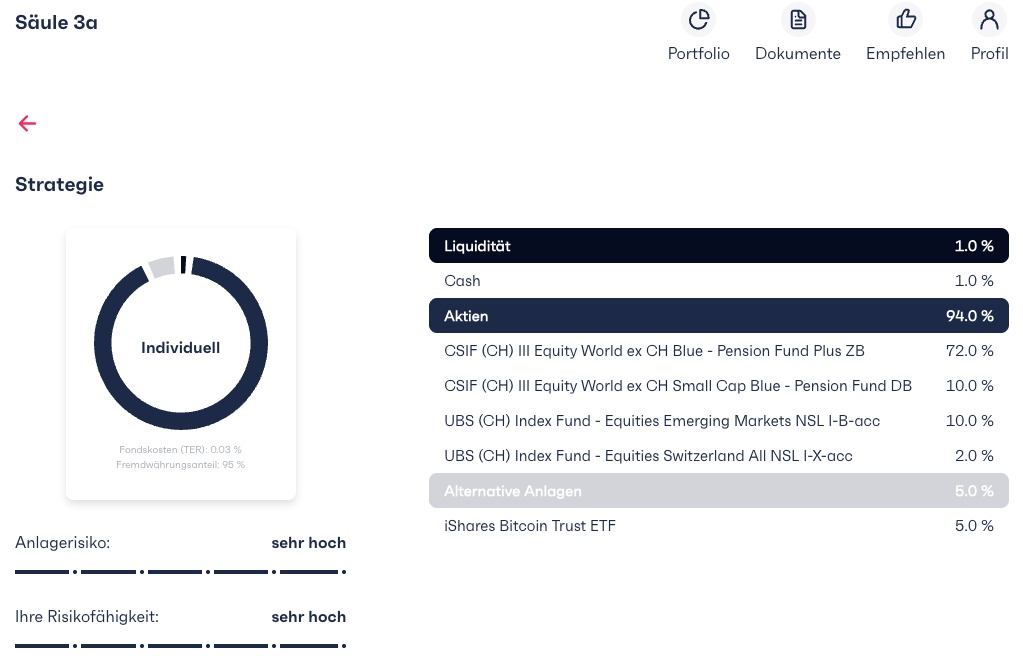

$BTC (+1.89%) From now on, payments will only be made into the 3a pillar with Finpension, but with a 5% $IBIT allocation 😀

#steueroptimierung

#3a

#finpension

#viac

#schweiz

Posts

20$BTC (+1.89%) From now on, payments will only be made into the 3a pillar with Finpension, but with a 5% $IBIT allocation 😀

#steueroptimierung

#3a

#finpension

#viac

#schweiz

Investors today face a striking dilemma. The S&P500, once the epitome of broad diversification, is now dominated by a small number of AI tech giants. Their share prices have risen so much that the index has almost become a mirror image of a handful of expensive companies. The risk of that is clear: if one of those giants stumbles, the whole market feels the blow. In contrast is the largest cryptocurrency.

Despite fluctuations, it offers momentum that is less dependent on a single cluster of companies.

Whereas the S&P500 floats on overconcentrated and pricey expectations, crypto actually seems to promise more room for new capital flows and growth. For those looking ahead, that's a compelling argument.

$VOO (+0.04%)

$VUSA (+0.65%)

$BTC (+1.89%)

$XRP (+1.37%)

$ETH (+3.16%)

$SOL (+2.32%)

$MSTR (+1.82%)

$BMNR (+3.32%)

$MARA (+1.14%)

$IBIT

$IB1T (+1%)

$ETHA

It's getting more and more exciting 👌

Joseph is the former Head of Digital Asset Strategy at BlackRock, where he worked on the launch of $IBIT and $ETHA -ETFs where he was involved.

Joseph Chalom:

After 20 years at BlackRock and helping to lead the digital asset strategy, I'm starting a new chapter:

I've joined SharpLinkGaming ($SBET) as co-CEO.

Here's why:

At BlackRock, I helped launch the following:

- IBIT - the world's largest Bitcoin ETP

- ETHA - the world's largest Ethereum ETP

- BUIDL - the world's largest tokenized fund (built on Ethereum)

We didn't just talk about digital assets, we built a bridge between TradFi and crypto.

Now I'm joining SharpLinkGaming ($SBET), a company led by Joseph Lubin and built on a clear belief:

That Ethereum ($ETH (+3.16%) ) will become the foundation of the global financial world.

And I couldn't agree more.

Stablecoins, tokenized assets, AI agents - everything is moving on-chain.

And it's happening on Ethereum.

That's where the future is being built.

SharpLink is already one of the largest corporate holders of $ETH (+3.16%) .

Our goal is not only to $ETH (+3.16%) but to activate it using native staking, restaking and Ethereum-based yield strategies.

All to increase the value of our coffers and create long-term value for shareholders.

We build a bridge between institutional capital and Ethereum-native returns, wrapped in a single public equity.

The asset is $ETH (+3.16%) , the ticker is $SBET (+3.45%) .

Bitcoin Smashed Through New All-Time High of $119,450, Signaling Strong Bull Run

Bitcoin hit a fresh peak at $119,450 today, breaking above the key $110K resistance with impressive trading volume. The RSI reading above 70 confirms solid bullish momentum, while the 50-day moving average now sits near $100K, offering clear dynamic support. On the macro level, rising institutional flows, halving effects, and growing adoption keep tailwinds firmly in place.

Investors using a dollar-cost averaging plan over the past five years have earned returns that far outpace any standard savings account. By buying a fixed amount of BTC each month, they smoothed out volatility and captured gains through every cycle. For savers seeking better yield and willing to weather ups and downs, DCA into Bitcoin remains a smart, long-term strategy. $BTC (+1.89%)

$SOL (+2.32%)

$ETH (+3.16%)

$XRP (+1.37%)

$XLM (+1.41%)

#bitcoin

$IBIT

$IB1T (+1%)

Introduction:

BlackRock and T. Rowe Price are two prominent asset managers that offer both active funds and ETFs. When deciding whether to invest in these companies' stocks, their active funds or their ETFs, it is important to understand the differences and characteristics of these investment vehicles.

Shares of asset managers:

Active funds vs. ETFs:

Cost comparison:

Performance comparison:

Some studies show that actively managed funds can outperform passive ETFs in certain market phases. For example, actively managed growth funds from T. Rowe Price and Fidelity outperformed the Vanguard Growth ETF over a short period.

Bottom line:

Choosing to invest directly in BlackRock or T. Rowe Price stocks offers the benefit of participating in the success of these asset managers, including their exposure to the crypto space, particularly BlackRock. However, this comes with specific business risks. Buying ETFs from these providers allows for broader diversification but reduces direct exposure to cryptocurrencies. The choice should be made based on the investment period and risk appetite.

I would be interested to know how you see this and why you chose the exact asset you have in your portfolio?

Ps: If there are any spelling mistakes or anything else, please let me know. Should be an attempt to have a discussion at a higher level.

The game theory continues and the next state actor has jumped on the $BTC (+1.89%) bandwagon🚀

The world's third-largest sovereign wealth fund with AUM of USD 1.057 trillion invested USD 24,436 million in Q4 $IBIT invested.

This was revealed in a 13F filing with the SEC:

https://www.sec.gov/Archives/edgar/data/1704268/000108514625001478/xslForm13F_X02/infotable.xml

Since yesterday, options trading of the BlackRock Bitcoin ETF $IBIT has been possible.

The derivative has collected almost USD 2 billion within 24 hours.

The following video by Florian Bruce-Boye explains quite well what this means and what new opportunities it opens up, especially for institutional investors.

It also explains why the price could potentially explode as a result. Take a look if you are interested:

20.11.2024

Walmart raises forecast again + Bitcoin: Is the next price explosion already in the starting blocks + Symrise wants to take over Swedish biotech company Probi completely

The US supermarket group Walmart $WMT (-0.64%) is once again raising its forecast. Net sales are expected to increase by 4.8 to 5.1 percent in the current financial year (until the end of January), excluding currency effects, as the company announced on Tuesday in Bentonville, Arkansas. Walmart had already raised its outlook in mid-August and expected growth of 3.75 to 4.75 percent. The share price rose by almost five percent in pre-market trading and is therefore likely to continue its record rally. According to the new forecast, operating profit adjusted for special effects is expected to increase by 8.5 to 9.25 percent. Previously, the supermarket group had only expected 6.5 to 8 percent. Walmart is now planning adjusted earnings per share of 2.42 to 2.47 US dollars, compared to the previous target of 2.35 to 2.43 dollars. In the third quarter of the financial year to the end of October, sales rose by 5.5 percent to 169.6 billion dollars (160.58 billion euros) compared to the same period last year. Adjusted for currency effects, the increase amounted to 6.2 percent. Adjusted operating profit increased nominally by 8.2 percent to 6.7 billion dollars. Adjusted earnings per share rose by just under 14 percent to 0.58 dollars. Walmart's figures exceeded analysts' expectations.

In the USA, another milestone in the development of Bitcoin $BTC (+1.89%) into an established investment instrument. Yesterday, trading in options on the BlackRock Bitcoin ETF (IBIT) $IBIT started yesterday. This could lead to a huge price explosion à la MicroStrategy $MSTR (+1.82%) price explosion. On November 18, the Options Clearing Corporation (OCC) announced that the necessary regulatory preparations had been completed. The IBIT ETF will be the first Bitcoin spot ETF on which options can be traded. Nasdaq plans to list the options starting November 19, as Alison Hennessy, Head of ETP Listings, explained.

The probi main shareholder Symrise $SY1 (+0.42%) wants to acquire its Swedish biotech investment. The manufacturer of fragrances and flavors wants to pay 350 Swedish crowns (30.24 euros) in cash for each outstanding share, the DAX-listed company announced on Wednesday. The offer corresponds to a premium of 42 percent compared to the closing price on Tuesday. In total, the Probi acquisition is valued at just under four billion crowns (344 million euros). Shareholders are expected to be able to accept the offer from December 18. Symrise already holds almost 70 percent of the shares in Probi. The largest shareholders after Symrise, Fjärde AP-fonden and Moneta Asset Management, have also already accepted the offer - they hold just under 18 percent of the outstanding shares. As soon as Symrise owns more than 90 percent of all shares, Probi will reportedly be delisted from the stock exchange.

Wednesday: Stock market dates, economic data, quarterly figures

ex-dividend of individual stocks

Hasbro USD 0.70

Target 1.12 USD

Quarterly figures / company dates USA / Asia

14:30 Delta Air Lines Investor Day

15:00 Stanley Black & Decker Capital Capital Markets Day

22:20 Nvidia quarterly figures

No time specified: Snowflake | Target | Palo Alto Networks Quarterly figures

Quarterly figures / Company dates Europe

08:00 Sage Group | British Land Company Quarterly figures

08:30 Symrise Capital | STMicroelectronics Markets Day

09:00 Novartis: Meet Novartis Management 2024

09:30 VW: IG Metall - Volkswagen Works Council, presentation of future concept for the VW brand

10:00 HSBC Holdings AGM

Economic data

$BTC (+1.89%)

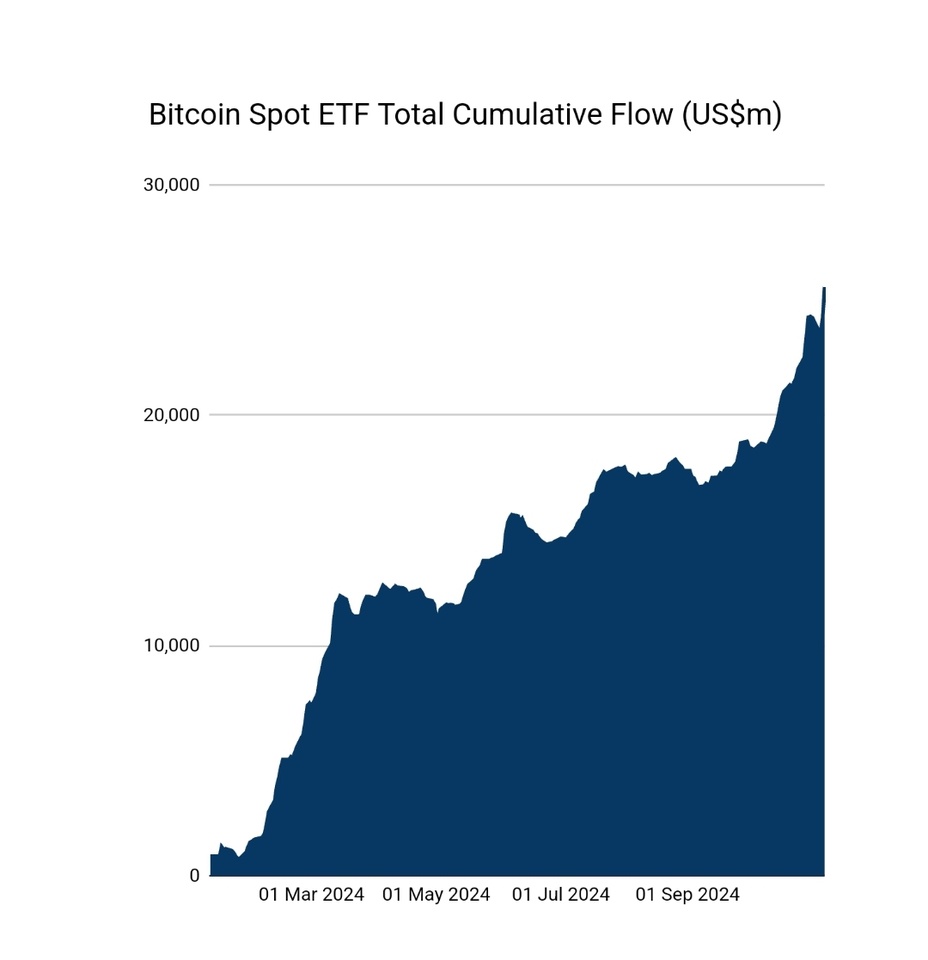

Spot ETFs had an absolute record day yesterday 🚀

On yesterday's trading day alone, over 1.3 billion dollars flowed into the Bitcoin Spot ETFs, which is a record.

The $IBIT of $BLK received 1.1 billion $🤯 alone

This brings the inflows since the ETFs started trading in January to over 25.5 billion dollars.

To put it in Larry Fink's words "$IBIT is the fastest growing ETF in the history of ETFs."

Source: https://farside.co.uk/btc/

Top creators this week