The ESG ETFs are relatively random and make no sense from a return perspective is nothing new.

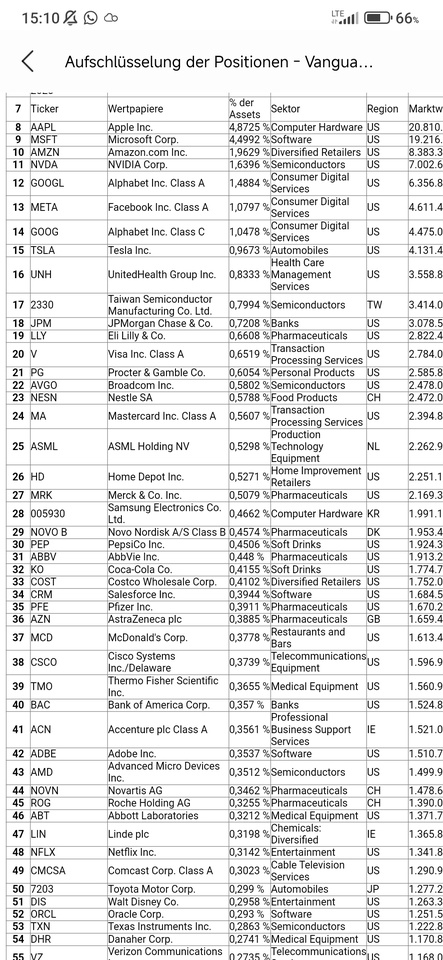

But after looking at the positions from one of the ETFs, questions arise as to what this is good for...

My favorite position in Vanguard's ESG global all cap with an 80billion market cap is. $NESTLE 😂

I wonder how many of the retail investors buying these ETFs have never looked at the positions?

(Why not just rename it random big cap, then at least

at least you know what is being bought)