Reading time: approx. 7min

1) INTRODUCTION

$ASML (+0.07%) is probably next to values like $NVDA (+2.51%) or $SMCI is one of the stocks that everyone is talking about at the moment. Even the last supposed expert knows that ASML plays a key role in the production of modern chips. The enormous AI hype and the story of the quasi-monopolist for lithography systems have driven ASML's valuation to unimagined heights since 2023. Since the Q2 earnings on Wednesday, the share has been undergoing a correction and has lost almost 16% lost (As of: 20.07.). Is ASML now a buy or is it still too expensive?

2.) CURRENT SITUATION

Since the announcement of Q2 earnings and, in particular, the somewhat disappointing outlook for analysts, the share price has corrected significantly. Despite the correction in the share price, the share is still up almost 25% in the plus and has only just fallen to the price level of 2 months ago in May. This is mainly due to the fact that the share price has risen enormously, driven by the hype surrounding AI and chips.

This price increase was only partially underpinned by fundamental data, but was rather based on the great fantasy that ASML would probably be able to sell significantly more lithography systems in the future if so many modern chips of the smallest structure sizes were needed in the future. As a result, there has been a massive multiple expansion since mid-2022: the ratio of price to operating cash flow, for example, rose from just under 15 to a peak of 85. The ratio of enterprise value to EBIT (EV/EBIT) rose in the same period from around 27 to over 50 [1].

Due to the ongoing correction after earnings, price-to-OCF has "cheapened" to around 70 and EV/EBIT to around 45. Is ASML therefore worth buying for long-term investors or is it too expensive?

3.) THE PATH TO A FAIR PRICE

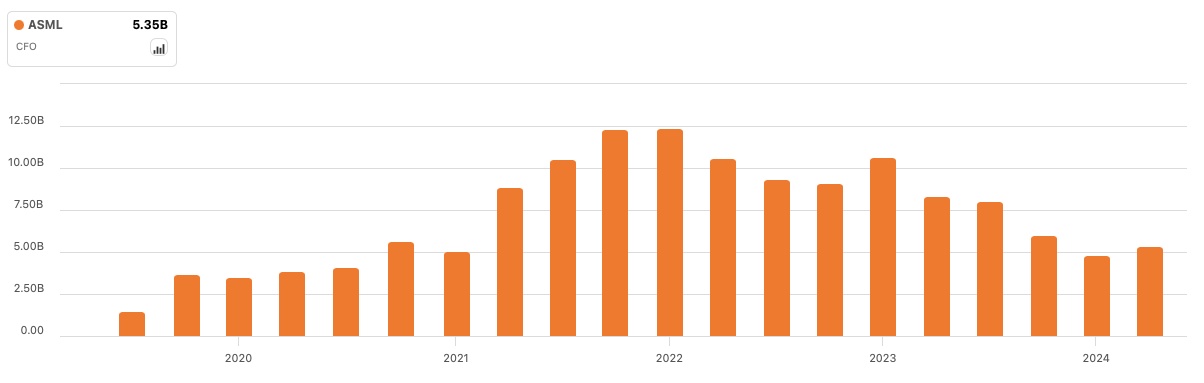

Looking at the development of ASML's operating cash flow in recent years, it is noticeable that it has fallen steadily from a peak during the coronavirus pandemic in 2021 to the present day: while OCF of a good EUR 11 billion was generated in 2021, it is now "only" a good EUR 5 billion:

This then also has an impact on the free cash flow because, as we all know, FCF is the operating cash flow less capital capital expenditures (CapEx). In addition, ASML has massively increased its expenditure on research and development in recent years, mainly through the development of the new lithography systems "High-NA" lithography systems, which are expected to generate even higher earnings than ASML's EUV platform, which is already the market leader. As a result, CapEx has risen massively in recent years: while around 8% of OCF was invested as CapEx in 2021, it is currently just under 40% [1]. As a result, the FCF has fallen by more than 70% from today has fallen.

As the new High-NA platform is now ready for the market and the first deliveries to customers have already been made [2], research and development expenditure is likely to fall back to a more normal level in the future.

The recovery of the FCF and future growth could therefore offer a good buying opportunity with the current price correction. However, despite the correction, ASML is still not cheaply valued on paper. To bring some light into the darkness, I have therefore tried to estimate the "fair price" of ASML on the basis of my valuation template [3],[4]. To do this, we need the following key data, among others:

- Sales growth

- EBITDA margin

- CapEx

sales growth

Analysts are currently forecasting sales growth of around 32% for the coming year [1]. ASML's historical long-term 5-year sales growth rates range between 13% and 19% [6]. In recent years, sales from services and maintenance in particular have also increased. This has a recurring share and increases with the number of lithography systems sold. In view of the historical growth rates and the outlook, I believe that ASML will achieve an annual growth rate of 14% over the next 10 years.

EBITDA margin

The EBITDA margin has ranged between 27% and 37% over the last 5 years, with the maximum during the coronavirus peak in 2021. The margin is currently around 33% [1]. This is also the long-term value that I expect ASML to achieve over the next 10 years.

CapEx

CapEx is currently particularly high due to the introduction of the new lithography systems. In the last 5 years, expenses have ranged between 4.8% and 8.0% of sales [1]. I think that in the next few years CapEx will return to a normal level (for ASML) of approx. 6.5% of sales over the next few years. I am deliberately not setting expenditure lower than this, because ASML will have to continue to invest heavily in the future in order to maintain its technological lead.

Miscellaneous

The tax rate was set at 4% of sales. In addition, I assume that ASML will pay approximately 0.9% of the outstanding shares in the future. This is essentially in line with historical data [1]. The risk free rate is conservatively set at around 6%.

ASML is currently trading at an FCF yield of approx. 0.9%. This reflects the current comparatively low FCF and the high market capitalization of ASML. I also assume that the FCF yield will stabilize in 10 years at approx. 4.0% in 10 years. The assumptions were of course made in good faith, but still contain enormous uncertainties. Let us therefore apply a margin of safety of 20% to the fair value, I arrive at a current fair price of around 1000€ per share.

4.) CONCLUSION

Despite all the (feigned) accuracy, this is of course also a subjective assessment on my part. A somewhat more conservative scenario with only 11% sales growth, 7% CapEx ratio and a low EBIT margin of 29% results in a fair price of only around 615€ per share. I am currently not invested in ASML, but have had the company on my watchlist for some time. Following the correction, the share has moved slightly higher on my list of potential buys. However, I will not rush to buy into falling prices.

What do you think of ASML? Do you have ASML shares in your portfolio? Which assumptions do you think are too optimistic or too conservative?

Stay tuned,

Yours Michael Scott

Sources:

[1] seekingAlpha: https://seekingalpha.com/symbol/ASML

[3] getquin (own contribution): https://getqu.in/rl57Yp/

[4] Google Docs (Spreedsheet): https://bit.ly/FCF_FairValue

[5] ASML IR: https://www.asml.com/en/investors/annual-report

[6] Macrotrends: https://www.macrotrends.net/stocks/charts/ASML/asml-holding/revenue