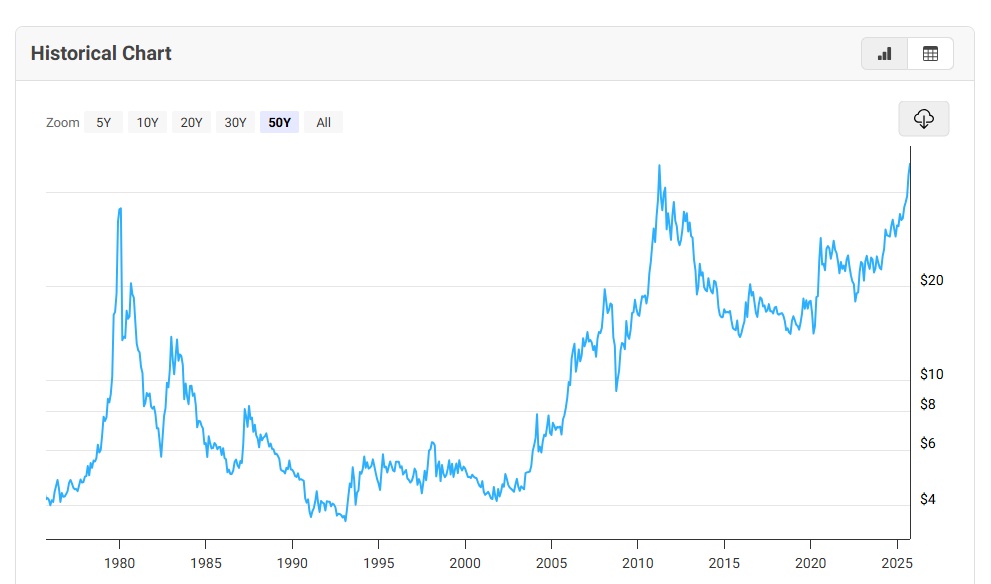

The crucial resistance has been broken. After more than 45 years, $965310 hits a new ATH at $51! What's next?

On the 50 year chart this means a breakout of the cup/handle pattern. Which indicates we could see significantly more gains. My target is well into the tripple digits, why?

- The 2011 high of $50 ajusted for inflation is $75 dollars.

- The 1980 high of $50 ajusted for inflation is $160 dollars.

- During previous highs of silver the gold/silver ratio was extremely low. While right now the gold/silver ration is extremely high, which indicates silver has to outpace gold the coming years to match the previous bull markets.

- Masive short positions on $SLV (+0.97%) could trigger a short squeeze

- Less silver is mined every year (including recycling)

- More silver is required by industries every year

- This means the yearly deficits are only getting worse from now on

- Add to that, increased retail investor demand because of FOMO

This all means a perfect storm for silver.

What are your plans? Selling to take profit? Buying more? Or just hold and enjoy the ride. Let me know.