Thank you for your feedback.

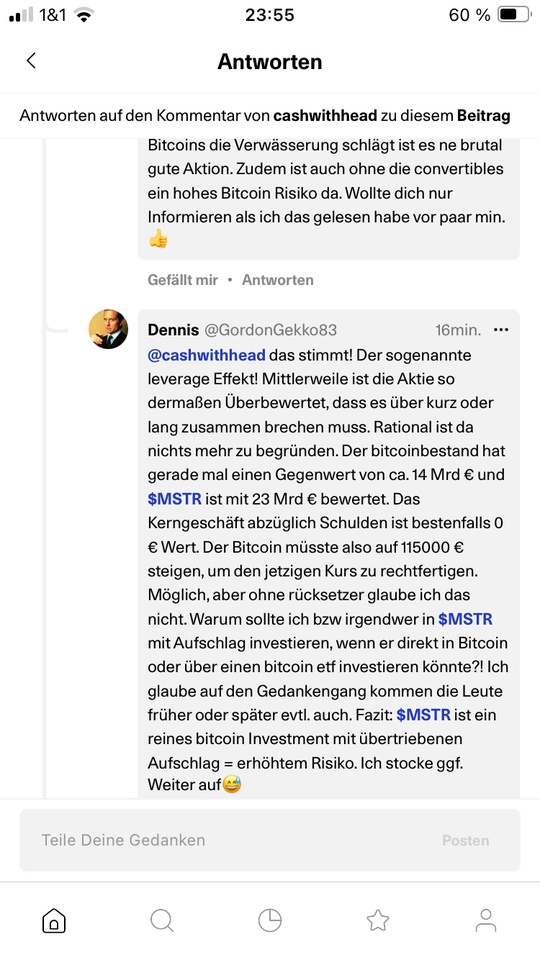

As already mentioned, the discrepancy between the company valuation and the Bitcoin holdings is, in my opinion, too high. Neither the leverage nor the main business activity justify this huge premium, and the risks of this debt are not factored into the valuation in any way.

Conclusion: I'm back and short $MSTR (+1.9%)

P.S. It is a risky gamble and I am acting as a "hermaphrodite" here, as I am invested in the $ADE (+1.13%) long, and I also believe in a new ATH in Bitcoin this year. But the current overvaluation of $MSTR (+1.9%) has left me no choice.😜😎