There are probably 2x

In case anyone is wondering about the price increase today.

Posts

26There are probably 2x

In case anyone is wondering about the price increase today.

Rule number 4 for a permanently green depot

Number 2 will surprise you

First: Open my profile, take a look at my portfolio and be amazed. Every single position is up since I bought it. This is proof that my method actually works. Even Warren Buffet used my method for his gigantic success.

And today I'm sharing with you exclusively the 4th of my 8 Donkey Rules for a permanently green portfolio. Free of charge for you, of course. This rule alone is enough to turn your deep red portfolio into a green portfolio. If you want more, e.g. a really lush green with plenty of growth, then book my exclusive course and learn the other rules too.

But here it is, my rule number 4 for a green depot. Exclusively for you and only on getquin:

4. sell any position that is in the red 🚀

Dear community,

after I have often thought about whether I would like to present my portfolio or not, I'll give myself a jolt with the new function and introduce myself briefly:

Who am I?

27 years old, AT. I have been working in development in the semiconductor industry for 3 years, before that I studied at university with holiday jobs and a small part-time job of 8 hours a week. I live with my girlfriend, am addicted to sports and have been addicted to investing for 1 year.

Career portfolio

Due to the (extensive) acquaintance with the co-founder of $MIOTA I entered the crypto world in 2018 and invested almost €500 (a lot of money as a student at the time) in Iota and other cryptocurrencies. After everything collapsed there (I had -95% in the meantime), I didn't want to know anything more about investing and concentrated on my studies and my life.

With my master's degree and the start of my permanent employment in 2021, the question then arose as to what I would do with my money and I finally ended up investing via various ideas (Amazon dropshipping, startup, etc.). After about 1 month of reading in, my first position was the $LCUW which I bought at $ASML (+2.24%)

$IFX (-0.84%)

$LIN (-0.6%) and $XMME (+0.04%) expanded it. Over time, more shares were added and by registering on Getquin, the MSCI Word + EM was then shifted to the $VWRL (-0.33%) (thanks to the community :)). Since then, most of the income (savings rate currently 2k/month ~50%) has been invested, $VWRL (-0.33%) and $SPYD (-0.74%) by savings plan + dip purchases, shares always by individual purchases.

Structure

As I come from the technology sector and see where technology is used everywhere, I deliberately have an abundance of technology in my portfolio. Basically, I'm focusing on growth (I'm still young) and core-satellite, with the aim of being able to live well from dividends and withdrawals in my later years and to give my children a good start in life. In addition to the Flatex custody account, there are also a few gambles in the crypto sector, but nothing major. Maybe in 10 years it will help with the house and Lambo

What would I like to change?

Through the community I came across the $SPYD (-0.74%) came to my attention. The good dividends and the good price performance in the past (> $VWRL (-0.33%) ) persuaded me to invest in the ETF as well. In recent weeks, however, I have become increasingly dissatisfied with the ETF's performance, partly because the companies it contains don't quite match my objectives. I will now (after feedback from the community) build up the $EQQQ (+0.23%) as a satellite ETF via a savings plan. The $SPYD (-0.74%) currently remains in place as I expect a tech correction in the near future where the $SPYD (-0.74%) should serve as a support. Whether I keep the Aristocrat or not is still up in the air (outcome of the post was 60% Nasdaq100, 22% SPYD and 18% both), I would be happy to receive feedback here. Also on the watchlist at the moment are $EW (+2.24%) and $CRWD (+0.39%) which, however, is a competitor to $FTNT (+0.07%) is. However, as I consider the sector to be very important for the future, I will get both on board.

Favorite stocks

$ASML (+2.24%) (The technology is extremely interesting)

$CDNS (-1.07%) (The program is complete garbage but quasi monopoly with $SNPS (-0.97%) )

Hate shares

$SRT3 (-2.2%) (Let's see if this is still something, was a purchase on online Google suggestions)

$NRJ (+0.23%) (I'll hold on to it, maybe it will be something in a few years)

$MIOTA (Well, the share price says it all :D)

I would be happy to receive feedback and suggestions for improvement, please let me know any criticisms/suggestions, that's the only way to keep learning;)

In this sense, enjoy the day and have a nice New Year's Day

Send via Internet-Explorer

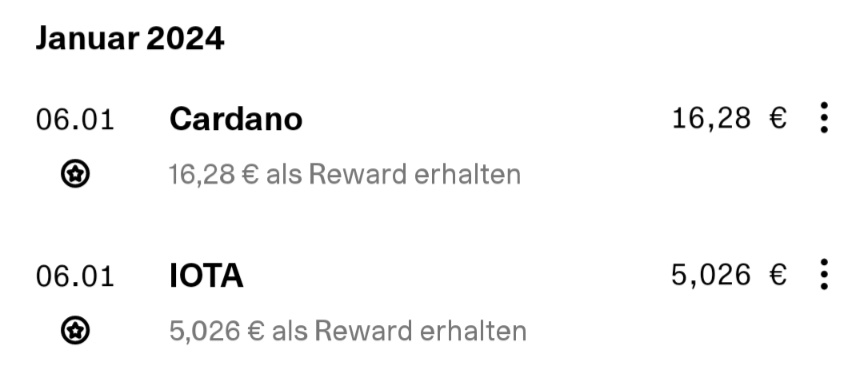

Today I claimed my staking rewards and airdrops. Take that, $UKW (-0.89%) Cult 🚨. Soon I'll be as cool and rich as @calvinhayward 🚀.

Unfortunately only as a picture and not as a shared transaction, because that only works with dividends and not with rewards. I feel bullied @Kundenservice

Dear donkey disciples,

Time and again I read here from GetQuin users who ask for feedback on their portfolio but only write 1 or 2 sentences themselves. These colleagues are then surprised when they receive unspecific comments that are always the same, such as "You are missing a good dividend payer from the tobacco industry in your portfolio" or "You should throw out the tobacco stocks, people are smoking less and less". At the same time, the reluctance of potential feedback providers grows when they are asked to evaluate the 100th 08/15 portfolio without explanation.

It is therefore time for more individual and high-quality portfolio feedback. You can get this by following the ultimate donkey guide to high-quality portfolio feedback.

Step 1: Tell us about your investment horizon and goals

I'm in my mid-30s, so I still have a few years to work before my state pension. My goal is to be financially independent as early as possible and to be able to live off my portfolio. Realistically, however, I will still need until shortly before I retire, as I still want to live and not restrict myself financially. In addition, I am not betting on my (early) death, which is why my goal is to preserve capital and not to consume it.

Step 2: Set out your strategy and explain how you intend to achieve your goals

I have realized that it is too exhausting for me to continuously deal with a large number of companies. I also have much more confidence in the markets than in individual companies. I therefore rely to a large extent on ETFs. With a little bit of crypto, however, there are also a few gambling positions in the portfolio. If these work out, I will reach my target sooner. If not, the stake was small enough so that my long-term goal was not jeopardized.

The 4% rule will probably cause me psychological problems if I still have to withdraw my 4% in a year with a loss. Accordingly, I would like to live largely from dividends. However, as I am still too young to buy high dividends through low growth, I am relying on share price and dividend growth. My calculation is that the dividends will have grown significantly in 20-30 years due to the selection of my positions and in relation to my investments and that I won't have to switch to an ETF with high dividends. I simply want to save myself the high taxes in old age that would be incurred if I switched from accumulating ETFs to ETFs with a high payout ratio. Distributions are of course reinvested directly.

Are you still missing a goal and the right strategy? Then take a look here: https://app.getquin.com/activity/VAKRkmXgSS

Step 3: Explain why you have chosen exactly the stocks in your portfolio

Optional, but depending on the size of your portfolio, it is at least a good idea to talk about the asset categories and / or the most important / most unusual investments. When you mention your assets, remember to mention them in such a way that the reader understands what you mean. Nobody knows what is behind LU0533033667.

The core of my ETF and also of my portfolio is an All World ETF $VGWL (-0.33%) for obvious reasons. In addition, there are currently 2 other ETFs in my portfolio: a Health Care ETF $CBUF (-0.06%) and an IT ETF $AYEW (+0.28%) . These are not too specific, as a cyber security or innovative health care ETF, for example, would be for my taste. I also see huge growth opportunities in both sectors and hope that they will actually outperform the global index in the long term. However, as I don't have a crystal ball and want to minimize my risk, the All World takes up the significantly larger positions in my portfolio. All ETFs are of course distributing.

Yes, what can I say about crypto? I started buying Bitcoin in 2011 $BTC (+3.37%) with some play money and only stopped again in 2017. Despite losing everything twice due to hacks or confiscation by the FBI from centralized exchanges, there is actually not much money in my Bitcoin position. The growth was simply gigantic. As the largest, first and only decentralized currency, Bitcoin should of course not be missing from any crypto portfolio. I also hold Ethereum $ETH (+3.48%) as the second largest currency, which has a bit more to offer than Bitcoin. About IOTA $MIOTA there is already an article by me [2]. The reasons for my investment in Hedera $HBAR (-0.1%) are quite similar to those of IOTA. Cardano $ADA (+2%) is simply a random position from the top 10 for diversification. Could have been BNB or whatnot (just not Solana or Doge). I have fixed and very ambitious prices for my cryptocurrencies at which I will sell shares. If these prices are not reached, I will hodl until the end of my days.

I am aware of the high US weighting in my portfolio and it was a thorn in my side for a long time. In the meantime, however, I have come to terms with it. Many of the US companies are actually global companies that benefit from American laws and culture. In addition, the last few months have confirmed the dominance of the USA from my point of view. Until last year, I could have imagined that China or possibly even Russia could overtake the USA. In my view, this scenario has now receded into the distant future. And Europe is just Europe, not really to be taken seriously. So why not overweight the USA?

You can read here why I sold my shares and no longer have any in my portfolio: https://getqu.in/EZANAH620OR1/sP2f6mVSqQ/

Step 4: Give us an insight into how you plan to further expand your portfolio

Personally, I'm not a fan of rebalancing. Swapping assets that are doing well for assets that are doing badly makes little sense to me. Therefore, it is not the balance of the book values in my portfolio that is important to me, but the balance of the invested capital. Specifically, I would like to expand my ETFs every year. A total of 70% in All World and 15% each in IT and Health Care. Crypto is not regularly invested in.

Step 5: Don't forget to share with the community what you don't want to have in your portfolio, i.e. which tips you can do without

Due to the ambitious goals and the long investment period, I deliberately decided against stabilizing factors that ultimately cost returns. One of these is gold, which I don't see as a sensible component in my portfolio. See also [3]. The same applies to bonds. Of course, I have a nest egg in my current and call money account.

Step 6: Share absolute values

Relative values are boring. The curiosity of the GetQuin community wants to be satisfied. So share your absolute values!

Why all this?

Only with this background knowledge and context can the community give you serious and specific advice that goes beyond any standard phrases. Every goal is individual and every portfolio looks the way it does for different reasons. The strategy determines how the goal is to be achieved with the portfolio presented. No one can tell you whether this is realistic or not without detailed information.

The detailed presentation and description also forces you to reflect on your portfolio yourself. Is there perhaps a certain position that doesn't fit into your strategy after all? What is your actual goal? Does the path match what you want to achieve? ...? These questions often lead to a self-awareness that provides you with starting points for improvement, even without community feedback. In software development, by the way, this is called rubber duck debugging [4].

Take a look at my profile picture now!

That's right. This is a how-to for you on how to get more meaningful and personalized feedback on your portfolio. I know that my portfolio, my strategy and my goal are perfect and of course I don't need any feedback. So instead, I'll ask you how you like my new, artistic profile picture? Dalle the 2nd has put a lot of effort into making me look perfect [5]. He would be very happy if his art was appreciated.

Anyone who has read this guide, uses it for their own portfolio feedback and would like feedback from me is of course welcome to mention me with @DonkeyInvestor mention me.

Sources

[2] https://app.getquin.com/activity/hCTDRERFED

[3] https://app.getquin.com/activity/lohxnDnlch

[4] https://en.wikipedia.org/wiki/Rubber_duck_debugging

[5] https://openai.com/dall-e-2/

This week Shimmer celebrated its debut as a $MIOTA

its debut as a test network

The IOTA Foundation has been promising the moon since 2017, but simply not delivering - until Wednesday of this week. That's when the test network actually went $SMR (-0.05%) in which new functions such as smart contracts for the IOTA network can be tested in the future.

$SMR (-0.05%) Was distributed earlier this year via an airdrop to $MIOTA Hodler who "staked" their coins via the Firefly wallet. In doing so, they were able to purchase coins over the entire staking period for 1 $MIOTA approx. 0.75 $SMR (-0.05%) for 1. Currently $SMR (-0.05%) is traded for about 0.5 USD. For the boomers here, this corresponds to a "dividend" of 3-4%, based on the "ex-dividend" day of IOTA 😉.

Even if the staking period for $SMR (-0.05%) has expired, you can $MIOTA can still be staked for another token, Assembly. This token is supposed to bring DeFi and Co into the IOTA network, but is currently struggling with funding problems.

𝐈𝐨𝐭𝐚 - 𝐝𝐢𝐞 𝐞𝐧𝐞𝐫𝐠𝐢𝐞𝐞𝐟𝐟𝐢𝐳𝐢𝐞𝐧𝐭𝐞 𝐊𝐫𝐲𝐩𝐭𝐨𝐰ä𝐡𝐫𝐮𝐧𝐠 𝐚𝐮𝐬 𝐁𝐞𝐫𝐥𝐢𝐧 𝐨𝐡𝐧𝐞 𝐍𝐞𝐭𝐳𝐰𝐞𝐫𝐤𝐠𝐞𝐛ü𝐡𝐫𝐞𝐧

Today we're going to take a look at the cryptocurrency Iota. Technically, Iota is mega interesting and one of the main reasons why I am invested. However, the response to my previous more technical posts shows that the GetQuin community is probably not the right audience for this. I therefore focus on facts that might be more interesting for a financial community. However, IT nerds can check out the sources at the end of the post - there are some interesting links there that shed more light on the technology. For crypto beginners, I recommend first taking a look at my series of posts "Cryptocurrencies for Beginners / Stock Market Disciples": https://app.getquin.com/activity/buTJFYxcSD . You can find a (non-)buy recommendation at the end of this post.

𝐔𝐧𝐝, 𝐰𝐚𝐬 𝐢𝐬𝐭 𝐣𝐞𝐭𝐳𝐭 𝐝𝐢𝐞𝐬𝐞𝐬 𝐈𝐨𝐭𝐚?

Iota is a crypto network based on a DAG (Directed Acyclic Graph [1]) instead of a blockchain. In 2015 / 2016, Iota was conceptualized as a network for the Internet of Things (IoT) and thus for many microtransactions. The unit of the network is also called Iota, but it is mostly expressed in millions of Iota (Miota, Mi). In total, the number of Miota tokens is limited to 2,779,530,283, so there are exactly 2,779,530,283,000,000 Iota that are already completely in circulation (no inflation) [2]. Currently, the network reaches a max. speed of 1,000 transactions per second [3].

𝐖𝐞𝐫 𝐡𝐚𝐭𝐬 𝐞𝐫𝐟𝐮𝐧𝐝𝐞𝐧?

No, not the Swiss. And not the Yanks either. Behind Iota is the Iota Foundation (IF), a non-profit organization based in Berlin [4]. Yes, the Berlin in Germany. Crazy, isn't it? And the IF team is not that small either, with about 200 members in over 25 countries [5]. The IF is financed by donations in the form of Iota tokens from the community, R&D budget from public institutions, and donations from individuals and companies [6].

𝐄𝐢𝐧 𝐝𝐢𝐫𝐞𝐜𝐭𝐞𝐝 ... 𝐝𝐢𝐧𝐠𝐬𝐛𝐮𝐦𝐬 ... 𝐆𝐫𝐚𝐩𝐡 𝐚𝐧𝐬𝐭𝐚𝐭𝐭 𝐞𝐢𝐧𝐞𝐫 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧? 𝐉𝐞𝐝𝐞𝐫 𝐬𝐩𝐫𝐢𝐜𝐡𝐭 𝐝𝐨𝐜𝐡 𝐢𝐦𝐦𝐞𝐫 𝐯𝐨𝐧 𝐝𝐞𝐫 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧. 𝐅ü𝐫 𝐦𝐢𝐜𝐡 𝐠𝐞𝐡ö𝐫𝐞𝐧 𝐊𝐫𝐲𝐩𝐭𝐨 𝐮𝐧𝐝 𝐁𝐥𝐨𝐜𝐤𝐜𝐡𝐚𝐢𝐧 𝐮𝐧𝐭𝐫𝐞𝐧𝐧𝐛𝐚𝐫 𝐳𝐮𝐬𝐚𝐦𝐦𝐞𝐧. 𝐖𝐨𝐫𝐢𝐧 𝐥𝐢𝐞𝐠𝐭 𝐝𝐞𝐫 𝐔𝐧𝐭𝐞𝐫𝐬𝐜𝐡𝐢𝐞𝐝?

A DAG, Directed Acyclic Graph or in German a directed acyclic graph is - just like the Blockchain - a kind of data structure. While in a blockchain data (blocks) are strung together and each block is followed by exactly one more block (Fig: https://en.wikipedia.org/wiki/Blockchain#/media/File:Bitcoin_Block_Data.svg), , a DAG consists of nodes that are almost cross-connected via edges. These nodes contain the data (comparable to the blocks in a blockchain), but in doing so they are usually not arranged strictly one after the other, as is the case in a blockchain. Instead, a node can have multiple successor and predecessor nodes (Fig: https://en.wikipedia.org/wiki/Directed_acyclic_graph#/media/File:Tred-G.svg). The only thing that must not occur is a "circle", otherwise we would be talking about a cyclic and not an acyclic graph.

In Iota, this data structure is implemented in the form of the "tangle" [7]. The tangle is thus Iota's counter-design to the blockchain. With the Tangle, the limitation of a blockchain to only write data sequentially and in competition with each other is resolved and parallelized [8]. To look at the Tangle and get an idea of how it is built, you can watch Iota live at work in what is called the Tangle Visualizer: https://explorer.iota.org/mainnet/visualizer/. The visualizer very quickly makes clear why the Tangle is called "tangle" in German.

𝐀𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐡𝐡𝐡𝐡𝐡𝐡𝐡𝐡𝐡𝐡𝐡𝐡𝐡𝐡𝐡𝐡!!! 𝐁Ö𝐒𝐄𝐑 𝐄𝐒𝐄𝐋! 𝐃𝐮 𝐡𝐚𝐬𝐭 𝐠𝐞𝐬𝐚𝐠𝐭 𝐤𝐞𝐢𝐧𝐞 𝐓𝐞𝐜𝐡𝐧𝐢𝐤!!!!! 𝐍𝐚𝐣𝐚, 𝐳𝐮 𝐬𝐩ä𝐭 ... 𝐛𝐫𝐢𝐧𝐠𝐭 𝐦𝐢𝐫 𝐝𝐚𝐬 𝐢𝐫𝐠𝐞𝐧𝐝𝐰𝐚𝐬? 𝐇𝐚𝐭 𝐈𝐨𝐭𝐚 𝐞𝐢𝐧𝐞𝐧 𝐔𝐒𝐏? 𝐎𝐝𝐞𝐫 𝐢𝐬𝐭 𝐝𝐚𝐬 𝐧𝐮𝐫 𝐞𝐢𝐧 𝐒𝐡𝐢𝐭𝐜𝐨𝐢𝐧 𝐰𝐢𝐞 𝐯𝐢𝐞𝐥𝐞 𝐚𝐧𝐝𝐞𝐫𝐞 𝐚𝐮𝐜𝐡?

Iota has no (!) network or transaction fees [9]. Right. None at all. If I send 2 iota (or 2,000,000 iota) from A to B, 2 iota (or even 2,000,000 iota) will also arrive there within a few seconds. Bam. This also means that, for example, NFTs could be sent without fees and smart contracts could be executed free of charge (if they already existed, but more on that later). You only need to confirm two other transactions to initiate one, which consumes a negligible amount of power on your computer. Which brings us to the second important argument for Iota: The energy cost per transaction. By the way, calculating the exact energy consumption of a transaction is not that trivial. For example, [10] assumes 0.00011 kWh, while [11] would like to have the power consumption calculated to a bit more than 0.000001 kWh per transaction. For comparison: According to [12], an Ethereum transaction consumes 238.22 kWh and a VISA transaction approximately 0.001486 kWh.

Overall, Iota aims to solve no less a problem than the blockchain trilemma, i.e., enabling decentralization, security, and scalability simultaneously [13] [14].

𝐖𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐚𝐬? 𝐊𝐞𝐢𝐧𝐞 𝐍𝐞𝐭𝐳𝐰𝐞𝐫𝐤𝐠𝐞𝐛ü𝐡𝐫𝐞𝐧, 𝐚𝐛𝐞𝐫 𝐠𝐥𝐞𝐢𝐜𝐡𝐳𝐞𝐢𝐭𝐢𝐠 𝐬𝐜𝐡𝐧𝐞𝐥𝐥 𝐮𝐧𝐝 𝐧𝐮𝐫 𝐠𝐞𝐫𝐢𝐧𝐠𝐞 𝐄𝐧𝐞𝐫𝐠𝐢𝐞𝐤𝐨𝐬𝐭𝐞𝐧? 𝐖𝐨 𝐢𝐬𝐭 𝐝𝐞𝐫 𝐇𝐚𝐤𝐞𝐧?

Charges are important for the security of the network. If coins are to be sent from A to B, nodes in the corresponding network must process and confirm this transaction. For example, nodes in the Bitcoin and Ethereum networks are credited with transaction fees, among other things, as compensation for this work [15]. Network fees are thus an important incentive for the node operators of the network to provide their hardware and computing power and to behave honestly. How much these fees are is specified in the code of each cryptocurrency. In the case of Iota, the decision was made to set these fees to 0 and thus not to charge them.

This, of course, creates a risk. Operating an Iota node appears to be a losing proposition at first. However, it can make sense for a company to have its own node, as this gives it direct access to the network without being dependent on other node operators. Moreover, such a node can be operated for as little as 5 USD / month and thus contributes to the existence of a fee-free network, which could certainly represent a huge added value for some companies. One can imagine the operation of a node as the monthly account maintenance fee at a bank. In the future, nodes will also be rewarded with "Mana" for confirming transactions. Mana, in turn, is said to allow higher-priority transactions, which could generate a market for trading in mana. In addition, services based on Iota could still charge fees, of course. Overall, however, it remains to be seen whether this will actually create sufficient incentives to establish a stable, secure, and decentralized network with many nodes and node operators. [16]

Speaking of decentralized: Another catch is in the coordinator. The coordinator is a central entity that is necessary in the current state of the network to ensure its security and stability. While the goal is to shut down the coordinator in the medium term, in its current state the network cannot be described as decentralized or trusted because of the coordinator. The shutdown is called Coordicide and is currently being tested in the development network [17]. No one can say for sure whether a successful shutdown will succeed in practice for the main network as well. Accordingly, Coordicide is also the biggest point of criticism and the biggest risk for Iota. However, a successful coordicide is likely to unleash a gigantic potential. [18]

Another problem is the Iota Foundation itself. Besides a lot of internal quarrels and scandals, promised timelines were often not kept, which shook the trust in the Iota Foundation [19] [20]. Various attacks, e.g. on the own wallet [21] or by tapping the private keys during key generation [22], did the rest.

𝐃𝐚𝐬 𝐢𝐬𝐭 𝐣𝐚 𝐬𝐜𝐡𝐨𝐧 𝐚𝐛𝐬𝐜𝐡𝐫𝐞𝐜𝐤𝐞𝐧𝐝. 𝐈𝐬𝐭 𝐁𝐞𝐬𝐬𝐞𝐫𝐮𝐧𝐠 𝐢𝐧 𝐒𝐢𝐜𝐡𝐭?

2021 was a year of transformation for Iota, as the Iota Foundation itself headlines in its blog post [23]. From my perspective, the Foundation and Iota itself came of age in the last 1-2 years [8]. One has said goodbye to idealistic ideas from the early days like a ternary instead of a binary system [24] and has not afforded any more scandals. The roadmap [25] now focuses on topics that can already generate added value today. One example here would be smart contracts. Attempts are being made to close the gap to the competition and, at the same time, to achieve decentralization by switching off the coordinator. However, whether IF actually delivers remains to be seen. Too often, the community has been disappointed by unfulfilled promises.

𝐖𝐨 𝐰𝐢𝐫 𝐠𝐞𝐫𝐚𝐝𝐞 𝐛𝐞𝐢 "𝐞𝐧𝐭𝐭ä𝐮𝐬𝐜𝐡𝐞𝐧𝐝" 𝐬𝐢𝐧𝐝. 𝐃𝐞𝐫 𝐊𝐮𝐫𝐬 𝐢𝐬𝐭 𝐣𝐚 𝐚𝐮𝐜𝐡 𝐠𝐚𝐧𝐳 𝐬𝐜𝐡ö𝐧 𝐢𝐦 𝐊𝐞𝐥𝐥𝐞𝐫 ...

Just in 2017, Iota was still hotly loved by the community and was a regular in the top 10 cryptos by market cap. The Miota ATH is over 5 USD [26] and has not been reached since the end of 2017. This is likely mainly due to the aforementioned scandals and delays. Currently, the price for a Miota is well below one USD and is miles away from the ATH. Iota is thus outside the top 50 cryptos by market capitalization.

𝐎𝐩𝐭𝐢𝐦𝐢𝐬𝐭𝐢𝐬𝐜𝐡 𝐛𝐞𝐭𝐫𝐚𝐜𝐡𝐭𝐞𝐭 𝐠𝐢𝐛𝐭 𝐞𝐬 𝐚𝐥𝐬𝐨 𝐯𝐢𝐞𝐥 𝐏𝐨𝐭𝐞𝐧𝐭𝐢𝐚𝐥 𝐧𝐚𝐜𝐡 𝐨𝐛𝐞𝐧. 𝐊ö𝐧𝐧𝐭𝐞 𝐝𝐚𝐳𝐮 𝐑𝐞𝐚𝐥 𝐖𝐨𝐫𝐥𝐝 𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 / 𝐝𝐢𝐞 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐞 𝐞𝐭𝐰𝐚𝐬 𝐛𝐞𝐢𝐭𝐫𝐚𝐠𝐞𝐧?

IF has always had many partnerships in industry [27] and tries to add value with real use cases. For example, with "Alvarium" there is a collaboration with Dell to measure the trustworthiness of data [28]. With EnergieKnip in the Netherlands, a project was launched to reward environmentally friendly behavior in about 50,000 participating households [29]. In addition, Iota is now participating in Phase 2a of the European Commission's European Blockchain Services Infrastructure (EBSI) implementation project [30]. To name just a few of the projects with companies and institutions.

𝐍𝐚 𝐢𝐦𝐦𝐞𝐫𝐡𝐢𝐧. 𝐖𝐢𝐞 𝐬𝐜𝐡𝐚𝐮𝐭 𝐞𝐬 𝐝𝐞𝐧𝐧 𝐦𝐢𝐭 𝐞𝐢𝐧𝐞𝐦 Ö𝐤𝐨𝐬𝐲𝐬𝐭𝐞𝐦 𝐫𝐮𝐧𝐝 𝐮𝐦 𝐈𝐨𝐭𝐚 𝐚𝐮𝐬?

This is currently under construction. Assembly will be used to bring smart contracts to Iota [31]. Lendexe is poised to become the first DeFi protocol for Lending on Iota [32] and TangleSea is a decentralized exchange in development on the Iota network [33]. Iota Identity provides a solution for mapping digital identities, which is also under development [34]. The Soonaverse is intended to bring communities, DAOs, and NFTs to Iota [35], but is currently more of a centralized platform, as Iota does not provide the necessary tools today [36]. Soonaverse is thereby a reference to the constant delays of the Iota Foundation. When will feature xyz be ready? Soon. In addition, in December 2021, a way to stake Iota was created for the first time, even if it was more like airdrops, since Iota is not a proof of stake currency [37]. Through the deposited coins, assembly tokens could be generated, among other things. By the way, there is currently (April 2022) another staking period for Assembly. If you own or buy Iota, send them to your Firefly wallet and get some free Assembly tokens.

𝐃𝐮 𝐡𝐚𝐬𝐭 𝐝𝐢𝐞 𝐓𝐞𝐜𝐡𝐧𝐢𝐤 𝐬𝐜𝐡𝐨𝐧 𝐚𝐥𝐬 𝐬𝐞𝐡𝐫 𝐚𝐮ß𝐞𝐫𝐠𝐞𝐰ö𝐡𝐧𝐥𝐢𝐜𝐡 𝐛𝐞𝐬𝐜𝐡𝐫𝐢𝐞𝐛𝐞𝐧. 𝐆𝐢𝐛𝐭 𝐞𝐬 𝐚𝐮𝐜𝐡 𝐊𝐨𝐧𝐤𝐮𝐫𝐫𝐞𝐧𝐳?

In fact, there are some cryptocurrencies with similar approaches [38]. A detailed comparison with them is beyond the scope here. Therefore, I am only sharing a non-exhaustive list of some cryptocurrencies with similar approaches here and ask you to do research on your own. Maybe I will write another article about Hedera sometime in 2022.

- Obyte. A relatively old cryptocurrency on a DAG rather than a blockchain. Currently at the top end of the top 1000 cryptos.

- Aleph Zero. A young project based on DAG far outside the top 1000.

- Hedera. Uses a DAG in the form of their "hashgraph" (cf. Tangle) as a blockchain replacement. Follows a central governance approach and is currently ahead of Iota in the top 50 cryptos.

- Nano. Also uses a DAG and sees itself primarily as a currency. Outside the top 100.

- Banano. A meme DAG coin for all the apes. Still in the Top 1000.

𝐃𝐞𝐫 𝐀𝐫𝐭𝐢𝐤𝐞𝐥 𝐢𝐬𝐭 𝐣𝐞𝐭𝐳𝐭 𝐞𝐜𝐡𝐭 𝐥𝐚𝐧𝐠 𝐠𝐞𝐧𝐮𝐠. 𝐒𝐨𝐥𝐥 𝐢𝐜𝐡 𝐧𝐮𝐧 𝐤𝐚𝐮𝐟𝐞𝐧 𝐨𝐝𝐞𝐫 𝐧𝐢𝐜𝐡𝐭?

By buying Iota, you are taking a significant risk. You are acquiring an altcoin that has not exactly covered itself with glory in the past and has had turbulent times. Iota is also not based on a blockchain, which is a big risk. DAGs as blockchain successors have yet to prove themselves in practice. But this is also where Iota's huge opportunity lies. If proven practical, Iota brings gigantic potential. Even though IF has yet to show that it can deliver, the project has taken a much more promising direction in recent months.

In my view, the key to a share price explosion lies in shutting down the coordinator in the main network and proving that the network can still do its job in a stable and secure manner. However, it could be years before this happens. Until then, I think it is likely that the prices of other coins, including Bitcoin, will develop better. On the other hand, you probably won't be able to buy as fast as the price rises, should the IF actually succeed in the feat of coordiciding.

If you want to add some spice to your crypto portfolio and are willing to accept the uncertainties and risks described above, a small position in Iota can be a good addition to the more stable crypto assets Bitcoin and Ethereum in your wallet. This gives you the chance to invest in Blockchain 2.0 today - or in a stillborn.

𝐔𝐧𝐝 𝐰𝐚𝐬 𝐢𝐬𝐭 𝐦𝐢𝐭 𝐝𝐢𝐫? 𝐁𝐢𝐬𝐭 𝐝𝐮 𝐢𝐧𝐯𝐞𝐬𝐭𝐢𝐞𝐫𝐭?

Yes, I am invested. You can take the percentage from my portfolio on a daily basis. I have been buying iota since 2017 and have pretty much taken every price possible. In 2017 I bought partially for over 5 USD, 2018 / 2019 for under 30 cents and 2021 at prices between 1 and 2 USD. I have never sold. I eagerly hodle with my Ledger in combination with the Iota Firefly Wallet.

𝐕𝐢𝐞𝐥𝐥𝐞𝐢𝐜𝐡𝐭 𝐛𝐚𝐮𝐞 𝐢𝐜𝐡 𝐦𝐢𝐫 𝐭𝐚𝐭𝐬ä𝐜𝐡𝐥𝐢𝐜𝐡 𝐞𝐢𝐧𝐞 𝐤𝐥𝐞𝐢𝐧𝐞 𝐈𝐨𝐭𝐚-𝐏𝐨𝐬𝐢𝐭𝐢𝐨𝐧 𝐚𝐮𝐟. 𝐖𝐨 𝐤𝐚𝐧𝐧 𝐢𝐜𝐡 𝐈𝐨𝐭𝐚 𝐤𝐚𝐮𝐟𝐞𝐧?

I bought my iota from Binance. Also, here is an overview of exchanges where you can trade iota: https://www.iota.org/get-started/buy-iota

Sources

[1] https://en.wikipedia.org/wiki/Directed_acyclic_graph

[2] https://coinmarketcap.com/de/currencies/iota/

[3] https://blog.iota.org/iota-shimmer-assembly/

[4] https://www.iota.org/impressum

[5] https://www.iota.org/foundation/team

[6] https://www.iota.org/foundation/vision-and-mission

[7] https://academy.moralis.io/blog/blockchain-vs-tangle-untangling-the-iota-tangle

[8] https://t3n.de/news/iota-web-3-blockchain-holger-koether-interview-1448851/

[9] https://wiki.iota.org/learn/about-iota/why-is-iota-feeless

[10] https://nairametrics.com/2021/05/20/top-5-eco-friendly-cryptocurrencies/

[11] https://blog.iota.org/internal-energy-benchmarks-for-iota/

[12] https://www.statista.com/statistics/1265891/ethereum-energy-consumption-transaction-comparison-visa/

[13] https://www.ledger.com/academy/what-is-the-blockchain-trilemma

[14] https://block-builders.de/iota-gruender-wir-loesen-das-blockchain-trilemma/

[15] https://support.trustwallet.com/en/support/solutions/articles/67000632070-what-are-network-fees-

[16] https://blog.iota.org/incentives-to-run-an-iota-node/

[17] https://v2.iota.org/

[18] https://coinmarketcap.com/alexandria/article/a-deep-dive-into-iota

[19] https://www.btc-echo.de/news/streit-bei-iota-dominik-schiener-zum-ruecktritt-aufgefordert-54427/

[20] https://www.capital.de/wirtschaft-politik/hacks-und-streit-unter-gruendern-was-ist-bei-iota-los

[21] https://de.cointelegraph.com/news/iota-lays-out-plan-to-re-enable-network-after-20-days-offline

[22] https://iotaseed.io/

[23] https://blog.iota.org/a-year-of-transformation/

[24] https://iota-beginners-guide.com/future-of-iota/iota-x-0-ternary-vision-abandoned/

[25] https://roadmap.iota.org/

[26] https://coinmarketcap.com/historical/20171219/

[27] https://www.iota.org/solutions/partnerships

[28] https://blog.iota.org/together-iota-and-dell-technologies-demonstrate-project-alvarium/

[29] https://blog.iota.org/building-a-local-green-currency-on-iota/

[30] https://digital-strategy.ec.europa.eu/en/news/european-blockchain-pre-commercial-procurement

[31] https://assembly.sc/

[32] https://lendexe.fi/

[34] https://www.iota.org/solutions/digital-identity

[36] https://web3.soonaverse.com/

[37] https://blog.iota.org/iota-shimmer-and-assembly-staking-roadmap/

[38] https://coinmarketcap.com/de/view/dag/

I am FEARFUL!!! Is the crypto market in a bear market? Should I sell???

I have to read or listen to this statement all the time. It simply annoys me. Everyone has to think it through for himself/herself whether he/she buys "cheap" now. Who generally wants to buy an asset, he/she has informed himself/herself about it steadily and thoroughly and trusts in his/her decision. For what reason do you want to sell now? Do you no longer trust your research. Are you insecure about having done something wrong? You should know. When bitcoin was at $60,000, you/were extremely euphoric about the market. You were eager to buy as many predicted Bitcoin would rise to $100,000. And what are you doing now? You are scared and don't believe it anymore. As mentioned before, do what you think is right. Bitcoin will surely reach 100,000$ or 1,000,000$, but not within a few days but over months and years. Don't always trust all the people who prophesy a lot. Do not trust me either. TRUST YOU or TRUST YOUR DECISIONS. in the middle of May the bitcoin price was at $60,000 and dropped to $30,000 within 13 days. There was also a fear in the market, but these price dips are "normal" in the crypto market. I always use these dips to re-buy. Why should I buy at the highest price when I can buy at low prices? Who does not understand the principle of trading: Buy high, sell low😂, the/they should not trade. I buy low and sell high and do it obligingly.

One thing I can promise you then. You just don't see green and it doesn't really bother you if the price has plummeted by 50%.

One thing I have to get rid of: The crypto market and analysts exaggerate. Don't let yourselves get rattled. The whales are planning to push me, you and all of us out of the market, so I, you and all of us will not benefit from the coming pump .

For now though, good luck investing. Stay strong.