Framework #7 Portfolio management

In my opinion, it’s impossible to find 10 companies in one year which are within your buying price (and margin of safety) and are within your circle of competence. That’s why I like to build up my portfolio via temporal diversification. You find 1 or 2 companies per year that are within your buying price and circle of competence, or some years you find none. But that doesn’t matter, over 5/10 years you have a great diversified portfolio with companies which you bought at great prices. That is in my opinion how you invest with a low level of risk because you buy businesses below intrinsic value.

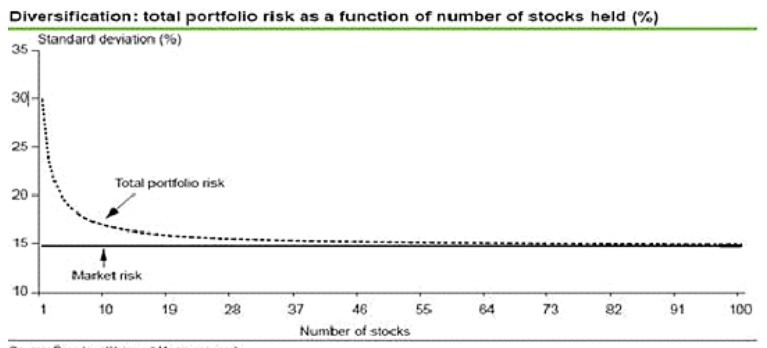

Scholars argue that diversification leads to lower risk, however, volatility isn’t the same as risk. Buying companies at a great price with a margin of safety means you invest with low risk because the risk of losing money is decreased. The figure below shows how the volatility reduces when the number of stocks increases. As can be seen in the graph, the volatility diminishes fast for the first 10 stocks but also the returns diminish as you are becoming more of an Index. If you want and feel really comfortable with your investments you could go more concentrated. When you have a lot of companies, you just average market return however less volatility. It just depends on your needs and what you feel comfortable with.

In the follow-up article, we are going to dive deeper in valuation.

Link to framework #6: https://app.getquin.com/activity/KEnnWwZnAn