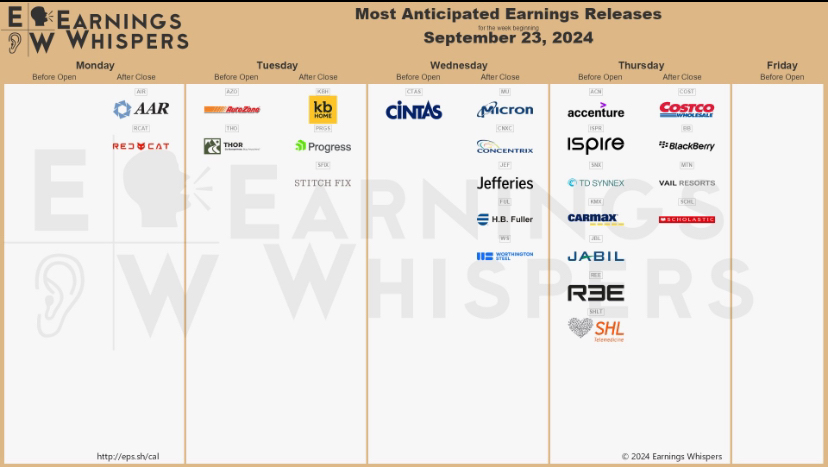

Earnings next week

Autozone Stock Forum

StockStockDiscussion about AZO

Posts

10Share analysis/share presentation ⬇️

Today we are talking about the company AutoZone: $AZO (-0.49%)

What is AutoZone and what does it do?

AutoZone is a company that sells car parts and accessories. They offer a variety of products for cars, such as oils, filters, batteries and more. AutoZone is a kind of one-stop store for car parts, where car owners can find everything they need to maintain and repair their vehicle. The company is known for its wide range of products, expertise and customer service.

Market capitalization:

AutoZone currently has a market capitalization of around 545.5 billion euros.

Strengths of the share:

Some of AutoZone's strengths:

- Wide range of car parts and accessories

- Knowledge and expertise in the field of car parts

- Good customer service and advice

- Locations in many cities for convenient access

- Online ordering options for easy shopping

- Regular offers and discounts for customers

- Fast delivery and pick-up options for urgent needs

- Return options for unwanted or incorrectly ordered items

- Warranty on many products for added peace of mind

- Eco-friendly initiatives and recycling programs

Weaknesses of the share:

Here are some of AutoZone's weaknesses:

- Limited availability of some specialty auto parts

- Potentially higher prices compared to online competitors

- Service quality can vary by location

- Long wait times at some locations during peak hours

- Return process can sometimes be cumbersome

- Limited selection of accessories compared to specialized stores

- Online orders could have delivery delays

- Possibly limited warranty coverage on certain products

- Less personalization compared to smaller auto parts stores

- Environmental impact from packaging and shipping processes

A little more about the business model:

AutoZone is a company that specializes in the sale of car parts and accessories. Their business model is based on providing a wide range of auto parts for different vehicle types and models. Through their numerous locations and online platform, they offer customers convenient access to high-quality products for vehicle maintenance and repair.

A key aspect of their business model is the expertise and customer service they provide. AutoZone employees are usually well trained and can assist customers in selecting the right parts and accessories. This contributes to customer satisfaction and loyalty.

Another important point is competitiveness in terms of prices and offers. AutoZone strives to offer competitive prices and provide regular discounts and special offers for customers. This helps to attract and retain customers.

AutoZone's business model also includes aspects such as logistics and inventory management. They need to ensure that they have a sufficient amount of different car parts in stock to meet customer demand. This requires efficient warehousing systems and supply chain processes.

Additionally, AutoZone invests in marketing and advertising to strengthen their brand and attract new customers. They use various channels to promote their products and raise awareness of their services.

Overall, AutoZone's business model is based on providing high-quality auto parts, good customer service, competitiveness in prices and offers, and efficient logistics and marketing strategies to meet customers' needs and grow their business.

A little more about the industry:

AutoZone belongs to the automotive accessories industry which specializes in the sale of auto parts and accessories. This industry is closely linked to the automotive industry and offers products for the maintenance, repair and customization of vehicles. AutoZone competes with other retailers and online platforms that offer similar products. The industry is dependent on the demand for vehicles and their age, as older vehicles tend to require more spare parts. Innovations in automotive technology and consumer trends also influence the development of this industry.

When and where was AutoZone founded?

AutoZone was founded in 1979 by Pitt Hyde in the USA. The company began as a small auto parts store and then expanded into a nationwide chain of retail stores offering auto parts and accessories. Over the years, AutoZone has become a leader in the automotive aftermarket industry and is known for its wide range of products and focus on customer service.

AutoZone's goal:

AutoZone aims to provide its customers with quality auto parts and accessory products to fulfill their vehicle maintenance and repair needs. The company strives to offer a wide range of products to meet the needs of different vehicle types and models. AutoZone emphasizes excellent customer service and strives to provide a comprehensive shopping experience that caters to customers' individual needs. Through innovation and industry leadership, AutoZone continually strives to increase customer satisfaction and serve as a trusted source for auto parts and accessories.

Your opinion:

Now I would like to hear your opinion on this stock in the comments.

I personally find the company very interesting and will continue to monitor it. It was an unknown company to me until recently, but that's exactly why I wanted to introduce the share to you.

What do you think of AutoZone and were you already familiar with this company?

Do you already have the share in your portfolio?

Please let me know in the comments.

This is of course not investment advice but just my own opinion that I would like to share with you.

ULTA Beauty.

$ULTA (-1.32%)

Currently, apparently, as cheap to get as the last time in fall 23, in the Corona Crash and sometime in 2018 (yet rare and short-lived).

The company is debt-free (bank debt) and operates over 1300 beauty stores, some of them directly in Target $TGT (-0.48%) stores.

Currently the outlook looks uncertain, is growth leveling off?

Will the competition (mainly Sephora, owned by LVMH $MC (-2.6%) ) snatch further market share in the higher-priced segment?

These are questions that I have been asking myself for a few days and have not yet found an answer to, so let's discuss them as a community in the comments.

I like the company policy, you have an experienced CEO who has been with the company for about 10 years and has grown up. ULTA has bought back an average of 2% of shares per year over the last 10 years and has been able to increase both the operating margin and same store sales substantially, both of which are above the average of normal retailers.

Retailers, a good point.

Retailers, as I have learned, you want to buy as cheaply as possible due to price pressure & competition, so if I apply a 10 P/E ratio to ULTA, for example, the company would still have about $4-4.5 billion in value downside or -25-30% in value loss per share. At the moment we are hovering between 15 & 16, historically 20 was a good median for this company.

According to the stock finder, the company is also cheaply valued, with a price/cash flow ratio of around 13 and an average of 17.94 over the last 10 years.

According to the fair value cash flow, we currently have almost a 20% undervaluation for ULTA Beauty, just like in October 2023.

The question is whether the growth will level off significantly and lead to a revaluation or whether Ulta might even manage to create ~300 new stores in the next 10 years (Canada/Mexico) which would continue to be a driving factor.

In the course of my research, I made comparisons with AutoZone $AZO (-0.49%) to see how a company with small sales growth and saturated locations can continue to grow strongly. Here, however, I came to the realization that the economic factor may have played a decisive role.

Phew, so actually I just wanted to ask "what do you think of Ulta Beauty?" 😂

GERIT 🐅

Back to topic: I also looked at the company recently and calculated a slightly favorable entry opportunity. I was then put off by the fact that I don't know enough about the beauty market and my forecast for the next few years wasn't reliable enough for me.

The coming week summarized:

Monday:

- New home sales (January)

- Quarterly reports from Workday ($WDAY (+0.04%) ), Zoom Video Communications ($ZM (+2.61%) ), Domino's Pizza ($DPZ (+3.32%) ) and Unity Software ($U (-5.68%) )

Tuesday:

- Orders for durable goods (January)

- S&P Case-Shiller Home Price Index

- Consumer Confidence (February)

- Quarterly reports from Lowe's ($LOW (+2.33%) ), ONEOK ($OKE (+3.15%) ), Bank of Montreal ($BMO (+0.97%) ), American Tower ($AMT (+3.55%) ) and AutoZone ($AZO (-0.49%) )

Wednesday:

- Gross Domestic Product of the USA (first revision of the fourth quarter)

- US trade balance (January)

- Retail inventories (January)

- Wholesale inventories (January)

- Quarterly reports from Salesforce ($CRM (+4.64%) ), Snowflake ($SNOW (-1.55%) ), Royal Bank of Canada ($RY (-0.13%) ), HP ($HPQ (-0.4%) ), TJX ($TJX (+1.65%) ), Paramount Global ($PARA (-3.73%) ) and Monster Beverage Corp. ($MNST (+1.28%) )

Thursday:

- Personal Consumer Price Index (PCE)

- Initial claims for unemployment benefits

- Pending home sales (January)

- Statements by Atlanta Fed President

Raphael Bostic, Chicago Fed President Austan Goolsbee and Cleveland Fed President Loretta Mester - Quarterly reports from Anheuser-Busch InBev ($BUD (-0.47%) ), Dell Technologies ($DELL (-1.28%) ), Toronto-Dominion Bank ($TD.PR.P ), Hewlett Packard Enterprise ($HPE (+4.52%) ) and Best Buy ($BBY (-1.61%) )

Friday:

- Statements from Dallas Fed President Lorie Logan, Federal Reserve Board Gov. Christopher Waller, Atlanta Fed President Bostic and San Francisco Fed President Mary C. Daly

- Quarterly reports from RadNet ($RDNT (+2.65%) ), Plug

Power ($PLUG (+1.6%) ) and FuboTV ($FUBO )

The next figures from q1 2024 will be exciting !!! 👍 that will decide a lot about how the year will go!

Thanks for the great list!

Good day,

I am 25 years old, a self-employed electrical engineer and have been dealing with shares for about 2 years. I know in this area average well, am absolutely no professional.

My goal is to build up a good long-term portfolio with individual shares.

I have 3 funds with my bank, which I can not mention here.

In an ETF I can not pay in the house bank monthly, therefore the funds. (Would have of course rather e.g. a Msci World or....)

And pay into an online broker I do not know, call me old-fashioned but that is too uncertain for me, I do not know much about it and am afraid that there is the online broker suddenly no longer and everything is gone.

My shares I bought earlier was mostly a mistake have bought too quickly or erwas read and that sounded so good have bought in greed. This should not continue now.

Well now to my shares, strategy I follow actually no right, have also too little time me daily several hours to read through. Often I look what do people buy, what do they use every day, from which brand is the....usw. In this respect, I read magazines or online and if I like a share, it first comes to the watch list, there it is not bought for 1-3 months because I do not want to be blinded. Each magazine, online article or video writes a company so special and future-proof that it affects my opinion, and therefore I wait a certain time until I deal with the companies.

In this respect I use most tradingview, aktienfinder pro and finanzen,net and a few others but not so often.

With the shares I have looked at the annual return of the past years, on the fair value, profit flow, profit of the next years and on other figures where I know less well. (This is just my opinion, I am absolutely not a professional, please correct me if I am wrong)

The shares are all long-term investments and I plan to hold them for several years,

$RACE (+1.18%) is an Italian company and therefore I would pay less tax on the sale at some point as an Italian citizen, but that should not be a reason, the last few years have gone very well and I also believe the luxury companies in this period can pass on the price increase well to their customers (SIMILAR TO $LVMH)

Unfortunately, I do not know how it looks with the E-cars if in the distant future only such are sold. How hard Ferrari is doing.

$MDLZ (+1.41%) I have looked at the 10 largest food companies and for me mdlz is the share that has the most potential to the upside, whether it is fair value or profit flow is still a lot up in it

$MCD (+2.19%) a rather low-risk company, I believe that mc donalds will still exist in 20 years, and when I look at the competition I see mcd far in front

$LIN I think is also a low risk company and with their business model I see in the next few years certainly a higher price

$NOVO B A pharmaceutical company never hurts. With a profit of 32% over sales and the latest drug that makes you slim you are way ahead of the competition. They are slightly overbought, but they always feel that way.

$LNG (+2.62%) and $EQNR (+0.29%) is rather risky, here I am talking about the LNG that will go to Europe in the future and the two companies are already working profitably, if you assume the next few years that they will go a lot to Europe then I think the company will rise.

$AZO (-0.49%) have dealt rather less with it, are a US Autoreperatur company with service and sales.

I do not know why but the company works well no negative numbers. Profit of the next few years should also be very good.

$V (+1.22%) I liked to have a payment service company where little risk is and according to figures Visa is from me seen better positioned than Mastercard.

$SIE (-2.51%) I wanted to buy actually only that I have not everything in Us company, I am currently but not quite convinced.

$PETR3 (+0.39%) Since I am a small gambler I would like to invest a small part here. It simply attracts with the high dividend and if the oil business is still profitable for a while it could be worthwhile.

In addition, half of the company belongs to the state of Brazil.

Yes that's it, I am not a stock expert, I hope for an honest opinion.

Thanks to @DividendenWaschbaer

Good day to you,

I do not know if anyone can read this, but I would appreciate an honest opinion.

Per company I would invest 1000-2000

$LNG (+2.62%) or $EQNR (+0.29%)

I have a long watchlist that I have been keeping for a long time and I have picked out the best ones in my opinion.

I would be happy for an opinion

Auto zone has returned 90% of share repurchase since 1998. With 2 to 2.5 leverage the companies is able to give awesome returns to shareholders.

Auto zone is a awesome company.

Sometimes you don't need fancy business models or hyped stocks. Often, the most boring stocks and simple business models can generate super returns over a long holding period.

One such example is the U.S. company AutoZone. The company is the second largest distributor of automotive aftermarket parts in the United States, headquartered in Memphis. The company was founded in 1979 under the name Auto Shack, then changed its name to AutoZone shortly thereafter due to a trademark lawsuit filed by RadioShack. Today, the company has nearly 6,800 stores in the United States, Mexico and Brazil.

Earnings per share last quarter were $25.69, $4.73 above expectations. Revenue also beat expectations by $290 million. Total sales were just under $3.7 billion, up 16.5% from the year-ago quarter. Stores that have been open longer posted 13.6% year-over-year sales growth.

On a one-year view, the stock is up more than 60%. The 10-year performance is over 450%. Over the past 20 years, the stock has generated an average return of 20%, significantly outperforming the S&P 500.

Which "unknown bores" do you know that have generated very good returns so far?

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝗘𝗹𝗲𝗸𝘁𝗿𝗼𝗮𝘂𝘁𝗼𝘀 𝗮𝘂𝗳 𝗱𝗲𝗺 𝗩𝗼𝗿𝗺𝗮𝗿𝘀𝗰𝗵 / 𝗔𝗱𝗶𝗱𝗮𝘀 𝘂𝗻𝗱 𝗕𝗼𝗿𝗲𝗱 𝗔𝗽𝗲𝘀

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

As of today, among others, Ametek ($AME (+1.84%)), Electronic Arts ($EA (-0.11%)) and HP ($HPQ (-0.4%)) are trading ex-dividend.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, among others, Ashtead Group ($AHT (-0.97%)), AutoZone ($AZO (-0.49%)) and Ferguson ($FERG) present their figures.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

Heidelberger Druck ($HDD (-0.05%)) - Heidelberger Druckmaschinen AG is expanding its range of products and services in the field of electromobility by acquiring the charging column technology of EnBW ($EBK). In addition to the range of charging devices on the wall at home (wallbox), corresponding products for public spaces are added. This is expected to attract new customers from the municipal utility, local authority or corporate sectors. The share was able to rise after this news and is currently at a level of 2.68 euros.

Tesla ($TSLA (+9.97%)) - Norway is the e-car front-runner. There are 81 e-cars per 1,000 inhabitants and 11,269 new electric vehicles were registered in November, most of which were Tesla models.

In Germany, the number of new registrations also increased, although there is still a lot of catching up to do in terms of network infrastructure.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

Adidas ($ADS (-1.81%)) - Adidas dives into the metaverse. In early December, adidas Originals confirmed collaborations with Bored Ape Yacht Club (BAYC), NFT comics PUNKS Comic, and crypto investor and NFT collector gmoney. Alongside this, adidas Originals has changed its Twitter profile image to a Bored Ape cartoon with adidas Originals apparel, featuring the PUNKS Comic logo and gmoney's iconography alongside the adidas Originals logo.

Follow us for french content on @MarketNewsUpdateFR

𝗠𝗮𝗿𝗸𝗲𝘁 𝗡𝗲𝘄𝘀 🗞️

𝙐𝙣𝙞𝙫𝙚𝙧𝙨𝙖𝙡 𝙈𝙪𝙨𝙞𝙘 - 𝙈𝙞𝙩 𝙋𝙖𝙪𝙠𝙚𝙣 𝙪𝙣𝙙 𝙏𝙧𝙤𝙢𝙥𝙚𝙩𝙚𝙣 𝙖𝙣 𝙙𝙞𝙚 𝘽ö𝙧𝙨𝙚 / 𝙀𝙞𝙨𝙚𝙣𝙚𝙧𝙯 𝙗𝙚𝙜𝙞𝙣𝙣𝙩 𝙯𝙪 𝙧𝙤𝙨𝙩𝙚𝙣?! / 𝙀𝙫𝙚𝙧𝙜𝙧𝙖𝙣𝙙𝙚 𝙯𝙞𝙚𝙝𝙩 𝙖𝙡𝙡𝙚𝙨 𝙧𝙪𝙣𝙩𝙚𝙧 - 𝙨𝙤𝙜𝙖𝙧 𝙙𝙚𝙣 𝘾𝙧𝙮𝙥𝙩𝙤-𝙈𝙖𝙧𝙠𝙩

𝗘𝘅-𝗗𝗮𝘁𝗲𝘀 📅

Broadcom ($AVGOP), LTC Properties ($LTP (+2.37%)), Total ($TOTB (-2.14%)) and Weichai Power ($WEICY) are trading ex-dividend today.

𝗤𝘂𝗮𝗿𝘁𝗮𝗹𝘀𝘇𝗮𝗵𝗹𝗲𝗻 📈

Today, Adobe ($ADB (-0.7%)), AutoZone ($AZ5 (-0.49%)), FedEx ($FDX (+2.24%)) and Kingfisher ($KGFHY) will present their figures.

𝗜𝗣𝗢𝘀 🔔

𝗨𝗻𝗶𝘃𝗲𝗿𝘀𝗮𝗹 𝗠𝘂𝘀𝗶𝗰 - Vivendi spins off its subsidiary.

The record label celebrates its IPO in Amsterdam, making it the largest IPO in Europe this year. The share opened at €25.05 instead of the previously set €18.50.

𝗠𝗮𝗿𝗸𝗲𝘁𝘀 🏛️

𝗖𝗼𝗺𝗺𝗼𝗱𝗶𝘁𝗶𝗲𝘀 - Iron ore has had one of its worst weeks since 2008. One reason is the shutdown in demand from China. According to the Chinese government, steel production is expected to be maintained at around 1 billion tons this year. Tensions between Australia, the biggest producer of iron ore, and China are also a reason for the Chinese government to limit steel production.

𝗗𝗲𝘂𝘁𝘀𝗰𝗵𝗲 𝗨𝗺𝘄𝗲𝗹𝘁𝗵𝗶𝗹𝗳𝗲 - German Environmental Aid (DHU) has criticized carmakers BMW ($BMW3 (-2.99%)) and Daimler subsidiary Mercedes ($DAII (-3.69%)) are suing. In early September, DHU and Greenpeace issued "climate-protective injunctions" to VW (), BMW, Mercedes and Wintershall (). They were asked to stop selling new cars with internal combustion engines from 2030. Wintershall was asked to stop oil and gas production projects by 2026. As the deadline set expired at ten o'clock last Monday, the lawsuits have now been filed. The basis is a calculation of the remaining CO2 budget available to carmakers to be in line with the Paris climate agreement.

𝗖𝗿𝘆𝗽𝘁𝗼 💎

𝗕𝗿𝗮𝘀𝗶𝗹𝗶𝗲𝗻 - BTG Pactual, one of the country's leading investment banks, is launching a new digital platform called "Mynt" where it is possible to invest directly in cryptocurrencies. Currently, Bitcoin and Ethereum can be purchased through the platform, but the bank has already announced that an expansion to other cryptocurrencies is already in the works.

𝗕𝗶𝘁𝗰𝗼𝗶𝗻 ($BTC-EUR (+1.27%)) - The world's largest cryptocurrency has fallen below a very significant support level over the past day, settling at $44,000. This sharp drop in price is explained by the panic of a possible financial crash stemming from the Chinese stock market. The liquidity bottlenecks of the Chinese real estate company Evergrande ($EV1A) have also had a significant impact on the crypto market, according to the report. On Monday night, the bitcoin price fell a whopping 2 percent in 2 hours to a daily low of $43,400. At the time of writing, the BTC price has not yet stabilized again and currently stands at $43,077.

Trending Securities

Top creators this week