Another exaggerated sell-off?

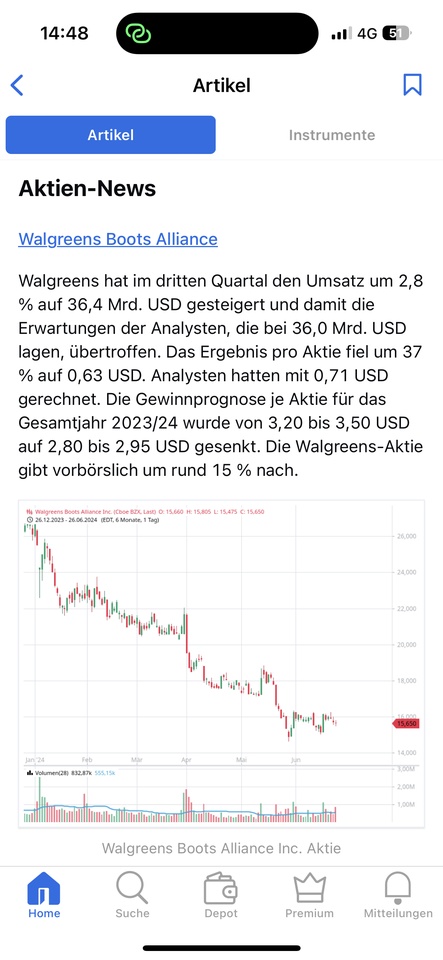

$WBA (+0.88%) falls after the company adjusts its earnings forecast again📉📉📉

In my opinion completely panicked sell-off -19% ,let's see if it goes even lower later....

What do you think?

Do you have $WBA (+0.88%) in your portfolio?