Build a portfolio with a STRONG FOUNDATION

ETFs are the easiest way to do this

$SPY (+0.28%) S&P 500

$QQQ Invesco QQQ

$VTI (+0.35%) Vanguard Total Market

$DGRW WisdomTree Div Growth

$SCHD Schwab US Dividend Equity

Posts

5Build a portfolio with a STRONG FOUNDATION

ETFs are the easiest way to do this

$SPY (+0.28%) S&P 500

$QQQ Invesco QQQ

$VTI (+0.35%) Vanguard Total Market

$DGRW WisdomTree Div Growth

$SCHD Schwab US Dividend Equity

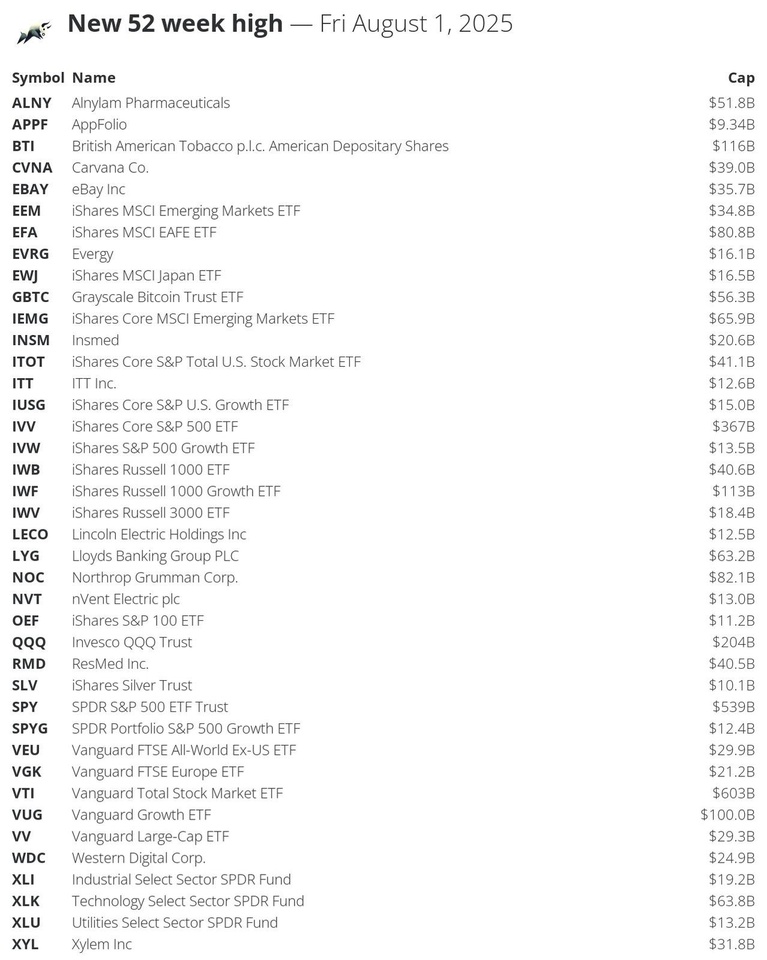

🔝 Stocks that made a new 52-week high today: $VTI (+0.35%)

$SPY (+0.28%)

$IVV (+0.25%)

$QQQ

$BTI (-1.24%)

$IWF (-0.07%)

$VUG (-0.09%)

$NOC (+0.46%)

$EFA

$IEMG (+0.21%)

$XLK

$LYG

$GBTC

$ALNY (-1.6%)

$ITOT (+0.32%)

$IWB (+0.26%)

$RMD (+0.91%)

$CVNA (-2.65%)

$EBAY (+1.9%)

$EEM

$XYL (+0.51%)

$VEU (+0.56%)

$VV (+0.26%)

$WDC (+1.28%)

$VGK (+0.36%)

$INSM (+1.15%)

$XLI

$IWV (+0.32%)

$EWJ (+2.08%)

$EVRG (+1.82%)

$IUSG

$IVW

$XLU

$NVT

$ITT (+0.32%)

$LECO (+2.78%)

$SPYG

$OEF (+0.16%)

$SLV

$APPF (-0.09%)

#52weekHigh

I've been asking myself a huge doubt for weeks:

The perfect allocation I want would be 50% $VTI (+0.35%) and 50% $VXUS ... 2 ETFs, covering the large, mid and small-cap market, low purchase commissions, very low management costs (0.05% on average) and assets divided into only two securities.

The cons of this allocation are having American distribution ETFs that pay me dividends in $ taxed at 26% immediately (living in Italy).

Perhaps, the most suitable alternative for a European investor would be to purchase 4 ETFs which, applying the right %, more or less replicate the allocation of the two above, with higher but more efficient management costs for passive investments (45% $VUAG (+0.23%) , 34% $EXUS (+0.59%) , 15% $EIMI (+0.46%) , 6% $WSML (+1.24%) ).

Having the possibility to purchase both ETFs domiciled in Europe and USA, what would you do?

Now if i look to retire at 65 (im 46) holding $VTI (+0.35%)

$JEPQ

$BNDW

$VXUS as my long term holds and $ARCC (-0.49%) and $ZIM (+1.12%) for the see how it goes but if it stays in the red not to fussed stocks - anyone got suggestions on maybe what to change.

The two for fun ones (Zim and Arcc) Im not to fussed about and they are just loose change at the moment but maybe will drop more $$ in to them at a latter stage.

$BNDW

$VXUS

$VTI I make a point of putting around $400 in each month

$ARCC (-0.49%) Only got 6 at the moment but looking to up my positions, just wondering what everyone thinks of this stock for the long term and using the Dividend to put towards something like $VTI (+0.35%)

Top creators this week