Snapchat -/ advertising shares now buyable?

Good day to you, stockbrokers,

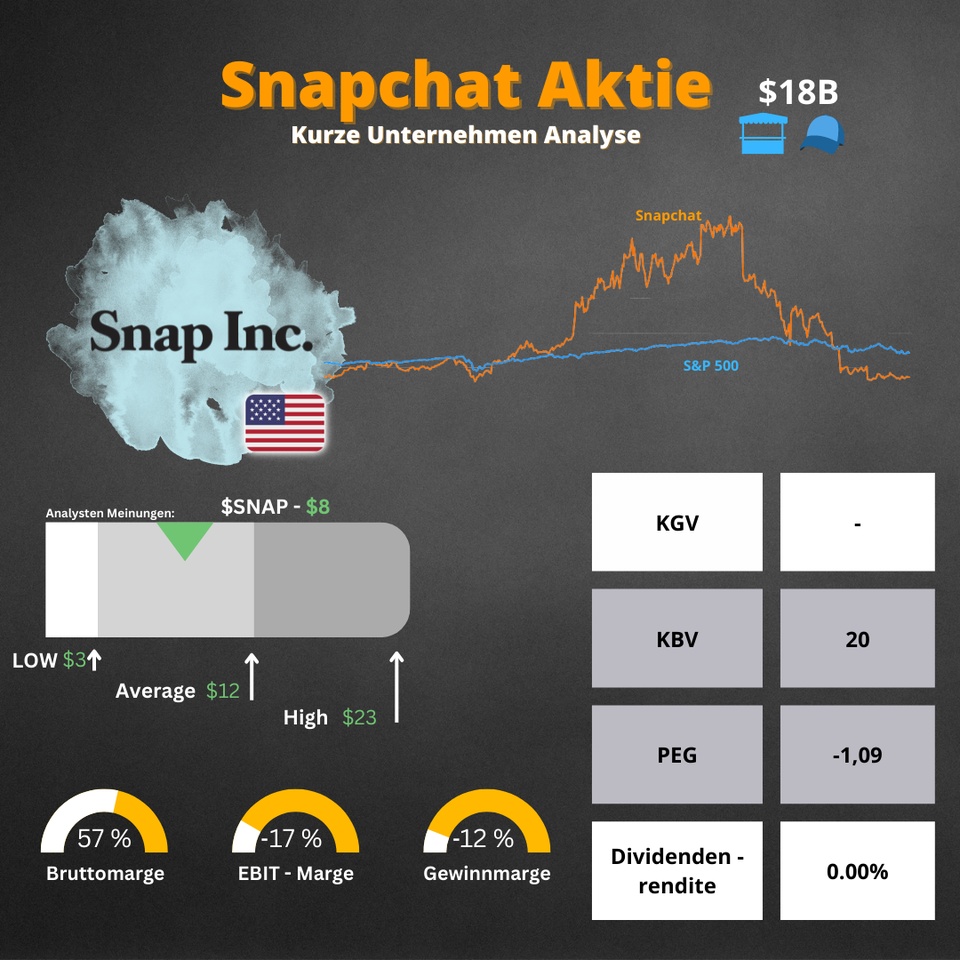

on Thursday evening, Snapchat (WKN: A2DLMS) opened its books and lost 27% of its share price in after-hours trading. This now raises the question of whether, on the one hand, Snapchat is now buyable, or, on the other hand, whether shares in the advertising market are now buyable.

For what reasons did Snapchat stock fall? [Facts and Earnings]

First, let's look at the analysts' expected earnings and the actual ones.

Forecast: EPS [-$0.24] Revenue [1.12B]

Actual: EPS [$0.08] Revenue [1.13B]

EBITDA: 73 million -> 3x higher than expected.

Purely from these two key figures, one wonders for what reasons the Snapchat share has fallen and how the earnings were?

On the one hand, we have an 11% year-over-year decline in revenue per user in Q3 2022.

In addition, however, to see a higher revenue due to the growth of "Average Daily Active User", which is +19% globally. (Growth due to the Asian market +34%).

This also shows a change in the operating margin, which was -17% in Q3 2021 and -39% in Q3 2022.

Let's then come to the main points of the share price losses, which became clear in the quarterly figures!

What does a shareholder not like at all? 🥁🥁🥁

When companies are not transparent!

Snapchat has not published a real outlook, which is the main driver of the crash, as bad things were thus priced in.

In the fourth quarter, Snapchat might not generate any revenue growth according to the outlook, which is highly problematic as a growth company.

In the same course, there is such a restructuring of the company by also laying off 20% of the staff, which additionally represent times with less growth.

In addition, Snapchat has announced a share buyback program in the amount of $500 million, which is highly rare as a growth stock, and is considered questionable by the market.

Thus, we have a growth company, with no growth, which is not trying to restore their previous growth. Since 2017, Snapchat has had double-digit growth and now, the first year with single-digit and then still quarterly forecasts with 0% growth, as well as an increase in net debt to 350 million euros (400% increase)!

Snapchat has had the beginning of the third quarter numbers in the advertising market and from these numbers it is again apparent that it is small and mid cap companies that are cutting their advertising budgets first and this is having a direct impact on the advertising industry => "We are seeing our advertising partners across many industries cut their marketing budgets, especially given the headwinds of the operating environment, inflationary cost pressures and the rising cost of capital." (Investor Letter)

Peer Group - Companies and Their Performance (Thursday - After Hours)📉

Pinterest -7 %

The Trade Desk -5 %

Meta -4 %

Alphabet -2 %

Twitter -1 %

...

Reasons why Snapchat has shown little growth lately:

Reasons for the growth can be read in part from the points above, but briefly summarized again here.

💨Apple privacy update 2021: Leads to less advertising revenue (Meta, Alphabet.. Are also feeling this change very strongly as 99% of revenue is generated from advertising revenue).

💨 Economic slowdown -> recession? Stagflation? -> China change the date of GDP (recession?)

💨 Interest rates and high inflation are a challenge for unprofitable companies

💨 Strong competition (Meta/Tiktok)

Finally, I have a question for you:

Are you buying current companies in the advertising market or are you waiting as there are exciting earnings coming next week in the advertising market, for example from Meta and Alphabet.

Sources:

https://www.cnbc.com/2022/10/20/snap-earnings-q3-2022.html

#stocks

#etf

#dividends

#crypto

#newsroom

#communityfeedback

#earnings

#longshort

#learn

#alternative

#aktien

#dividende

#earnings