After prolonged tensions and disagreements over the economic policy course, particularly with regard to the debt brake and investmentsChancellor Olaf Scholz effectively ended the traffic light coalition on November 6, 2024 with the dismissal of Finance Minister Christian Lindner (FDP) ended. The FDP then withdrew from the government and left the previous coalition with the Greens and the SPD broke up. Scholz sharply criticized Lindner's financial policy and accused him of using one-sided austerity policy the urgently needed modernization and promotion of growth in Germany.

In order to clarify the situation and "secure" the confidence of the Bundestag Scholz held a vote of confidence for January 15, 2025 has been announced. Should he lose this, the path for new elections would already be open end of March 2025 would be free. The CDU/CSU however, are calling for a quicker vote and are banking on new elections as early as January. Until the new elections, Scholz would form a minority government with the Greens would lead.

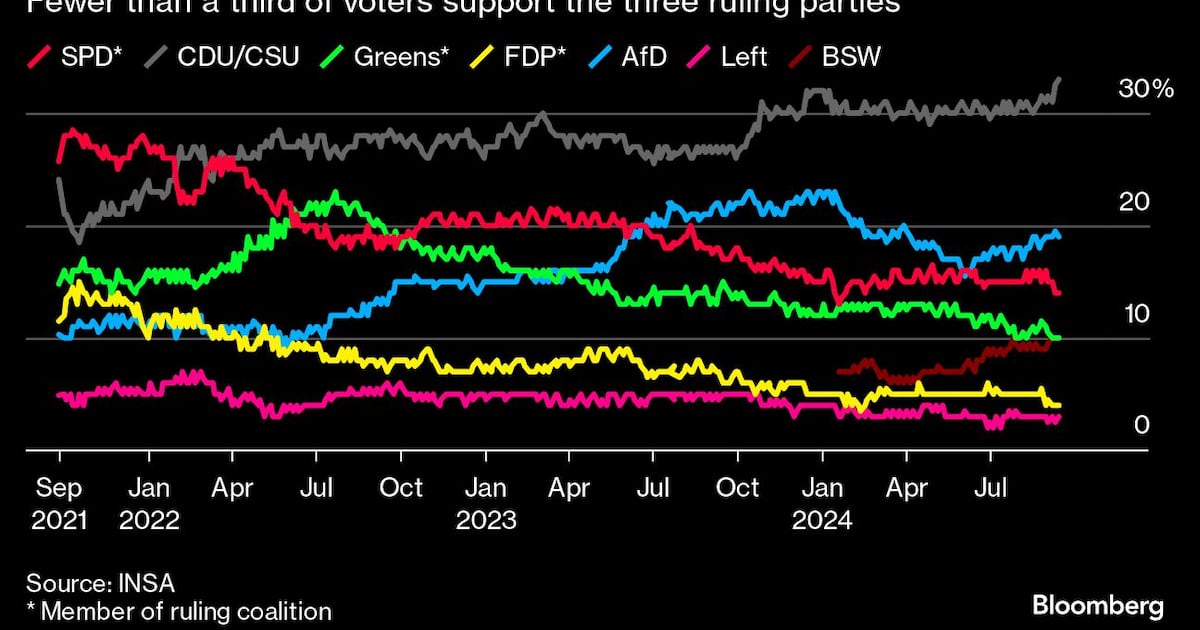

The upcoming new elections could lead to a clear change of direction in Germany. Currently, the CDU/CSU dominate the opinion polls with around 32%. Voters who are disappointed with the previous traffic light coalition could now switch to a more conservative, more business-friendly program program. It is assumed that the election campaign topics will primarily focus on economic policy issues. At a time when Germany is struggling with weak economic growth, investment laziness and infrastructural challenges issues surrounding the debt brakefinancing public investment and ways to revive the economy could play a central role.

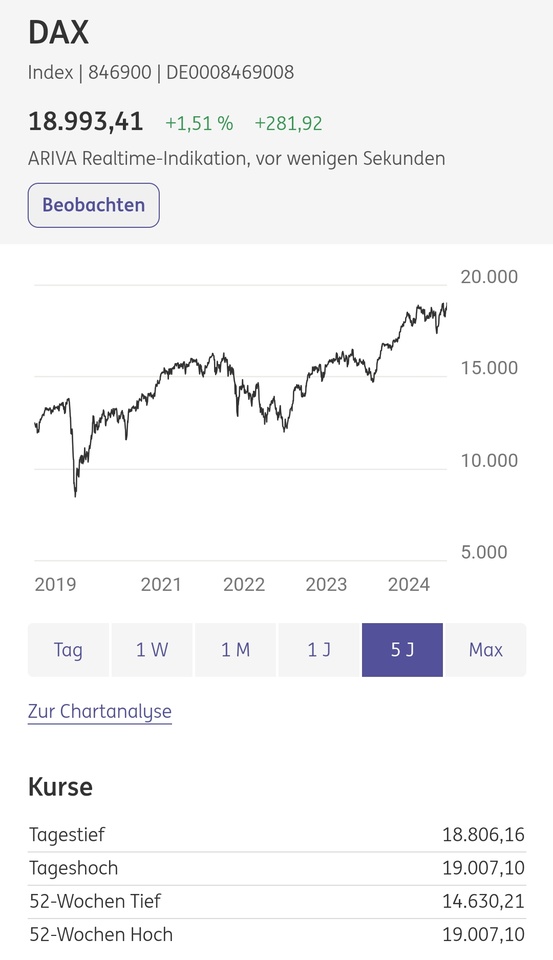

The political instability could short-term put pressure on the DAX $DAX under pressure in the short term. The index recently reached 19,275 points, a record high. Especially the sectors automotive industry ($VOW3 (-0.31%) | $MBG (-1.69%) | $BMW (-2.54%) ), the energy sector ($RWE (-2.42%) | $EOAN (-0.04%) ) and infrastructure companies could be affected by increased volatility due to their dependence on government increased volatility but this would also be limited.

At the heart of the crisis is the question of whether the debt brake can be relaxed in order to allow urgently needed investments in infrastructure, education and digitalization financing. The possibility of a new government pursuing a looser fiscal policy could have a positive effect on the German economy and remove barriers to investment. reduce barriers to investment reduce barriers to investment.

A clear economic policy signal after the new elections could boost the confidence of investors and the long-term growth prospects of Germany. Election campaign topics such as structural reforms, improvement the competitiveness and investments in a sustainable infrastructure could lead Germany into a phase of sustainable growth.

Unfortunately, the political crisis comes at a time of geopolitical change, particularly with Donald Trump's return to the White House. Germany's role on the international stage, especially in transatlantic transatlantic relations and in trade issuescould be influenced by this realignment. The possibility of punitive tariffs or changes in US policy could economic policy decisions and investment decisions German companies even more difficult.