"Rule one is to collect cash flow regularly . Rule two is: never forget rule number one."

Homer Simpson November 8, 2024

Posts

43All of these shares reached new ALL-TIME HIGHS at some point today ⤵️

Nvidia $NVDA (-0.03%)

Amazon $AMZN (-0.02%)

Netflix $NFLX (+0.37%)

Walmart $WMT (+1.81%)

JPMorgan $JPM (+0.97%)

Goldman Sachs $GOS0

Palantir $PLTR (+5.8%)

Blackrock $BLK

American Express $AXP (+0.52%)

Arista $ANET (+0.19%)

Apollo $APO PR A

Blackstone $BX (+1.53%)

Booking $BKNG (+1.31%)

Instacart $INSTA

Caterpillar $CAT (-2.91%)

Capital One $COF (+1.17%)

Discover Financial $DFS (+0.81%)

Electronic Arts $EA (-0.11%)

GE Vernova $GEV (+2.57%)

Hilton $HLT (+1.96%)

Howmet $HWM (+2.93%)

Interactive Brokers $IBKR (+1.86%)

Cheniere $LNG (+2.62%)

Morgan Stanley $MS (+1.35%)

Marriot $MAR (+1.62%)

Nasdaq $NDAQ (+1.15%)

News Corp $NWSA (+2.21%)

Oracle $ORCL (+2.18%)

Palo Alto $PANW (+1.75%)

ServiceNow $NOW (+0.65%)

Steel Dynamics $STLD (+1.87%)

Stryker $SYK (+2.44%)

Royal Caribbean $RCL (+2.93%)

Reddit $RDDT (+1.54%)

Trade Desk $TTD (+3.69%)

Visa $V (+1.22%)

Wells Fargo $WFC (+1.06%)

American Express

$AXP (+0.52%) has secured its place as the second largest holding in the portfolio of Warren Buffett and Berkshire Hathaway $BRK.B (+1.54%) and thus secured Bank of America

$BAC (+1.3%) from second place.

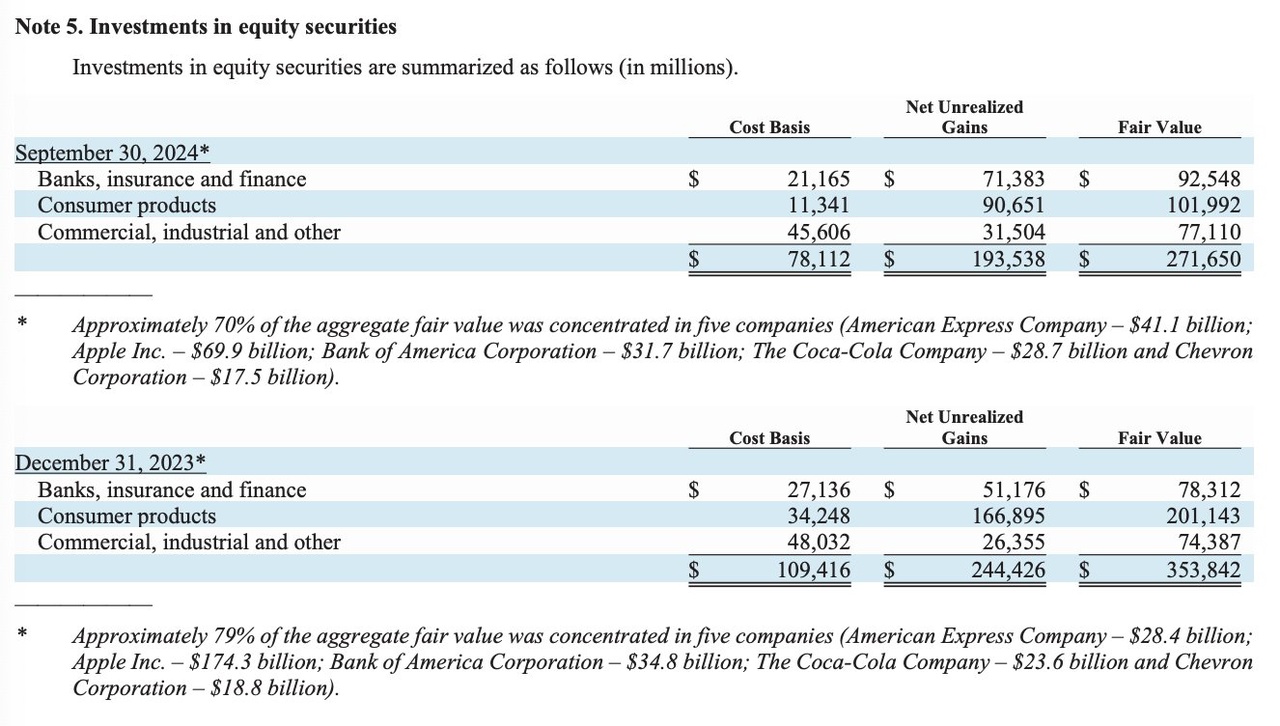

Warren Buffett and Berkshire Hathaway $BRK.B (+1.54%) currently hold Apple shares

$AAPL (+0.65%) worth about 69,9 billion US dollars (as at the end of the 3rd quarter), compared with a previous value of 84,0 billion US dollars.

The cash position at the end of the third quarter amounted to 325,2 billion US dollars, a new all-time high, up from 276,9 billion US dollars at the end of the second quarter.

The Apple share rose by 10.75 % in the third quarter.

If Buffett had not sold any Apple shares during the quarter, his position would now be around 93,3 billion US dollars.

At the end of the third quarter, the largest equity holdings Warren Buffett and Berkshire Hathaway were as follows:

-25,7 % - Apple

$AAPL (+0.65%)(compared to 29.6% at the end of Q2)

-15,1 % - American Express

$AXP (+0.52%)

-11,7 % - Bank of America

$BAC (+1.3%)

-10,6 % - Coca-Cola $KO (+1.1%)

-6,4 % - Chevron

$CVX (+0.94%)

Photo: Bloomberg

Part 2:

The evolution of embedded finance: banks at a crossroads

Reading time: approx. 4 minutes

The emergence and growth of embedded finance have presented banks around the world with a strategic decision: Do they give up "simple" payments and payment processing and focus on more more complex services such as asset management, M&A and IPOs? Or do they continue to build the financial infrastructure to keep pace with fintechs and tech companies?

To grasp the deep understanding of embedded finance and the role of banks, we need to analyze the change in the financial world and the shift in power between traditional banks and tech giants.

Embedded finance: redefining the role of banks

Historically, banks have been banks were not only the main players in the provision of financial products, but also the sole point of access to these services. However, the digital revolution, led by tech giants and fintechs, has profoundly changed the relationship between bank and customer. Embedded financewhich enables the seamless integration of financial services into digital platforms, poses a major challenge for banks.

Technological platforms take over payment processing: Companies such as Stripe, Adyen and Square offer comprehensive payment infrastructures that enable platforms to offer financial services without the direct involvement of a bank. These companies are often faster, more flexible and, above all, cheaper than traditional banks.

Banks as infrastructure providersSome banks have opted to take on a strategic role in the background. They provide the infrastructure for payments and loans but leave the customer experience to the platforms. Examples of this are banks such as Hypothekarbank Lenzburgfintechs such as neon to offer banking services without having a banking license themselves.

Retreat into more complex services: On the other hand, there are banks that specialize in high-quality, advisory-intensive services such as asset management, IPOs and M&A transactions focus. These services require deep expertise, regulatory experience and trust - factors that tech companies struggle to replicate.

Which direction are banks taking?

Banks are faced with a strategic choice between (mainly) two models:

1.) Becoming an infrastructure provider:

Some banks no longer want to be the central interface to the customer, but focus on providing a robust infrastructure. BBVA and Goldman Sachs for example, have started to provide their infrastructure via Banking-as-a-Service (BaaS) to other companies. They provide platforms with the necessary financial tools without being in the foreground. The advantage: they can earn money from a growing number of transactions without competing directly with tech companies.

Advantages for the banks:

Disadvantages:

2) Focus on advisory-intensive services:

Another group of banks is focusing on high-value financial servicesthat require personalized advice and specific know-how. The UBS is an example of this. By withdrawing from the mass business with simple payments and loans, it can concentrate on asset management and corporate finance where margins are higher and there is less competition from tech companies. The divestment of "Swisscard" to AmericanExpress may be an indication that UBS wants (or needs?) to focus on its core business.

Advantages:

Disadvantages:

Technological change and competitive pressure

A key driver of this change is the technologization of the financial sector. APIs enable platforms such as Amazon, Airbnb or Shopifyto offer financial services without a bank in the foreground. These developments have not only made the banking market smaller, but have also put pressure on bank margins increased.

One example of the influence of embedded finance is the shift in credit and payment options. Klarna offers "Buy Now, Pay Later" (BNPL) models directly at the checkout of online retailers. Although the customer thinks they are paying the merchant directly, the actual credit processing takes place in the background via Klarna. The merchant receives their money immediately, and Klarna earns from the customer's installment payments. This underlines how tech companies have taken over the traditional model of the credit business without being a bank themselves.

Banks at a crossroads?

The future of banks will depend heavily on the strategic decisions they make. The The loss of direct customer contact in payment transactions through embedded finance is a challenge, but banks can use this change to either focus on infrastructure or high-value services specialize in either infrastructure or high-value services. However, both require massive investments in technologyto remain competitive.

In the next part of the series, we take a closer look at how the technologies behind embedded finance work and how banks and companies can use these systems efficiently to consolidate their position in the market.

Let me know what you think! - Leave a comment!

Happy investing! 😊

GG

$AXP (+0.52%)

$UBSG (-1.95%)

$ADYEN (-4.7%)

BONUS:

The global embedded finance market in 2023 was estimated at USD 83.32 billion and is expected to grow at a compound annual growth rate of 32,8% further growth. This growth is due to the increase in smartphones and internet access worldwide.

Stay tuned, the series continues! ♥️🔥

$PYPL (+3%)

$GOOGL (-0.6%)

$GOOG (-0.66%)

$AMZN (-0.02%)

$PYPL (+3%)

$AFRM (-2.83%)

💳 The card game of the giants: Visa, Amex, Mastercard - Who will win the payment poker game? 🃏

For the development (company figures), a better view and more, check out the free blog: https://topicswithhead.beehiiv.com/p/das-kartenspiel-der-giganten-visa-amex-mastercard-wer-sticht-im-zahlungspoker

Company Portraits

$V (+1.22%) was founded in 1958 and is headquartered in San Francisco, California. The company operates one of the largest electronic payment networks in the world and is best known for its credit, debit and prepaid cards.

$MA (+0.88%) The company was founded in 1966, is headquartered in New York and is one of the leading global payment providers alongside Visa. It enables payments with debit, credit and prepaid cards via its own network.

$AXP (+0.52%) (Amex), founded in 1850, is a renowned financial services provider headquartered in New York. In addition to payment cards, Amex also offers extensive travel services and is known for its exclusive products, which appeal primarily to affluent customers.

Historical development

Visa emerged from the BankAmericard, a credit card originally issued by the $BAC (+1.3%) was issued. The company was renamed Visa in 1976. The company has been listed on the stock exchange since its IPO in 2008.

Mastercard was created in response to the success of BankAmericard. It was originally a merger of regional bank card networks. The company was listed on the New York Stock Exchange in 2006.

American Express began as an express delivery service and later expanded its offering to include financial and travel services. In 1958, the company introduced its first store card and has since developed a range of exclusive card products, including the famous Centurion card, which was launched in 1999.

Business model

Visa and Mastercard operate as pure payment networks that facilitate transactions between banks, merchants and cardholders. They charge fees for each transaction, but do not bear any credit risk.

American Express acts as both a payment network and a card issuer. As a result, Amex benefits not only from transaction fees, but also from annual fees and interest on outstanding balances. Unlike Visa and Mastercard, Amex bears the credit risk of its cards.

Core competencies and future prospects

Visa and Mastercard stand out for their global reach, technological innovation and strong brand presence. Both companies are investing heavily in digital payment technologies and security systems to consolidate their market position.

American Express, on the other hand, is focusing on its particular strength in the premium segment, with first-class customer service and an attractive bonus program. Amex is also increasingly investing in digital solutions and expanding its offering for business customers.

Strategic initiatives

1. expansion of its presence in emerging markets

2. further development of innovative payment technologies such as contactless payment and blockchain

3. cooperation with fintech companies

4. strengthening cyber security

Market position and competition

Visa leads the market as the largest global payment network, followed by Mastercard. Together, these two companies dominate the market for payment networks.

American Express holds a strong position in the premium segment, but faces challenges, particularly due to the comparatively lower acceptance among merchants, which is attributable to Amex's higher fees.

All three providers are facing increasing competition from new digital payment services such as PayPal, Apple Pay and innovative fintech start-ups.

Total Addressable Market (TAM)

The market for digital payments is growing steadily. Ongoing digitalization and the global trend towards cashless transactions offer Visa, Mastercard and American Express considerable growth potential, particularly in emerging markets, making it almost the global payment market.

Share performance

Over the past few years, all three companies have shown impressive stock performance, with Visa and Mastercard generally outperforming American Express. Visa TR over 10 years is 454%, Mastercard TR over 10 years is 612% and Amex is at a 10 year TR of 259%.

For the performance (company numbers), better view and more check out the free blog: https://topicswithhead.beehiiv.com/p/das-kartenspiel-der-giganten-visa-amex-mastercard-wer-sticht-im-zahlungspoker

Conclusion

With Mastercard and Visa, there is actually a duopoly in the market, which is why it is difficult to choose between the two. In terms of performance, Mastercard has done better, but is also more highly valued. If you can get hold of the shares at a good price, you should go for it; there is not much more you can say.

The situation with American Express is more complex. Although Amex has a network, the company operates somewhat differently and has different risks. Things are going well at the moment, but we have also seen less good times in the past. I therefore consider Amex to be an interesting investment, but less so for me personally. Amex seems too much like a bank in payment transactions, and there are other options that are more attractive to me. There would be $AFRM (-2.83%) Paypal, Klarna or Co would be more interesting.

Hello my investment friends!

Today I would like to present you my analysis of $V (+1.22%) today.

Should I also start providing download links soon, where you could download the whole analysis as a PDF?

September 30, 2024

1. introduction

1.1 Brief description of the company

Visa Inc. is a global leader in payment technology. It provides electronic payment services and enables secure transactions between consumers, merchants, financial institutions and governments. Visa operates one of the largest global payment networks, VisaNet, which processes payments in over 200 countries and regions. The business model is based on charging fees for transaction processing and services, not on granting credit. Visa is active in the areas of credit, debit and prepaid cards as well as digital payments and supports traditional, mobile and online payments.

1.2 Current market situation

In September 2024, the overall economic situation shows stabilization after a period of uncertainty, although several risks remain. Global inflation has weakened, leading to an easing of monetary policy in many countries. This has stimulated consumption and stabilized growth at a moderate level.

For Visa, this situation presents both opportunities and challenges:

Positive impact from interest rate cuts: Interest rate cuts have lowered borrowing costs worldwide, which has led to an increase in consumption. This is having a positive impact on Visa's transaction volume as consumers are spending more and using credit and debit cards to do so.

Cross-border payments and tourism: Travel, particularly in regions such as Asia and Europe, has largely recovered, boosting Visa's cross-border transactions. However, certain markets such as China are showing a decline in travel, which is impacting Visa's revenue in these regions.

Ongoing risks: Despite moderating inflation, fears of recession remain, particularly in Europe and North America. A potential decline in consumer spending could weigh on Visa as uncertainties could affect consumer behavior.

2. fundamental analysis

2.1 Business model and market position

Visa operates a global payment network that enables financial institutions, merchants and consumers to process payments quickly and securely. The company is not a lender, but provides the technological infrastructure through which payment transactions are processed. Visa's main revenue comes from transaction fees charged for processing card payments and from network service fees paid by banks and payment service providers for using the Visa network. They benefit from scaling: the more transactions are made worldwide, the higher the revenue.

Visa is a clear market leader in the area of payment services and the credit card industry. Together with Mastercard, Visa dominates global payment transactions, especially card payments. While Mastercard operates a similarly strong network, Visa has the largest market share in terms of the number of cards issued and transaction volume. In the USA and worldwide, Visa has by far the largest market share among the card networks. Competitors such as $AXP (+0.52%) and $DFS (+0.81%) also have strong positions, but are more focused on specific regions or target groups and often operate as closed systems where they are both card issuers and network operators.

Visa has several long-term moats:

Network effects: The more consumers use Visa cards and the more merchants accept Visa, the more valuable the network becomes for all participants. This network effect creates high barriers to entry for new competitors as Visa has already built a massive global infrastructure.

Global reach and scale: Visa operates in over 200 countries and is able to process payments in multiple currencies and across national borders. This global presence and scalability gives Visa a significant advantage over smaller or regional competitors.

Brand loyalty and trust: Visa enjoys a high level of trust among consumers, banks and merchants worldwide. The brand stands for security, reliability and convenience, making it difficult to lose existing partnerships and customers to competitors.

Technological infrastructure and security: Visa invests heavily in cutting-edge technology to make payment systems safer and faster. Solutions such as tokenization and advanced fraud detection systems provide additional security, which both consumers and merchants appreciate. This creates another moat against competitors who cannot invest on the same scale.

Strong partnerships: Visa has created a deeply rooted ecosystem through close relationships with banks, merchants and payment service providers. These partnerships enable the company to constantly improve its services and tap into new markets.

2.2 Key valuation figures

Tables missing due to missing function

P/E values for the last 15 years

With a current value of 29.5, we are already in a rather high range. However, it should also be borne in mind that we have seen very high values of up to 39 in the past.

P/B values of the last 15 years

With a current value of 13.5, we are in an average range compared to the last few years. The average values of the last 15 years are not relevant here due to different conditions.

P/S values of the last 15 years

With a current rating of 15.3, we are in a rather above-average range for the last 15 years. Of greater significance, however, is the relatively average situation compared to the last 3 years.

2.3 Growth potential

In recent years, the company has recorded steady sales and profit growth, driven mainly by the growing acceptance of digital payments and expansion into new markets. Visa has achieved average revenue growth of 10-12% per year in recent years. In 2023, revenue increased by around 11% compared to the previous year. This increase was driven by the growing use of digital payment methods and the increasing use of real-time payment systems. Visa's profits also developed strongly, with double-digit growth rates in recent years. High operating margins of over 60 % contributed to this increase, as the company was able to scale its digital payment solutions efficiently. Similar profit growth and strong annual profit growth of 10-15% are forecast for the future.

Visa has invested heavily in technology and innovation in recent years. Key new products and services include:

Again this year, they have introduced many new digital products and services specifically focused on security, fraud protection and payment optimization. Some of the notable new developments include:

Visa has continued to focus on expanding its reach in emerging markets in recent years. The company sees enormous growth potential in regions such as Southeast Asia, Latin America and Africa in particular, as the digitalization of payments is not yet fully advanced there. The company is investing heavily in partnerships with local financial institutions and fintech companies in order to increase the acceptance of digital payment methods. In countries such as India, Visa has already made significant progress through collaborations and customized payment products. Just this spring, for example, they also partnered with fintech company Numa to expand into the Saudi Arabia and UAE markets.

Visa uses acquisitions to integrate new technologies and penetrate emerging markets. One of the most notable acquisitions was Tink, a leading open banking company that is helping them to further establish themselves in Europe. In addition, Visa is investing heavily in AI and cybersecurity companies to strengthen its capabilities in fraud detection and payment security. Most recently, they have announced that as part of its expansion strategy, they will acquire UK-based Featurespace, which specializes in artificial intelligence (AI)-powered fraud prevention and financial crime protection. This acquisition, which is expected to be completed in financial year 2025, aims to strengthen Visa's portfolio in the area of fraud detection and risk analysis. By using Featurespace's AI algorithms, they will be able to combat fraud in real time, which should increase confidence in digital payment systems worldwide.

3. technical analysis

3.1 Chart analysis

In the long term, Visa is in a sustained upward trend, which is occasionally interrupted by medium-term corrections. We have been experiencing such a correction since March of this year. At the beginning of August, the re-entry into an old FVG (€ 231.70-232.12) led to a highly probable reversal of the short-term downtrend. Since then, we have returned to the structure of an upward trend, which was, however, impaired by the news about the antitrust lawsuit. As a result, the price corrected again into a FVG (€237.45-241.72), from which we have risen again so far.

The chart structure to date does not indicate a continuation of the medium-term downtrend. However, if the FVG is broken in the range of € 237-241, this would be a bearish signal and would probably trigger a further decline to below € 232.

3.2 Indicators

The 9 moving average crossed the 21 moving average to the downside a few days ago, which is generally seen as a bearish signal. However, only limited importance should be attached to this indicator in the daily chart, as it depicts short-term movements. In the weekly chart, on the other hand, this indicator is more meaningful when it comes to recognizing medium to long-term trends. A bullish signal is emerging here over the next few days. In addition, we are currently back above the 200-day line, which can be seen as another positive sign.

Another signal for a possible end to the medium-term correction is provided by the RSI indicator. When the price reached a lower low and dipped into the FVG (Fair Value Gap) in the range of € 231.70-232.12, this was not confirmed by the RSI. Instead, the RSI formed a higher low. This phenomenon is known as bullish RSI divergence and often indicates the end of a downtrend. It signals that the selling pressure is easing, although the price has continued to fall, which could indicate an imminent trend reversal.

3.3 Volume analysis

Since the last FVG was reached, the price increase has been accompanied by significantly above-average volume. On each of the two relevant days, twice the average volume was traded. In addition, the on-balance volume indicator (OBV) shows an increase, which points to increased buying pressure. Both factors indicate that the price could be in a sustained upward trend. This increases the likelihood that the current rise will be underpinned by broad market support and could continue.

4. SWOT analysis

4.1 Strengths

4.2 Weaknesses

4.3 Opportunities

4.4 Risks

5 Evaluation and conclusion

5.2 Comparative evaluation

Visa is currently valued with a P/E ratio that is just below the industry average and lower than that of Mastercard, but higher than that of $PYPL (+3%) . This lower valuation compared to Mastercard could indicate that the market expects more growth from Mastercard due to its higher innovation and aggressive investment in new technologies such as blockchain and digital currencies. Visa, however, remains solidly and stably valued as it relies on its strong market position and scaling of existing payment systems. PayPal, on the other hand, has the lowest P/E ratio, which could indicate lower growth expectations

5.3 Risk assessment

Visa has some weaknesses and risks, which were explained above and should be taken into account. Nevertheless, in my view the strengths outweigh the weaknesses, in particular the market leadership, the strong brand awareness and the network effect. These factors give the company a solid basis for future growth. In my view, the risks and opportunities do not completely balance each other out, but the strengths outweigh the risks, which leads to a more positive assessment of the future prospects. For me, this definitely speaks for a lucrative risk/reward ratio.

5.4 Summary

Based on the entire analysis, the following can be said:

Visa is definitely a stock that has earned its place in the portfolio of long-term investors. Based on the company's current efficiency and profitability, it can be predicted that Visa will continue to grow strongly in the future. Its transaction fee-based business model and multiple moats - such as network effects, global presence and strong partnerships - provide the company with long-term stability and security. These factors promise that even in volatile market phases, Visa is well positioned to mitigate risk and continue to generate solid returns.

The technical data already provides a solid foundation for a potential uptrend. Nevertheless, I am not yet fully convinced, as another small setback seems possible. I would see a final confirmation of the uptrend if green candles with above-average trading volumes appear again in the next two days. An intersection of the 9 and 21 moving averages (MAs) in the weekly chart would be equally decisive, which would represent a strong bullish signal.

These factors would strengthen confidence in the continuation of the trend and minimize potential risks. However, until these signals materialize, I remain cautious and do not recommend buying the stock yet. For existing shareholders, however, I think it is advisable to hold the position and even consider buying more in the event of a possible setback in order to fully exploit the share's potential.

I hope I have been able to help you with this analysis!

Your duck

My opinion on the DOJ lawsuit against VISA

The DOJ Visa $V (+1.22%) lawsuit is absolutely laughable.

Visa is clearly not a monopoly, Mastercard $MA (+0.88%) is also still there. If you want, you can add American Express $AXP (+0.52%) can also be included. To apply double standards here is simply extremely unprofessional.

The DOJ is particularly bothered by the "client incentives" and debit cards. The "client incentives" are simply marketing expenses to Visa customers. These do not even serve to exclude others, everywhere you can pay with Visa, Amex, Mastercard and PayPal are also accepted.

The focus here is only on debit cards and not credit cards, in order to develop a narrative that Visa is harming the "poor" here.

In addition, Visa's fees are allegedly partly to blame for inflation. Anyone who has ever looked at quarterly reports from Visa or Mastercard knows that this is absolute bs.

On the one hand, the DOJ claims that Visa charges too high a fee, forcing merchants to permanently raise their prices. On the other hand, it bothers the DOJ that these merchants receive money from Visa.

The fact that merchants choose Visa (also Mastercard and Amex) because the transaction network is extremely secure and a basis of trust is ignored.

The DOJ, which is so concerned about consumers, also doesn't seem to realize that none of these consumers need to use Visa's network in any way. They also ignore the fact that paying with cash also incurs costs (article in the comments).

I really hope the DOJ doesn't start looking for scapegoats for inflation now.

If that is the case, it looks very politically motivated to blame others afterwards, as always, but not those who make the political decisions that were/are a driver of inflation.

US election campaign - major figures from the business world support Kamala Harris

In a letter to presidential candidate Kamala Harris, 88 personalities with immense experience in the management of billion-dollar companies have announced their support for her candidacy.

The reasons given are:

Among the endorsers are:

https://www.cnbc.com/2024/09/06/harris-endorsed-trump-murdoch-yelp-snap-ripple.html

Top creators this week