Hello dear community,

What do you think about the following investment strategy?

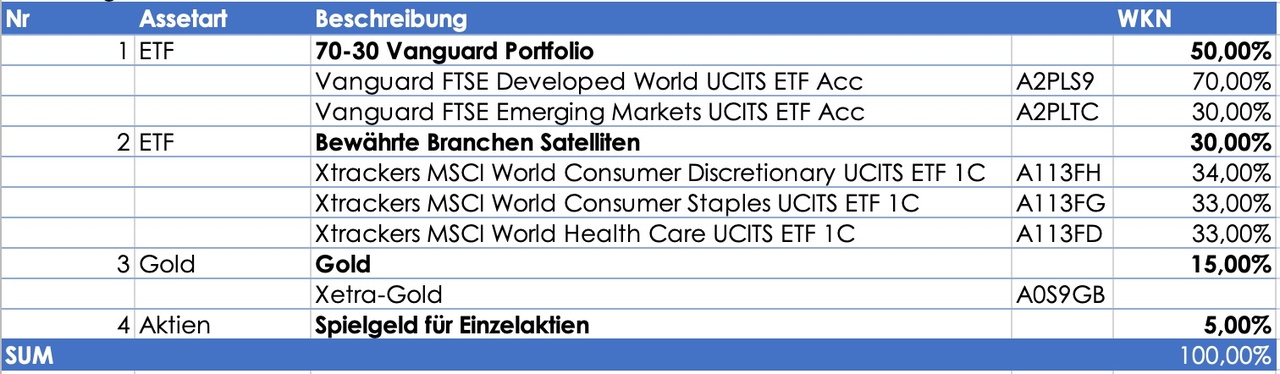

In essence a 70/30 strategy with some proven industry satellites around.

I am in my late 20s and would like to invest a larger sum according to the key as well as a monthly savings plan of 2k+ EUR (in the savings plan no gold, but more play money for individual stocks).

I am not interested in dividends, my investment horizon is 20+ years, risk affinity is not too high. I already have a stock portfolio but it costs me quite a bit of time and is always emotionally present. With a larger ETF portfolio I would like to bring a little peace in.

I would be interested to know what you think or what you would do differently.

#strategie

#portfoliostrategie

#anlagestrategie

#aufteilung

#etfs

#etf

#community

#personalstrategy

#portfoliofeedback

#etfanalyse

#etffeedback