Disclaimer: No investment advice or recommendation, this article is for information purposes only. Before you decide on an ETF, take a closer look at it in terms of positions, sampling, regions, etc. I can't describe everything here as it would go beyond the scope of this article.

Part 1 (Definition, Categories

& Z-score and quality factor): https://getqu.in/RCSY4a/

Part 2 (Value ETF): https://getqu.in/Nfnhqb/

Part 3 (Low Volatility ETF): https://getqu.in/Ub7KpG/

Part 4 (Momentum ETF): https://getqu.in/CNMgGw/

Part 5 (Small- and Growth ETF): https://getqu.in/0NoqmW/

Part 6 (Dividend ETF): https://getqu.in/NJtoF5/

Part 7 (Multifactor ETF): https://getqu.in/qBLxfo/

What are Equal-Weight ETF?

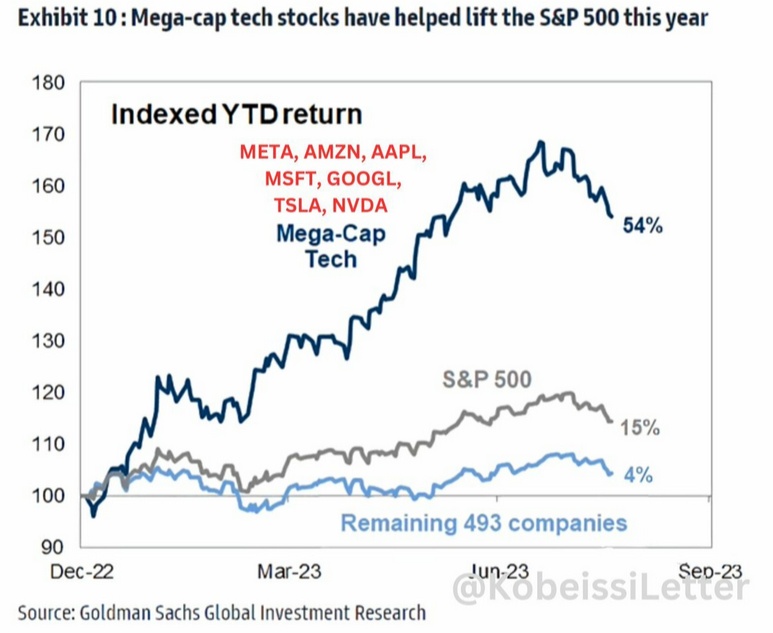

Equal-weight ETFs are - as the name suggests - characterized by the fact that the positions held in the ETF are all equally weighted and not, as is usually the case, according to their market weighting. The investment case for this form of investment is based in particular on the observation of the recent past that the weighting of indices is becoming increasingly concentrated on a few stocks/sectors and countries. For example, the top 10 positions in the S&P 500 already account for 33% of the index weighting. The global comparison is no different: In the Euro Stoxx 600, the top 10 account for around 20 % of the weighting and in the MSCI World around 24 % and this with over 1,400 positions (!). The USA accounts for 70 % of the MSCI World and the technology sector is weighted at around 27 %. The market capitalization often no longer corresponds to the GDP weighting of the respective countries (as a measure of a country's economic strength).

With free trade and globalization, this is not too bad, as companies can generate a large proportion of their profits abroad. However, with increasing protectionism and the reversal of free trade, this discrepancy can become a risk.

Due to the high concentration, the return of the indices essentially consists of a few large companies with a strong US focus. This creates a cluster risk, although this has paid off well in the recent past (

https://stock3.com/boersenwissen/gleich-vs-kapitalisierungsgewichtet-gibt-es-einen-gewinner-13016464)

The Equal-Weight ETFs are therefore created for all those who are concerned about the growing concentration on the markets and want to spread the risk over more shoulders.

Furthermore, there is a natural size-tilt, as both small and large companies are equally weighted in the index, meaning that a much higher weighting is placed on small and mid-caps compared to the normal indices.

Historical returns

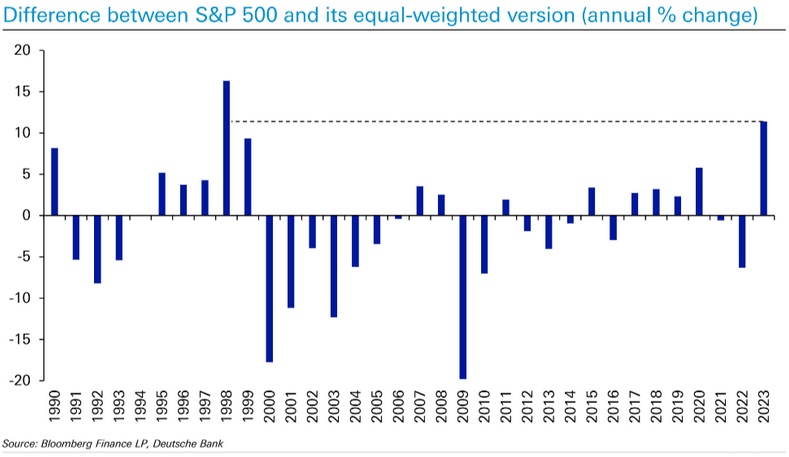

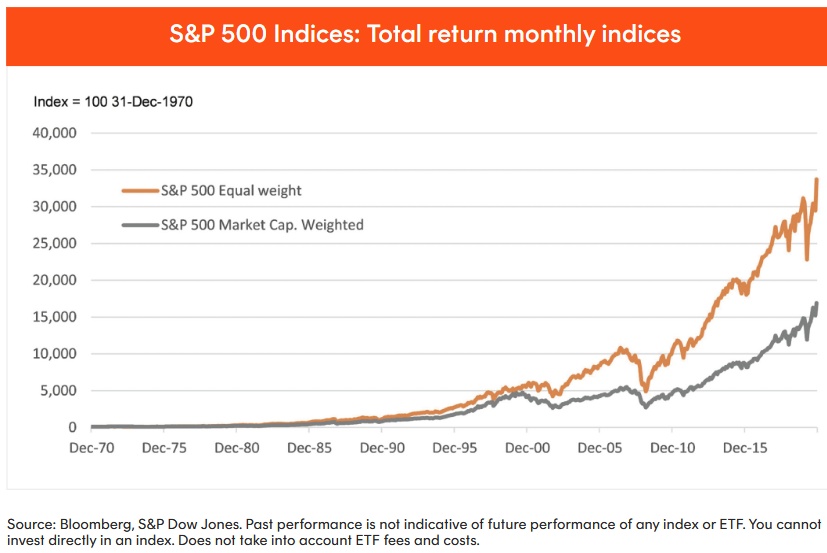

The charm of the equal weight approach becomes apparent if we look beyond the recent past to a longer-term horizon:

https://www.betashares.com.au/files/collateral/brochure/QUS-Brochure.pdf

Annualized comparison of annual returns (negative = outperformance of the equal weight approach):

https://stock3.com/boersenwissen/gleich-vs-kapitalisierungsgewichtet-gibt-es-einen-gewinner-13016464

In a study from 1994 to 2000, the returns already converge strongly:

https://www.lynalden.com/equal-weighted-index-funds

Overall, the picture is similar to the size-premium - logically, since size stocks are also more strongly represented - in the long term, the equal-weight approach would be worthwhile, but in the recent past, due to the tech/Us concentration, one would have achieved an underperformance. The higher weighting of smaller stocks also increases volatility, something that would probably not have been expected as many take the equal weight approach to minimize risk.

👉Equal-Weight ETF:

-$TSWE (-3.44%) (World | TER 0.20 % | TD 0.47 % | EUR 0.8 bn invested volume | 3Y underperformance vs All-World -11 %pt. | 5Y underperformance -14 %pt. | 10Y underperformance -30%pt.)

- Index methodology: Selection of 250 companies according to Moody's sustainability criteria (no alcohol, gambling, military, animal testing for cosmetics etc.), then equal weighting.

-$XDEW (-1.71%) (US | TER 0.20 % | TD -0.02 % | EUR 12 bn invested vol. | 3Y underperformance vs. S&P 500 -18%pt. | 5Y underperformance -36 %pt. | 10Y underperformance -114 %pt.)

- Index methodology: Equal weighting of all companies included in the S&P 500.

-$MOTV (-0.93%) (US | TER 0.46 % | TD n.a. | EUR 0.1 bn invested vol. | 6 months outperformance vs. S&P 500 +0.5%pt.)

- Index methodology: Index focuses on Morningstar's "Wide Economic Moat" rating. These are companies that Morningstar analysts believe will outperform over the next 20 years. From these companies, the most undervalued are filtered (delta market price to fair value). The companies are then equally weighted

-$WEBA (-1.38%) (US | TER 0.07 % | TD n.A. | EUR 0.5 bn invested vol. | 1Y underperformance vs. NASDQ -17 %pt.)

- Index methodology: Equal weighting of NASDAQ100 stocks

-$S6EW (-3.65%) (Europe | TER 0.30 % | TD 0.06 % | EUR 0.1 bn invested vol. | 3Y underperformance vs. Euro Stoxx 600 -15%pt. | 5Y underperformance -18 %pt. | 10Y underperformance -11 %pt.)

- Index methodology: Screening of the Euro Stoxx 600 according to - UN defined - ESG criteria (no coal, weapons, tobacco,..) and subsequent equal weighting.

Conclusion - what remains?

Equal weight strategy aims to reflect the high concentration of stocks/sectors & countries much less in the conventional indices (which are market capital weighted) by including the stocks in equal proportions. This reduces the cluster risk while at the same time increasing the exposure of smaller and medium-sized companies.

In the long term, however, there has been outperformance in recent times (with the tech boom). In my view, there is a strong performance overlap with the small-cap ETFs, so I would definitely not put both in my portfolio & would rather stick with a small-cap ETF, partly because the current selection of equal-weight ETFs is not yet too broad.

The choice between equal-weight and market-cap ETFs ultimately depends on individual risk tolerance, investment horizon and assessment of future market developments. Equal-weight ETFs can serve as a diversification instrument in a balanced portfolio.