Does anyone have any idea why the msci world has fallen so much? According to the website it should be €2 higher. My other one is plus minus zero. So how can it be down 2%?

- Markets

- ETFs

- Amundi MSCI World III ETF

- Forum Discussion

Amundi MSCI World III ETF

Price

Discussion about AHYQ

Posts

9Conversion of my depot from Q2 2025!!!

Thank you for your constructive tips, suggestions and criticism!!! 👍🏻👌🏻 (@Chucky075 , @DADlikesCRYPTO , @Aktienmasseur , @Meikl_22 , @Dividenden-Sammler , @Berliner_Weltenbummler , @Epi)

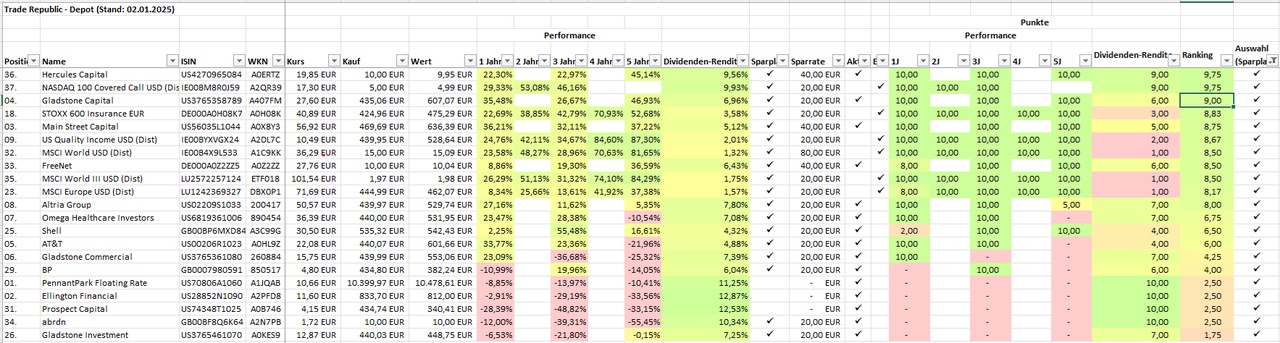

I sat down and picked my portfolio apart. I evaluated each stock & ETF. I took a close look at the performance and dividend yield of the individual stocks and rated them according to points. Based on this points plan, I selected 6 ETFs for the new portfolio.

From 22 ETF titles, only 6 ETFs remain. I have selected the following ETFs:

- $HMWO (+0.37%)

EUR 460.00 from the savings rate (approx. 82.14%)- $AHYQ (+0.24%)

EUR 40.00 from the savings rate (approx. 7.14%)- $FUSD (+0.34%)

EUR 40.00 from the savings rate (approx. 7.14 %)- $EXH5 (-0.7%)

EUR 40.00 from the savings rate (approx. 7.14 %)- $XIEE (+0.84%)

EUR 40.00 of the savings installment (approx. 7.14 %)- $QYLE (+0.52%)

EUR 40.00 from the savings installment (approx. 7.14 %)

All shares remain in place and are saved through savings plans. Furthermore, I have decided to leave the remaining 16 ETFs in the portfolio, but not to save any more.

The allocation of the portfolio should consist of 70% ETFs and 30% individual shares. The savings installment is EUR 800.00 per month. EUR 240.00 will be invested in individual shares and EUR 560.00 in the above-mentioned ETFs.

What do you think?

Do you have any tips or ideas?

Of course, I hope I've found the right approach now. 🙈🙊

I would appreciate some constructive help!

I have been investing myself since 2013 and started with individual shares and options (leverage products). In my youthful recklessness, I had to learn the hard way. Fortunately, I have been able to recoup my losses very well over the years.

For this reason, I have steered clear of options since 2014 and now only invest in individual shares and ETFs.

In 2023, I started to set up a portfolio for my retirement provision (see below). For this reason, I liquidated my old portfolio with good profits and reinvested them in the new portfolio.

The new portfolio is saved monthly in the amount of EUR 800.00 through savings plans. Some of you are probably wondering about the large position $PFLT (+0%). I have held this single share since the beginning and it offers a good cash flow with few price fluctuations.

I follow a dividend strategy myself, so I always have some liquid funds available and can allocate them better to the individual positions.

The position $PSEC (+0%) will not continue to be held after a dividend cut.

It's not the best portfolio. But so far I'm satisfied. Nevertheless, I would be very happy to receive help and tips from you. ☺️

Thank you already for your feedback!!! 👌🏻👍🏻

So: what are you interested in? Max return? Min max drawdown? Min vola? What is your goal, what is your risk profile?

Without everything, I would always recommend the Epi portfolio: 60% world AG, 20% gold, 20% BTC. Above-average return with average risk. Unfortunately, your suggestions have neither. 🤷

Hello dear community,

today I would like to ask you for feedback on my portfolio.

Briefly about me, I am just in my early 30s and started investing after my studies in 2019. After my apprenticeship and a short time as an employee, I successfully completed my studies, which I paid for with jobs during the semester break. As traveling, living and self-financing were very important to me during my student days, I had exactly €0 in my account at the start of my second working life.

I then started investing smaller amounts in 2019. Money has been flowing into my account really regularly since 2021. During my time as an investor, I made a lot of mistakes, sold too early at the beginning, then bought Canadian penny stocks with my roommate, but fortunately only in moderation. I am not pursuing a pure growth or dividend strategy, but would like to have a balanced portfolio mix. My investment horizon will be until I retire, so I will have a few years left, around 30-35. As I earn relatively well, my savings rate is around €1000 per month, which is divided between ETFs and individual share savings plans. To all those who don't like savings plans in individual shares - for me they are a good tool and I don't regret it. I also make individual purchases from time to time.

About my stocks. Many of you will no doubt mention the duplications in my portfolio. First of all, I would like to talk about the world ETFs. Initially, I had an MSCI World $AHYQ (+0.24%) and additionally a $IEEM (+0.44%) . I have kept these in my portfolio, but now I am saving the $VWRL (+0.33%) instead, as I have found it to be better for me personally and it still covers a small proportion of EM. As I am an employee of a large company, this stock is relatively well represented in my portfolio due to an employee share program and will continue to grow.

I am currently considering $META (+0.62%) , $AMZN (+0.51%) , $MSFT (+0.28%) and $AAPL (+0.65%) selling my individual shares one by one and investing the capital in $VWRL (+0.33%) (taxes then become a nasty issue). I would collect these again in another market situation and then possibly sell them again. There are also other duplications here, such as $MUV2 (-0.49%) , $ALV (-0.8%) or $KO (-0.7%) , $PEP (-0.04%) or $MO (+0.14%) , $BATS (-0.95%) , etc. My idea behind this is to avoid a cluster risk.

In future, I would like to increase my holding in $VWRL (+0.33%) and expand the individual shares with smaller amounts. If there are favorable opportunities for individual shares, I may take them. However, I don't really want to increase my number of positions significantly. Why don't I invest in an accumulating world ETF? Quite simply - I dream of being able to retire earlier and live off my dividends. I don't know if I can achieve this and would be more likely to do so with an accumulating one --> maybe, but I just feel comfortable with my few dividends at the moment.

In addition to my custody account, I currently have a small 5-digit amount in Trade Republic, which earns 4% interest. Maybe it will turn into a small property. As long as I have the 4 or 3.75%, I'm happy with it for now.

I'm actually very happy with my portfolio performance, although it could have been better if I hadn't made any mistakes at the start. I am reinvesting all my dividends and would like to break the magic 100,000 portfolio value next year.

I hope I haven't forgotten anything important, otherwise just ask me about it.

AND I am happy to receive tips, suggestions and angry comments as to why I don't have an accumulating ETF :)

Thank you.

I was hoping for some feedback and that's why I put everything out in the open 😁

I'm mostly a silent reader but maybe the people who swirl through my feed have some feedback for me.

@Simpson @GoDividend @DividendenWaschbaer @Michael-official @Fabzy @finanzperpetuum @KevinC @Alumdria

Thank you!

My old EM ETF was converted last year: $AE5A (+0.6%)

I have been in the red here for 2 years, even with the previous EM ETF. current performance -7.80% . Performance incl. div. -4%

Now the situation in China is becoming increasingly delicate, I am considering switching to an ETF without China or simply taking an All World. $AHYQ (+0.24%) I have also been running since I entered the stock market.

I would just like to hear some opinions.

Thank you.

$AHYQ (+0.24%) does anyone know when the Etfs of Amundi distribute? Have yes since the beginning of the year the Etfs of Lyxor taken over. Lyxor has distributed in July.

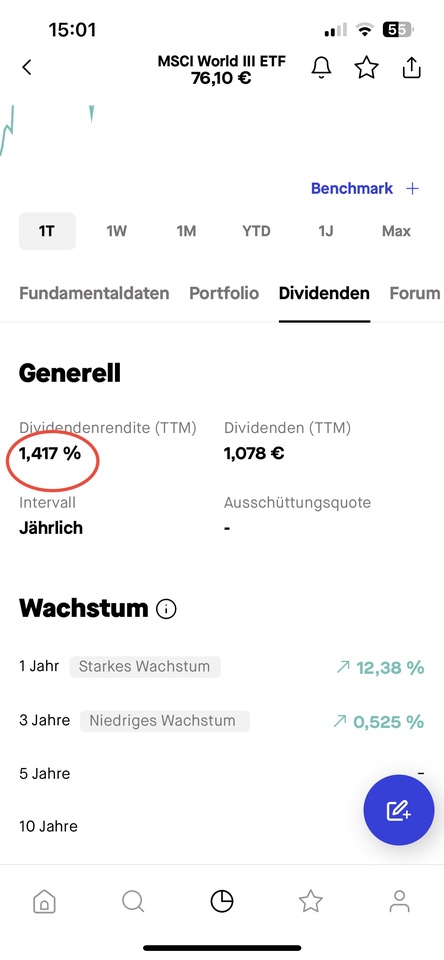

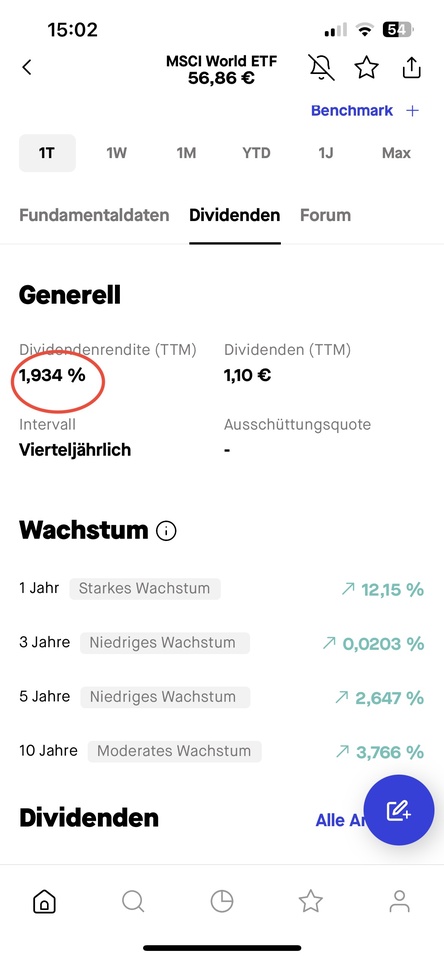

How can it be that two MSCI World ETFs one different high dividend yield have? See pictures:

$AHYQ (+0.24%) and $IWRD (+0.37%)

Hello to all,

I have been investing in these two ETFs for 4 years:

- Accumulating: $IWDA (+0.35%)

- Distributing: $AHYQ (+0.24%)

I have now thought to only manage the accumulator, since I am not dependent on the dividend and the performance is also differentiated.

My question now would be:

Just leave the distributing one or liquidate/pay out/sell it and put it into the accumulator?

Hello, I am since August last year on the stock market and 19 years old. My goal is to improve my pension, which is due in about 45 years, so that I do not have to worry about old age poverty. To explain the two world etfs had the $AHYQ (+0.24%) first and later decided for the $VWRL (+0.33%) later. The investment in the $INRG (+0.22%) I regret meanwhile but would like to separate from this only if he is in plus. Looking forward to your feedback and wish everyone a good day.

I have a question of understanding. This is about the above mentioned MSCI World III ETF from Amundi, which is merged with the former Lyxor MSCI World ETF. On the website of Amundi, the composition is differentiated between top 10 index components and top 10 components.https://www.amundietf.de/de/privatanleger/products/equity/amundi-msci-world-iii-ucits-etf-dist/lu2572257124

What exactly is this supposed to tell me? I'm kind of on the fence right now

Trending Securities

Top creators this week