The first half of the year is already over, so here's a quick look at my portfolio:

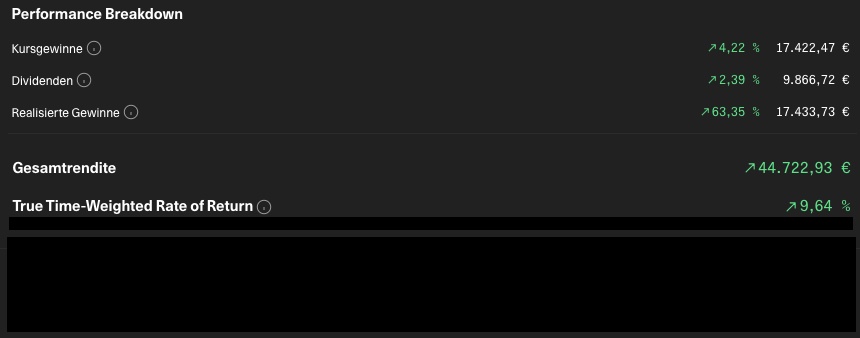

The overall performance doesn't look too bad for 1HY, with realized gains already accounting for a large part. The delisting of $OHB (-3.52%) and thus the sale of my position is most noticeable. Nice $OHB (-3.52%) profits over time, I would have liked to have kept them. But who knows, at some point they might come back like $Renk, for example

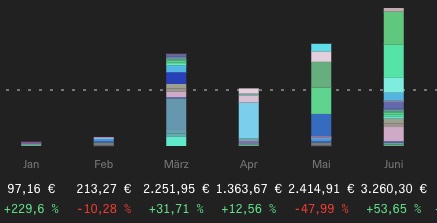

Net dividends are at last year's level. Many dividends were reduced in May (e.g. $SIX2 (+0.5%) without special dividend, $KNIN (-0.01%) adjustment) or, as in the case of OHB or $Baywa, no longer paid due to sales. Some payments were also simply postponed to June. Over the year as a whole, an increase of 9-10% should be possible.

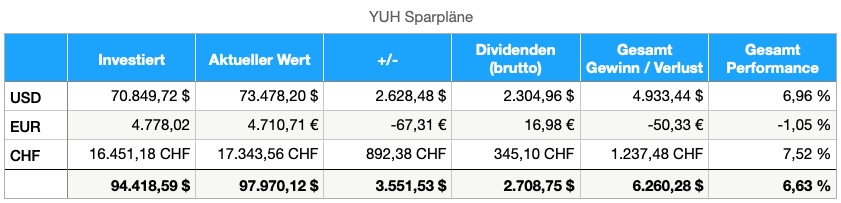

The savings plans I started in 04/2022 are still running. Some positions are full and others have been added over time. My target here is 5000tsd $/€/CHF per individual position, with the exception of ETFs which are still running. The overall performance here is ok, it has been significantly better in the past. The dividends of the equivalent of 2700$ in two years are of course great and ensure additional purchases. Conclusion: in future I will save less in individual stocks, but with higher amounts (currently 150, then more like 300-500 depending on the situation) I want to remain a little more flexible and prefer to buy in good times.

At the moment, CHF 2750 a month is invested in fixed savings plans and CHF 400 goes into an employee share scheme with my employer. It will stay that way and then we'll see where we stand at the end of the year.

Happy weekend!