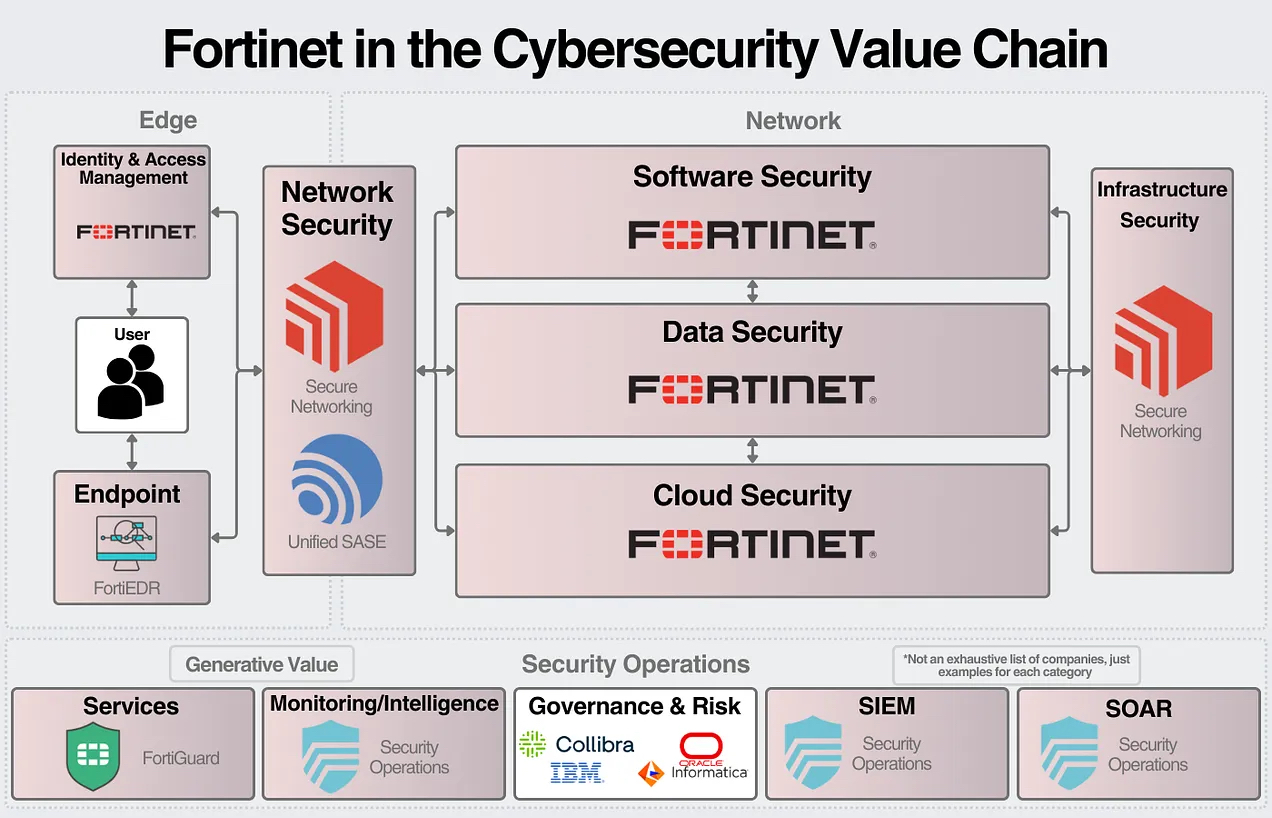

$FTNT (+17.41%) - Fortinet:

Fortinet is the second largest pure-play cybersecurity company by revenue. Like Palo Alto, their core product is the firewall (both hardware and software). Fortinet is still primarily a network security company (60-70% of revenue) and is focused on providing a strong SASE (Secure access service edge) product for growth. Apart from that, they have an extensive portfolio of security products including cloud security, app security, data security and managed services. Fortinet has achieved a turnover of 5.3 billion dollars in the last 12 months.

$CRWD (+0.55%) - Crowdstrike:

Crowdstrike's core product is endpoint security; they are another example of being able to expand to a platform. In endpoint security, they are one of the two market leaders (Microsoft is the other). In cloud and software security, they have a unified platform for posture management, workload protection and app protection. They offer a data protection suite as well as services for security operations. They do not offer Identity & Access Management, but they do offer identity security that protects other IAM (Identity & Access Management) products.

Their product is based on a unified data layer. CEO George Kurtz explained that the

true value comes from centralizing data, using AI/ML to detect threats and anomalies, and responding to those threats. This value can be continually delivered through new products that give us the overall roadmap for how CrowdStrike expands in the future. CrowdStrike has generated $2.8 billion in revenue in the last 12 months.

$MSFT (+0.15%) - Microsoft:

In January 2021, Microsoft surpassed 10 billion dollars in security revenue. Just two years later, Microsoft announced that they had surpassed 20 billion dollars in revenue from Microsoft security.

Microsoft has 6 main segments of its cybersecurity portfolio: Microsoft Defender, Microsoft Sentinel, Microsoft Entra, Microsoft InTune, Microsoft Priva and Microsoft Purview. Defender (Cloud, Apps, Endpoint, IoT) is Microsoft's security product across all solution areas. Sentinel is a SIEM/SOAR solution. (SOAR = Security Orchestration, Automation, and Response) (SIEM = Security Information and Event Management) Entra is Microsoft's IAM solution (market leader by market share). InTune is a unified endpoint management tool. Priva covers data protection and compliance. Finally, Purview is a data governance tool.

$CSCO (+0.48%) - Cisco Systems:

Cisco has an impressive collection of security products; with the acquisition of Splunk, it became one of the largest security companies in the world. In FY2023, Cisco generated ~$4 billion in security revenue, while Splunk had $3.7 billion in ARR at the end of the same quarter. Together, this puts Cisco in the same revenue range as Palo Alto.

Cisco's core security strength comes from its massive networking business. They have also expanded into cloud, endpoint and SASE. Splunk brings a strong SecOps presence with SIEM, SOAR and analytics. It will be interesting to see what synergies Cisco can further create between the two companies.

$GOOGL (-0.6%) - Google:

One of Google's main goals is to be the go-to cloud for security, and they have done an impressive job building their portfolio. They offer network security with load balancing, cloud firewalls and secure web proxies. GCP (Google Cloud Platform) offers several services for data protection (building on their strength as a data company). They also focus on securing DevOps with several SecDevOps tools.

In 2022, Google completed the acquisition of Mandiant for $5.4 billion, which strengthened GCP's managed services offering (in addition to other products). Combined with their data governance, observability and SIEM/SOAR solution, it makes GCP a formidable player in the security space. It will be interesting to see what revenue figures management reveals for security in the future.

+ 3

With the $PEP (+1.38%) purchase yesterday, this savings plan will also be discontinued. Started in April 22, this is after $CSCO (+0.48%) and $JNJ (+0.03%) the third candidate where my minimum investment of $5000 per position was reached. Purchases will only be made on occasion and when there is money left over.

The free money will be allocated to the other stocks or used for new savings plans. New candidates for a savings plan possibly $MA (+0.88%) or $V (+1.22%)

Hello GQ community,

I am very interested in Cisco Systems $CSCO (+0.48%) the stock seems to be fairly valued to undervalued in the last few weeks.

According to TR, new analyst results are due in the next few days. I am torn between opening a first position, as I cannot estimate whether the stock could drop dramatically after the publication of the analysts' ratings.

What are your assessments and opinions on this?

Many thanks in advance🫶

Trending Securities

Top creators this week