Bayer share at 20-year low. Buying opportunity or threat of a capital increase? Share analysis 2024

Hello everyone,

Today there is an analysis of Bayer AG . As announced in the current election of the stock analysis in March (please vote!), I prefer the analysis.

As always, it is nicely presented on my site in web article format with pictures for each section and an interactive live chart: Bayer Aktienanalyse 2024

Bayer share (WKN: BAY001 / ISIN: DE000BAY0017)

Bayer (WKN: BAY001 / ISIN: DE000BAY0017) is a German life science company. life science company with a more than 150-year history and 3 core businesses Pharmaceuticals (Pharmaceuticals), Healthcare (Consumer Health) and agriculture (Crop Science).

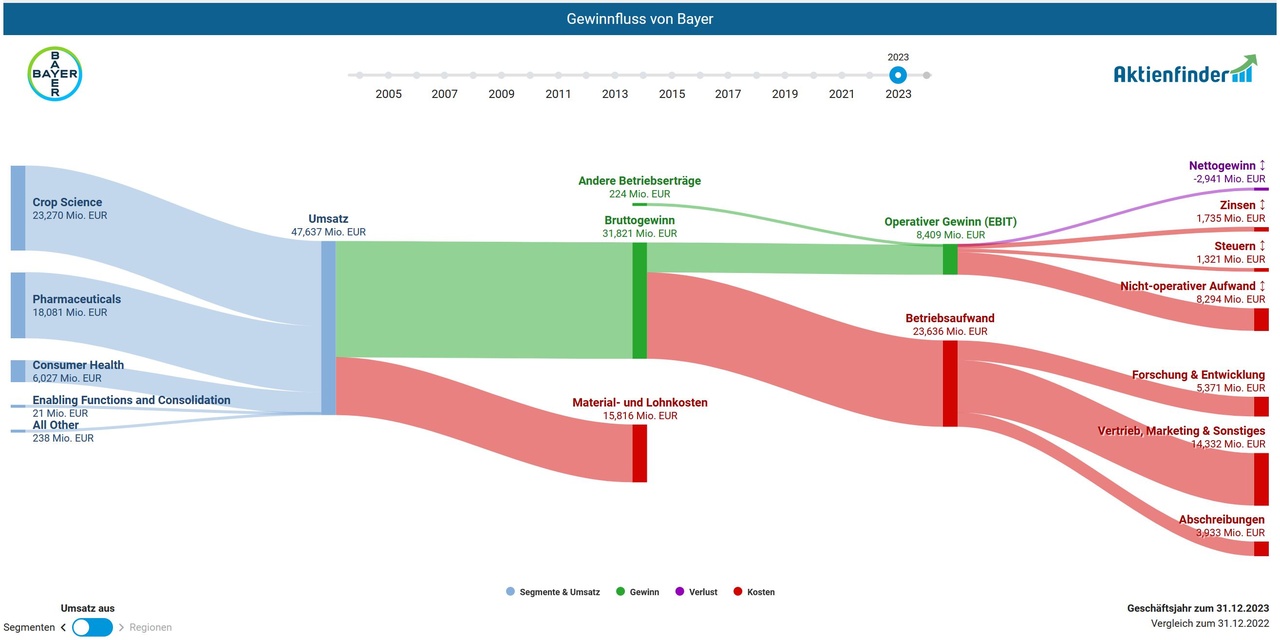

In the Pharmaceuticals (38% of sales in 2023), Bayer is involved in the development and marketing of prescription and innovative medicines.

The Healthcare (13 percent of sales in 2023) focuses on over-the-counter products for everyday use. These include medicines for dermatology, colds, allergies, gastrointestinal diseases and dietary supplements.

In the Agriculture Division (49 percent of sales in 2023), Bayer develops products and services for crop protection, pest control and seeds.

CEO since June 2023 is the US-American Bill Andersonwho replaces former CEO Werner Baumann after a joint handover phase. Werner Baumann is retiring after 35 years of service.

Bayer Share Live Chart

Bayer has been in a strong downtrend since 2015. downward trend at the 20-year low. A loss of over 80 percent in 9 years. Is everything already priced in and the share can rise again?

Why have Bayer shares fallen so much?

Glyphosate lawsuits, expiring patents, setbacks with new drug trials, rising debt and the pre canceled dividend or the reduction of the dividend to the statutory minimum for 3 years drive Bayer shares to a 20-year low.

Glyphosate lawsuits

Since the takeover of glyphosate manufacturer Monsanto in 2018 for 63 billion dollars, Bayer has been involved in 167,000 lawsuits from alleged victims. According to its own statement, 113,000 of the approximately 167,000 lawsuits have already been settled. The Group has made appropriate provisions for all other ongoing proceedings. Bayer is taking legal action against all lawsuits and judgments. Settlements are not sought unless this offers an economic advantage.

In a 5-Punkte-Plan Bayer maintains a page with an overview of current judgments and negotiations. The US Environmental Protection Agency (EPA) has determined that Roundup is not carcinogenic and has approved the product label accordingly without a warning. 17 of the last 19 legal disputes were decided in Bayer's favor. However, the two lost cases weigh heavily. On January 26, 2024 a court in Philadelphia sentenced Bayer AG to pay 2.25 billion dollars. Following the verdict, Bayer shares fell by 6 percent. On November 17, 2023 there was another heavy defeat. At that time, Bayer was ordered to pay 1.5 billion dollars in damages. Bayer will appeal both judgments.

Despite the provisions and the large number of legal disputes won, the issue is weighing heavily on the Group and its share price.

The day before yesterday, CEO Bill Anderson announced in an interview with the Frankfurter Allgemeine Sonntagszeitung that Bayer is working on an alternative to glyphosate is being worked on. The substance is currently being tested on plants and is due to be launched on the market in 2028. This is the first groundbreaking innovation in agriculture in the last 30 years. At the same time, he emphasizes that glyphosate is harmless.

Expiring patents

The Pharmaceuticals division is an important source of sales and income. Here, patented drugs in particular generate high sales and income.

The patents for the two key sales drivers of the anticoagulant Xarelto and the eye medication Eylea will soon expire.

Phase III trial failed

As successor for the expiring patent of the drug Xarelto the new preparation against atrial fibrillation and stroke risk Asundexian should generate sales. It was already in Phase III trials.

Bayer had high hopes for the drug and forecast sales of sales of more than 5 billion dollars per year.

The study was surprisingly discontinued due to a lack of efficacy.

Without Asundexian, Bayer lacks the urgently needed successor and growth driver of the pharmaceutical division.

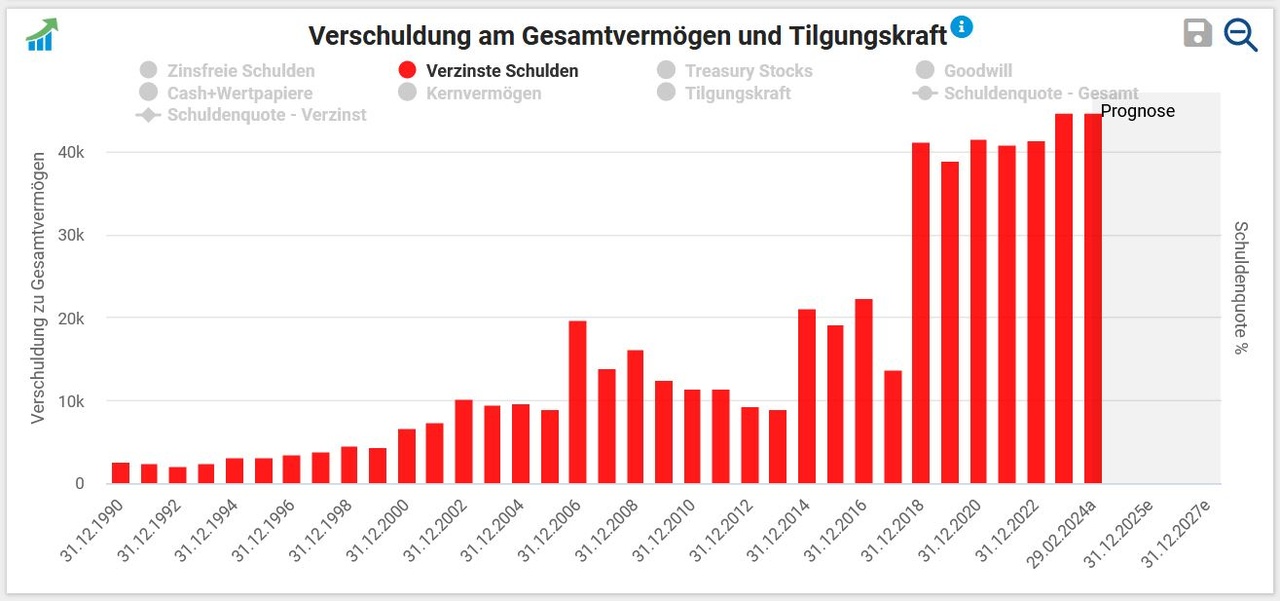

Debt at record high

The interest-bearing debt are at record level and are an additional burden on the ailing company. The debt ratio is 73,18 % and the interest burden 2.67 billion euros.

Dividend reduced to 11 cents

Under the rising debt burden, Bayer cuts the dividend dividend for 3 years to the statutory minimum of 11 cents. The aim is to reduce net debt.

Facts, figures and data

Environment and news

The environment could hardly be more difficult be more difficult. The legal disputes costing billions, expiring patents in the second largest source of revenue, setbacks in research and lack of successors for expiring patents and rising record debt and the dividend almost completely canceled dividend are forcing Bayer shares down to a 20-year low.

Is Bayer threatened with a capital increase?

NoBayer CEO Bill Anderson assured at the Capital Markets Day on March 5. According to Anderson, there will be no capital increase in the near future, nor is one planned.

There are also rays of hope

The new CEO Bill Anderson is seen as a beacon of hope. He is to provide a breath of fresh air and restructure the company and lead it out of the crisis. A few days ago announced Bill Anderson announced a groundbreaking innovation in an ongoing test phase for an alternative glyphosate alternativethat will be available in 2028 to be launched on the market in 2028.

A restructuring of the organization is expected to save 2 billion euros in personnel costs annually from 2026.

Bayer's profit flow

The profit flow 2023 illustrates why the dividend cut the right step was the right move. The company's profitability, with the expiring income from the patent business and the special charges from the legal disputes, are increasingly weighing on the company.

Bayer share dividend 2024

The next dividend cut is due in a few days on 29.04.2024 the payout will follow on 02.05.2024. The dividend payment 2024, as well as for 2 further years, amounts to 11 cents.

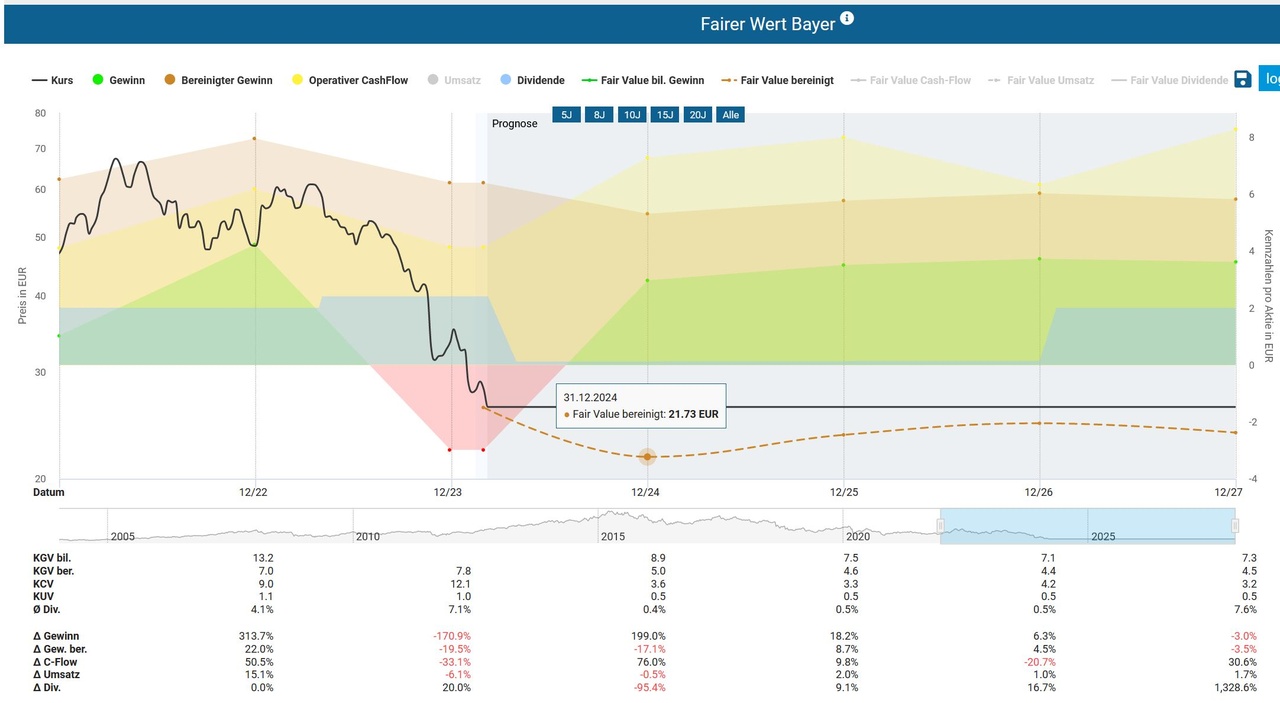

Everything priced in?

Market participants are unsettled and are wondering whether all the risks already priced in and the share, which is currently at a 20-year low traded at favorably and fairly valued is?

Are the reserves formed reserves sufficient for the current lawsuits?

Can Bayer continue the expiring patent business compensate?

Will the dividend reduction for 3 years to service the current interest payments and the record record debt reduce the record debt?

Is there a threat of an emergency capital increasewhich would put additional pressure on the share price?

Fair value

Based on the reported business figures for 2023, the Aktienfinder.net analysis tool gives a calculated fair share price of 21.73 euros for the Bayer share.

With the upcoming next quarterly figures Bayer will report on 14.05.2024 new figures and new valuation bases deliver.

The dividend cut should help to compensate for the losses.

22 analyst opinions on Bayer shares

The current sentiment of the analysts as of 03.03.2024 on Consorsbank / FactSets is as follows. Out of a total of 22 analysts rate:

- 5 buy

- 1 overweight

- 15 hold

- 1 underweight

- 0 sell

The price potential for the year is currently estimated at 39.5 euros at 50,48 % seen. Caution! In just 2 months, the share price has fallen by over 30 percent. The analysts' price targets are slowly being tightened. The average opinion is hold.

Bayer share chart analysis

Big Picture (35 years)

In the Big Picture (35-year view, 1 candle = 3 months) Bayer is in a 9-year downward spiral. downward spiralthat has not yet not yet ended. It went down within 12 years from 9 euros to 144 euros, an increase of 1500 percentmore than 100 percent per year. But it also went down almost as quickly. Since the high of EUR 144 in 2015, Bayer has lost over 80 percent of its value to date and is currently at a 20-year low at currently 26 euros. The long-term situation is slowly approaching the oversold area, but is not yet complete from a technical chart perspective.

Bayer share downtrend

The 9-year downtrend has broken all Fibonacci levels and is therefore considered a sustained and persistent downward trend and not a correction. This means that the share is not temporarily in a correction of an overriding upward trend, but the overriding trend is and remains the downward trend. A trend reversal is currently technically not to be expected. The next technical targets/supports are now so far back that they are of little significance. These are the EUR 24 to 26 ranges in the years 1997 to 1999.

A clearer technical support can only be found at EUR 18.3 to 18.5, but this was also 20 years ago.

The last technical level is at EUR 8.8, where the lows were in 1990 and 2003; TradingView has no prices below these two levels. In my view, a lot has to happen for the share price to fall that far. Either further billion-euro lawsuits or a capital increase.

Basically, the chart technology currently no new impetus. Further falling prices must be expected.

Indicators (RSI, MACD)

The indicators MACD and RSI are negative in the daily, weekly and monthly charts and follow the trend. They partly indicate a short-term oversold situation situation. This is due in particular to the rapid fall in the share price over the last two months. However, there are fundamental reasons for this. On the one hand, there was the 2.25 billion dollar claim for damages and the cut in the dividend. Even if there are short-term counter-movements, these are unlikely to be sufficient to end the downward trend without clearly positive news.

The chart technology provides no reasons for a trend change.

Bayer share Conclusion of the share analysis 2024

Environment and news

The environment remains for Bayer difficult. The drivers are still the glyphosate lawsuitsthe expiring patents of the pharma division and the setbacks in the patent pipeline. The debts have reached a record high so that the dividend to repay the interest to the statutory minimum of 11 cents had to be reduced.

But there is also a ray of hope. A few days ago, the new CEO Bill Anderson announced that the first groundbreaking innovation in the field of agriculture in the last 30 years. The product is said to be a glyphosate alternative and will be launched on the market in 2028. It is currently being tested on plants.

Although Bayer wins most lawsuits, the few that it loses cost it billions.

Analysts' sentiment

With the rapid fall in Bayer's share price, analysts are unable to adjust the share price. adjust the share price. After the reported business figures for 2023 and the lost lawsuit in January with a compensation payment of 2.25 billion, Bayer's share price plummeted by a further 30 percent in just 2 months. This means that the once cautious price targets in the EUR 30 to 40 range, where the shares stood around 2 to 3 months ago, now show a price potential of over 50 percent. The analysts are adjusting the share price, but are sticking to their maintain their assessment.

Bayer share chart analysis

The chart analysis provides no new impulses. The share has been in a strong downward trend for 9 years and is likely to remain there for the foreseeable future. Due to the rapid fall of over 30 percent in the last 2 months, the share price is in the short term in the oversold areafrom a technical point of view countermovements merely corrections in the overriding downward trend. We can therefore expect further falling prices to be expected.

Outlook

Bayer faces major challenges. The lawsuits in the USA represent a major risk. Even if the Environmental Protection Agency (EPA) has certified that the weedkiller is safe and not classified as carcinogenic, and even if Bayer wins most of the lawsuits, a few lost lawsuits are enough to cause major damage. Of the last 19 lawsuits, 17 were dismissed. The two lost lawsuits in November 2023 and January 2024 cost Bayer 3.75 billion dollars. With over 50,000 outstanding cases, the risk remains high.

The expiring patentsand the setbacks in the patent pipeline are reducing the company's profitability and growth.

The rising debt and the interest burden of 2.67 billion euros are weighing on the company, meaning that the dividend will have to be cut.

If the company succeeds in getting a sustainable grip on legal security in the USA, a major risk factor would be eliminated. This could break the downward trend.

The planned restructuring of the organization should reduce personnel costs by 2 billion per year from 2026. The dividend cut for 3 years is intended to help the company reduce net debt. reduce net debt.

Long-term measures (personnel costs and dividend cut) will help the company to get back on its feet. The announced groundbreaking innovation should also ensure further growth from 2028. Bayer is now worth less in terms of market capitalization than it paid for the acquisition of Monsanto.

In the short term however, there is no signs of a rapid trend reversal. The measures announced will not be fully effective for another 2-3 years. Wait and see appears to be the better option under these circumstances. New news may improve the outlook. I am putting the share on my watch list and waiting for technical signals for the first tranches.

As always: No investment advice and no recommendation to act. Purely an informative article.

I appreciate every follow ❤️

Choice of stock analysis March 2024: https://getqu.in/zxkbVZ/